Also in this letter:

■ Alphabet and Microsoft quarterly earnings

■ ETtech Done Deals

■ Kotak raises Zomato’s fair value

Honasa Consumer’s key products’ share in operating revenue falling

(L-R) Varun Alagh and Ghazal Alagh, cofounders, Mamaearth

Honasa Consumer, the parent of personal care brand Mamaearth, said it has seen a reduction in contribution to revenue from its top 10 products. Any fall in sales of these products could “adversely affect our business, cash flows, financial condition”, the company said. The omnichannel consumer firm is expected to launch its initial public offering (IPO) on October 31.

Driving the news: In FY23, the contribution of Honasa’s top 10 products fell to 27.38% of its total operating revenue of Rs 1,492.75 crore, according to the red herring prospectus filed with the markets regulator. In FY22, the share of top 10 products in the company’s operating revenue of Rs 943.46 crore was 30.17%.

Other brands rising: The flagship Mamaearth brand’s share in the overall revenue for its parent company, excluding revenue from services, has decreased. In the June quarter, it was Rs 303.63 crore, making up 67.1% of the total operating revenue, compared to the same period last year when it raked in Rs 256.78 crore, accounting for 87.1%.

Also read | Personal care brand Mamaearth gets set for renewed overseas push

In the financial year 2023, Mamaearth contributed nearly 82% to the company’s total revenue, down from 93% in the previous fiscal year, and around 96% in the fiscal year 2021.

Meet the founders: Ghazal and Varun Alagh started Honasa Consumer after struggling to find toxin-free products for their son, Agastya, in India back in 2016. This inspired the launch of Mamaearth, offering toxin-free products for babies and young mothers in recyclable packaging as an online-first brand.

Ghazal, who started her career as a corporate trainer at tech services company NIIT, is known to be hands-on with product development and management of communities. Varun, an alumnus of Delhi College of Engineering and XLRI Jamshedpur, brings in FMCG experience from Hindustan Unilever, Diageo PLC and Coca-Cola.

Also read | Mamaearth cofounder Ghazal Alagh denies IPO valuation rumours

Tech Mahindra Q2 profit tumbles 62% on year, revenue falls 2%

IT services company Tech Mahindra posted a consolidated net profit of Rs 494 crore in the second quarter, down about 62% on year, and well below the ET Now Poll estimate of Rs 670 crore.

Key highlights:

- Revenue from operations declined 2% year-on-year to Rs 12,864 crore.

- The company’s Ebitda (earnings before interest, tax, depreciation, and amortisation) fell 46% YoY to Rs 1,072 crore.

- Segment-wise, the communication, media, and entertainment (CME) vertical lost the most as revenue fell 11% YoY, followed by the BFSI segment, whose revenues dropped 6% in the second quarter.

- Revenues from the technology and manufacturing divisions rose 2.8% and 5.7%, respectively, in the reporting period.

Also read | Bleak days ahead for IT firms as macro trends crimp spending

Dividend and other details: The company’s board approved an interim dividend of Rs 12 per equity share.

Tech Mahindra added 2,307 employees in the second quarter, taking the total headcount to 150,604.

