Also in the letter:

■ Indian IT takes a bigger bite out of Europe

■ Invesco marks Swiggy valuation up to $7.8 billion

■ Big banks adopt private LLMs to increase efficiency

Tata Digital Esop gets delayed, company offers incentives to top brass

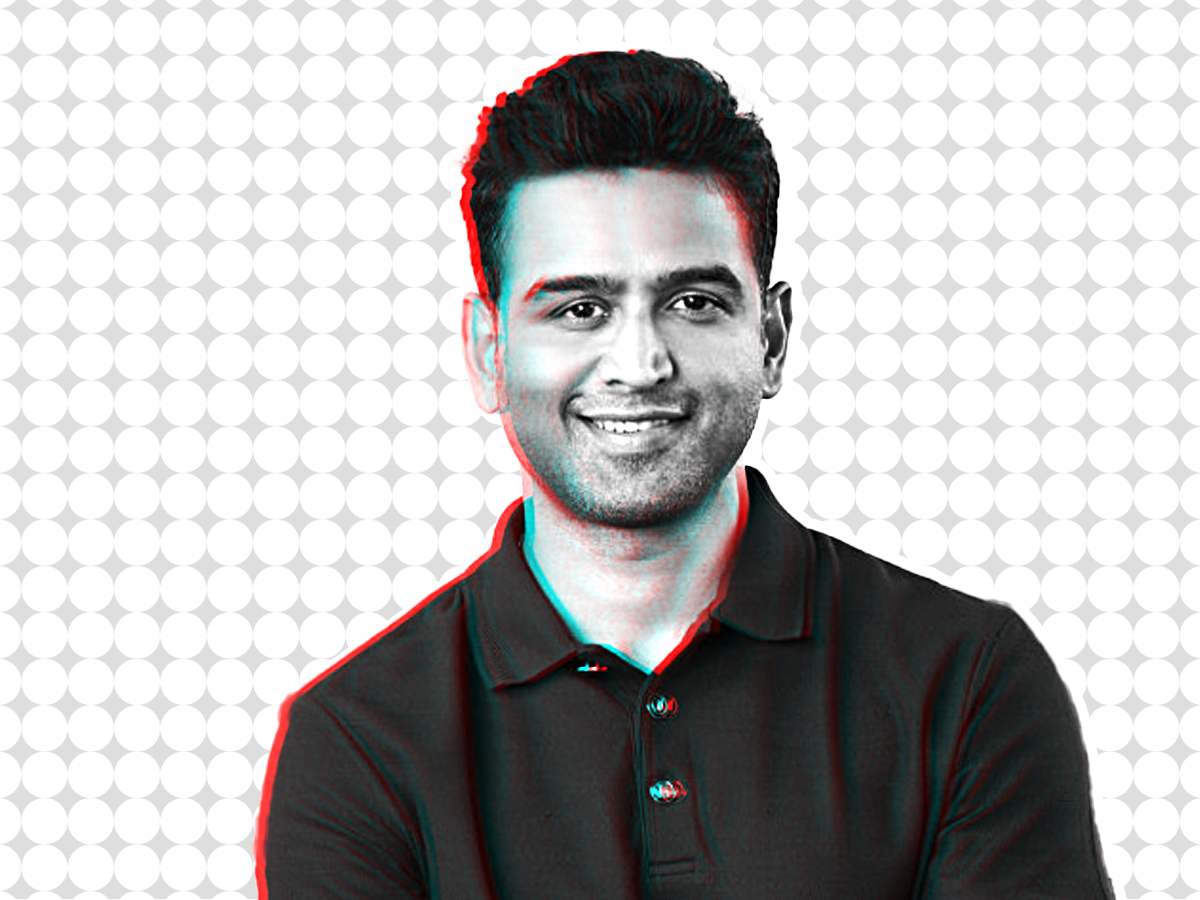

Pratik Pal, CEO, Tata Digital

Tata Digital — the ecommerce arm of the Tata Group — has not allocated employee stock options (Esops) to senior executives as per the company’s plan when they were hired over the past two years, multiple sources told ET. The top leadership is in discussions to resolve the matter.

