Source: Giphy

Also in this letter:

■ 8i Ventures aims to raise larger second fund

■ Freshworks loses $5.45B m-cap since Q3 results

■ Ola plans IPO in first half of 2022

Swiggy to invest $700 million in quick commerce biz amid growing competition

Sriharsha Majety, cofounder and CEO, Swiggy

Swiggy has earmarked $700 million for its Instamart service, amid heightened investor interest and growing competition in the instant grocery delivery segment, cofounder and chief executive Sriharsha Majety said.

Instamart, launched in August last year as Swiggy’s quick commerce vertical, is set to reach an annualised GMV run rate of $1 billion in the next three quarters, the company said. Gross merchandise value, or GMV, is a key online retailing metric for the total value of merchandise sold through a marketplace.

There is, however, no set time frame for the deployment of the cash as it is an overall commitment to the category, Majety told us.

- “It is not a dated commitment where we are going to deploy this in the next 12 months or 18 months. We think that is the size of ammunition that we need to deploy to be able to do justice to this category,” he said.

Tell me more: Swiggy’s large capital commitment for Instamart comes on the back of the Bengaluru-based company holding talks to close a $600-700 million funding round led by US asset manager Invesco, we reported first on Sept. 28. The fundraising, which is likely to ascribe the firm a valuation of over $10 billion, is part of a re-rating exercise that will double the company’s valuation post rival Zomato’s bumper IPO.

Quote: “It is an exciting category and our commitment to invest is also a function of that. Every time there is a new category that is starting to explode or open up—whether globally or locally— there’s always going to be interest and there will be some funding happening along the way,” Majety said about the flood of investments in the ultra-fast delivery space.

The competition: The delivery platform, which competes with Zomato-backed Grofers, Mumbai-based Zepto and Tata’s BigBasket in the quick commerce category, is clocking more than one million grocery orders per week and runs 150 dark stores across 18 cities. It will add 100 more of these so-called dark stores, over the next few months.

Grofers, which is likely to receive $500 million capital from Zomato, operates a network of 200 dark stores to which it plans to add another 100, the company had announced in a blog post in November. Zepto, a pure-play quick commerce platform that recently raised $60 million, is targeting 100 dark stores by the year-end.

Quick delivery push: Zomato’s move to double down on the fast-growing quick delivery segment comes on the back of rival Swiggy prioritising Instamart.

Food delivery remains the focus: Even as Swiggy pushed ahead aggressively on the grocery delivery front, the company’s food-delivery business hit a $3 billion annualised GMV run rate, a lifetime high for the category, Majety told us. The company’s food delivery volumes have surpassed pre-pandemic level, he said, without getting into the specifics.

8i Ventures aims to raise larger second fund at $50 million

8i Ventures partners

Mumbai-based 8i Ventures is looking to raise a $50-million Fund-II, almost four times larger than its previous corpus, as the seed-stage investor looks to double down on its investments across commerce and fintech.

Portfolio: Founded in 2019 by entrepreneur and angel investor Vikram Chachra along with Vishwanath V, 8i Ventures has backed seven early-stage startups from its maiden $13-million Fund-I.

The firm’s fintech bets like Slice, a credit-card issuing startup; M2P, a card-issuing platform; and Difenz, a digital risk and fraud management firm, have performed well. In fact, last week, Slice said it had raised $220 million from Tiger Global and Insight Partners, among others, as its valuation topped $1 billion. 8i Ventures first invested in Slice earlier this year, when it was valued at $200 million and is sitting on a 7.4X paper gain clocked in less than six months of its investment.

The firm has also backed consumer brands like Blue Tokai Coffee and Bbetter, an Indian supplements brand.

Quote: “8i’s Fund-I is clocking a multiple of 4.2 times on the capital we have drawn down, and 5.6 times on the investments we have made from the fund, over the last two years…We raised our fund in 2020-21 and expect to return around 25% of the fund assets under management by the end of FY22. We should be able to return the entire fund by FY23,” Chachra told us

Investment trend: Majority of the investments made by the fund is in the range of $1-$1.5 million in the seed stages, as well as through follow-on investments in Series A and B rounds.

With the new fund, the VC expects the cheque sizes to go up to $5 million, depending on the growth stage and maturity of the companies.

Freshworks loses $5.45 billion market cap since declaring Q3 results

Freshworks CEO Girish Mathrubootham

Freshworks Inc. had exactly a month ago toppled Zendesk Inc. in terms of market capitalisation for the first time. Since then, however, it has been a slippery slope for the stock of India’s SaaS poster child.

Taking stock: On November 2, shares of the Chennai- and San Mateo, California-based software-as-a-service (SaaS) company hit an intraday high of $53.35 per share, ascribing the company a market cap of $13.56 billion—about $1.4 billion higher than Zendesk’s $12.1 billion on that day. But the stock has declined nearly 30% over the past month to $35.22 on December 1, eroding the company’s valuation by $5.45 billion.

