Also in this letter:

■ IT firms may slash hiring from campuses by up to 50% this year

■ Up to 50% of startups will have to sell or shut amid funding winter: Tribe Capital’s Sethi

■ India to outpace US on ecommerce users in two years: Bain report

Tata Consultancy Services reported a net profit of Rs 10,431 crore for the September quarter, an 8.4% increase from the same period last year. This performance was led by growth across industry verticals and major markets such as the US, UK and Europe.

By the numbers: The Mumbai-headquartered company reported revenue of Rs 55,309 crore, up 18% year-on-year, which was slightly above estimates of 17.5% growth. The company declared an interim dividend of Rs 8. Attrition stood at 21.5% compared to 19.7% in the previous quarter.

On a sequential basis, revenue was up 4.8% and profit was up 10%. This was also the first time the company crossed Rs 10,000 crore in quarterly net profit.

It reported total deal wins of $ 8.1 billion, in line with brokerage estimates of $8-8.5 billion. It bagged deals worth $8.2 billion in the quarter.

CEO speak: Chief executive Rajesh Gopinathan said that customers were spending on growth, transformation and business resilience offerings.

“We see demand momentum across all our operating markets… (but) the environment is challenging and it requires all of us to remain vigilant. We have demonstrated that our focus on distributed portfolio of services and ability to remain relevant to customers,” said Gopinathan.

Macro concerns: The sector will see the impact of macro concerns on client budgets in three to six months, but these concerns have not materialised in the company’s order pipeline, Gopinathan added. “It’s difficult to say if we will be totally insulated but our intent is to stay close to customers, carve out a niche for ourselves and minimise any impact,” he added.

Campuses that are popular with IT services companies looking to hire engineers are likely to see the number of offers for the class of 2023 fall by as much as half, a new study suggests.

Driving the news: According to the study by staffing services firm Xpheno, IT services firms, product and startup companies, and others in the sector made more than 600,000 offers for entry-level positions in FY22, but that number is likely to fall by up to 50% this year,

The top eight IT services providers alone hired around 3.3 lakh people at the entry level last fiscal year, Xpheno cofounder Kamal Karanth told us.

Placement officials at colleges like Vellore Institute of Technology (VIT), Amity University, government engineering colleges at Thrissur, Palakkad and Kannur, and Mar Athanasius College of Engineering (MACE) in Kothamangalam, Kerala, confirmed that based on the early trends, hiring by IT services companies from the class of 2023 would likely be lower compared with the previous batch, in some cases by 25-50%.

IT companies typically recruit thousands of people every year from these campuses.

Caveat: The number of offers made for entry-level positions in fiscal 2022 was the highest ever, driven by pent-up demand for talent after the pandemic. Some like Jimit Arora, partner at Everest Group, see the current expectations as normal compared with the pre-pandemic hiring trend.

An economic slowdown in the US and Europe, their biggest markets, may also be weighing on the hiring plans of the IT companies. The pressure is being felt by students of the class of 2022 as well.

Onboarding of the class of 2022 by several IT services is getting pushed back by two to three months, said Anjani Kumar Bhatnagar, deputy director, Amity Technical Placement Centre.

Tribe Capital will continue investing in companies that enable commerce in India, founding partner Arjun Sethi told us, even as a funding slowdown in technology affects dealmaking across the globe.

Grim outlook: Talking about the rout faced by the tech sector in public and private markets, Sethi said India was similar to the growth market in the United States (tech growth stocks), where late-stage companies have seen 50-70% shaved off their enterprise value. Fintech has been hit the hardest, along with workflow and software-as-a-service (SaaS) application companies.

Sethi said around 50% of companies would have to sell or wind down globally and in India amid the tight funding environment.

“I think consolidation is good for the ecosystem… it will be harder to raise the next rounds unless the companies are in the top 5-10% of logos and performance; (these companies) will not have issues…” The Silicon Valley-based early-stage venture capital firm plans to invest around $800 million to $1 billion in India over the next few years.

Founded by former executives of Chamath Palihapitiya’s Social Capital, Tribe’s founding partners include Sethi, Jonathan Hsu, and Ted Maidenberg, who have backed companies such as Slack, Snapchat, Carta, Gusto, across their two funds.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