Driving the news: When these executives were hired over the past two years in the run-up to the launch of superapp Neu, there was an Esop component added to their overall compensation. But the same has not materialised yet.

Company’s plans: As a way to assuage senior executives, the group is looking at options like cash incentives. While a short-term solution like certain payouts is being offered to these executives, the company is still looking to eventually have a pool of stock options for employees, sources close to the company said.

Out of habit: “Most senior executives have come from large consumer internet firms, and Esops are common practice there at that level,” a person aware of the matter said. “However, the issue of Esops was discussed recently after the company closed the annual appraisal process.”

Another source said the salt-to-software conglomerate is still only warming up to the concept of Esops, common in new-age companies.

Tata Digital’s overhaul: ET had reported that Tata Neu, after two years of riding on the Indian Premier League (IPL) wave through the title sponsorship of its parent, has been rejigging its existing team to stabilise operations.

Also read | Chandrasekaran’s Call: Tata chief pushes for profitable ecommerce growth

Rainmatter gets into heart of investing via road not taken

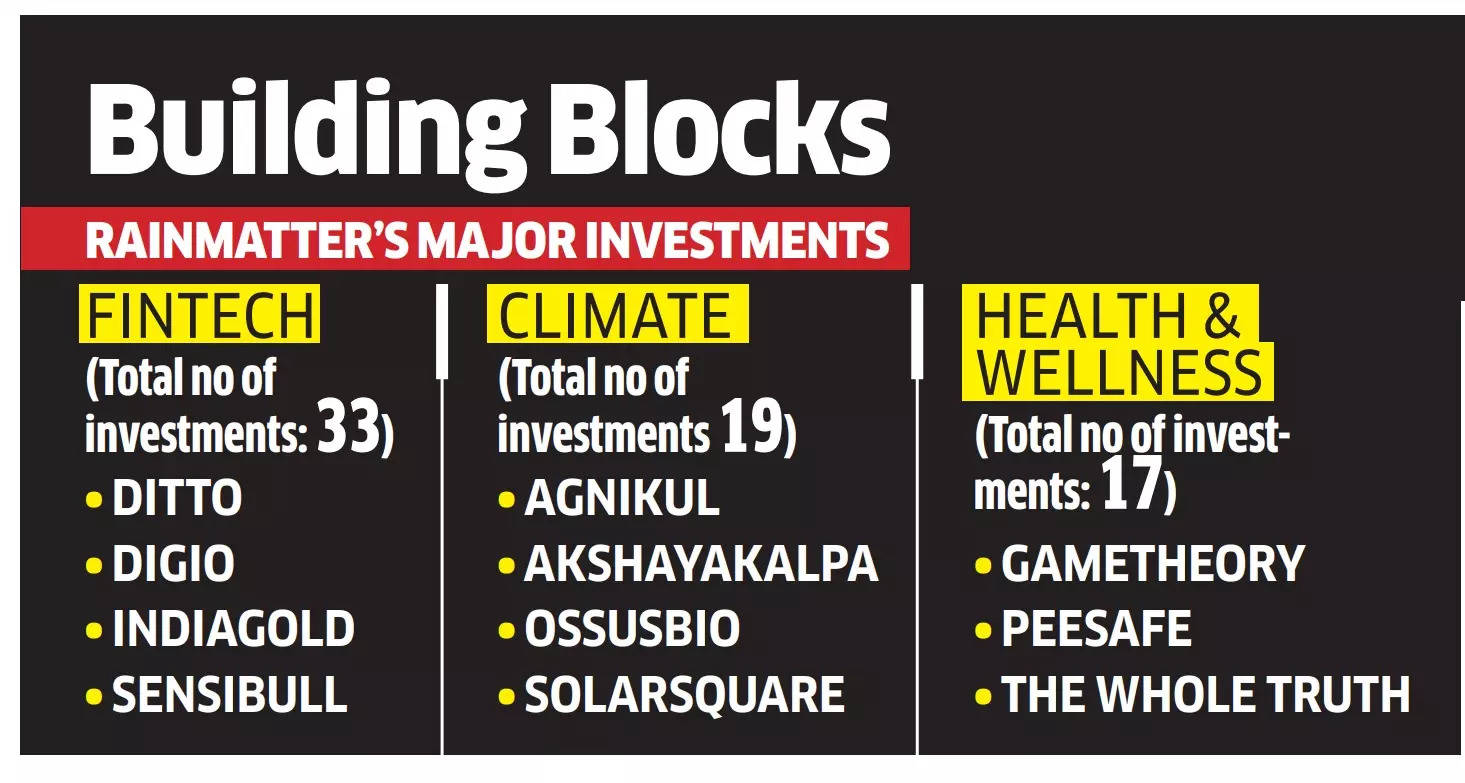

Unlike many other successful founders, Nithin Kamath started his investment journey pretty early in his career. Rainmatter, Zerodha’s own fund for early-stage startups, was born back in 2016. Today, it has a corpus of around Rs 1,400 crore, with Rs 1,000 crore of commitment and Rs 400 crore deployed already in more than 80 startups.

Inception: Kamath started his investment journey mostly through angel investments in founders he liked and problem statements that excited him. From 2016, after the formation of Rainmatter, the investments started getting formalised and routed through the fund. It started with investing in fintechs, mostly wealth-focused startups, but now has expanded into sectors like health and climate.

Also read | Zerodha’s FY23 revenue jumps 38% to Rs 6,500 crore

