Losses at the new commerce venture widened more than five times to Rs 3,051 crore in FY22 due to the new acquisitions.

The spike in revenue mainly came from the company’s acquisition of a majority stake in e-pharmacy startup 1mg, and Supermarket Grocery Supplies Pvt Ltd, the parent company of e-grocer BigBasket.

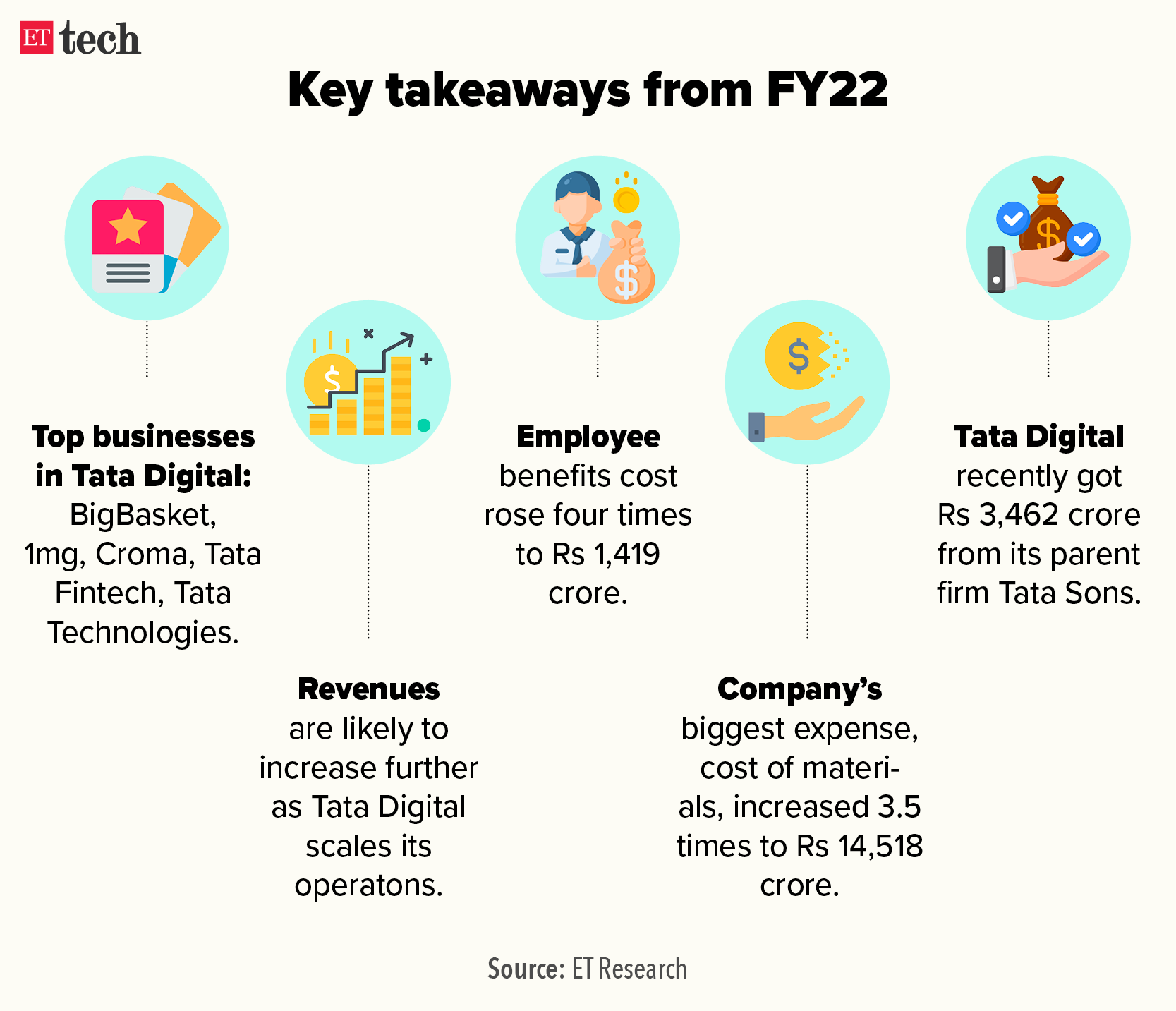

Tata Digital’s consolidated revenue also includes businesses such as Croma, Tata Fintech, Tata Technologies and previous BigBasket acquisitions like DailyNinja and Savis Retail.

The major contributor to the increased revenue was BigBasket’s parent company, which added Rs 7,238 crore to the total revenue.

The acquisition happened in May 2021.

Discover the stories of your interest

ETtech

ETtechIf it had taken place at the beginning of the year, the revenue contribution would have been Rs 8,502 crore, according to the filings.

Revenue will likely multiply further this year as Tata Digital may expand its portfolio of companies to include more scalable tech businesses.

ET reported on September 29 that Tata Industries was set to hive off some of its significant startup businesses such as Tata Cliq, Tata Cliq Luxury, Tata Cliq Palette and Tata Health to Tata Digital in the next two weeks as part of a move to consolidate scalable ecommerce entities under one roof.

Cost of materials grew 3.5 times to Rs 14,518 crore from Rs 4,508 crore in the previous year, while employee benefit costs also increased more than four times to Rs 1,419 crore during FY22.

ET reported recently that Tata Digital was expected to receive capital infusion of Rs 3,462 crore from parent Tata Sons, while BigBasket was finalising a new $200 million funding round at a valuation of up to $3.5 billion.

Online pharmacy 1mg became a unicorn – or a privately held company with a valuation of $1 billion or more – earlier this month and is being valued at over $1.25 billion.

ETtech

ETtechTata Digital acquired 1mg at a valuation of around $450 million in June last year. It owns a little over 62% in the e-pharmacy, which has resulted in a revenue contribution of Rs 523 crore, while the business made a loss of Rs 489 crore.

In total, Tata Digital has three unicorns under its stable – Mukesh Bansal-founded healthtech startup Curefit, 1mg and BigBasket.

For BigBasket, the estimated increase in valuation will be around 75% compared with the last primary cash infusion in the company.

Tata Digital is the new entrant in India’s fast-growing ecommerce space, taking on established players including US-based e-tailer Amazon, Walmart-owned Flipkart, and Reliance Industries-owned JioMart.