Also in this letter:

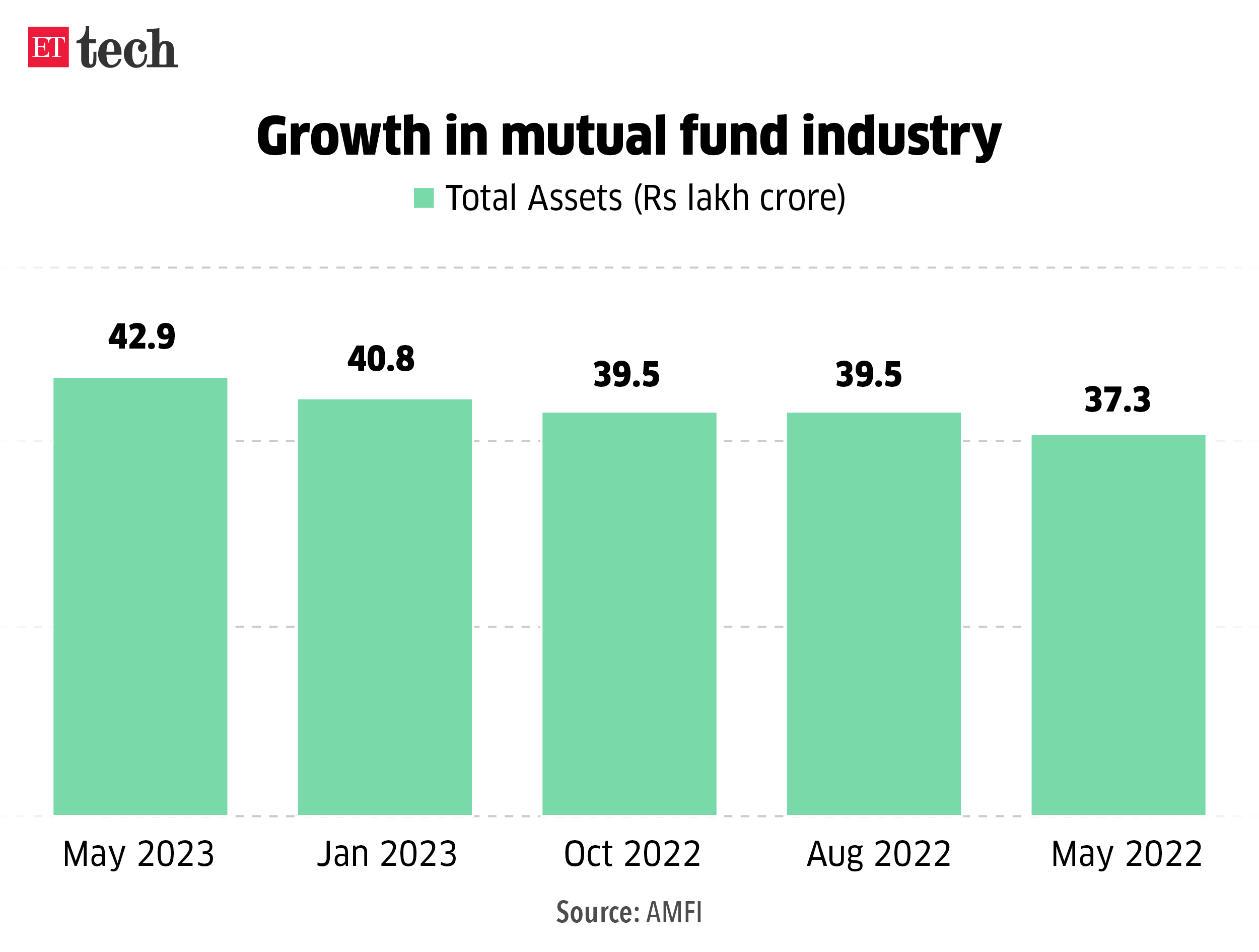

■ Monetisation a hurdle for direct MF platforms

■ Byju Raveendran tells staff his commitment to company is unwavering

■ Top 4 IT firms see subcontracting costs jump 60%

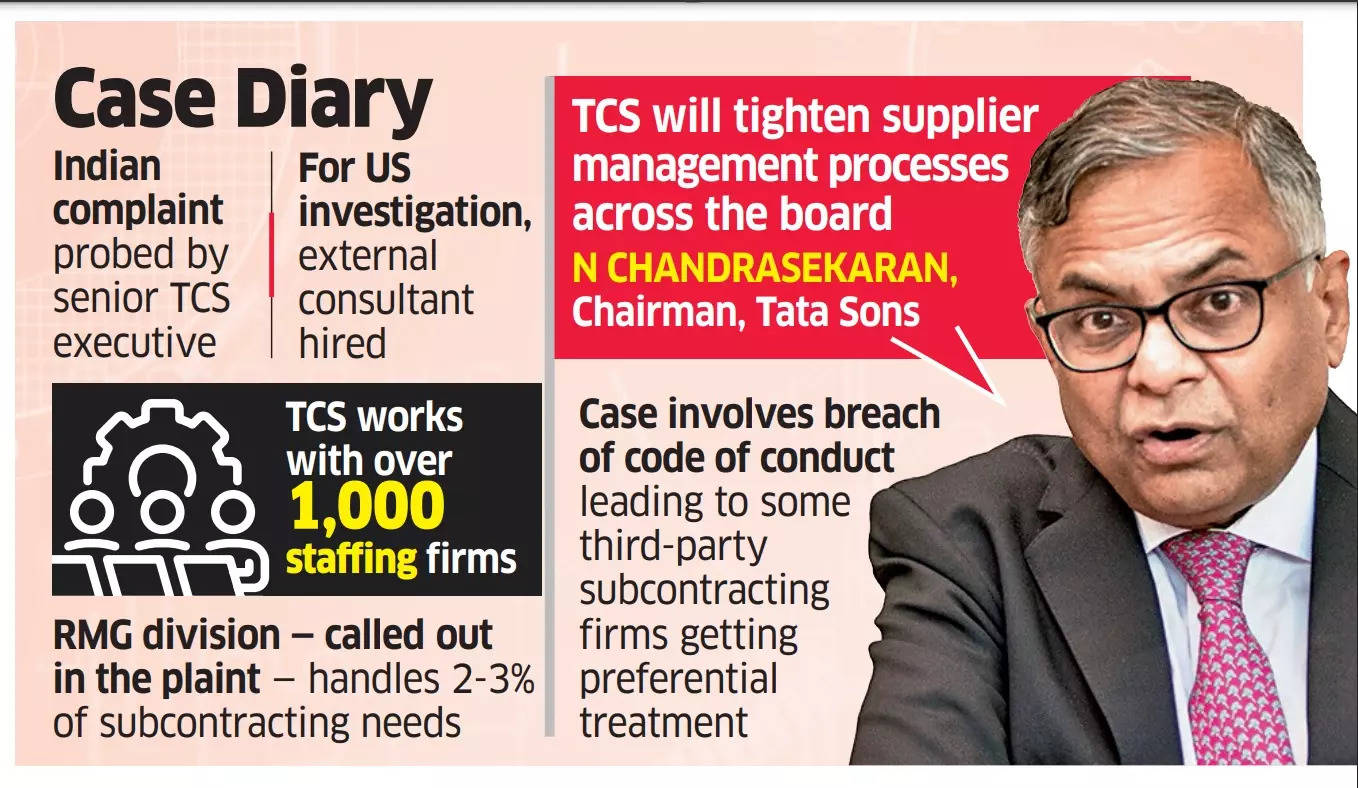

Jobs scam | TCS sacks six employees, as many staffing firms: N Chandrasekaran

Following allegations by a whistleblower of a recruitment scandal at Tata Consultancy Services (TCS), the company has sacked six employees and as many staffing firms for violating ethical standards, Tata Sons chairperson N Chandrasekaran informed shareholders during the company’s 28th Annual General Meeting (AGM) on Thursday.

Strong systems: Chandrasekaran said TCS will review and tighten its supplier management process to ensure that incidents like this are not repeated. He also emphasised the need for ethical conduct and integrity among employees.

Verbatim: “The most important thing expected of every employee is ethical conduct and integrity, ahead of any financial performance. So, whenever there is a violation of ethical conduct by any employee, it pains me. All the leaders take it extremely seriously and we will always deal with such incidents very strongly’’, he said.

What happened? The complaint alleged that TCS executives were allegedly giving preferential treatment to certain staffing firms in recruiting contractual employees, in exchange for gratification.