Small team: Even as investments and portfolio size continue to rise, the Rainmatter team remains an intimate huddle of around three to four full-time executives. Dinesh Pai heads the team, assisted by the likes of Somnath Mukherjee and Viraj Joshi.

“There is no rigid structure; we are a close-knit team—we do not follow fixed rules. As and when required, the Zerodha leadership pitches in to help an investee company,” Pai told ET.

Investment thesis: Unlike many other funds, Rainmatter does not follow any set rules for investments. While there are sectors which appeal to the Zerodha founders, Pai said he prefers to scout for companies through social media platforms and mutual connections. Kamath gets a lot of inbound pitches too.

If they like a company, they go ahead and back the founder.

Also read | Zerodha allocates an additional Rs 1,000 crore to back startups through Rainmatter

Cultural match: Founders who have raised funds from Rainmatter shared what Kamath and team bring to the table. The fund might not dig deep into its portfolio company’s financials, one of them said but will definitely push early stage founders to build internal checks and systems to manage corporate governance and sector regulations.

Indian IT takes a bigger bite out of Europe as US business growth slows

The quarterly results for the top three IT companies – Tata Consultancy Services (TCS), Infosys and HCLTech announced last week show that a larger percentage of their current growth is coming from the European region as growth from the US is slowing due to macroeconomic concerns.

Details: Within Europe, the UK is consistently proving to be among the fastest-growing markets. TCS said the UK registered a 10.7% growth even as North America grew by a meagre 0.1% in revenues.

For Infosys, Europe witnessed a year-on-year growth of 10.9% (5.4% in constant currency terms) while North America’s growth stood at 1.2% (1% in constant currency). For HCLTech, the July-September period saw a slight growth in market share in Europe at 28.5% from 27.5% in the same quarter last year.

What do CEOs say: TCS chief K Krithivasan acknowledged that the UK is certainly “one of the bright spots”. In the post earnings analyst call in Q1, to a question on Europe holding better than the US market for Infosys, CEO Salil Parekh said, “The Europe growth has been stronger than what we’ve seen in the US.”

