Well, that changed this week when microblogging platform Twitter appealed to the Karnataka High Court claiming the demands of content regulation on its platforms and takedown orders by the Indian government amounted to an “abuse of power”.

Twitter, in its writ petition, said orders from the ministry of electronics & information technology (MeitY) were “overboard and arbitrary, failed to provide notice to originators of the content” and were “disproportionate in several cases”.

This is not the first time the social media platform has had a tussle with the Indian authorities. Tensions between both first surfaced last year when Twitter declined to fully comply with an order from the IT ministry to take down accounts and posts that allegedly spread misinformation during the peak of the anti-government protests by farmers.

Things further soured as the Indian authorities, over the past year, asked Twitter to act on its content, which included accounts supportive of an independent Sikh state and tweets critical of the government’s handling of the Covid-19 pandemic.

Since then, it has been an array of notices, warnings of criminal proceedings, police investigations, and disparate inculpations concocted with a general sense of disquiet among both parties.

While the Indian government claims Twitter’s policies breach the constitutional validity of Section 69A of the Information Technology (IT) Act, Twitter rebuts that the government’s assertion fails to demonstrate how its content falls within the periphery of the Act or is a constitutional violation at all.

Twitter is logged in a fight with a government that, if international reports are to be believed, has a history of taking criticism head-on – online or offline. And, this is where both are at a crossroads.

Time and again, Twitter has made it clear that some of the content the government asked it to take down was posted by the official handles of political parties, and blocking that is tantamount to a violation of freedom of speech and expression.

However, the California-based tech firm is not new to such controversies and backlashes.

In 2019, Twitter had to update its ‘hateful conduct rules’ to specifically prohibit language that dehumanised others based on religion after it came into the public ire for being unable to prevent trending hashtags and conversations en masse around religious discrimination.

Twitter was caught in its echo chamber effect – something that’s seen as a feature or a bug, depending on who you ask. What started out as a space for conversations around one’s interests also became filled with hateful content.

Add to this, the thousands of fake followers granting more legitimacy to the cacophony of tweets, retweets, and hashtags. Interestingly, these fake followers have now jeopardized Twitter’s buyout deal with Elon Musk.

According to the latest report in the Washington Post, Musk and his team are now second-guessing their bid to buy Twitter. The world’s richest man has already expressed his displeasure over the behemothic number of fake accounts and implied that he could walk out of the $44-billion deal that first surprised the world in April this year.

If Twitter has had its share of misgivings, the Indian government, too, has tightened the noose on big tech firms on several occasions when it comes to content regulation.

Meta conflict

Last year, the government was embroiled in a similar legal battle with Meta-owned WhatsApp after it revised the IT rules making it mandatory for social intermediary companies with over five million registered users to have compliance, nodal, and grievance officers who are residents of India.

Further, messaging platforms such as WhatsApp, Telegram, and Signal were required to trace the origin of the messages sent on their services.

The response from WhatsApp was similar to Twitter.

It knocked on the doors of the Delhi High Court saying the traceability clause in the new rules undermined people’s privacy. WhatsApp had deep reservations about this because it felt requiring messaging apps to “trace” chats was breaking end-to-end encryption and equivalent to asking them to keep a fingerprint of every single message sent on WhatsApp.

Despite the legal battle that ensued, the government held its stance that social media platforms must “reengineer their platforms” if need be to help law enforcement agencies trace the origin of messages.

Thus, it is a matter of time and choice for Twitter – with its potential new owner being a staunch supporter of free speech – whether it complies, denies, or seeks a middle ground because it may not wish to harm its prospects in a country that is home to its over 25 million users.

Written by by Gaurab Dasgupta

Top Stories By Our Reporters

Rajeev Misra steps back at SoftBank to launch new fund

Rajeev Misra, CEO of SB Investment Advisers, which manages SoftBank Vision Fund, will step back from his executive role at the technology fund, according to a note from SoftBank’s founder Masayoshi Son. Misra, 60, played a prominent role in raising the $100-billion Vision Fund, the largest pool of private capital which disrupted technology investing globally.

A new reality sets in for the influencer

.jpg)

What’s going on? As the global economic scenario resets and startups focus on revenue and costs, the marketing budgets of these companies are being slashed. As a result, the deal flow and earnings of the finance creators have dropped 30-40%, according to half a dozen influencer marketing agencies and creators we spoke to.

