Today we have a special edition of Top 5 to recap the first few weeks of 2022. Is it just us or has it been an action-packed start to the year?

Tech stocks have crashed, as has crypto, and private markets could be in for a correction too. The hot-headed founder of one of India’s best-funded fintech startups is on leave until the end of March, and Elon Musk sparked a nationwide controversy with a 10-word tweet on Tesla’s (lack of) progress in India.

So… not just us, then.

Here’s a look back at the biggest stories from a crazy January.

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

Global equity crash batters India’s newly listed tech firms

On January 21, we reported that after US tech stocks entered correction territory on the back of possible interest rate hike by the Federal Reserve, senior executives at SoftBank and Sequoia – two of the world’s top tech investment funds – said private tech markets were due for a similar correction.

The comments from Rajeev Misra and Shailendra Singh are significant as their funds power a large number of deals in India and abroad. This also means companies will have to readjust their valuation demands.

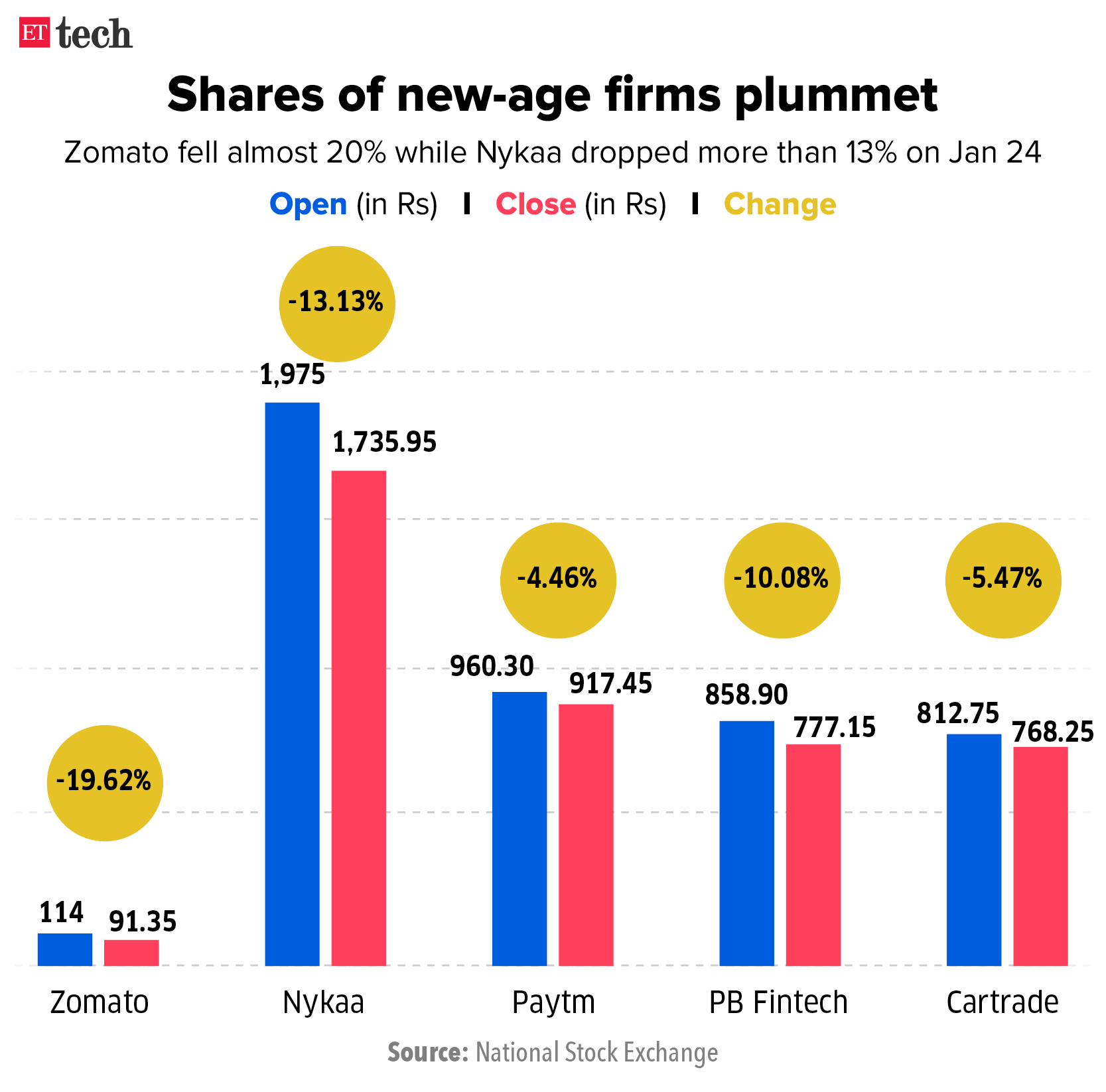

Down we go: Three days later, India’s recently listed tech firms felt the effects of the previous week’s sell-off in US tech stocks as the Sensex lost 1,546 points or 2.6% while the Nifty declined 468 points or 2.7%.

