Also in this newsletter:

■ Technology to push investments globally: TCS chief

■ Indian food delivery rivals back UrbanPiper

■ India to have over 250 unicorns by 2025: Report

Technology to push investments globally for many more years: TCS chief Rajesh Gopinathan

Cyber security, building resilient and adaptable supply chains, various forms of data protection and sovereignty-related issues will emerge as “big drivers for technology spend globally”, Rajesh Gopinathan said in an interaction with ET.

- “The theme that technology will be an increasing percentage of (business) spends is unlikely to get challenged for the next many years,” the TCS chief executive officer and managing director said.

India’s largest software services company is aiming for “profit-driven growth,” as it looks to double its revenue to $50 billion by the end of the decade. “We are closer to a cycle than a sports car. It’s not about the speed rush, it’s organic growth and we know that balance is more important than the sport,” Gopinathan said.

Also Read: TCS Q4 consolidated net profit up 7.4% YoY, matches estimates

The $25.7 billion software giant expects to match double-digit growth with margins of 26-28%.

Report card: In the financial year 2022, TCS grew 15.9% on the back of record deal wins amounting to $34.6 billion for the full year with nearly a third coming in during the final quarter. In comparison, rival Infosys grew 19.7% but clocked lower operating margin at 23% compared with 25.3% reported by TCS.

Also Read: Globalisation’s poster child Infosys is facing political headwinds

Rivals Swiggy, Zomato back UrbanPiper in a $24 million funding round

UrbanPiper founders (from left) Manav Gupta,Saurabh Gupta & Anirban Majumdar

UrbanPiper, a restaurant management platform, has raised $24 million in a new round of funding led by existing investors Sequoia Capital India and Tiger Global, as well as food aggregator giants Swiggy and Zomato. This is the first time that both of these food-delivery giants have together invested in a startup.

What will the funds be used for? The company plans to use the funds raised to scale its product and engineering teams, strengthen its platform capabilities, as well as broaden its offerings to enable more services to restaurants.

Angel investors included Pankaj Chaddah, the cofounder of Zomato and Shyft; Ankit Nagori, the founder of Curefoods; and Saahil Goel and Vishesh Khurana, the founders of Shiprocket, among others.

Quote: “With this investment, we will continue to widen UrbanPiper’s offerings to meet many more digital opportunities in the restaurant ecosystem, along with bolstering our platform capabilities,” said Gupta, CEO, UrbanPiper.

Microsoft joins Udaan’s debt funding round: Microsoft Corporation has joined Udaan’s debt financing round of over $200 million, according to a note sent to employees by Aditya Pande, CFO of the business-to-business (B2B) ecommerce company. With this, Udaan has now raised a total of $225 million through convertible notes.

Udaan cofounders (from left) Amod Malviya, Vaibhav Gupta and Sujeet Kumar

“We are excited to announce that Microsoft Corporation joined our convertible notes offering launched in October last year. M&G Prudential, Kaiser Permanente, Nomura, TOR, Arena Investors, Samena Capital and Ishana Capital amongst others participated in the convertible notes offering round,” Pande told Udaan in an internal note.

Tweet of the day

ETtech Done Deals

■ Expertia AI, deeptech virtual recruitment platform, has raised $1.2 million in a funding round led by marquee investors Chiratae Ventures and Endiya Partners with participation from Entrepreneur First and angel investor Archana Priyadarshini. The startup plans to use the funds for assembling a team of artificial intelligence (AI) researchers and software engineers and creating brand, product awareness in the Indian market.