Startups and layoffs

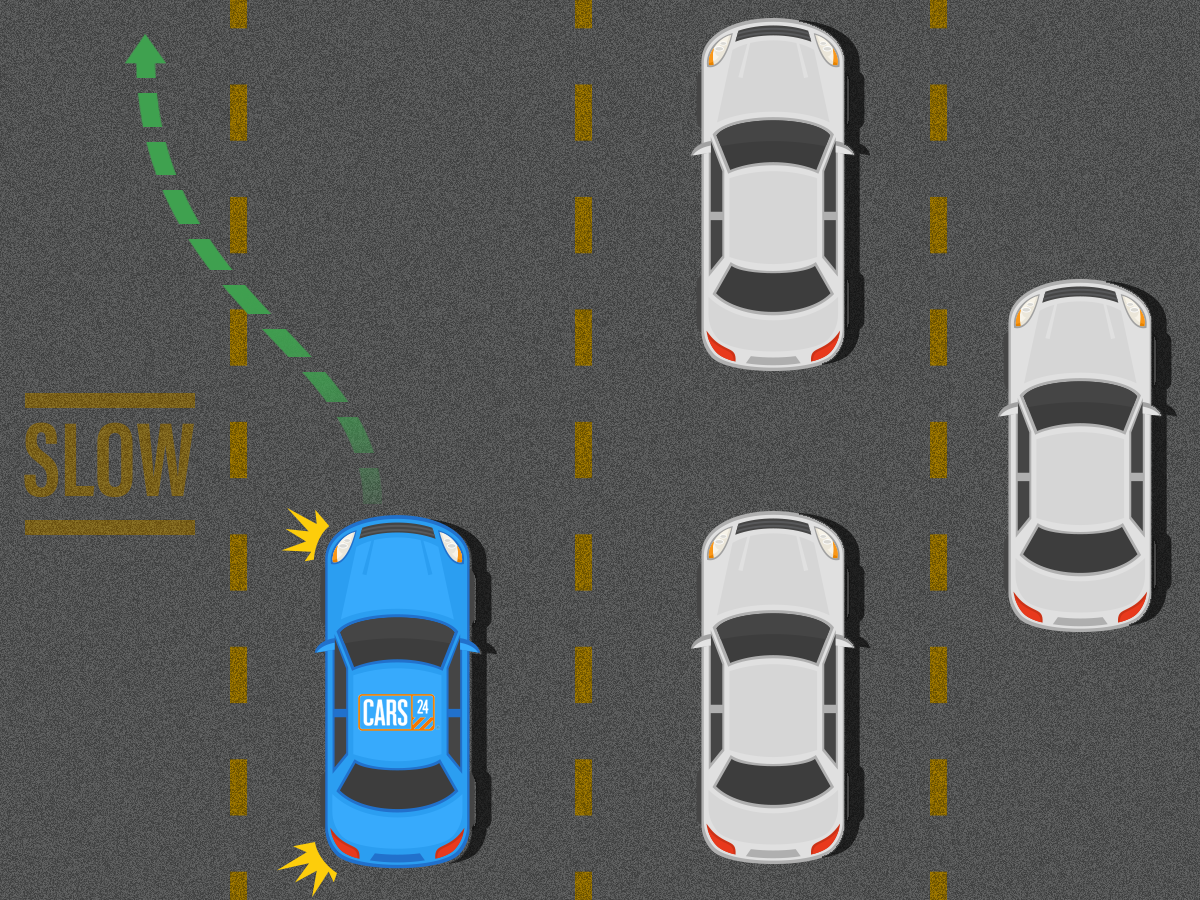

Cars24 shifts to slow lane amid funding winter

Used-car selling platform Cars24 is shifting gears to cut costs through a spate of measures as late-stage funding deals dry up, sources told us. The company, backed by SoftBank and Alpha Wave Global, is looking to reduce its burn by around 50% to extend its runway.

Startup valuations fall sharply, hurting IPO plans: Valuations of several new-age companies have taken a beating in the market for unlisted shares as the craze for startups wanes, possibly delaying many companies’ plans to go public. PharmEasy, Oyo, Boat and Ixigo have seen a sharp fall in value in the past six months, according to people dealing in the unlisted equity market.

Startup layoffs have triggered panic among senior professionals: The recent spate of layoffs at Indian startups has triggered panic among senior professionals, prompting them to actively look for jobs outside the industry, according to a survey commissioned by ET and conducted by staffing firm Ciel HR Services.