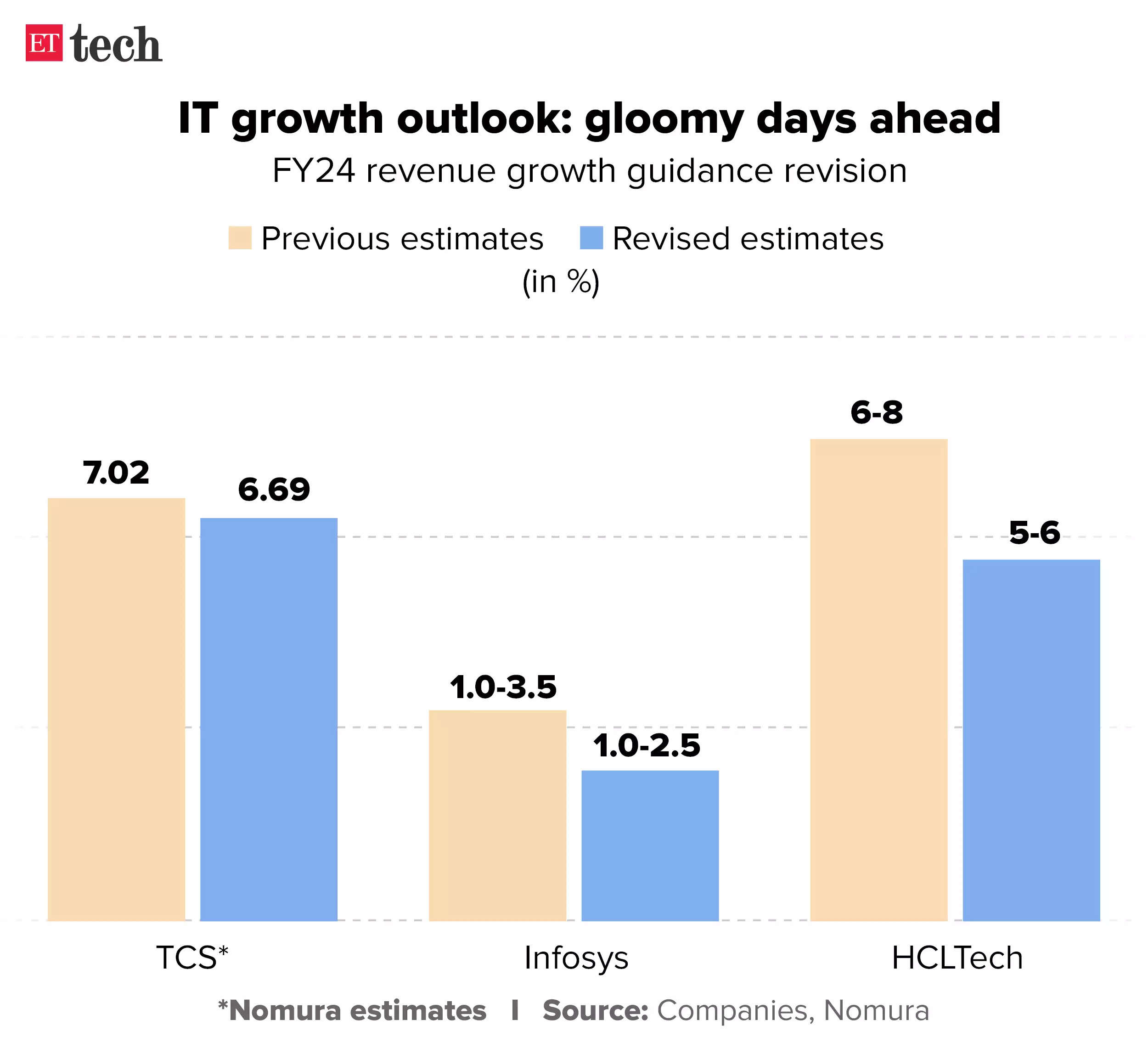

IT downturn continues: Large software services companies, including Tata Consultancy Services (TCS), Infosys and HCLTech have reported below-than-expected September-quarter earnings.

We reported on October 23 that some of the biggies of India’s $245-billion IT industry may be staring at their slowest growth ever.

Also read | Tech winter diet: TCS, Infosys and HCLTech shed weight, reduce employee intake

Infosys, India’s second-largest IT services company, is likely to report its slowest growth ever based on the current guidance of 1-2.5%. For Wipro, growth numbers are down to its FY99 levels.

TCS and HCLTech are likely to report their slowest growth since the pandemic.

Alphabet reports $19.6 billion in Q3 profits; Microsoft’s profits at $22.3 billion

Sundar Pichai, CEO, Alphabet

Alphabet and Microsoft kicked off the earnings season for Big Tech companies in the US on Tuesday. While California-based Alphabet posted a profit of $19.6 billion, Microsoft’s bottomline stood at $22.3 billion.

Alphabet’s key financial takeaways:

- The Google parent reported $76.7 billion in quarterly sales, up 11% from a year earlier.

- The internet giant’s profit jumped 42% to $19.7 billion.

- Revenue from Search and other related services that form a bulk of Google’s business, rose 11% to $44 billion.