India likely to mint over 250 unicorns by 2025: Report

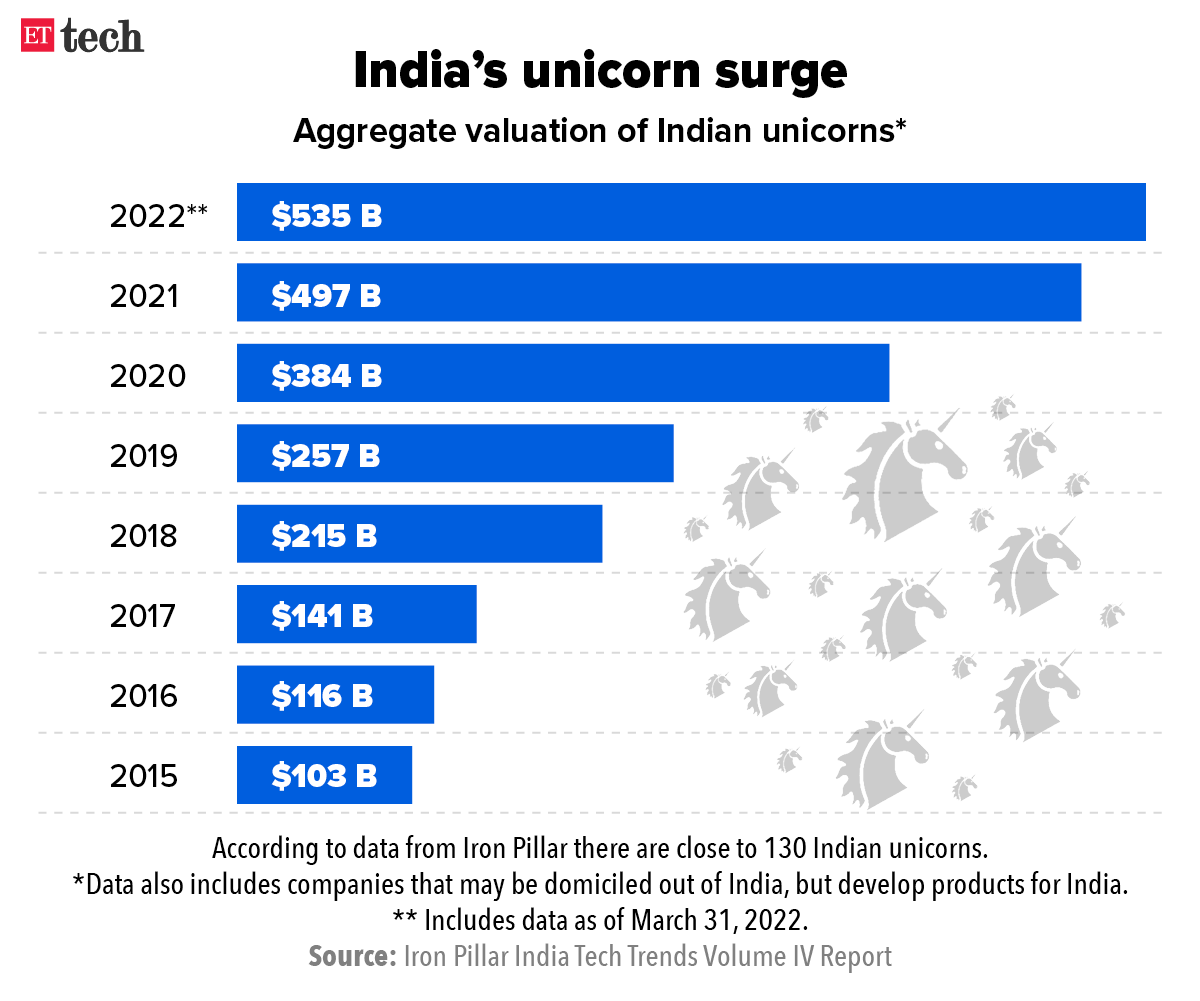

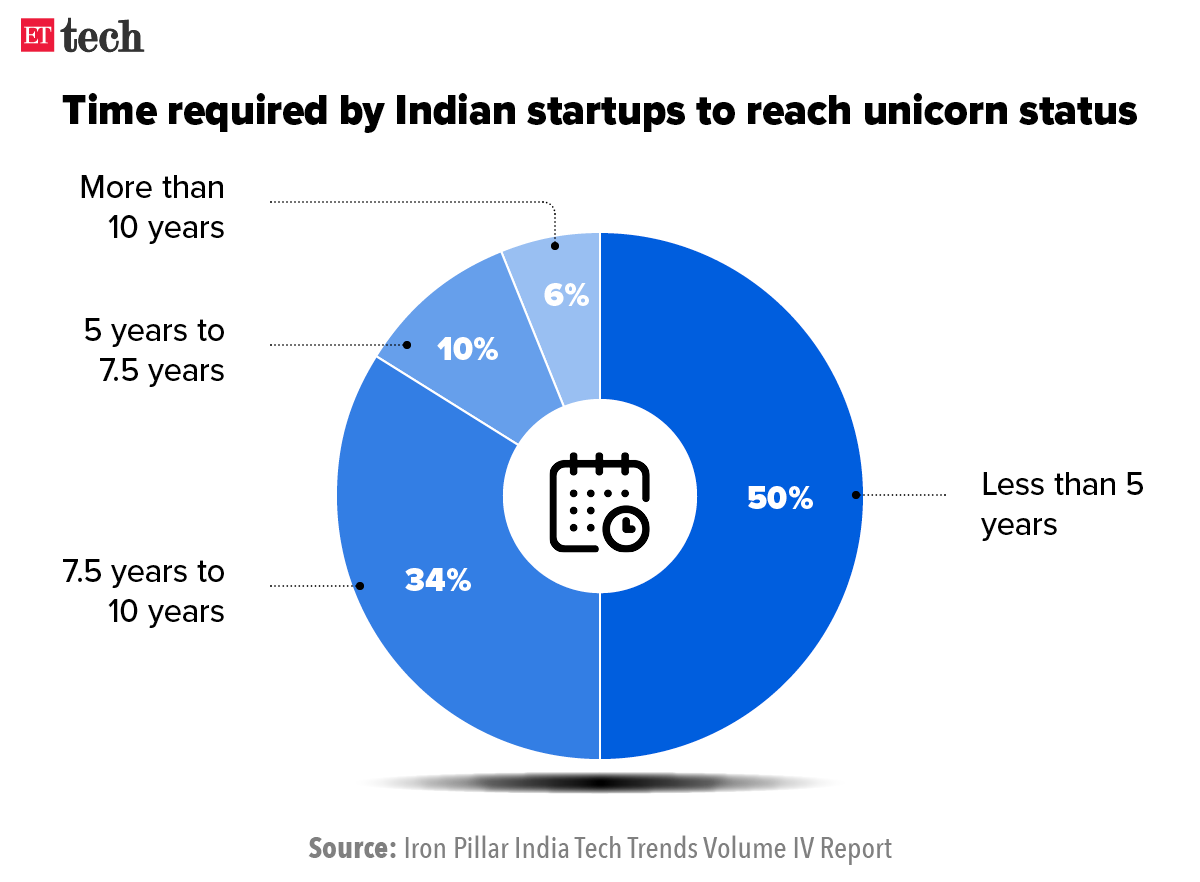

With 2021 being a watershed year for startup investments, India is now expected to have more than 250 unicorns or privately held startups with a $1 billion valuations or above by 2025, according to a report by investment fund Iron Pillar.

It’s all about numbers: The aggregate value of Indian unicorns stands at $535 billion, says the report. With close to 130 Indian unicorns, including those domiciled out of India, the venture capital fund said that total unicorns in the country have more than doubled to 130 in the last 15 months alone. Indian startups raised $36 billion in risk capital in 2021, making it a seminal year for fundraising, also because a bunch of tech firms went public on the Indian bourses.

In spite of private market investors taking a ‘wait and watch approach, due to global macro trends, Indian startups still raked in over $10 billion in funds during the first quarter of 2022, up from $5.7 billion in the same period in 2021, according to data sourced from Venture Intelligence.

Also Read: ETtech Opinion – Let’s redefine unicorns

Quote: “The total number of unicorns built from India more than doubled from 62 to 130 in the last 15 months. While we believe that this pace may reduce a bit in the next 24 months, creating 250 companies with over $1 billion valuation by 2025 is an extremely achievable goal for Indian founders. We are especially bullish since almost 50% of these scaled companies are building for markets beyond India as well,” said Anand Prasanna, managing partner at Iron Pillar, in a statement on Monday.

After Musk, Jack Dorsey slams Twitter’s board amid takeover push

As Tesla and SpaceX chief executive officer Elon Musk puts pressure on the board of Twitter to let him acquire the micro-blogging platform for $43 billion, its cofounder Jack Dorsey has finally broken the silence, labeling the board as “consistently the dysfunction of the company”.

The former Twitter chief executive officer (CEO) also agreed with venture capitalist Gary Tan, who posted that a badly run board “can literally make a billion dollars in value disappear.”

Dorsey, who left Twitter in November last year — handing over the baton to Indian-origin Parag Agrawal — remains a board member until next month with his 2.2% share.

Meanwhile, Musk has said that the Twitter board should be more concerned about other potential bidders than him who has made a fair offer to acquire 100% of the micro-blogging platform for $43 billion.

