Here are five tech giants that have been brought to their knees this year.

(All figures are as of market close on Thursday.)

Coinbase: down 71.72% in 2022

A sell-off in crypto assets has triggered a huge drop in the market value of the largest US cryptocurrency exchange in 2022.

Late on May 10, Coinbase reported a first-quarter loss and 27% lower revenue than a year ago, missing Wall Street’s forecasts. The following day, Coinbase shares plummeted more than 25% to hit their lowest level ever. Its shares lost more than half their value in that week alone — from $130.15 on May 4 to $53.72 on May 11.

The stock has recovered slightly since then but is still at $69.70, down almost 72% in 2022, and 81.1% down from its all-time high of $368.90 in November 2021.

Founder Brian Armstrong, who had a personal fortune of $13.7 billion in November and about $8 billion at the end of March, is now worth under $3 billion.

Snap: down 68.21% in 2022

Late on May 23, Snap CEO Evan Spiegel warned that “the macroeconomic environment has deteriorated further and faster” than it anticipated in its earnings guidance on April 21.

In the filing, Snap said it expected revenues and adjusted earnings to fall “below the low end” of its guidance range in the second quarter of 2022, ending June.

The following day, Snap’s shares plunged 43%, their biggest intraday decline ever, falling below the 2017 IPO price of $17.

The sell-off erased almost $16 billion in market value and dragged down Snap’s larger peers, including Meta, Alphabet, Twitter and Pinterest.

Social media stocks lost more than $135 billion in market value that day, and the tech-heavy Nasdaq dropped about 2.4% to 11,264.45.

Netflix: down 67.96% in 2022

Shares of Netflix tumbled 39% on April 20 after it reported a sharp decline in its subscriber base. The stock fell as low as $212.51 in New York, down 64% this year, making it the worst-performing stock on the S&P 500 and Nasdaq this year.

The streaming service shocked Wall Street, saying it lost 200,000 customers in the first quarter – the first time it has shed subscribers since 2011. It also projected it would lose another two million customers in the second quarter.

In its earnings report, the company said the war in Ukraine and the decision to raise its prices in the US had hit subscriber numbers. Pulling out of Russia alone had cost it 700,000 members, Netflix said.

About a month later the company laid off 150 employees – about 2% of its North American workforce – mainly in its office in California. It said the job cuts were due to a drop in revenue.

Though the stock has fallen further and is now down almost 68%, it has been dethroned by Coinbase and Snap as the biggest loser of 2022.

Sea Ltd: down 64.38% in 2022

On February 16, Sea Ltd. lost more than $16 billion of value after its shares plummeted 18% — their biggest one-day drop – on reports that India had abruptly banned its most popular mobile gaming title, Garena Free Fire, along with 53 other apps linked to China.

India has banned hundreds of Chinese apps over the past two years, but the inclusion of Sea’s app took everyone, including the company, by surprise. While Sea is based in Singapore, its founders are Chinese-born. The company is also backed by the Chinese technology and entertainment firm Tencent.

Shares of Sea plunged another 13% in US trading on March 1, after the company reported an earnings miss in its fourth-quarter data, wiping out $1.1 billion of chairman Forrest Li’s net worth.

On May 18, Sea’s shares jumped 14% after its first-quarter revenue beat analysts’ expectations, but the stock is still down more than 64% this year.

Meta: down 43.4% in 2022

Shares of Facebook’s parent company Meta Platforms crashed more than 25% on February 3, the biggest single-day slide in market value for a US company, after the social media giant issued a dismal forecast, blaming Apple’s privacy changes and increased competition.

The huge drop, erasing over $200 billion from Meta’s market capitalization and around $29 billion from Chief Executive Officer Mark Zuckerberg’s net worth, spilled over to the broader technology sector and dragged the Nasdaq Composite Index lower.

It marked the company’s worst one-day loss since its Wall Street debut in 2012.

Meta’s rallied on April 28 posted its slowest revenue growth in years and narrowly missed analysts’ predictions for daily and monthly active Facebook users. Its profits, while ahead of expectations, were down 21% from the same period a year ago. Amid the broader downturn, weary investors found something to celebrate after this decidedly mixed news, sending Meta’s shares soaring 18% in after-hours trading.

Meta’s shares are still down 43.4% this year – a stunning number for a company with a market cap of around $935 billion on January 1.

Top Stories By Our Reporters

Tesla will not manufacture in India unless it is allowed to sell, service cars: Elon Musk

Tesla will not make cars in India until it is allowed to sell in the market first, Elon Musk tweeted. Musk’s tweet was in response to a user who asked about the company’s India manufacturing plans. “Tesla will not put a manufacturing plant in any location where we are not allowed first to sell & service cars,” he tweeted.