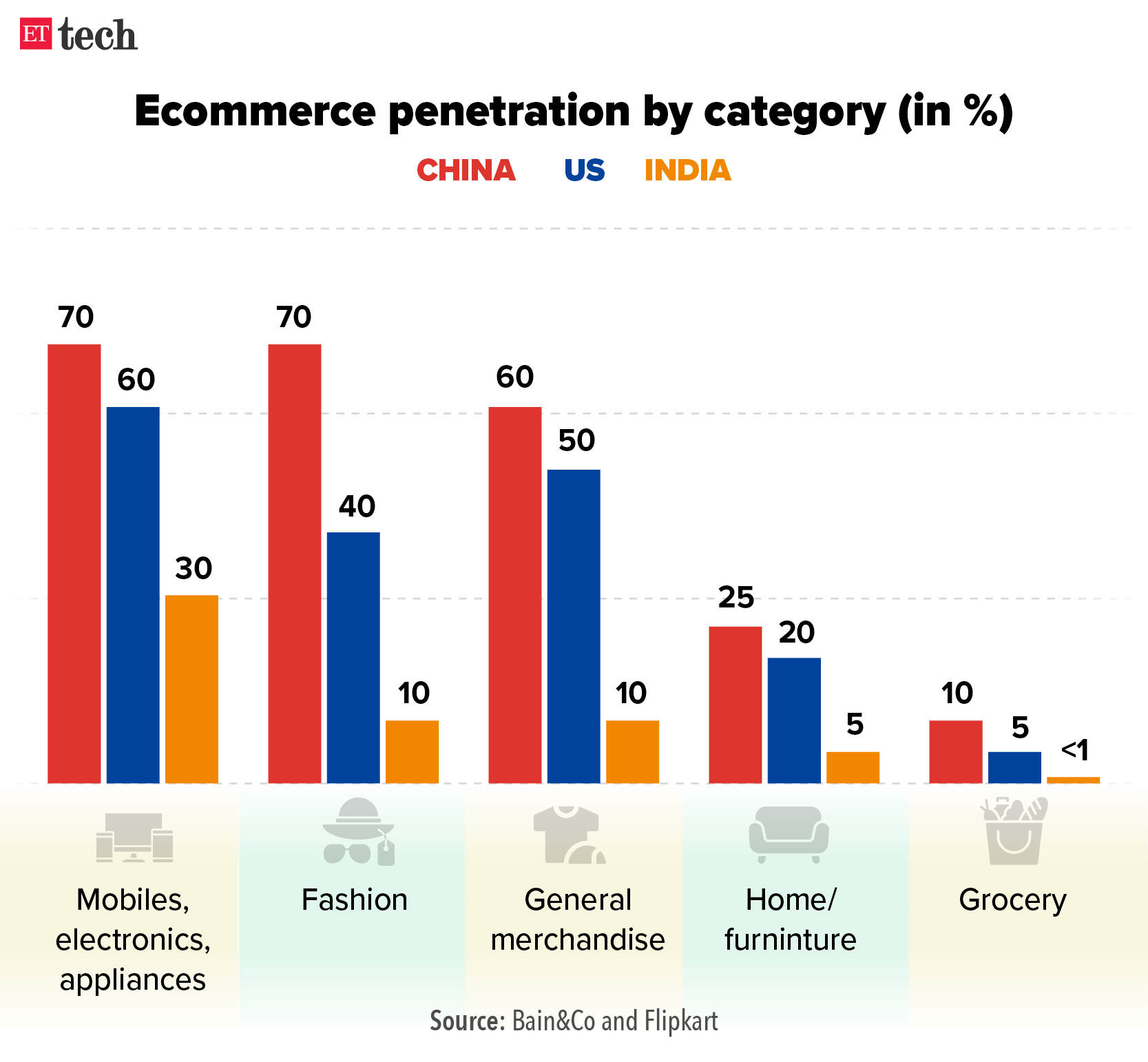

Ecommerce in India is expected to grow at 25-30% annually for the next five years, with a steady increase in user base that is estimated to beat the second-largest ecommerce country by users – the United States – in the next one or two years, according to a report by consultancy firm Bain & Co and Flipkart.

By the numbers: The online shopper base in India, which was at 180-190 million in 2021, will increase to about 400-450 million users by 2027, by when the industry is estimated to be valued at over $150 billion. The report pegged the ecommerce market at $50 billion this year, up 40% from last year.

“With the pace of growth we are talking about, we are very soon going to be the second largest shopping base, only behind China,” said Manan Bhasin, partner, Bain & Co.

Growth drivers: Going forward, the category mix in online commerce is expected to evolve, with growing demand for fashion, grocery and other categories as its reach widens across the country. Bhasin said the share of fashion will likely increase from 20-25% of overall ecommerce sales to 25-30%.

TWEET OF THE DAY

Artha Group looks to close Rs 450-crore opportunity fund to back winners

Artha Group is looking to close a Rs 450-crore opportunity fund to back winners from its existing portfolio, a senior executive told us.

Details: The new vehicle, Artha Select Fund (ASF), includes a Rs 120-crore green shoe option and has secured commitments of more than Rs 100 crore from existing limited partners, or sponsors, of Artha Venture Fund (AVF).

ASF, led by Anirudh Damani, will invest in the growth rounds of companies backed by AVF and Artha India Ventures.

Mumbai-based Artha Group, the umbrella entity of ASF, has investments in over 100 startups across India, the United States, Israel, Africa, and the UK.

Oyo, Purplle, LeveragEdu, and Rapido, are some startups in its India portfolio.

Last June, AVF raised Rs 225 crore from family offices in the United States, United Arab Emirates, Israel, Russia, Morocco, and the Middle East, ultra-high net-worth individuals (UHNIs) and Small Industries Development Bank of India (SIDBI).

ONDC to open to public in parts of Delhi next month: The Open Network for Digital Commerce (ONDC) is set to extend beta testing in the groceries, and food and beverages segments in select pin codes in Delhi early next month, according to network participants who did not wish to be named.

Licious enters plant-based meat business: Online meat retailer Licious has entered the plant-based meat business with a new brand called Uncrave. Unlike typical mock-meat brands that sell to vegan customers and ‘activists’, Licious will offer Uncrave to its core meat-consuming customers as an alternative for occasions when they abstain from eating meat, such as Navaratri, cofounder Abhay Hanjura told us.

Global Picks We Are Reading

■ If BJP’s Amit Malviya reports your post, Instagram will take it down – no questions asked (The Wire)

■ WhatsApp is now a spammers’ paradise in India (Rest of World)

■ Hurricane Ian destroyed their homes. Algorithms sent them money (Wired)