Shareholding pattern: Asset management firm Vanguard Group disclosed last week that its funds now own a 10.3% stake in Twitter which makes it the largest shareholder. Saudi Prince Al-Waleed bin Talal, who rejected Elon Musk’s offer, has about 5.2% share in Twitter. With 9.2% stake, Musk is one of the largest shareholders in Twitter. Meanwhile, the board of Twitter adopted the ‘poison pill’ strategy to stop Musk from forcefully buying it.

Larsen weighs merging Mindtree & L&T Infotech into a $22 billion firm

Larsen & Toubro Ltd. is weighing a merger between Mindtree Ltd. and Larsen & Toubro Infotech Ltd, Bloomberg reported citing sources. The boards of Mindtree Ltd. and Larsen & Toubro Infotech Ltd., two software units controlled by the Mumbai-based engineering firm, could consider share swap ratios for the merger as early as next week.

Deal details: The two companies have minimal overlap in businesses or clients, and a tie-up would give them better pricing power and lower costs. Deliberations around the merger are ongoing and the plan could be delayed or fall apart, the Bloomberg report said.

Larsen acquired control of Mindtree in 2019. The conglomerate holds about a 61% stake in the company, which has a market value of $8.3 billion, and has around 74% of L&T Infotech, which has a market capitalization of $13.6 billion.

The planned merger comes at a time when software companies are facing increased demand from enterprises adopting digitization, which has accelerated since Covid-19.

Mindtree’s response: “We wish to clarify that news reports of a merger between Mindtree Ltd. and L&T Infotech are speculative in nature. In this regard, we would like to state that there is no information available with the company as of today, which is required to be reported under extant SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, and which may have a bearing on the stock price.”

Mindtree Q4 net profit jumps 49%: The IT services firm said its consolidated net profit for the quarter ended March 2022 jumped 49.1% to Rs 473.1 crore compared with Rs 317.3 crore in the same quarter last year. Sequentially, the profit figure was up 8.1%.

Revenue from operations for the quarter stood at Rs 2,897.4 crore, up 37.4% from Rs 2,109.3 crore in the corresponding quarter a year ago. Quarter on quarter (QoQ), the growth came in at 5.4%.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Aishwarya Dabhade in Mumbai. Graphics and illustrations by Rahul Awasthi.