Taking stock: Shares of Zomato, Nykaa, Paytm, Policybazaar and Cartrade hit all-time lows.

- Zomato dropped 19% to hit a low of Rs 91.70 in early trade and closed the day 19.62% down at Rs 91.35. The company’s shares have fallen about 30.5% in the past five trading sessions and 45% from their 52-week high of Rs 169.10 on November 16.

- Nykaa, which opened the day at Rs 1,975, dropped more than 13% to Rs 1,735.95. The scrip has plummeted more than 30% from its all-time high in November.

- PB Fintech, the parent company of PolicyBazaar, slumped 11.38% to Rs 766 at one point before ending the day at Rs 777.15, more than 10% down. The stock is now down about 50% from its peak.

- Paytm’s parent firm One97 Communications dropped 8% to Rs 881.50 at one point before closing the day at Rs 917.45, down 4.46%. The stock has lost about 60% of its value from the issue price of Rs 2,150.

- Cartrade closed the day at Rs 768.25, down 5.47%.

Zomato CEO Deepinder Goyal

Zomato’s Goyal ‘was waiting for this’: As Zomato’s stock fell sharply, founder and CEO Deepinder Goyal told employees he had been waiting for a bear market. “Let me tell you a secret… I have been waiting for a bear market for a long time now. That is when funding dries up for everyone, and companies with the most solid teams and execution rise to the top,” he wrote in a note on the company’s internal chat group.

Tweet of the day

Ashneer Grover steps back from BharatPe

Ashneer Grover, founder and MD, BharatPe

Exactly a week ago, Ashneer Grover, the controversial cofounder and managing director of BharatPe, said he was taking a voluntary leave of absence until the end of March.

In a statement on January 19, he said, “I’ve been relentlessly at work building up BharatPe for almost four years. After much deliberation and introspection, I plan to take a temporary leave of absence from BharatPe till March-end. I will return on or before April 1, 2022.”

Mum’s the word: Grover has been in the midst of a controversy after an audio clip of his purported rant at a Kotak Mahindra Bank employee was leaked earlier this month, but his statement did not not address the controversy or the allegations against him.

It said instead he would use his time off to “rejuvenate and refresh” himself for Bharatpe’s “next sprint of value creation” and “invest in myself personally”.

‘Best interests’: The company’s board said it had accepted Grover’s decision, which it agreed was “in the best interests of the company, its employees, investors and merchants. It said the company would continue to be led by chief executive Suhail Sameer, who was appointed to the post in August.

Controversies: Grover has been in the spotlight since the turn of the year for all the wrong reasons.

In the first week of January, an anonymous handle on Twitter — ‘bongo babu’ — had posted a SoundCloud link to an audio clip of a man – allegedly Grover – abusing and threatening the bank employee over the phone in October after missing out on Nykaa’s initial public offering.

Grover initially tweeted that the audio clip was fake and that “some scamster” was trying to extort $240,000 in bitcoin from him. He also shared screenshots of the alleged emails seeking money.

The same week, the audio clip was taken off Twitter and SoundCloud and Grover deleted the tweet claiming it was fake.

On Monday, we reported on a leaked email exchange from August 2020 between Grover and Harshjit Sethi of Sequoia Capital India, in which the BharatPe founder allegedly used several expletives. Sethi, who has been with Sequoia Capital India since 2015, was promoted to managing director in the venture team in July 2021.

The previous day, we had delved deep into Grover’s controversial past, quoting the founder of a startup who has known him for over a decade as saying, “I have seen this problem in some of the prominent founders in India. It’s called the God Syndrome. Often when things don’t turn out the way they intended, he said, “it comes out as extreme anger and frustration.… Ashneer’s alleged remarks over the call are a typical example of this.”

Grover and BharatPe have also been embroiled in a public spat and legal battle around the ‘Pe’ suffix with rival PhonePe, which is owned by Flipkart.

Timeline: Ashneer Grover’s fortnight to forget

Delhi High Court suspends Amazon-future arbitration in Singapore

On January 5, the Delhi High Court halted arbitration proceedings in Singapore between Future Group and its estranged US partner Amazon in light of the fact that the Competition Commission of India (CCI) recently suspended a 2019 deal between the two sides.