Invesco marks Swiggy valuation up to $7.8 billion

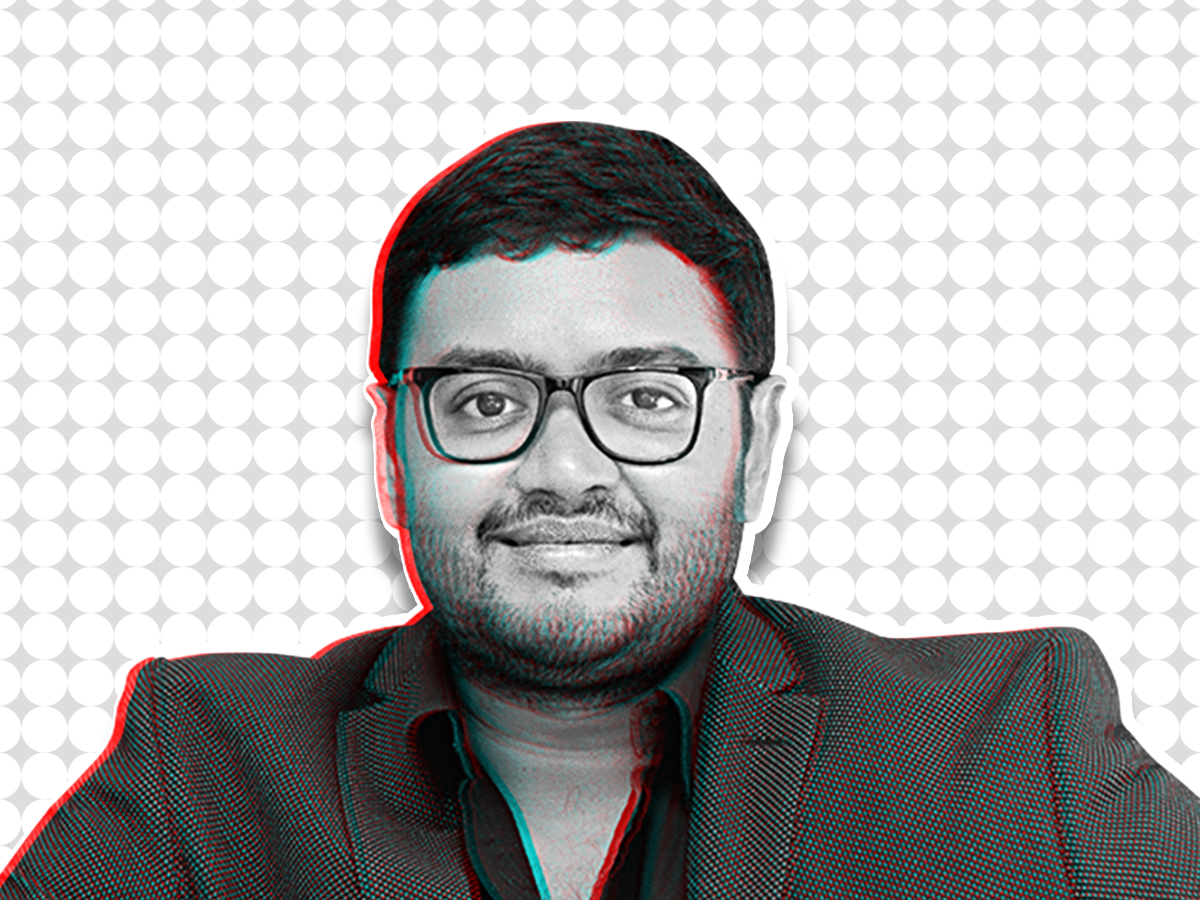

Sriharsha Majety, CEO, Swiggy

US asset manager Invesco has increased the valuation of food and grocery delivery platform Swiggy by 42% to $7.8 billion as of July 31, as per filings made with the US Securities and Exchange Commission. The rise is significant in comparison to the $5.5 billion valuation that Invesco ascribed to the Bengaluru-based firm as of April 30.

Valuation puzzle: The latest bump-up notwithstanding, Swiggy’s valuation — as ascribed by Invesco — is still lower than the company’s last known valuation from a fundraise. It had raised $700 million in January 2022 in a round that valued it at $10.7 billion.

Also read | Swiggy hikes its platform fee on food orders to Rs 3

Tracking Zomato: The higher valuation has come in the backdrop of its listed rival, Gurugram-based Zomato, witnessing a steady ascent in its share price, which has more than doubled in the last six months. On Tuesday, the scrip closed at Rs 113.90 after scaling a new 52-week high of Rs 114.10 during the day on the BSE. At close of trade, Zomato’s market capitalisation stood at $11.7 billion.

