This comes amid signs of a funding slowdown and overall macro headwinds hurting technology investments and valuations globally. It also follows a

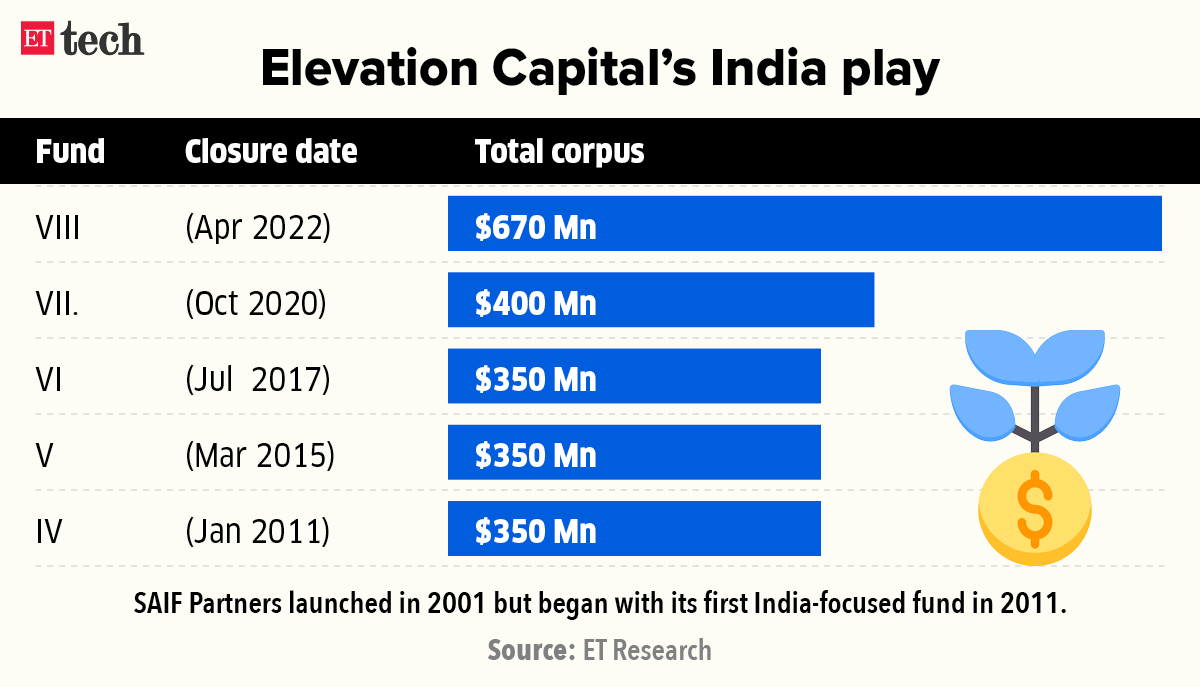

$400 million fundraising by the venture capital firm as part of its India-focussed Fund VII in October 2020, which coincided with the start of a never-seen-before boom period for Indian startups as record-breaking capital flowed into the country.

As the pace of funding starts to decelerate, Elevation said it would look to deploy the fresh capital over a three-year time frame, unlike the previous fund which was aggressively distributed among more the 30 startups.

Last month, Accel, one of the most prominent venture funds in India,

announced the close of its seventh fund at $650 million, while its Silicon Valley counterpart Sequoia Capital is on track to rack up $2.8 billion for its latest India and Southeast Asia fund, as per sources in the know, signalling the ever-increasing pool of capital being committed to address the India opportunity.

In fact, 2021 was a banner year for newer venture capital firms like

Stellaris Venture Capital,

A91 Partners, and Sixth Sense Ventures, all of which doubled or tripled their fund sizes.

Discover the stories of your interest

Elevation, known for having kept its fund at the $300-400 million mark even as peers raised much bigger funds over the last few years, said it was now at an inflection point. Elevation will continue to only invest in India, while most of the bigger VC funds have diversified into Southeast Asia.

“With a larger cheque, we can show a lot more conviction, even more than what we had in the past… this will help us in writing bigger cheques in the first round itself – at seed or Series A stage,” said Mukul Arora, who was recently promoted to co-managing partner along with the fund’s founder Ravi Adusumalli. “It also improves our ability to back portfolio companies much later in their journeys.”

Arora said sectors like Software-as-a-Service (SaaS), web3 and crypto will be the new focus areas and, therefore, an enlarged corpus would help them take bets.

ETtech

ETtechElevation raised a new fund in a short period of 18 months partly due to an acceleration in the growth of tech companies, Arora added. “Last year, we did more than 2x of investments compared to previous years and that also led to a relatively shorter fund cycle…We will go back to the three-year deployment cycle,” he said.

Deepak Gaur, partner, Elevation Capital said, “There has always been a very strong demand from investors (limited partners or sponsors) to increase the fund size, but broadly it’s a function of our assessment of the opportunity to deliver the best returns in India and the size of the opportunity that we see.”

Arora and Gaur said the increased fund size will not hamper their returns, a risk many firms run into while shoring up more dry power.

Early-stage going strong

Elevation closed around 30 deals last year and will continue to write cheques of $2 million to $5 million during the early stages with capital commitments going all the way up to $25 million during the lifecycle of a startup.

“In this new fund, we may do a similar or slightly higher number of deals, but these will be larger initial cheque sizes and more capital for these companies in the long term, over a period of three years,” said Mayank Khanduja, a Bengaluru-based partner at Elevation Capital.

ET has been reporting about the early signs of

consolidation and the slowdown in deal making since the start of the year.

The seed and Series A stage funding are still unaffected, said Mridul Arora, partner, Elevation Capital.

“We think the opportunity set remains very active. If you also look at seed and series A, our activity level is fairly active. Compared to last year, relatively speaking, it has come down but if you go bottoms up and go by the quality of ideas and quality of founders and by the depth of the opportunity, we have never been more excited about India,” he said.

Indian startups

raised $36 billion in risk capital in 2021, as per UK-based investment data platform Preqin, making it a seminal year for fundraising, even as a bunch of tech firms went public on the Indian bourses.

One97 Communication, the parent of digital payments platform Paytm where Elevation was the first institutional investor, was one of those to make a public market debut, though its

stock has been falling since its listing in November.

Mukul Arora said the focus of the Paytm management has been to make the business stronger on a monthly and quarterly basis. “Fundamentally, we have always taken a long-term interest in Paytm,” he said.

Will the poor performance of Paytm and the overall negative sentiment around high-burn, cash-guzzling, unprofitable startups going public, dent the plans of other IPO candidates?

“I would say five years back, people would wonder whether Indian tech companies could ever get listed. Nobody is asking us that question…Irrespective of what has happened in the stock markets, going public is not an isolated phenomenon. I think if you look at the entire global markets…so it is not something specific to India what (tech stocks plunging) has happened,” Gaur said. “There are no long- or mid-term concerns about capital flows as well as the ability of (Indian) companies to go list.”

Bringing in diversity

Elevation, which has an all-male- partnership, at a time when lack of diversity across investment firms is a hot-button issue, Guar said, they were mindful of it.

” We know there are various benefits in having diverse perspectives… It takes people to grow up into the partnership…We are strong believers of people getting promoted from within. I think we have made significant improvements in terms of hires,” he said.

In the past few years, funds like Sequoia Capital and Lightspeed Venture Partners have announced women partners but the Indian venture capital industry lags far behind its global counterparts in having women decision-makers at funds.