Also in this letter:

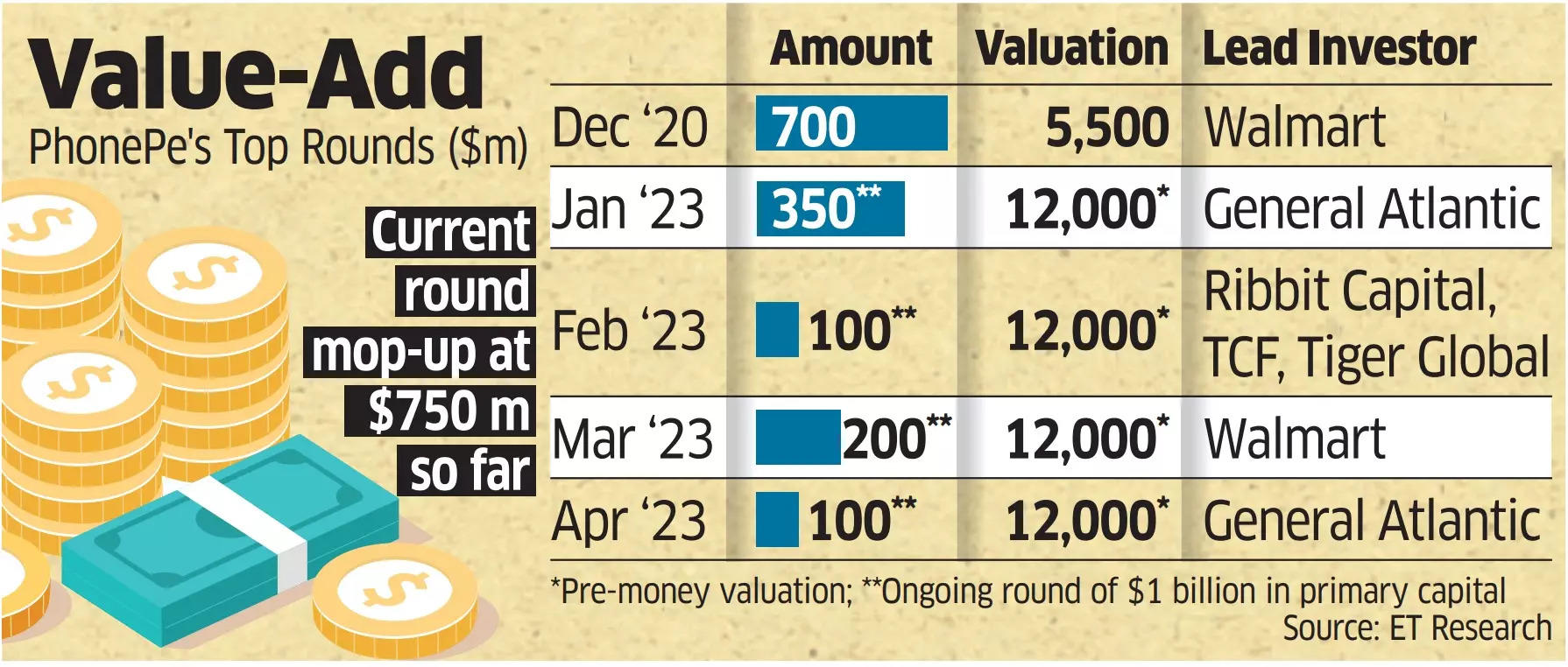

■ PhonePe gets another $100 million from General Atlantic, more expected

■ Zerodha forms JV with Smallcase for mutual fund business

■ Vedanta-Foxconn’s fab JV talks with STMicro hit a bump

TCS Q4 net profit up 15% to Rs 11,392 crore

Tata Consultancy Services (TCS) said its net profit for the final quarter of fiscal 2023 rose 15% on-year, but India’s largest software exporter pointed to macroeconomic concerns, especially in its largest market of North America, which dragged down its quarterly performance.