Setback for Amazon: The decision was a setback for Amazon, which had successfully used the terms of its 2019 investment in a Future Group subsidiary to block the Indian company’s attempt to sell retail assets to Reliance.

But after the CCI suspended the 2019 deal last month, citing suppression of information by Amazon while seeking clearances, Future argued there was no legal basis for the arbitration between the two sides to continue.

A two-judge bench led by Chief Justice D N Patel of the Delhi High Court agreed with Future’s arguments, putting the arbitration proceedings on hold. If the proceedings are not halted, Justice Patel said it would cause an “irreparable loss” to Future.

“We hereby stay further proceedings of arbitral tribunal till next date of hearing,” said Patel, adding the court will hear the case next on February 1.

Asset sale: Earlier this month, we reported that lenders of Future Retail were likely to seek buyers for its small-format stores to recover dues worth Rs 3,494.5 crore after it failed to honour payments scheduled on December 31. Lenders were preparing to sell Easyday and Heritage Fresh stores numbering about 850 across India.

Amazon offers financial help: On January 20, Amazon offered financial assistance to cash-strapped Future Retail. It came with a rider, though. The US firm warned Mumbai-based FRL not to sell any of its retail stores without Amazon’s consent.

“We reiterate our willingness and ability to assist FRL in addressing any financial concerns of FRL, within the framework of the agreements, including the solution proposed in the term sheet between Samara Capital, and FRL, which contemplated an infusion of [Rs 7,000 crore] in FRL,” Amazon wrote in a letter sent to FRL’s independent directors.

FRL’s independent directors turn down Amazon’s request: On January 23, we reported that the independent directors of Future Retail have decided not to accept Amazon’s request to allow private equity fund Samara Capital to conduct an urgent due diligence of the cash-strapped retailer.

Ravindra Dhariwal, one of FRL’s three independent directors, described Amazon’s offer as a “smokescreen” and said it was untenable.

Crypto bill will skip budget session; cryptocurrencies crash

On January 18, 2022, we reported that the Centre is unlikely to introduce the much-awaited cryptocurrency bill in the upcoming budget session.

The reason? It wants to hold more discussions and build consensus on the regulatory framework. The government also wants to wait for the pilot launch of Reserve Bank of India’s digital currency, expected in a few months.

Also Read: HNIs shifting cryptocurrency assets to wallets outside India

Sinking feeling: Meanwhile, after a rollicking 2021, cryptocurrencies have been sliding in 2022. Bitcoin, Ethereum and Solana and other cryptocurrencies lost 8-10% of their value on January 20 and 21. The mini-crash was said to be the result of a proposed ban on cryptocurrencies in Russia and the fall in the US stock market.

Also Read: 2021 Year in Review | Defining moments in India’s crypto saga this year

Indian investors wary of buying the dip: Unlike during other dips, when Indian buyers were inclined to buy, there was caution amongst crypto investors and traders this time, according to Indian crypto players.

“The buy intensity is definitely lower than the last several months. But this has less to do with India and more to do with global crypto sentiment. The global crypto sentiment isn’t negative. It’s cautious and investors are waiting to understand what direction the market will take in the coming weeks,” said Nischal Shetty, cofounder of WazirX.

Musk’s 10-word tweet sparks controversy in India

Tesla CEO Elon Musk

Elon Musk has been planning to bring Tesla to India since 2019 and the company made its first moves in 2021. But talks between Tesla and the government have come to a standstill over two main issues: high taxes and Tesla committing to set up a factory and manufacture cars in India.

“Still working through a lot of challenges with the government,” the billionaire wrote on Twitter on January 13, replying to a user who wanted to know if there was any update on Tesla’s launch in the country.

Govt calls it a pressure tactic: Musk’s tweet drew sharp criticism from the government. A source told ET, “With such tweets, Tesla is trying to put pressure on the government, and this is not the first time.” The source added that Musk was looking to get the government to reduce import duties without committing to produce Teslas in India.

Also Read: Stop-and-go traffic: the story of Tesla in India

Tesla’s request for tax cuts was first reported in July 2021, when sources told Reuters that the company had written to Indian ministries seeking a big reduction in import duties on electric vehicles. Soon after, Musk tweeted that Tesla was likely to set up a factory in India if successful with imported vehicles.

States try to woo Tesla: Despite the tussle between the Centre and the electric car manufacturer, leaders from non-BJP-governed states of Telangana, Maharashtra, Punjab and West Bengal invited Elon Musk’s Tesla to set up its electric car manufacturing facility in their states after the tech mogul tweeted about facing challenges in launching operations in India.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanaban in New Delhi and Zaheer Merchant in Mumbai.