Also in this letter:

- Tata’s payments play

- Traders vs etailers, again

- HomeLane’s IPO plans

India’s crypto sector likely to update code of conduct

Hi, it’s Apoorva in Mumbai.

Today we are delving into the self-regulatory code that the buzzy and mostly controversial cryptocurrency industry is drawing up for itself, amid many twists and turns in the sector.

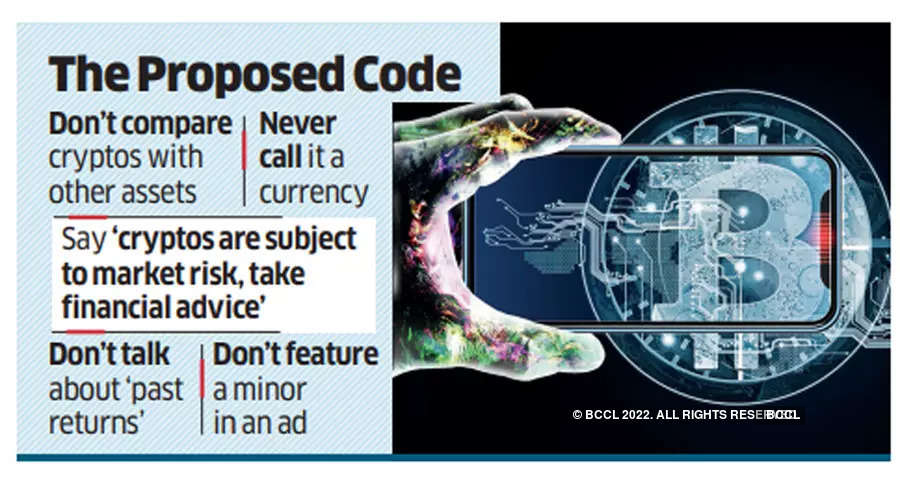

On Jan. 12, we reported that India’s top crypto players are consulting with the Advertising Standards Council of India to bring about checks and balances in its communication. My colleague Sugata Ghosh wrote that a note was circulated among several crypto platforms recently.

Today, I’ve picked up from my sources that besides drafting a code for advertising and communication, the industry is also looking to add more disclosures to safeguard users.

So, what’s new?

- Cryptocurrency-selling platforms may add warnings that highlight the volatile nature of the industry while onboarding new customers on their platform, a person familiar with the discussions said.

“At present, there is no standardised format for terms and conditions and risk warnings,” said the person, requesting anonymity due to the sensitivity of the discussion. “We are trying to bring that as well into the guidelines so that the warnings customers get are the same.”

- Discussions are also on to appoint a tax expert from one of the Big Four consulting firms to conduct an audit and give recommendations to members on tax compliance strategy.

Crypto-selling platforms have been under scrutiny of the Directorate General of Goods and Services Tax Intelligence for alleged tax evasion.

Also Read: India’s crypto platforms lack clarity on tax provisions: Industry

Present code of conduct: Crypto players have to adhere to a code of conduct, as part of the Blockchain and Crypto Assets Council, which regulates the sector. BACC counts WazirX, CoinDCX, Coinswitch Kuber, ZebPay and others as its members. Full list here.

There are no monitoring or compliance officers to check if the members are sticking to the code. And going off track could amount to scams and loss of retail investor money. (Indians visited crypto scam websites more than 17.8 million times in 2020. In 2021, the number was 9.6 million times, according to a new report by blockchain data platform Chainalysis).

What’s the bottom line? Self-regulation is here to stay, as India’s Cryptocurrency Bill is unlikely to be tabled during the budget session of the Parliament. The industry continues to be dependent on the players to come up with guidelines and make sure they aren’t being circumvented.

Tata Digital sets up 100% arm for payments play

Tata Digital Ltd. has floated a wholly owned subsidiary, Tata Payments Ltd., that will take over all payment-related assets of the Tata Group firm.

- The move is seen as a precursor to the salt-to-software conglomerate entering the payments business in a big way under the Tata Pay banner. Just days ago, Tata Digital set up Tata Fintech, a financial services marketplace.

Details: The board of Tata Digital has approved transfer of payments-related assets to Tata Payments through “an itemised sale transaction” at a valuation of about Rs 50.37 crore, as per latest regulatory disclosures made to the Registrar of Companies (RoC).

Tata Digital, which will be rolling out the group’s ecommerce platform through a super app, will integrate Tata Pay as a payments gateway for consumers. Tata Pay may also be offered to other companies as a digital payments gateway.

Quote: “Tata’s payment business is in the nascent stages. Its separation from Tata Digital indicates that Tata Group harbours the intent of dominating not only ecommerce but also the payments space,” said business intelligence firm AltInfo’s founder Mohit Yadav.

Tweet of the day

Meity’s project to digitise govt services kicks off

The government has begun work on a new project that is expected to speed up delivery of myriad citizen services through the help of advanced technologies such as AI/ML.

