Also in the letter:

■ Race on for Dealshare CEO post

■ Startups innovate interview formats

■ Sorin’s Sanjay Nayar teams up with Peak for Cleantech Play

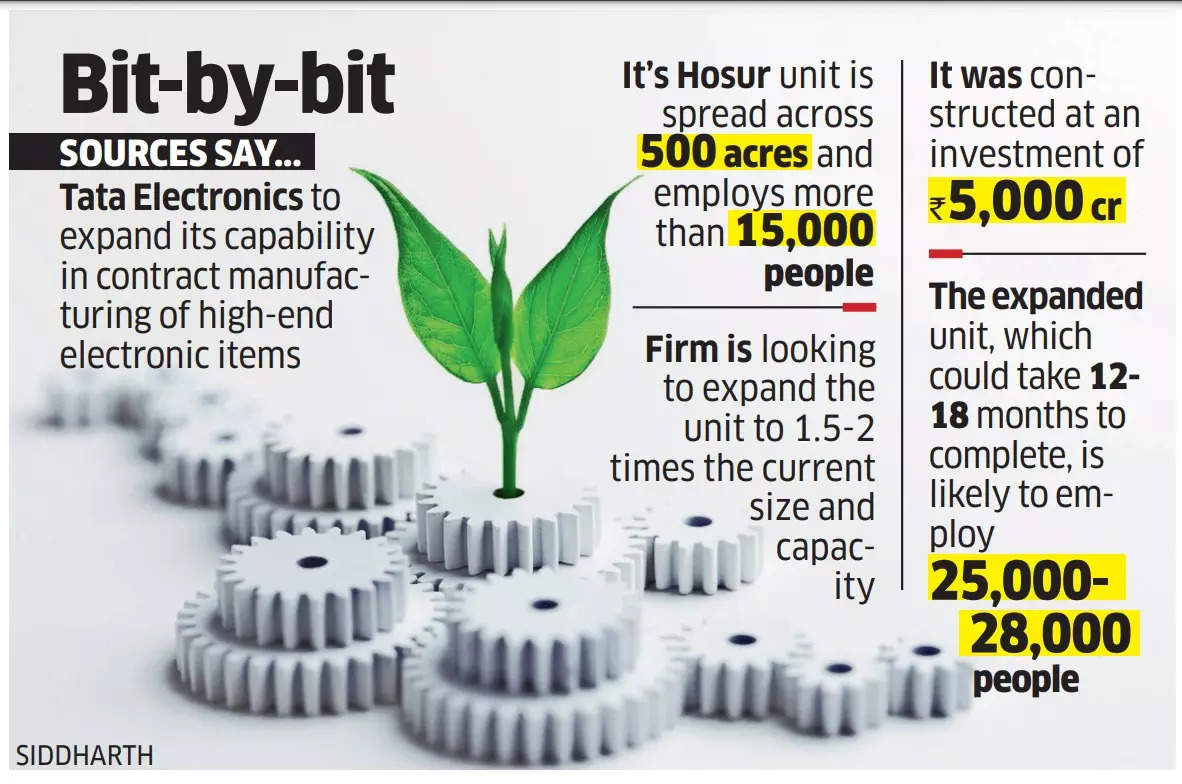

Tata Electronics to expand its iPhone unit in Hosur

Tata Electronics, a part of the Tata Group, is planning to double the size of its existing iPhone-casing unit in Hosur, sources familiar with the matter told ET. The company, having acquired Wistron’s iPhone assembly plant in Karnataka, is set to boost its contract manufacturing capacity for high-end electronic items and accessories.

The details: The expansion, estimated to take 12-18 months, could result in employing 25,000-28,000 people at the facility. The expanded unit may focus on manufacturing components not only for Apple but also for other high-end phone brands.

ET reported in May that Tata Electronics was scouting for land near its electronics manufacturing facility in Hosur.

Larger India push: Tata Electronics’ expansion aligns with Apple’s broader plan to enhance smartphone manufacturing in India. It will serve Apple’s increasing export demand, and the Tata Group company is ready to increase volumes, sources added.

Tata Electronics, the sole Indian firm shortlisted by Apple as a vendor, plays a crucial role in Apple’s China-plus-one strategy.