Delhivery IPO

Volatile markets left us nervous before listing, says Delhivery CEO

Delhivery’s top management was “nervous” ahead of its listing on Tuesday due to uncertain investor sentiment but were never “really concerned” about the issue not being fully subscribed, cofounder and chief executive Sahil Barua told us after the listing.

Delhivery’s market debut more than doubles SoftBank stake value to $1B: Amid a global rout in tech stocks, Delhivery’s market debut turned out to be one of the best by a SoftBank-backed firm this year. In 2019, SoftBank invested about $390 million in two tranches in Delhivery. That investment is now worth almost $1 billion based on Delhivery’s stock price after its first day of trading. SoftBank holds close to 19% in Delhivery.

Ecommerce corner

Swiggy eyes e-commerce foray through Mini marketplace

Swiggy is planning to enter the ecommerce space. It is working on a marketplace to onboard local stores and direct-to-consumer (D2C) brands and the pilot is already underway, multiple people aware of the matter told us. The platform is called Minis. There are select brands and merchants with whom Swiggy is testing this out.

Google in talks to partner with ONDC, following Amazon, Reliance and Flipkart: Google is in active discussions with the government-backed Open Network for Digital Commerce (ONDC) and is “exploring” ways to partner with the ambitious initiative, multiple sources told us. The “exploratory” talks have spanned various businesses within Google, including search and payments, one of the sources said, adding “there is a definite interest” from Google in engaging with the ecommerce network.

Flipkart forays into home services to rival Urban Company: Ecommerce firm Flipkart has quietly

entered the home services business, starting with AC servicing, sources told us. The company is providing the service through Jeeves, an after-sales services company it acquired several years ago. Flipkart’s home services business is likely to also include washing machine repairs and other similar offerings going forward.

Nykaa’s consolidated net profit falls 57.65% YoY in Q4: FSN E-Commerce Ventures, the parent company of omnichannel beauty retailer Nykaa, reported a 57.65% drop in its consolidated net profit to Rs 7.5 crore for the fourth quarter that ended March 31, 2022, from Rs 17.9 crore in the same quarter last year. Meanwhile, Zomato said on Monday that net losses in the fourth quarter of FY22 stood at Rs 359.70 crore, a 2.5x jump from Rs 134 crore in the same quarter of FY21. It had reported a net loss of Rs 67.20 crore in the third quarter of FY22.

Invact Metaversity saga

Cofounder Manish Maheshwari agrees to leave Invact Metaversity

Manish Maheshwari, cofounder and chief executive of troubled edtech startup Invact Metaversity, has agreed to

leave the company following serious differences with cofounder Tanay Pratap. “I am moving out of Invact to first take a break for a few months and then pursue new opportunities. It is heartbreaking for a founder to leave the startup, like a mother leaving her baby. I am going through the same emotion,” Maheshwari said in a tweet announcing his exit on Friday. Pratap will now take over as the CEO of the startup.

CEO Manish Maheshwari holding company hostage, tweets Invact Metaversity angel investor: Troubled ed-tech firm Invact Metaversity’s early angel investor, Gergely Orosz, publicly criticised the company’s CEO, Manish Maheshwari, days after the latter tweeted about the company’s likelihood of getting shut down.

Invact CEO broke his promise to quit, investor alleges: Earlier, Orosz told investors of the company in an email that its cofounder and CEO Manish Maheshwari went back on a promise to quit the troubled company. He said Maheshwari, the former head of Twitter in India, now wants “more equity than vested.”

Invact Metaversity may wind down ops, cofounder says: Invact Metaversity, the ed-tech startup founded by former Twitter India chief Manish Maheshwari, is likely to wind down within months of starting operations.

Funding winter

Era of being rewarded for hypergrowth at any costs is coming to an end: Sequoia Capital

Sequoia Capital has again issued an advisory on the global downturn, warning the founders of its portfolio companies that they should not expect a quick recovery from the current market conditions. In a 51-page note, the venture capital firm said loose monetary policies globally in the past two years had led to negative interest rates, making fundraising effortless for growth companies and driving up valuations.

Funding winter will last 12 to 18 months, Unacademy CEO tells employees: As investments in startups slow to a trickle amid global macro headwinds, Unacademy cofounder and chief executive Gaurav Munjal has told employees that “winter is here” and that funding will remain scarce for at least the next 12 to 18 months.