- The idea is to proactively take government services to citizens instead of waiting for them to seek those services. The project, called Digital Government Mission, will break down silos and make government systems more intelligent, officials said.

Quote: “Currently, we are operating in silos. Many people are not aware of the benefits. This system will facilitate discovery of eligible people for the benefits and inform them proactively of the schemes for which they qualify,” a senior government official said.

- The idea is that the benefits should be offered to citizens without them having to apply for it. “This is the next phase of e-governance,” the official said.

Offline traders target etailers at DPIIT meeting, again

Offline traders used a meeting held by the Department for Promotion of Industry and Internal Trade (DPIIT) on ecommerce’s role in digitisation in India to raise concerns about etailers and their alleged trade practises with government officials, yet again.

- Multiple trade associations reiterated the need for a level playing field with etailers and accused brands and ecommerce firms of cornering bulk of new products in top selling categories, leaving only a smaller share of products for offline outlets.

Allegation: When the discussion turned into how India can tap into ecommerce’s potential to accelerate digitisation of commerce, taking small businesses and kiranas on board, offline merchant associations vented their fury on etailers, saying they burn billions of dollars to sell products at discount and hurt traders.

Counter: Ecommerce players told officials they already have initiatives focusing on kiranas and other store owners to broaden their reach, and that they will further work with government and other stakeholders to digitise commerce in the country.

ETtech Done Deals

■ Microsoft has agreed to buy ‘Call of Duty’ creator Activision Blizzard for $68.7 billion in cash, a deal that makes the Xbox maker the third-largest gaming company by revenue.

- Microsoft’s offer of $95 per share is at a premium of 45% to Activision’s Friday close. Shares of Activision were up nearly 38% at $65.39 before being halted for news.

Electronic Arts, Roblox and CD Projekt are now being talked-up as potential acquisition targets, especially amidst the rising interest in gaming and the metaverse.

■ Online wealth manager Scripbox has raised $21 million in debt and equity from Accel Partners and others to bolster its new product verticals, expand its customer base and partner with more independent financial advisors.

■ Reliance Retail Ventures Ltd., the retail unit of Mukesh Ambani’s Reliance Industries, has picked up a 54% stake in robotics startup Addverb Technologies for $132 million.

■ Nazara Technologies has acquired a 55% stake in Datawrkz, in a deal that values the programmatic advertising and monetisation company at around Rs 255 crore.

■ MyCaptain, an eight-year-old startup that allows students to directly learn from young professionals, has raised $3 million in a funding round led by Ankur Capital.

■ AppX, a platform that helps creators monetise their apps and websites, has raised $1.3 million from Y Combinator, Global Founders Capital and Rocket Internet.

HomeLane plans Rs 1,500 crore IPO by mid-2022

HomeLane—a home-interior solutions startup backed by former Indian cricket captain MS Dhoni—plans to raise up to Rs 1,500 crore through an initial public offering that should hit the market by mid-2022.

What we know so far: According to multiple people aware of the development,

- Bank of America, Axis Capital and ICICI Securities have been hired to run the HomeLane IPO that will see dilution of 25-30% stake.

- The IPO will be a mix of primary and secondary shares, wherein some existing investors—including Sequoia and Accel—will make part exits.

- Last week, HomeLane bought back ESOPs (employee stock ownership plans) worth Rs 27 crore from current and former employees.

- About 70% stake in the Bengaluru-based firm is held by investors including Sequoia Capital, Accel Partners, IIFL AMC and Stride Ventures.

About HomeLane: Founded in 2014 by Srikanth Iyer and Tanuj Choudhry, HomeLane provides end-to-end personalised home interior solutions. The company has served more than 20,000 customers through 34 experience centres in 19 cities of India. It competes with the likes of Livspace , which is likely to turn unicorn soon, as well as Bonito Designs and Spacejoy.

Other Top Stories

Meesho has rolled out a gender confirmation leave policy: Employees looking to transition their gender can get up to one month of paid leave for gender reassignment surgery and other medical procedures. (read more)

India PE/VC funding, exit deals hit all-time high in 2021: These investments came across 1,266 deals including 164 large deals worth $58 billion. Exits worth $43.2 billion were made through 280 deals, according to an IVCA-EY report. (read more)

TCS is new title sponsor, tech partner of Toronto Waterfront Marathon: India’s largest IT services firm recently renewed its title and technology sponsorship of the TCS New York City Marathon, and became the new title and technology sponsor of the TCS London Marathon this year. (read more)

Global Picks We Are Reading

■ Can anyone satisfy Amazon’s craving for electric vans (NYT)

■ Chamath Palihapitiya’s SPAC to merge with ProKidney in $2.6-billion deal (Bloomberg)

■ US examining Alibaba’s cloud unit for national security risks (Reuters)