On Wednesday, ET reported that TCS has written to its board members and clarified the allegations. “This is not an issue related to hiring of employees of TCS, but with the contractors of TCS. There are claims that the amount involved is Rs 100 crore — it is not even remotely close’’, a board member told ET off the record.

More from the AGM: Chandrasekaran said that TCS has performed well despite the macroeconomic headwinds and the ongoing geopolitical volatility.

“The year 2022-23 witnessed intense geopolitical and economic volatility. The ongoing Russia-Ukraine conflict and geopolitical tensions have disrupted the smooth functioning of global supply chains. There has been a surge in inflation, especially in the developed markets’’, said Chandrasekaran.

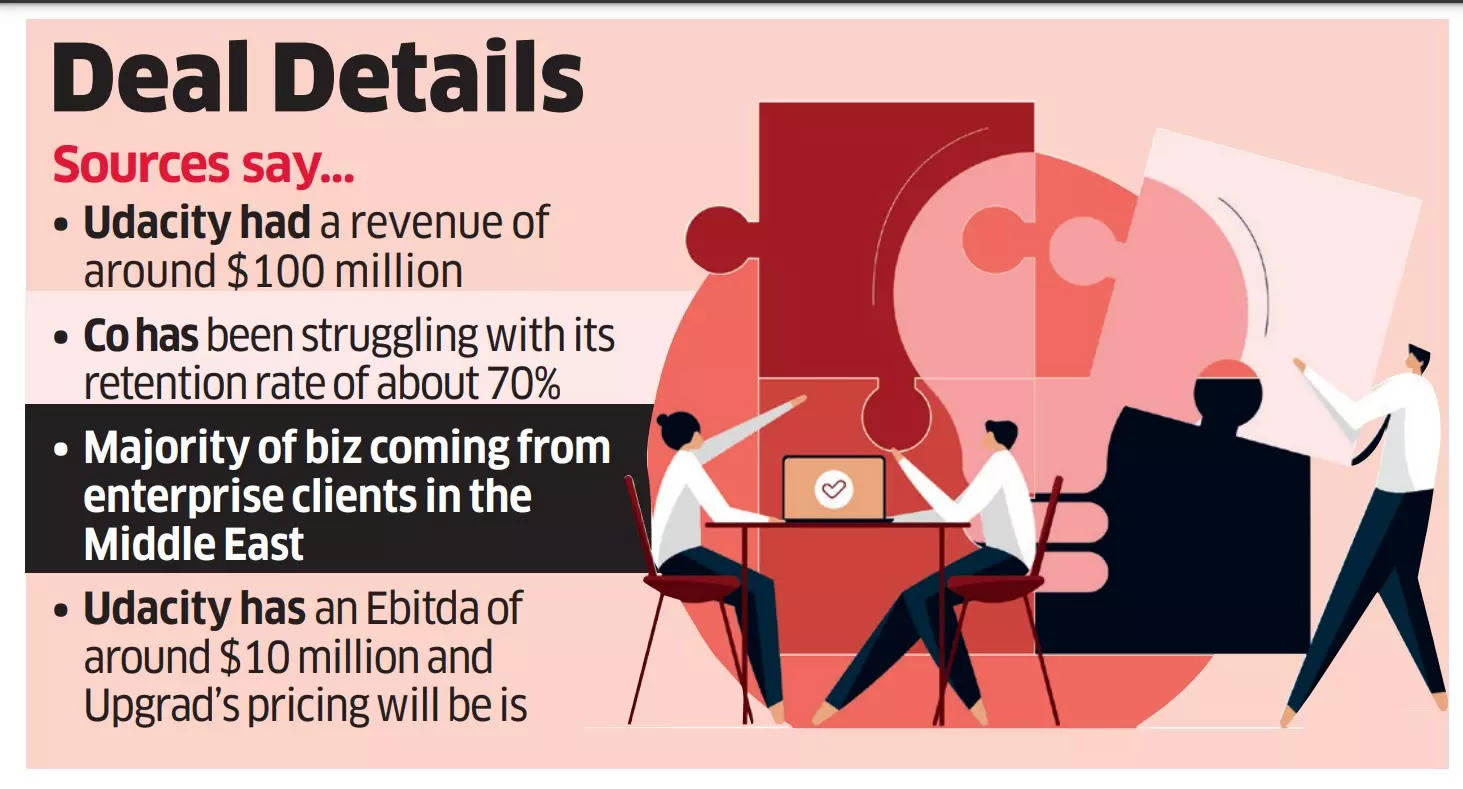

Edtech unicorn Upgrad in talks to buy US-based Udacity

Higher education and upskilling-focussed edtech company Upgrad is in discussions with US-based online learning platform Udacity for a majority stake in the company, sources told ET. The deal is expected to be through an equity swap. Udacity has been on the block for a few months.