- Advertising sales at YouTube, Google’s video platform, climbed 12% to $7.95 billion.

- As of September 30, the company said it had 182,381 employees, against 186,779 during the same period last year.

The India angle: Last week, Google said it would start manufacturing its flagship Pixel phone in India. CEO Sundar Pichai on Wednesday said the phone was the fastest growing smartphone brand in its top markets. Notably, Tensor, the chip used to power Pixel, is already being designed in India. Last week, IT minister Ashwini Vaishnaw said the government was nudging the company to begin fabrication of these chips in India.

Also read | Google’s cutting-edge Tensor chip: Designed in India for the world

Straight from the C-Suite: “The fundamental strength of our business was apparent again in Q3, with $77 billion in revenue, up 11% year over year, driven by meaningful growth in Search and YouTube, and momentum in Cloud. We continue to focus on judicious capital allocation to deliver sustainable financial value,” CFO Ruth Porat said.

Microsoft’s key financial takeaways:

- Microsoft raked in $56.5 billion in revenues in the quarter ended September, up 13% from a year earlier.

- The Windows OS maker saw its profit hit $22.3 billion, up 27% on year.

- Flagship cloud computing product Azure grew 29%, up from 26% in the previous quarter.

- The personal computing business grew just 3%, to $13.7 billion. The revenue of the Windows operating system installed on new computers was up 4%.

- Revenue for LinkedIn grew just 8% to $3.9 billion in the quarter.

Cloud boost on AI: The company, which has invested heavily in artificial intelligence (AI), through its $13 billion bet on ChatGPT maker OpenAI, is seeing a resurgence in sales from its Cloud division which houses the Azure cloud-computing platform, where much of the AI work will take place. Microsoft had told investors that AI wouldn’t start producing meaningful results until after the start of 2024, when more products become widely available.

Also read | Alphabet and Microsoft see earnings rise on AI-infused cloud

A MESSAGE FROM OUR PARTNERS

Netradyne: Revolutionizing truck safety with AI tech from India

The essential truck driver’s companion. Utilizing cutting-edge AI and computer vision technology, they enhance fleet safety, proudly originating from India. Committed to their mission of saving lives through accident reduction, Netradyne is reshaping the transportation industry. Know more here

ETtech Done Deals

Agnishwar Jayaprakash, founder & CEO, Garuda Aerospace

Drone maker Garuda Aerospace raises Rs 25 crore: Drone manufacturer Garuda Aerospace has received Rs 25 crore funding from a fresh bridge round led by integrated incubator Venture Catalysts, WeFounderCircle to meet its working capital requirements. The funds would be primarily utilised to address the demand for drones.

Aditya Birla Group’s TMRW invests in The Indian Garage Co: TMRW, ecommerce roll-up venture owned by the Aditya Birla Group, has invested Rs 155 crore in menswear brand The Indian Garage Co. Founded in 2012, the brand reported a revenue of Rs 300 crore in FY23 alongside a “healthy double-digit profit margin.

Kotak Institutional Equities values Zomato at Rs 125 per share

Brokerage firm Kotak Institutional equities has revised Zomato’s fair value per share to Rs 125 from the previous Rs 100. This adjustment reflects the substantial increase in the contribution margin for the food delivery business, which rose to Rs 18.5 per order in FY23 from Rs 6.6 in FY22.

The valuation: Kotak valued Zomato’s food delivery business at Rs 83,100 crore using a discounted cash flow (DCF) method. In addition to food delivery, Zomato also operates quick commerce platform Blinkit and business-to-business grocery sourcing service Hyperpure.

Also read | At Rs 2 crore, Zomato turns profitable for first time this quarter

The details: Zomato’s contribution margin soared due to a notable Rs 6.3 boost in revenue per order. A higher take rate accounted for Rs 2.7 of this increase, while Rs 3.6 came from amplified advertising revenue, as indicated by Kotak. Variable costs dropped by Rs 5.2 per order, owing to fewer discounts and decreased expenses, alongside a minor reduction in delivery costs by Rs 0.4 per order.

Today’s ETtech Top 5 was curated by Megha Mishra in Mumbai and Siddharth Sharma in Bengaluru.