VC fund Beenext tells startup founders how to adapt to the funding winter: Singapore-based early-stage investor Beenext which has backed companies like BharatPe, Open, Jupiter, among others, has joined the growing list of venture capital funds to issue cautionary notes to their portfolio companies asking them to reset and adapt to the current market downturn.

Startups chase venture debt as investments slow: Venture debt is in high demand at startups following a sharp slowdown in equity funding over the past few months. Startups across fintech, edtech, software-as-a-service (Saas) and the direct-to-consumer (D2C) space are tapping this option, said industry experts.

Startup funding woes may hurt IPL ad prospects: The funding tap is running dry at startups, and one major

casualty could be the Indian Premier League (IPL). According to trade pundits, over 50% of IPL advertising is from new-age companies.

Startups and layoffs

Many tech pros return to IT firms after startup dreams fade

Many tech professionals are giving up on their startup dreams and returning to a more stable work environment. After losing talent to startups, which offered fat pay cheques, IT service providers such as Tata Consultancy Services (TCS), Infosys, Wipro and HCL are seeing many employees return.

Some edtech startups remain bullish despite layoffs: Chief executives of a few edtech startups like UpGrad, Eruditus, and Scaler are positive about the sector’s future prospects and growth plans despite seeing close to 2,000 layoffs recently.

Digital health platform Mfine lays off 500 employees: Mfine has laid off around 500 employees, people in the know said, becoming the latest to cut jobs as startups struggle to raise funds. The job cut accounts for about half the workforce at the Bengaluru-based company, which had been hiring until last month, according to media reports.

IT corner

Indian IT firms take M&A route to tap top talent, boost capabilities

The top buzzword among Indian IT service providers these days is M&A. These mergers and acquisitions are primarily intended to build capacities around cloud computing, cybersecurity, and application transformation as software service exporters scamper to meet client demand.

Infosys board extends Salil Parekh’s term by five years: The Infosys board has reappointed Salil Parekh the company’s chief executive officer and managing director for five more years, subject to the approval of shareholders.

Infosys CEO’s remuneration rose 43% in FY22: Salil Parekh, CEO of IT giant Infosys, saw his remuneration rise 43% to Rs 71 crore in the fiscal year 2021-22, according to the company’s annual report. The steep increase was due to a rise in his performance-based pay variable and stock incentives awarded in the past few years.

Despite regulatory hurdles, new crypto ventures abound

Unfazed by a severe crypto market crash, the imposition of a high income tax rate by the Indian government, a massive dip in trading volumes, the collapse of a popular token and continuing global uncertainty around digital asset regulation, Indian entrepreneurs have continued launching scores of new crypto ventures supported by strong angel funding.

Visa bets big on commercial payments in India

Visa is making a big bet on business-to-business (B2B) payments in India. The payments major is bolstering its corporate card-based solutions for commercial statutory payment use cases such as payments to suppliers, reconciliation and GST-based payments, a top executive said.