What’s happening? Udacity has an Ebitda (earnings before interest, taxes, depreciation, and amortisation) of around $10 million, and Upgrad’s pricing for the firm is based on that. “The talks have moved at a fairly good pace. The valuation would be around $100-120 million, which is about 10-12 times its Ebitda’’, a source told ET.

If the deal goes through, it would mean a steep fall from a peak valuation of $1 billion.

Vanishing equity: Before Upgrad, Udacity had asked a previous buyer for a valuation of around $200 million, but the prospect had passed. A source — who had reviewed the sale proposal earlier — told ET that Udacity had a revenue of around $100 million but is struggling with its customer retention rate of about 70%.

“If retention is dropping then it may not justify the price in the long run, even if it’s through an equity swap,” a source told ET.

What’s in it for Upgrad? The Mumbai-based company has doubled down on its offerings in the reskilling space and has been on the lookout for deals as the K-12 segment in India has seen Covid tailwinds vamoose. This has led to steady demand for edtechs focussed on higher education and upskilling.

“The deal will add some revenues to Upgrad. This is a good time for buyouts and assets are available at better prices in the US than in India,” one of the sources added.

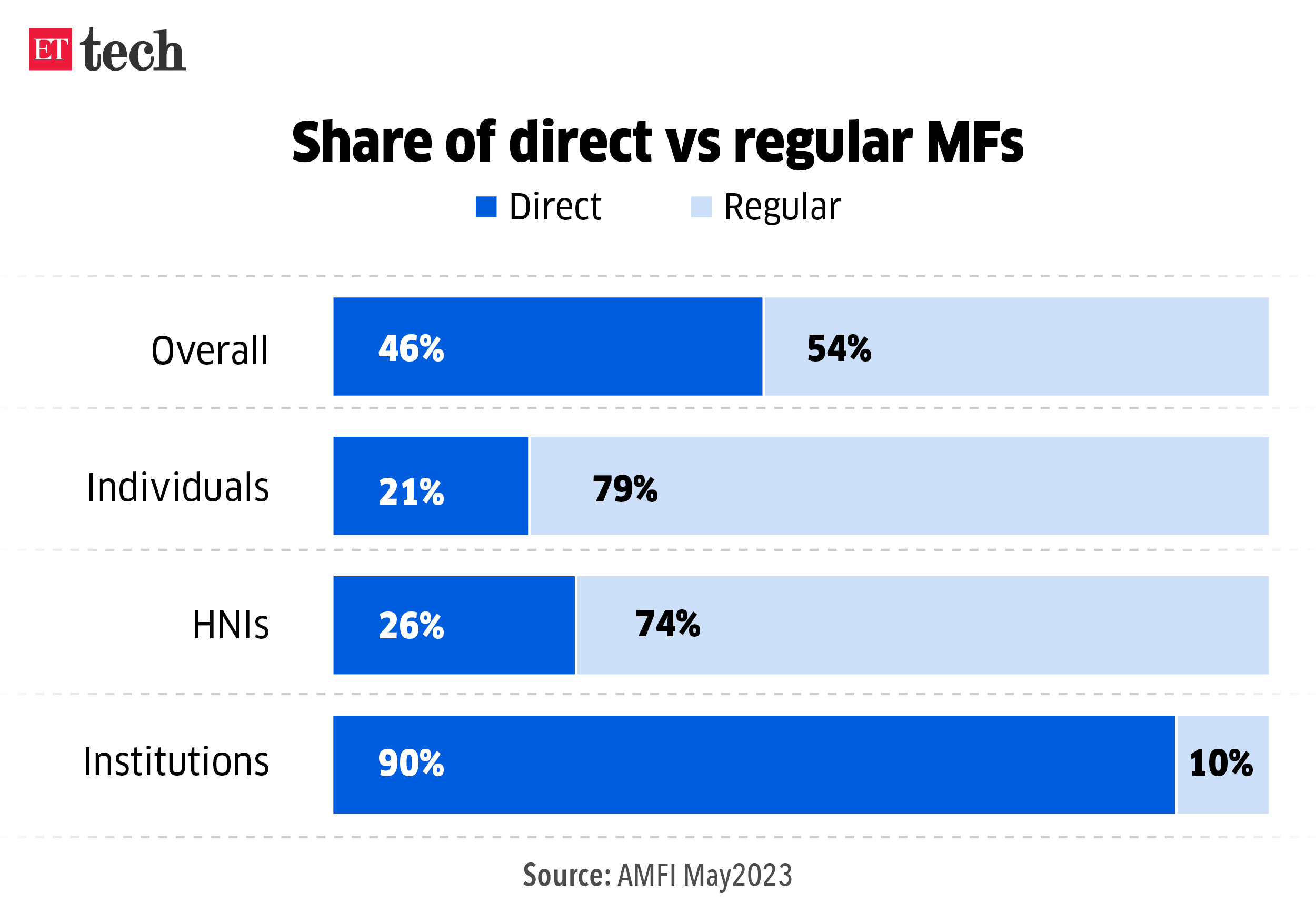

To charge or to keep free, direct MF players fret over this core question

While market regulator SEBI has allowed a new set of entities named EOPs (execution-only platforms), who facilitate investment in direct mutual funds (MF), to start charging for their services, many startups still need to figure out how to go about this.

Story so far: Fintechs like Groww, Zerodha Coin, and ETMoney have built direct MF distribution platforms and do not charge their users for these services. Looking at the unsustainability of this business model, SEBI allowed them a few weeks back to start charging either AMCs (MF companies) or their customers.

What’s happening? The problem is these platforms have spoilt consumers with free services. If they start charging them, many might drop off.

Also, who will first go the monetisation route is a big question, as they might see a significant drop. And given the competition, no one would like to lose their hard-earned customers.

Solution: Most players feel that AMCs will be charged for these services. Given that direct platforms help get them new customers, AMCs can shell out a commission. But for players like Groww and Zerodha Coin, their primary source of revenue is stock trading. For them, mutual funds are just a customer acquisition tool. Why would they want to disturb that?

Counter argument: Some industry insiders feel the pressure will come from the investors of these startups. Since every VC in town is pushing their portfolio companies to focus on the topline, the fintechs might eventually move that way. As of now, there is still no consensus though.