.jpg)

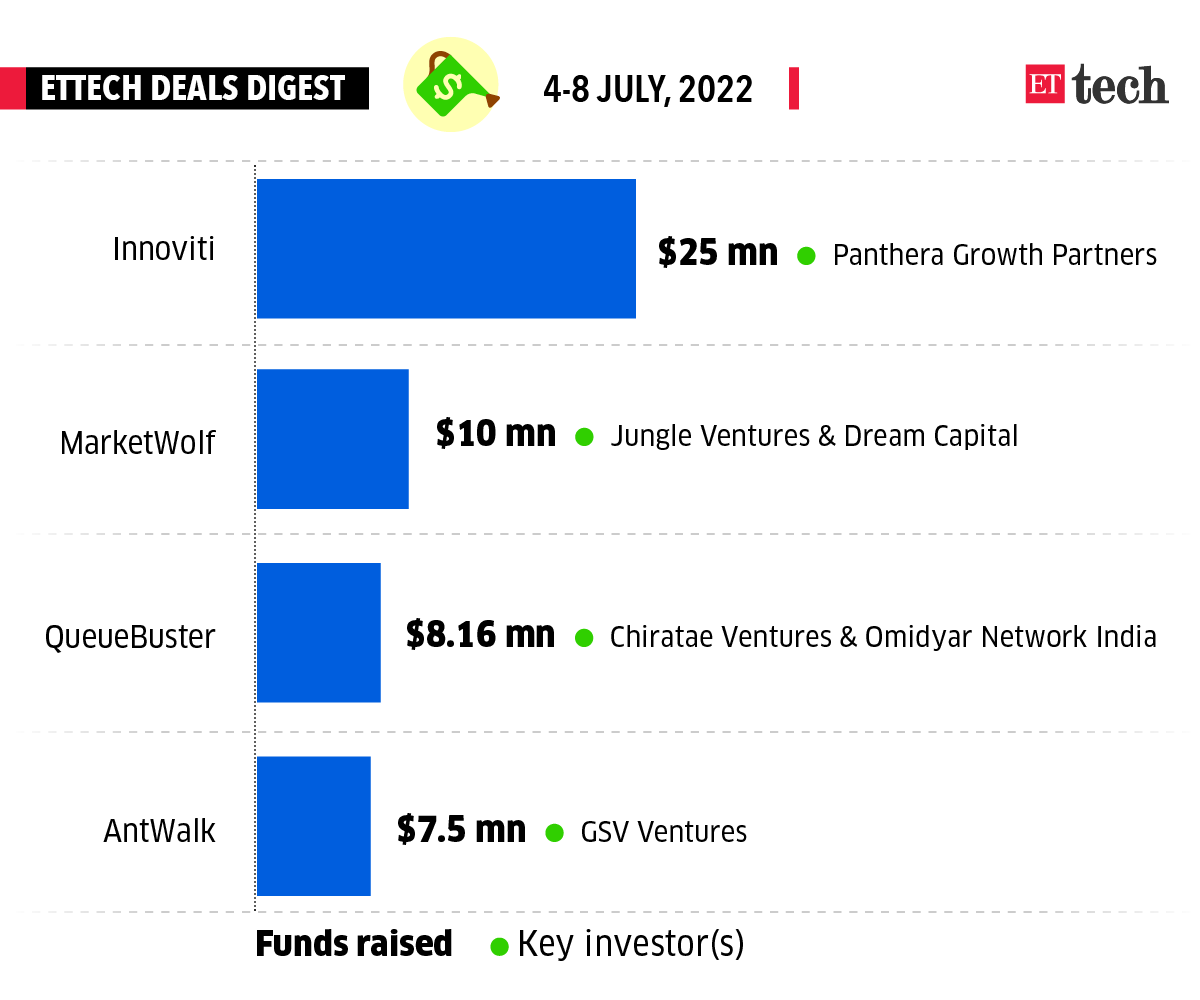

Funding for Indian startups fell almost 40% in Q2: Venture capital funding in Indian startups dipped 37% in the second quarter of this year to $6.9 billion, according to data from Venture Intelligence. In the first quarter, overall investments in startups stood at $11 billion. For the first half of the year, the overall investments stood at $17.9 billion, a 36% increase from the same period last year.

Ola starts handing pink slips, defers impending appraisal: Mobility unicorn Ola joins the long list of Indian startups that have handed the pink slip to their employees amid a tightening funding environment triggered by global macroeconomic factors, geopolitical tensions, and volatility in publicly-traded technology stocks.

RBI and Fintechs

Razorpay, Pine Labs get RBI nod for payment aggregator licence

Razorpay, Pine Labs, and US-based Stripe received an in-principle nod from the Reserve Bank of India (RBI) to operate as payment aggregators. Once the central bank comes out with the final list of the shortlisted firms, they will have to conduct an audit within six months to get the final approval – a process that is followed by the RBI for granting all licences.