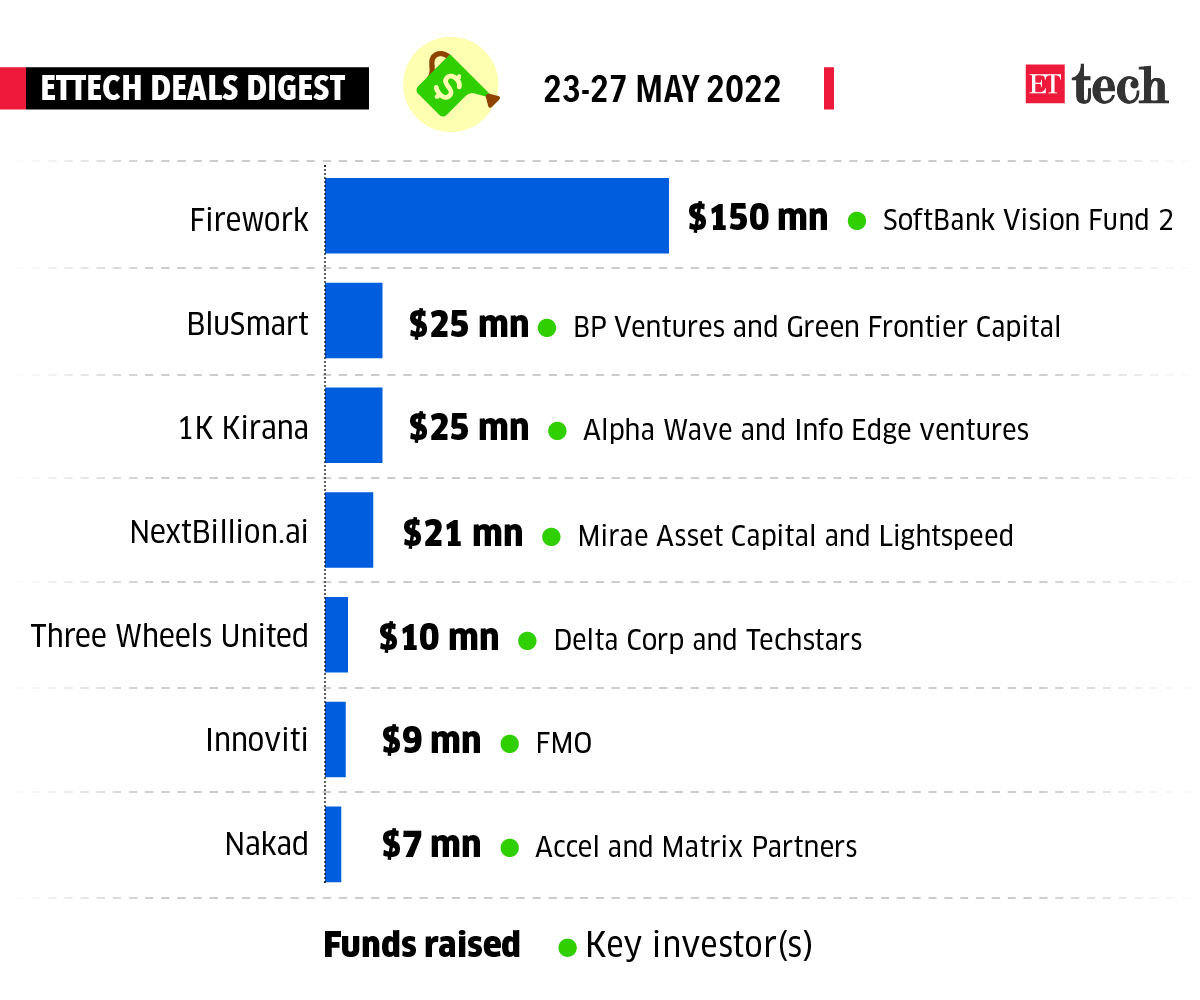

ETtech Deals Digest

Live commerce platform Firework was the only startup to raise a big sum this week, as large startup funding continued to dwindle. BluSmart, 1K Kirana and AI startup NextBillion.ai also raised funds. Here’s a look at the top funding deals of the week.

■ Marico Limited, maker of Parachute and Saffola oil, said it has acquired a 54% stake in HW Wellness Solutions, owner of health food brand True Elements through a primary infusion and secondary buyouts. It did not disclose the size of the deal.

■ Inventus Capital, which has backed companies like RedBus and PolicyBazaar, has launched its fourth and largest India fund (Fund IV) with a target corpus of Rs 900 crore (roughly $116 million).

■ Direct-to-consumer (D2C) fresh foods brand Country Delight has raised $108 million in a funding round led by Venturi Partners and Temasek, valuing the company at $615 million post-money. The company will use the funding for geographical expansion, enter new product categories and deepening its existing product portfolio.

■ Edtech startup Infinity Learn has invested $7.5 million to pick up a 75% stake in cognitive development edtech firm WizKlub. WizKlub is valued at $10 million, and the company plans to acquire the rest of the stake in three years, Infinity Learn’s chief executive Ujjawal Singh told ET.

■ Software-as-a-Service (SaaS) major Zoho has invested Rs 20 crore in Genrobotics, a startup that has rolled out a robotic scavenger capable of cleaning confined spaces such as sewers in its attempt to eradicate manual scavenging in the country. The five-year-old company has been backed by industry veterans like Anand Mahindra and Rajan Anandan.

■ Online beauty and personal care products retailer Purplle has held talks with its existing investors to raise $75-100 million, giving it a pre-investment valuation of about $800 million, four sources told us.

■ Lumos Labs has announced the launch of a metaverse platform for developers to learn, earn, and explore opportunities after raising over $1.1 million in funding led by web3 venture fund Delta Blockchain Fund. The round also saw participation from venture capitalists such as Superblock, Next Web Capital, Arcanum Capital, AG Build, Paradigm Shift Capital, and multiple angel investors from the web3 ecosystem.

Google to pursue licensing deals with publishers in India, abroad: Pichai

Google is in talks with publishers worldwide to pay them for their content and is “working toward striking some of these conversations” in India too, according to its chief executive officer, Sundar Pichai.

Curated by Judy Franko in New Delhi.

That’s all from us this week. Stay safe.