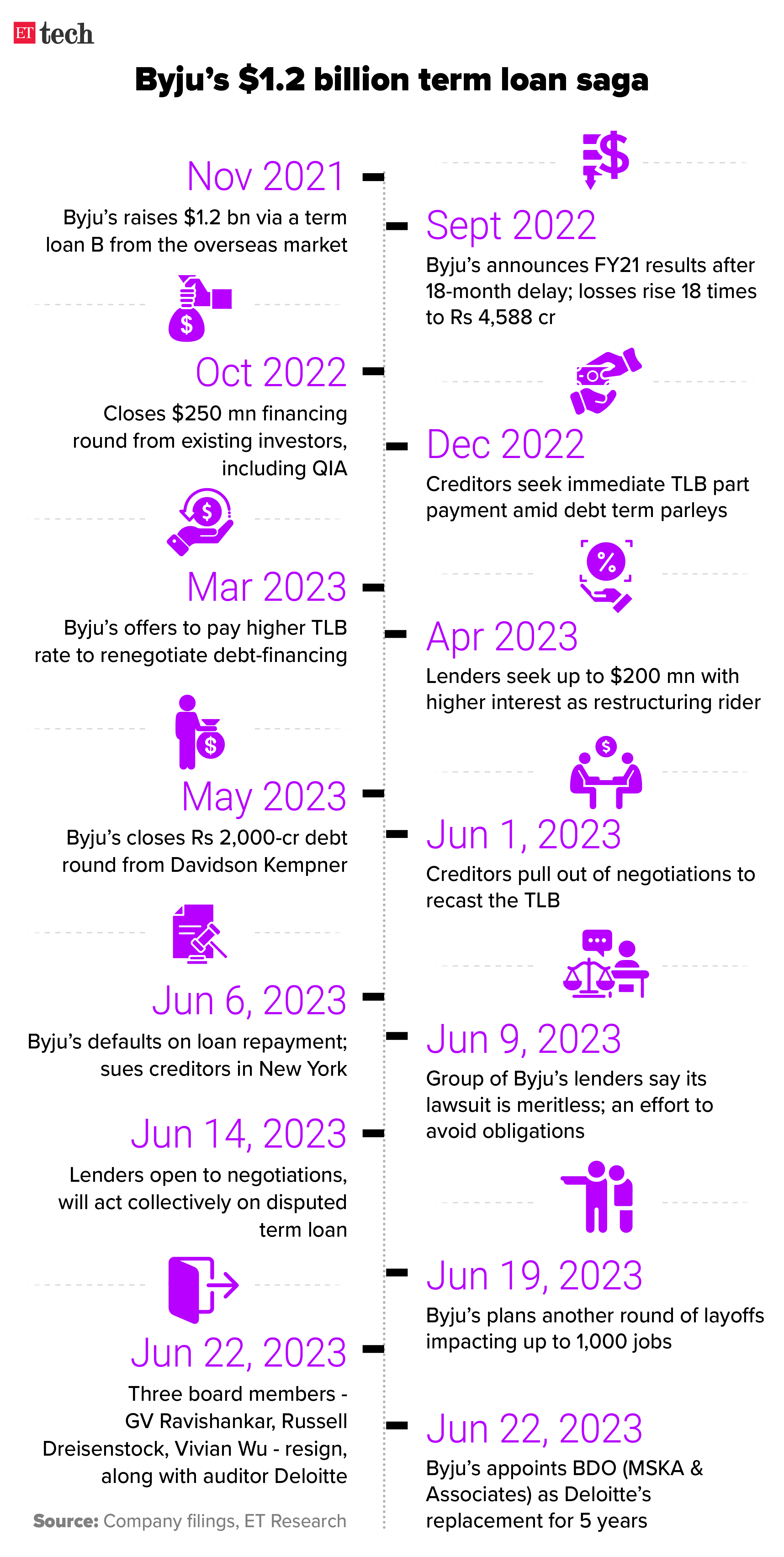

Heart goes out to team members facing downsizing: Byju Raveendran writes to staff

“When the going gets tough, the tough get going”, with this quote, Byju’s kicked off its townhall, and founder and chief executive Byju Raveendran reassured employees that things were not as bad as they seemed.

On layoffs: Byju’s has laid off thousands of employees in the past few months, with the most recent round of culling announced just last week. On this, Raveendran said in a letter to employees that his heart goes out to each and every team member who is facing the difficult reality of downsizing. However, he did not indicate if any more job cuts were in the offing, nor what the company would do to ease the pain of axed employees.

On auditor, board exits: Raveendran said Deloitte had left as the company’s auditor on amicable terms and that it was a mutual decision.

He added that the board members’ exits were not linked to Deloitte’s resignation. “There was a difference of opinion regarding how to handle some of the strategic issues… like the TLB negotiations. But I continue to be on great terms with them’’, he asserted.

Troubles abound: ET reported on Wednesday that Byju’s is yet to receive the entire Rs 2,000 crore sanctioned by Davidson Kempner Capital last month as it had failed to meet the loan terms.

Byju’s has been mired in loan defaults, valuation markdowns, and a string of high-level exits that saw three of the edtech’s board members — GV Ravishankar, managing director at Peak XV Partners (formerly Sequoia Capital India), Russell Dreisenstock of Prosus (previously Naspers) and the Chan Zuckerberg Initiative’s Vivian Wu — step down.

Rainbow beckons: Given the winds whipping Byju’s, Raveendran signed off his letter to the employees with an upbeat allegory: “The stronger the storm, the brighter the rainbow’.”