Also read | Apple bites big, turns largest smartphone exporter from India

Workers hope for a better tomorrow at Wistron plant: At Tata Son’s recently acquired iPhone assembling plant in Narasapura, Kolar District, workers are hoping that the new Indian owners will be more benevolent then their Taiwanese predecessors. Though they don’t expect salaries to be hiked immediately or contracts to improve, in the long run they hope it will lead to better working conditions and improved benefits. The workers, who hail from a number of southern and eastern states, work eight-hour shifts, six days a week. The plant makes the base version of the latest iPhone 15, as well as older models like the iPhone 14.

Read the complete story of the workers at the iPhone assembly plant in Kolar, Karnataka.

PhonePe set to unveil consumer lending by January

From left: PhonePe cofounders Sameer Nigam and Rahul Chari

Digital payments major PhonePe is readying to launch consumer lending on its platform by January, next year, as it looks to diversify its revenue streams further from merchant and bill payments, hoping to replicate the success it has had on the insurance distribution side.

What do we know? To begin with, the Walmart-backed fintech will work as a distributor for personal loans as it slowly builds up its internal credit underwriting, sources told ETtech. It is in the final stages of integrations with five lenders, a mix of banks and non-banking finance companies (NBFCs). ETtech had also reported last week that PhonePe was in the final stages of partnering with Axis Bank to distribute the bank’s credit card offerings.

Also read | PhonePe FY23 revenues rise 77% to Rs 2,914 crore

Crucial play: With a valuation of $12 billion ascribed to it in the previous round this year, and plans to go public, it is important for PhonePe to start building other revenue lines if it plans to showcase a strong growth story to public market investors.

Distribution heft: Supporting its consumer credit foray are the 500 million registered users that it has amassed over the years, offering them UPI, bill payments, mutual funds along with other services on the app. The firm also supports over 37 million merchants through its platform, and announced its entry into the merchant lending distribution space earlier this year.

The other side: PhonePe’s entry into personal loans distribution comes at a time when rival Paytm has moderated its guidance towards the category, after seeing 100%-150% growth in the previous years. Addressing analysts for its second quarter results in October, Paytm president and COO Bhavesh Gupta said the company expects personal loans to grow 30-40% on year.