Source: Google

Also read | India’s food delivery segment seen growing 10% sequentially in July-September period: UBS

PM Modi reviews readiness of Gaganyaan Mission, affirms its launch in 2025

Ahead of the first unmanned test of Flight Test Vehicle Abort Mission-1 (TV-D1) for the Gaganyaan mission, Prime Minister Narendra Modi chaired a high-level meeting to assess its progress and to outline the future of India’s space exploration endeavours.

TV-D1 launch: The test of TV-D1 for the Gaganyaan mission is scheduled for October 21 at 8 am from the first launchpad at Satish Dhawan Space Centre, Sriharikota, the Indian Space Research Organisation (ISRO) had announced. As it is the first demonstration flight of the Crew Escape System Test Vehicle, the meeting evaluated the mission’s readiness, affirming Gaganyaan’s launch in 2025.

Big banks take to large language models trained on internal data

Big banks such as HDFC Bank and Axis Bank are among those in advanced stages of adopting private large language models (LLMs), trained on their internal data, to build out more responsive and intuitive user experience interfaces and drive efficiencies.

Plans ahead: HDFC Bank will roll out a private LLM-powered website in the next two quarters, Ramesh Lakshminarayanan, chief information officer and group head of IT, told ET. The site is in the beta stage.

Axis Bank is looking to start out with generative artificial intelligence (gen AI)-based virtual assistants for customers and using inferencing capabilities to automate use cases in operations.

Other Top Stories By Our Reporters

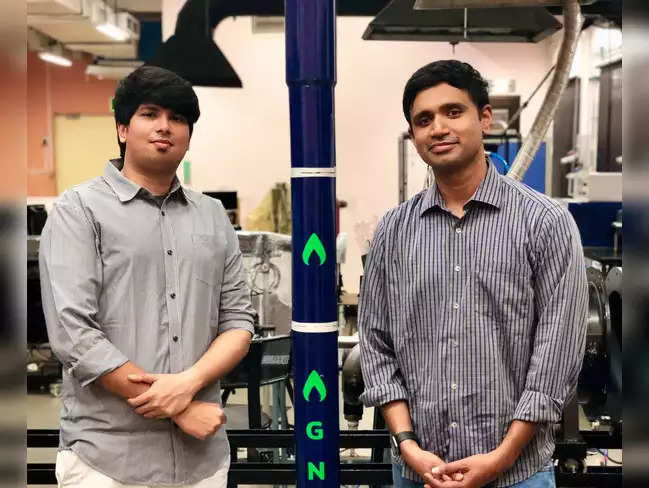

From left: Agnikul Cosmos founders Moin SPM and Srinath Ravichandran

Agnikul Cosmos raises over $26 million: Spacetech startup Agnikul Cosmos has raised $26.7 million from investors like deep tech-focused venture capital firm Celesta Capital and investment firm Rocketship.vc, among others.

Nithin Kamath’s Rainmatter invests in Game Theory: Real sports gaming platform Game Theory said on Tuesday it has picked $2 million in funding from Rainmatter (a startup accelerator fund started by Nithin Kamath’s Zerodha), Indian tennis player Rohan Bopanna, WEH Ventures, Prequate Advisory, and angel investors, including Balakrishna Adiga.

B2B SaaS startup Leucine secures $7 million funding: Leucine, a business-to-business startup servicing software for pharmaceutical companies in India and the US, has raised $7 million in a Series A funding round led by Ecolab.

Meesho CXO Utkrishta Kumar exits: Utkrishta Kumar, the chief experience officer for business at ecommerce firm Meesho, has resigned after five years with the company. Kumar will be leaving to pursue entrepreneurship. Megha Agarwal, currently the CXO for growth, will take over Kumar’s role, with responsibilities split into three categories.

Mphasis appoints Wipro’s Ayaskant Sarangi as global CHRO: Sarangi will be leading the company’s global human resources strategy and operations; talent management, including recruitment and leadership development; overseeing the company’s talent lifecycle and development including all aspects of HR Operations.

Global Picks We Are Reading

■ Millions of workers are training AI models for pennies (Wired)

■ ‘Netflix effect’ returns as studios license old shows to their streaming rival (Financial Times)

■ Snapchat now lets you embed videos and lenses on the web (The Verge)