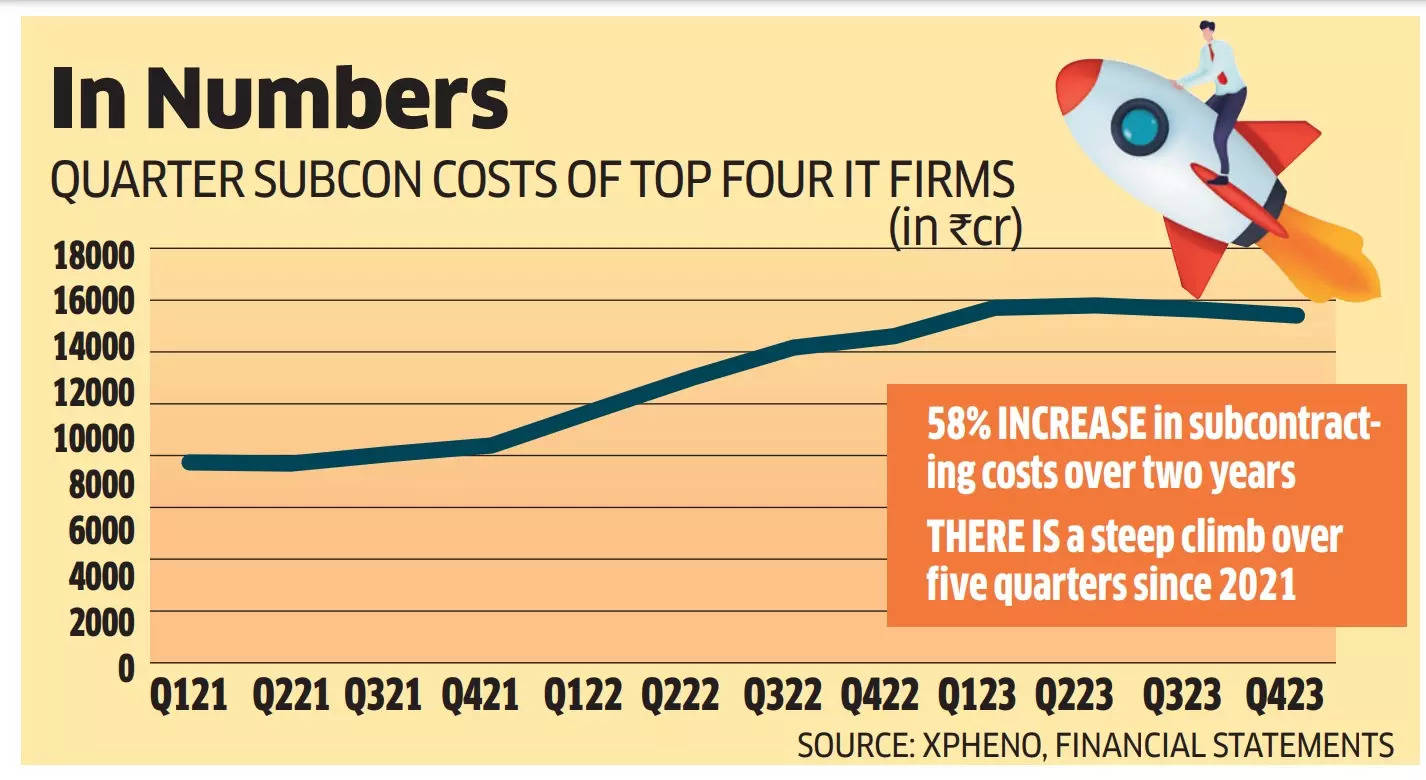

Subcontracting costs rise 60% in 2 years for top 4 IT firms

Sub-contracting costs incurred by India’s top four IT firms have risen nearly 60% in the last two years, fuelled by heightened attrition and demand that the sector witnessed after the pandemic.

Data decoded: The outsourcing cost of TCS, Infosys, Wipro and HCLTech increased to more than Rs 62,939 crore ($7.6 billion) for the year ended March 31, 2023, compared with Rs 39,368 crore ($4.8 billion) in fiscal 2021, according to data compiled by staffing firm Xpheno.

Expert take: “The billion-dollar-plus spent on subcontracting at large IT firms, which rapidly rose post-pandemic, has impacted the decade-old practices of staff procurement’’, said Kamal Karanth, co-founder of Xpheno.

Other Top Stories By Our Reporters

BigBasket’s B2C arm sees net loss nearly double in FY23: Innovative Retail Concepts, which runs the B2C arm of grocery and quick commerce firm BigBasket, on Thursday reported an 89% increase in net loss for the fiscal year ended March 31, 2023.

Sops on the anvil for small firms to create local cloud solutions: The government is working on a scheme that aims to give incentives to Indian companies, especially MSMEs, to bring new cloud solutions to the local market.

Global Picks We Are Reading

■ Wagner Mutiny Puts Russia’s Military Bloggers on Razor’s Edge (Wired)

■ A thirsty new Tesla factory comes to a parched corner of Mexico (Rest of World)

■ Big Tech’s Battle Royale Is Coming. The Winner? You. (WSJ)