Dealshare president of retail, founder Medda in race for CEO post

Dealshare founders Sourjyendu Medda (left) and Kamaldeep Singh

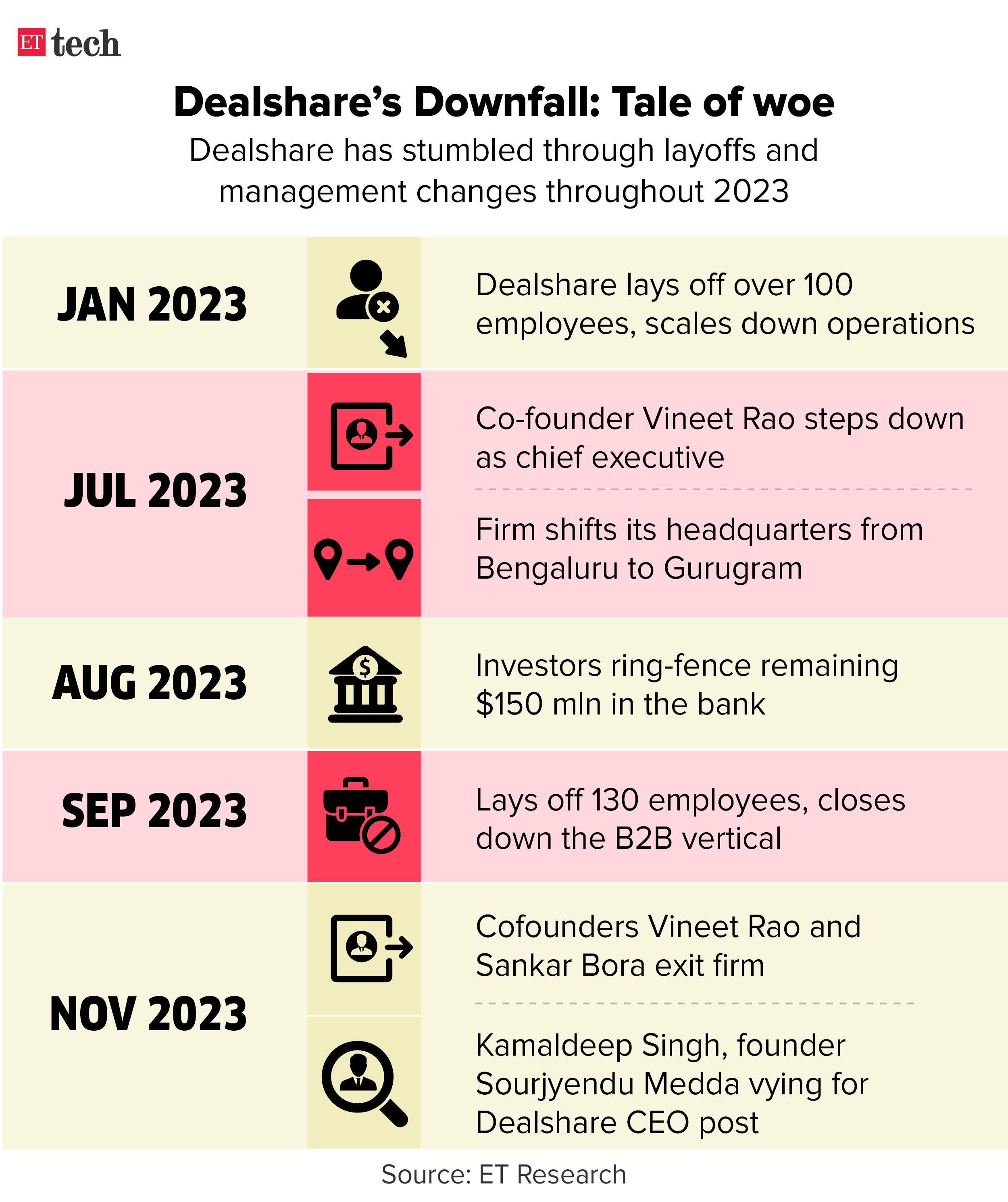

Dealshare has seen two of its cofounders leave the firm recently, but there is a CEO search underway.

Internal contenders: Even as founder Vineet Rao stepped down as CEO in July, cofounder Sourjyendu Medda is vying for the top role at the firm. Giving him company in the race is Kamaldeep Singh, president of retail business at Dealshare who was previously the CEO of Big Bazaar. Sources said both Medda and Singh have interviewed for the process.

External candidates: A third-party executive search firm, along with the company’s board, is running the process to identify the new CEO. External candidates have been reviewed for the same and the board is keen on closing the process soon, sources added. ET reported on November 24 saying two cofounders–Rao and Sankar Bora–have moved on following the ongoing restructuring

Retail model: Following investor-led restructuring in Dealshare, which was last valued at $1.7 billion, both online and offline retail is key to the company’s strategy. Singh has been leading that internally and is one of the senior-most executives. He has been working with the founders closely since joining from Big Bazaar last December. Dealshare had to shut the business-to- business vertical in September and fired another 130 staffers.