By the numbers: For the January-March quarter, the Mumbai-headquartered company’s net profit rose to Rs 11,392 crore from Rs 9,926 crore a year back. Sequentially, net profit grew 5%. Revenue came in at Rs 59,162 crore, up 16.9% year on year, led by strong performance in continental Europe and the retail vertical.

Weaker than anticipated: Outgoing CEO & MD Rajesh Gopinathan told reporters on Wednesday that the fourth quarter numbers were “definitely weaker than anticipated.” He is scheduled to hand over the baton to the new CEO-designate K Krithivasan, who will take over from June 1, the company said. Noting that “North recovery has turned out to be slower than originally expected,” Gopinathan said that it has led to clients delaying technology spends

Also read | No rush to tweak organisational restructuring: TCS CEO designate

Organisational restructuring: TCS is in no hurry to amend the new organisational structure put in place last year, Krithivasan said on Wednesday. He added that the new structure was “put in place with a lot of internal deliberations.” “I will meet with all customers and make a reference list, if there’s any tweak required, we will do it appropriately. So, there’s no rush to do it now,” he said.

Also read: TCS reports addition of 821 employees during March quarter, attrition eases

PhonePe bags another $100 million from General Atlantic, more expected

General Atlantic may continue to infuse capital into the online payments company, sources tell ET.

What’s driving the news: Sources tell ET that even after General Atlantic has infused $450 million into PhonePe, this year, talks between both entities are on for another $100-$200 million infusion. However, the investment is subject to achieving certain conditions and milestones by PhonePe.

The missing pie: With its latest raise, PhonePe has closed $750 million out of the $1 billion it set out to raise at the start of the year. With $250 million more to go, it is likely that General Atlantic and existing backer Flipkart co-founder Binny Bansal, who also sits on PhonePe’s board are likely to fill in for the remaining portion of the funding. ET had exclusively reported on March 10 that Bansal is likely to invest $100-150 million in PhonePe.

PE interest in fintech peaks: Global and Indian PE funds have been active in backing fintech startups in the country. Last year, TPG co-led a $110 million round in digital lender, Fibe (previously EarlySalary), through its Rise Fund. Similarly, Advent International, Premji Invest along with others invested in KreditBee’s $200 million fundraise, which closed at the start of this year.

ZestMoney deal falls off: PhonePe’s fundraise takes place amid deal talks between BNPL platform, ZestMoney and PhonePe falling through. Sources say that PhonePe is looking to build its BNPL muscle in-house and is likely to absorb some employees of ZestMoney for its foray in the space.

Manish Singhal, founding partner, pi Ventures

Early-stage fund pi Ventures raises Rs 100 crore: Early-stage venture capital fund pi Ventures on Wednesday said it has received a commitment of Rs 100 crore (about $12.2 million) for its second fund from Small Industries Development Bank of India’s (Sidbi) equity scheme Fund of Funds for Startups (FFS). The fresh capital is about 2.5 times what Sidbi’s FFS had invested in the first fund, the statement added.

The announcement comes two weeks after the Bengaluru-based firm, which focuses on artificial intelligence and deeptech-based businesses, raised Rs 22 crore from Belgium’s Colruyt Group for the same fund.

Zerodha forms JV with Smallcase for mutual fund business

Online stock brokerage firm Zerodha has formed a joint venture (JV) with wealth management platform Smallcase for the mutual fund business, founders of both entities announced on Wednesday. Zerodha, India’s largest stock brokerage in terms of the number of customers, already has the initial clearance for an asset management company (AMC) from the Securities and Exchange Board of India (Sebi) and is awaiting the regulator’s final approval.

Also read | ETtech Interview: Zerodha’s revenue may drop 30-40% in FY24: CEO Nithin Kamath

Details: Zerodha had received Sebi’s in-principle approval to set up an AMC in 2021. The AMC will “use learnings and shared values from both companies to build an enduring fund house”, said Smallcase founder Vasanth Kamath. The news comes after acquisition talks between Smallcase and fintech Cred fell through due to disagreement over valuation.

