Also in this letter:

■ Servify raises $65 million in pre-IPO round

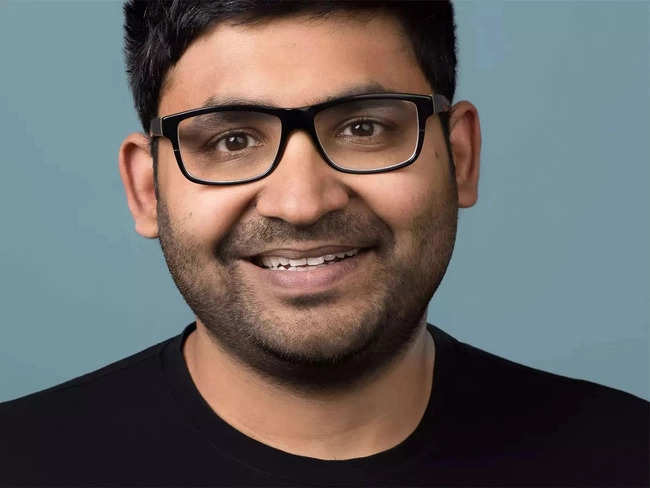

■ Twitter CEO Parag Agrawal hits back at whistleblower

■ Celsius sues ex-money manager over alleged theft

Global tech firms look to assess potential impact of Digital India Act

Global technology firms have roped in legal and technology experts to figure out how the upcoming Digital India Act will affect their operations and help them pre-empt any likely conflict, sources aware of the development told us.

Catch up quick: The government is looking to introduce the Digital India Act (DIA) in the winter session of parliament, as we first reported last week.

The proposed legislation seeks to cover the entire digital ecosystem, from social media and streaming platforms to apps, blockchains and the metaverse.

It could empower the government to block a Twitter handle or Facebook page for 24 hours if it is deemed to be spreading misinformation or inciting violence.

The new regulatory framework will impact large tech companies such as Google, Meta, Twitter, and Amazon experts said.

Potential effects: Insiders told us global tech companies are also looking to analyse the potential impact the proposed law would have on their intellectual property and revenue.

Under DIA, Indian users would be able to give specific permissions to various apps they use and then take away that permission. They would also be able to ask apps not to save their data or not use their personal data for any other purpose, which could reduce revenues of these apps, experts said.

Servify raises $65 million in pre-IPO round

Device management startup Servify has raised $65 million in funding as a part of its pre-initial public offering (IPO) round, led by Singularity Growth Opportunity Fund.

Servify provides white-label warranty and after-sales support products to smartphone original equipment manufacturers (OEMs). It entered the appliance after-sales servicing space with the acquisition of 247around in February.

Existing investors including Iron Pillar, Beenext, Blume Ventures and DMI Sparkle Fund, and new investor AmTrust also participated in the funding.

The latest funding takes the valuation of Servify to roughly $800 million, sources told us.

The startup is eyeing a stock market listing in the coming 18-24 months.

Not done yet: The funding round hasn’t closed yet and could see another $7 million infusion from strategic partners such according to the company’s founder and chief executive Sreevathsa Prabhakar. The final closure – expected by mid-September – would take round size to $72 million.

ETtech Done Deals

■ Edtech startup Brightchamps has acquired Singapore-based Schola, a live-learning platform for kids to develop communication and English skills, in a $15 million cash and stock deal. The company aims to use the acquisition to bolster its presence in the K-12 education segment.

■ TVS Motor Company said it has invested Rs 85.41 crore (about $10.6 million) for a 48.27% stake in Narain Karthikeyan’s startup DriveX, a pre-owned two-wheeler platform.

■ Deconstruct Skincare, a Bengaluru-based startup, has raised $2 million in funding led by Kalaari Capital’s flagship program CXXO and Beenext. The company will use the capital for research and development, hiring, and expansion as it aims to become a Rs 100-crore brand in the next two years.

■ AI-led sales pipeline readiness startup RevSure AI said it has raised $3.5 million in funding led by Innovation Endeavors, along with angel investors Katrin Ribant, Rick Scanlon, and Sharath Keshava Narayana.

Twitter CEO Parag Agrawal hits back at whistleblower

Twitter CEO Parag Agrawal has lashed out at the company’s former security head, Peiter ‘Mudge’ Zatko, terming his claims false and “riddled with inconsistencies”. On Tuesday, Zatko claimed that the company lied about the actual number of spam accounts on its platform and misled federal regulators about users’ data safety.

Statement: “We are reviewing the redacted claims that have been published, but what we’ve seen so far is a false narrative that is riddled with inconsistencies and inaccuracies and presented without important context,” said Agrawal in an internal message to Twitter employees, which he also posed on Twitter.

Advantage Musk? Zatko’s claims could benefit Elon Musk, who is set to face Twitter in a five-day trial starting October 17. Musk’s lawyers have already sent him a subpoena.

Meanwhile, the Tesla CEO took to Twitter to post an apt meme in light of the developments.

Also read: Twitter reshuffles ‘health’ team amid spam bot debate

Bankrupt crypto lender Celsius sues ex-money manager over alleged theft

Bankrupt crypto lender Celsius Network has sued its former investment manager Jason Stone, accusing him of stealing tens of millions of dollars in assets before the company went broke last month.

Details: Celsius claimed that Stone misappropriated assets to buy hundreds of NFTs that he stored out of reach and kept himself safe using Tornado Cash — a crypto “mixer” that helps laundering cybercrime proceeds.

Celsius filed for bankruptcy last month owing to plunging prices of cryptocurrencies and inflationary pressures.

Three Arrows update: Meanwhile, liquidators of Three Arrows Capital have received a nod from the Singapore high court to access financial records of the now bankrupt crypto hedge fund. The liquidators have already gained control of about $40 million of the company’s assets.

TWEET OF THE DAY

FTC agrees to drop Mark Zuckerberg as defendant in antitrust suit

The US Federal Trade Commission has said that it will remove Meta CEO Mark Zuckerberg from its lawsuit to block the company’s acquisition of Within Unlimited, the maker of virtual reality fitness app Supernatural.

The regulator’s decision comes after Zuckerberg promised that he would not try to purchase Within Unlimited personally. Meta was blocked from acquiring Within in June after the FTC filed a complaint against it with a US District Court in Northern California, accusing it of trying to dominate the nascent virtual reality space.

Snap settles suit for $35M: Meanwhile, Meta’s rival Snap Inc has agreed to pay $35 million to the US state of Illinois in a class-action lawsuit over illegal user data collection. The lawsuit alleged that Snapchat’s filters and lenses violated the state’s Biometric Information Privacy Act (BIPA).

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.