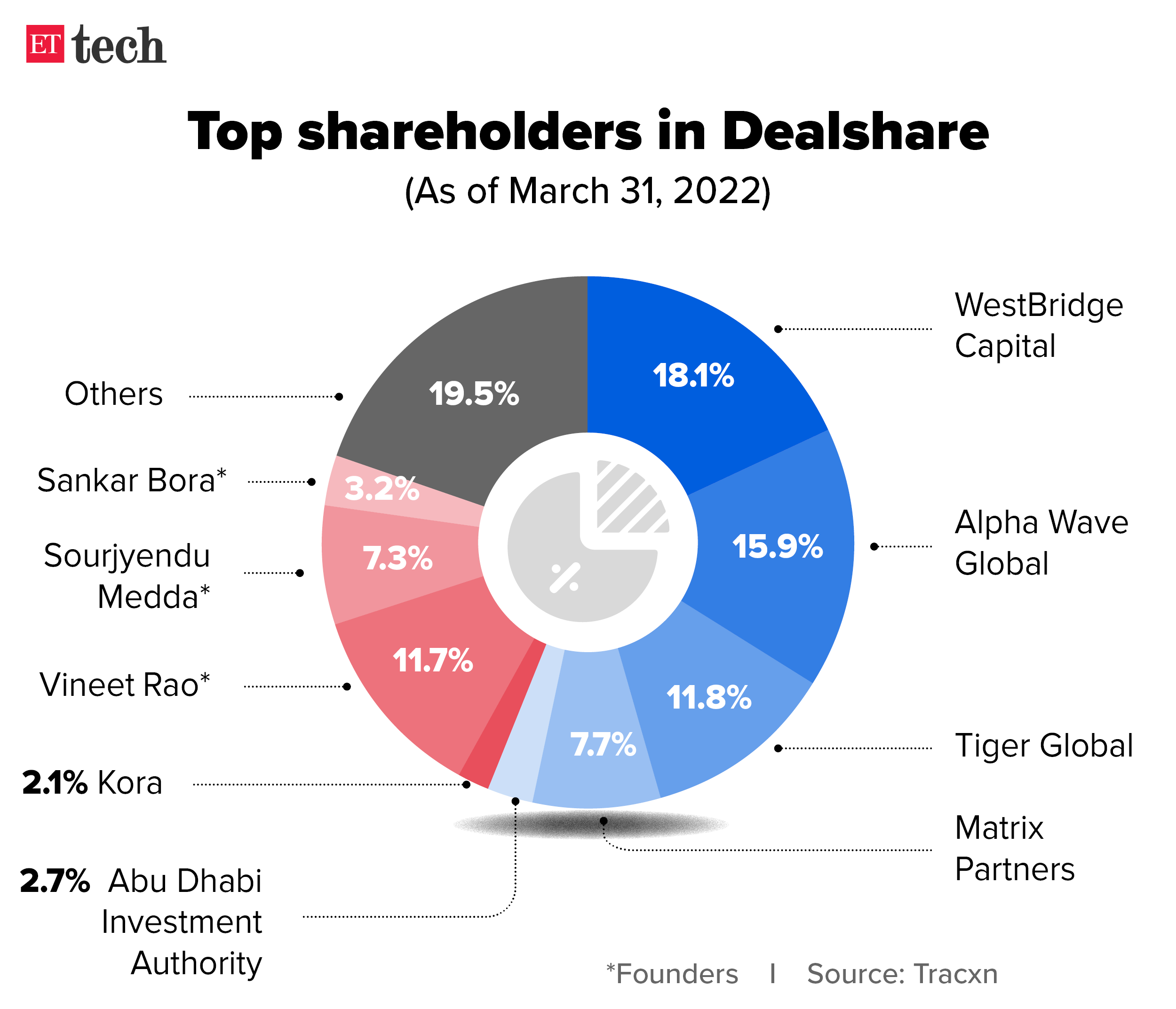

Board matters: Dealshare’s board has seven members –Medda, Rao and Bora along with representatives from four investors —WestBridge Capital, Alpha Wave, Matrix Partners and Tiger Global. Vineet Rao held a 11.7% stake in the firm as of March 2022, Sankar Bora owned about 3.2% and Medda had 7.1%, data from Tracxn showed. Rajat Shikhar–the fourth founder– did not own any stake.

Sorin’s Sanjay Nayar teams up with Peak for Cleantech Play

KKR India CEO and chairman Sanjay Nayar

Former KKR India CEO and chairman Sanjay Nayar is marking his foray into a new space – climate tech. He is partnering with Peak Ventures – a Mumbai-based early-stage fund specialising in cleantech areas such as new energy, food systems, clean water and climate. Nayar would be taking up the role of general partner at the firm.

Tell me more: Peak Ventures’ first investment fund, planned to be about $150 million, is expected to accelerate the fundraising process following Nayar’s onboarding, the firm’s managing partner Samir Shah told ET. The firm has received a nod from the Securities and Exchange Board of India (Sebi) for Nayar coming in as general partner.

Veteran dealmaker: Nayar, who retired from KKR India in April this year after spending 14 years at the private equity firm, also runs technology-focused venture capital fund Sorin Investments.

