MG, Mahindra and BYD, meanwhile, have recorded an uptick in year-on-year sales.

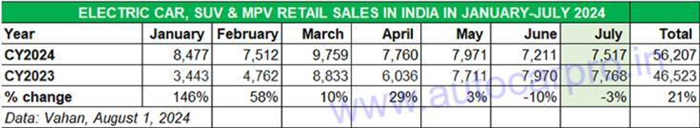

Retail sales of electric cars and SUVs have crossed the 7,500-unit mark for the third month in a row in July 2024. While the 7,517 units sold in July 2024 are down 3 percent on year-ago sales (July 2023: 7,768 units), they’re still a 4 percent increase over last month (June 2024: 7,211 units).

Meanwhile, cumulative sales for the first seven months of CY2024, at 56,207 units, are up 21 percent YoY (January-July 2023: 46,523 units) and already 68 percent of CY2023’s 82,546 units sales. This retail sales data is from the government of India’s Vahan website as of August 1.

Tata Motors

EV market leader Tata Motors, which has the largest portfolio, comprising the Nexon EV, Tigor EV, Tiago EV and the Punch EV, sold 4,752 units in July 2024. This is a 13 percent decline YoY (July 2023: 5,470 EVs), reflecting the increased competition in the marketplace. In July 2024, Tata Motors’ share of the electric vehicle market was 63 percent, down from 70 percent in July 2023. January-July 2024 retail sales of 37,842 units, is an increase of 7.57 percent YoY (January-July 2023: 35,178 EVs). At this stage, Tata Motors has achieved 63 percent of its total CY2023 sales of 60,053 units.

MG Motor India

MG sold 1,520 units of the ZS EV and Comet EV in July – its best monthly performance in the year to date. This gives it a market share of 20 percent, improving upon its year-ago share of 16 percent in July 2023. The company is also upping the ante on the sales network front by expanding to Tier 3 and Tier 4 cities as well as rural markets. Simultaneously, the carmaker is gearing up to introduce its third EV in our market – the Windsor – which is a rebranded Wuling Cloud EV from Indonesia. The launch is expected by late August or early September.

Mahindra

Mahindra ranks third on the EV leaderboard with 485 units of its XUV400 sold, which is a 27 percent increase (July 2023: 380 units). This gives the company a 6.45 percent EV market share for the month. Mahindra has sold 4,325 units since January 2024, up 117 percent YoY (January-July 2023: 1,985 units). The carmaker, which will have added manufacturing capacity of around 1,00,000 units for its upcoming Born Electric vehicles by end-March 2025, plans to invest Rs 12,000 crore towards its EV programme. It has announced 4-5 new models on the INGLO platform that will borrow key components from the Volkswagen Group.

BYD, Citroen and Hyundai

BYD, which sells the Atto 3 SUV, e6 MPV and the Seal sedan, is ranked fourth in July and the January-July 2024 period with 342 units (4.54 percent market share) and 1,368 units, respectively. This is the carmaker’s best monthly sales in the year to date, and an improvement over June 2024’s 238 units. BYD was behind Hyundai for the first three months of this year, but has surged ahead of the Korean carmaker since April for four straight months.

Citroen has overtaken Hyundai in July with 155 units of the eC3 sold, which is a 35 percent decrease over June’s 238 units. However, the company is seeing growing demand for the eC3 from EV fleet operators like Blusmart, OHM E Logistics and Cab-E, who have placed an order for over 7,000 units between March and July.

Having discontinued the Kona in India, five years after launching it in July 2019, Hyundai sold 55 Ioniq 5 EVs in July. For the first seven months of 2024, Hyundai’s retail sales total is 753 units, up 5 percent (January-July 2023: 716 units).

Luxury EV sales

Demand for luxury electric cars, sedans and SUVs was slow in July compared to previous months. As per Vahan data, combined retail sales of seven carmakers in July 2024 were 165 units, down 14.50 percent (July 2023: 193 EVs). However, they have logged a 28 percent YoY increase when it comes to cumulative seven-month sales: 1,525 units in January-July 2024 versus the 1,191 units sold in January-July 2023.

BMW India is the luxury EV market leader both in July (70 units) and in January-July 2024 period (615 units). While the July sales are down 34 percent (July 2023: 107), the cumulative seven-month sales are up 4 percent YoY (January-July 2023: 589).

Mercedes-Benz India, with 30 units in July 2024, sold seven fewer EVs than it did in July 2023. However, its January-July 2024 sales (435 EVs) are up 85 percent YoY (January-July 2023: 235 EVs). Volvo Auto India saw 40 of its EVs going home to new buyers in July, five more than in July 2023. Cumulative seven-month sales at 314 units are a 13 percent improvement over year-ago sales of 277 units. Audi India sold 17 EVs last month, compared to nine in July 2023. The carmaker’s first seven-month sales this year at 99 units are up 90 percent YoY versus the 52 percent in the year-ago period.

Also See:

New FASTag rules mandate replacing tags older than five years