Important to understand RBI objective, we’re well-capitalised, says Slice CEO: Rajan Bajaj, the founder, and chief executive of credit card startup Slice, in an internal memo urged his team to understand the Reserve Bank of India’s (RBI’s) recent objectives as the company tries to build a platform in a highly regulated sector.

Cryptoverse

ED issues notices, summons crypto execs in FEMA probe

The Directorate of Enforcement (ED) has sought more details and documents from crypto firms as part of its ongoing probe into alleged violations of foreign exchange laws, if any, by these firms, sources told us.

Crypto trading volumes crash again as 1% TDS kicks in: Spot trading volumes on crypto exchanges CoinDCX, WazirX and Zebpay fell by at least 70% from June 30 to July 3 as the 1% tax deductible at source (TDS) on all crypto transactions kicked in on July 1. Volumes on WazirX were down the most at 82%, according to data sourced from crypto research and consulting firm Crebaco. The decline was almost 70% on CoinDCX and 76% on ZebPay.

Crypto-lending platform Vauld freezes withdrawals as winter bites: Crypto platform Vauld has suspended withdrawals and trading and is seeking new investors as the 2022 crypto winter takes its toll. In a blog post, Vauld CEO Darshan Bathija said it was facing “financial challenges” because of volatile market conditions, financial difficulties at its key business partners, and the current market climate.

UK crypto exchange Nexo gives Vauld a lifeline: London-based crypto exchange Nexo will acquire crypto lending platform Vauld, pending due diligence — marking the latest sign of consolidation in the crypto market amidst falling prices. London-based Nexo said it would “reorganize its future operations to accelerate its deeper presence in Asia”. However, it did not say when the deal would close.

E-commerce

FMCG sales fall on Amazon after Cloudtail transition

FMCG sales have fallen significantly on Amazon India after brands including Nestle, Dabur, and HUL were asked to switch to new seller Rocket Kommerce from Cloudtail, two sources aware of the matter told us. Sources estimate that the fall in sales could be in the range of 30-40%.

Shopsy brings in about 25% of Flipkart’s new customers: About a quarter of new customers for the entire Flipkart group have come from its one-year-old social commerce app Shopsy, a senior executive at the e-commerce firm said. The group has several apps, including the Flipkart app, Myntra, payments app PhonePe, and travel service app Cleartrip.

ETtech Done Deals

■ Omnichannel eyewear brand Lenskart has been valued at $4.5 billion in a new $200 million investment led by Alpha Wave Global (previously Falcon Edge), a person briefed on the matter told us.

■ In the wake of rising early-stage investments by VCs, Axilor Ventures is launching its second technology fund Axilor Technology Fund-II, worth $100 million, as it looks to double down on its Indian startup investments.

■ Financial infrastructure provider M2P Fintech acquired cloud-lending platform FinFlux for an undisclosed sum. Launched in 2010, Bengaluru-based Finflux offers loan origination, loan management, BNPL products, and credit scoring services via its cloud platform, servicing over 12 million borrowers.

■ Online tax filing service provider Clear (formerly ClearTax), has acquired company compliance automation platform CimplyFive for an undisclosed sum in an all-cash deal. This is Clear’s second acquisition this year as it continues to double down on its software platform and looks to diversify services for its 4,000 enterprise customers.

Twitter v/s Government

Centre’s 39 ‘take down’ orders fail ‘proportionality’ test: Twitter in HC

Twitter will challenge 39 blocking orders issued by the centre, including some sent as far back as February 2021, on the grounds that they do not pass the test of “proportionality,” the microblogging site stated in a petition filed at the Karnataka High Court.

Twitter withholds Goddess Kaali poster tweet on govt request: Twitter India withheld a tweet by filmmaker Leena Manimekalai – who has been embroiled in a controversy after a poster of her film depicted Indian Goddess Kali smoking a cigarette – on a legal request from the government, the microblogging site said in a report to Lumen Database on Wednesday.

From the IT corner

TCS Q1 Results: Profit rises 5% YoY to Rs 9,478 crore, misses estimates

Tata Consultancy Services (TCS) on Friday reported a 5.21% year-on-year (YoY) rise in consolidated net profit at Rs 9,478 crore in the June quarter compared with Rs 9,008 crore in the same quarter last year.

IT firms may report higher attrition in Q1: Most Indian information technology companies may report an uptick in attrition yet again as they start reporting their financials for the quarter ended June. The attrition rate, however, is expected to start falling from this quarter onwards, experts said.

Top IT firms to post modest revenue growth in Q1, analysts say: India’s top IT service providers are expected to report modest revenue growth in the first quarter as supply-side pressures including wage increments, onsite wage inflation, and travel costs loom large, analysts said.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.