Tweet of the day

Vedanta-Foxconn’s JV talks with STMicro hit a bump

The Vedanta-Foxconn semiconductor consortium’s discussions with STMicroelectronics for inducting the European company as a technology partner have got stuck due to lack of agreement on finer details of technology transfer, the duration of the partnership and the funds to be invested by each company, multiple people aware of the situation told ET.

Reason: One key sticking point is that STMicroelectronics wants to limit the scope of the technology transfer as well as have a sunset clause regarding the duration of the joint venture, said a person close to the development. “STMicroelectronics also has some reservations regarding its investment in the (Vedanta-Foxconn) combine. They want Vedanta to take the lead and invest more,” this person said.

STMicro seeks early exit: Another source, who has been monitoring the deal closely, said STMicroelectronics wants to exit the joint venture after “5-10 years during which it can complete technology transfer,” the Vedanta-Foxconn combine wants the European chipmaker to stay on for longer.

Background: In February this year, ET had reported that the Foxconn-Vedanta combine was close to inducting European chipmaker STMicroelectronics as the technology partner in their proposed semiconductor chip manufacturing unit in India. This was after officials from the ministry of electronics and information technology, which is the nodal ministry looking after the plan to develop a semiconductor, had last year told ET that since Vedanta or Foxconn did not have the necessary experience, they will require to onboard a third partner which had the technology as well as the manufacturing know-how.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Demand for cybersecurity experts defies slowdown in tech hiring

Despite a hiring slowdown in India’s technology sector, demand for cybersecurity professionals has reached an all-time high this year, as investing in cyber resilience has become a top priority for tech companies.

What are the numbers: According to exclusive data from Naukri.com, there has been an up to 70% increase in various roles in security this year compared with last year. Top profiles in demand include network security engineer (up 66%), application security engineer (up 57%), DevSec engineer (up 27%) and cybersecurity (22%). Executive search firms such as Ciel HR Services and Longhouse Consulting too have seen a nearly 60-80% increase in hiring mandates in cybersecurity roles.

Quote, unquote: “IT security is a rising concern for most organisations,” said Nitin Bhatt, partner & technology sector leader at EY. “With an increasing trend towards cloud-based deployments from on-prem environments, work from home, and an increase in the number of startups and firms utilising open-source tools, organisations are feeling greater need for strengthening security for their networks, apps and associated data,” he added.

Other Top Stories By Our Reporters

Blinkit delivery workers protest in Delhi-NCR over changes in pay structure: Hundreds of delivery partners working with Zomato-owned quick commerce platform Blinkit in Delhi-NCR went on a strike on Wednesday, protesting against a renewed fee structure that they say will reduce their income, disrupting services at some locations.

Indian social media laws strict, can’t go beyond, says Elon Musk: Social media laws in India are quite strict and Twitter can’t go beyond the laws of the country, Elon Musk said on Wednesday. Being compliant with India’s laws is better than having employees go to jail, Musk said, while talking in the context of taking down posts related to the BBC documentary on Prime Minister Narendra Modi. But Musk said he was not aware of “this particular situation” about the documentary.

US court spikes caste bias case against Cisco: A US court has accepted the California Civil Rights Department’s (CRD) plea to dismiss its case alleging caste discrimination against two Cisco employees. While the CRD has voluntarily sought the dismissal of the case against the two Indian-American employees of Cisco, it is still processing the case against the US-based tech company. The reason for the CRD’s move wasn’t immediately known.

Global Picks We Are Reading

■ LinkedIn Will Finally Offer Ways to Verify Your Job (Wired)

■ Most expensive license plate sold for $15m at Dubai auction (Morning Brew)

■ Silicon Valley VCs tour Middle East in hunt for funding (Financial Times)