The financials: Net loss stood at $0.04/share against an estimated $0.10/share, even as revenue rose 46% to $96.6 million. Free cash flow was negative $4.2 million compared to $10.3 million in the year-ago period.

Revenue forecast: The company has raised its revenue forecast for the fourth quarter and the full year. It now expects the revenue to be in the range of $99-101 million in Q4 and $364.5-366.5 million in 2021. Freshworks, which listed on Nasdaq in September, follows the calendar year as its fiscal.

Bumper year: It has been a banner year for Indian SaaS as investors increasingly backed cross-border companies amid a record-breaking year of fundraising. SaaS firms like Postman and Browserstack have raised capital at much higher valuation compared to their previous rounds, signalling the premium investors are ascribing to these companies.

Also Read: Freshworks initiates $500 million share sale to tap listing gains

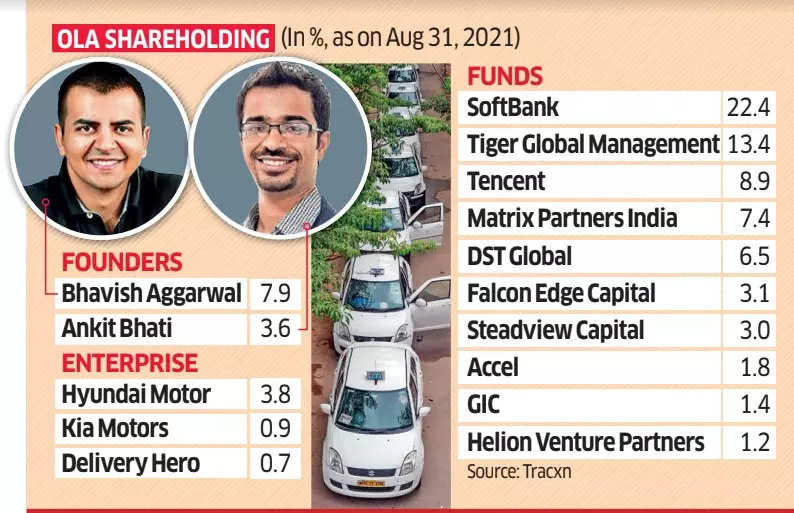

Ola plans IPO in first half of 2022, readies ‘super app’

Ola chief executive Bhavish Aggarwal

Ride-hailing company Ola plans to go public in the first half of 2022, chief executive officer Bhavish Aggarwal said on Thursday, undeterred by the recent volatility and lackluster listing of some startups in the country.

IPO plans: Ola, which has a majority share of India’s ride-hailing market, where it competes with Uber Technologies, has plans to raise up to $1 billion through an IPO.

Indian companies have raised a staggering $9.7 billion through initial public offerings (IPOs) in the first nine months of 2021, according to accountants EY, but the dismal stock market debut of Indian digital payments firm Paytm last month has caused worries among some bankers.

Ola ‘super app’: The Bhavish Aggarwal-led firm is also gearing up to create something of a “super app” with plans to broaden its services beyond mobility to include personal finance and micro insurance, Aggarwal told the Reuters Next conference.

Quote: “We are not a company that takes a short-term view on anything. Short-term, there might be volatilities in the market but that has never informed our decisions,” said Aggarwal.

EV ambitions: Aggarwal also plans to list Ola’s separate electric vehicle business in the future, and is currently building it out starting with its electric scooters, for which it has received 1 million reservations, he said.

It plans to launch an electric car in 2023 and is looking at setting up local battery cell manufacturing.

Pre-IPO funding: Ola is finalising a pre-IPO financing round that’s likely to be led by IIFL Wealth Management and Edelweiss Private Equity, we reported in November.

The fundraise, which could range anywhere from $250-500 million, will double Ola’s valuation from its previous round in July to around $7 billion.

Paytm just got its first ‘Buy’ rating after IPO flop

Paytm, which has moved wildly since its listing after India’s largest initial public offering, has received the first buy rating from a brokerage that expects the company to turn profitable by March 2026.

Brokerage’s view: Dolat Capital Market Pvt, the third brokerage to initiate coverage on the digital payments giant after Macquarie Capital Securities and JM Financial Institutional Securities Ltd., said its transition to a “manufacturer” of financial services from an agent, cross-selling of services, and strong growth in the number of users will help the company.

- Paytm’s “super app” has emerged from a pure “want” category to reach to the “need” status, Dolat analysts, led by Rahul Jain, said.

On the Street: The brokerage has set a target price of Rs 2,500, which is 16% higher than the company’s issue price. Paytm dropped as much as 2.7% to Rs 1,592 on Thursday, the fifth day of declines, after plummeting 37% in the first two sessions of trading. JM Financial has a sell rating on the stock, while Macquarie has rated it as underperform.

By the numbers: In its first earnings report since going public earlier this month, Paytm said expenses rose 37.1% year-on-year to Rs 1,599 crore and consolidated net loss increased to Rs 474 crore from Rs 437 crore a year ago. Revenue from operations surged 63.6% to Rs 1,086 crore for the quarter ended September.