Also read: SIDBI, NSIC to back Sanjay Nayar’s startup fund

Quote unquote: “Over time, we are looking to build a large institutional platform, and Sanjay’s addition is strategic from the point of view of writing bigger cheques and bringing his investment acumen to decision making. Besides his capital contribution, his investment experience in India and ability to institutionalise Indian funds to attract high-quality local capital comes as very important,” said Samir Shah, managing partner, Peak Ventures.

Details: Through the Peak Ventures Sustainability Fund-I, the firm is looking to invest in 18-20 early-stage companies with the average cheques ranging between $2 million and $5 million. While the fund is largely India-focused, it could also look at startups building technologies outside of the country that can be scaled here. Shah indicated that the firm aims at a 75:25 split in investments between Indian and foreign companies.

From quirky questions to AI use: How startups are reinventing hiring

Startups are revamping hiring methods, incorporating tech, posing unorthodox questions, and testing candidates in unconventional ways to ensure the right fit, according to industry leaders.

AI is watching: Recruiters are relying on AI tools to screen candidates as well as to frame questions for the job interviews. According to Saurabh Arora, founder of student housing platform University Living, a whopping 80% of the entry-level workforce is screened and embedded with use of AI and ML screening tools such as Zoho Recruit, Turbohire and Recruitee.

Quirky questions: Candidates need to be ready for unique interview experiences as startups are moving away from conventional methods of questioning. For example, a candidate might even be asked something on the lines of “Share an experience you wish to tell but can’t.” According to Arora, while these queries may seem unusual, they often offer valuable insights into candidates’ personalities and their potential fit for company culture.

Quote unquote: “Cultural alignment is key because without it, people talk past each other and not with one another. The softer aspects can really create a difference, it helps create camaraderie at the workplace and fosters empathy,” said Anirudh Arun, cofounder of all-electric ride-hailing service BluSmart.

Air India to integrate GenAI with in-house systems

The Tata Group, upon acquiring Air India and its outdated technology infrastructure, is set to propel the airline into the future with cutting-edge technologies like Generative AI. In an exclusive interview with ET, Air India’s chief digital and technology officer, Satya Ramaswamy, shared insights into the ambitious tech overhaul initiated by the new management.

The AI push: Air India has been an early adopter of OpenAI, integrated through its collaboration with Microsoft, even before the formal launch of ChatGPT in November last year. Maharaja, the airline’s virtual assistant powered by Microsoft Azure OpenAI, has successfully addressed over half-a-million queries in four different languages, said Ramaswamy.

Modernising the Maharaja: Air India’s technology team is on a mission to modernise the airline’s enterprise systems, targeting 160 different technology modules. Over 70 modules have already undergone updates, with a swift transition of the SAP-based finance system from the outdated mainframe to the cloud in just six months.

Other Top Stories By Our Reporters

Arundhati Bhattacharya, CEO, Salesforce India

GenAI taking investments to the cloud: Salesforce’s Arundhati Bhattacharya | Salesforce India chairperson and CEO Arundhati Bhattacharya told ET that the demand for generative AI is helping the adoption of cloud solutions in India. She added that the Indian public sector cloud investments have been hampered by security concerns and a lack of understanding of the solutions.

Nearly 73% of Indian mid, large companies hit by ransomware in 2023: The cyberattacks on organisations including All Indian Institute of Medical Sciences (AIIMS), Indian Council of Medical Research (ICMR) and Taj Hotels this year were just a drop in the ocean; nearly 73% of mid and large-sized organisations in the country were hit by a ransomware attack in 2023, a survey has revealed.

Google may invest in Indian AI company Corover.ai: Google is close to investing about $4 million in homegrown conversational artificial intelligence startup Corover.ai, said people in the know, in yet another indicator that the Indian AI startup space is poised for explosive growth.

Global Picks We Are Reading

■Twitter’s Former Head of Trust and Safety Finally Breaks Her Silence (Wired)

■ The Do’s and Don’ts of Using Generative AI in the Workplace (WSJ)

■ Your guide to talking about climate tech over the holidays (MIT Technology Review)