Instamart,

launched in August last year as Swiggy’s quick commerce vertical, is set to reach an annualised GMV run rate of $1 billion in the next three quarters, the company said. Gross merchandise value, or GMV, is a key online retailing metric for the total value of merchandise sold through a marketplace.

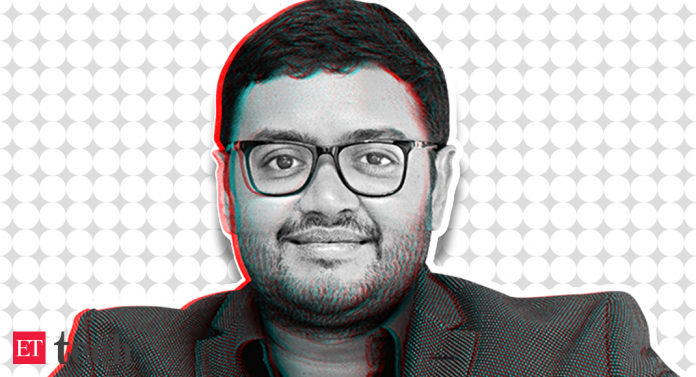

There is, however, no set time frame for the deployment of the cash as it is an overall commitment to the category, Majety told ET. “It is not a dated commitment where we are going to deploy this in the next 12 months or 18 months. We think that is the size of ammunition that we need to deploy to be able to do justice to this category,” he said.

The delivery platform, which competes with Zomato-backed Grofers, Mumbai-based Zepto and Tata’s BigBasket in the quick commerce category, is clocking more than one million grocery orders per week and runs 150 dark stores across 18 cities. It will add 100 more of these so-called dark stores, over the next few months.

Grofers, which is

likely to receive $500 million capital from

, operates a network of 200 dark stores to which it plans to add another 100, the company had announced in a blogpost in November. Zepto, a pure-play quick commerce platform that

recently raised $60 million, is targeting 100 dark stores by the year end.

Swiggy’s large capital commitment for Instamart comes on the back of the Bengaluru-based company holding talks

to close a $600-700 million funding round led by US asset manager Invesco, ET reported first on Sept. 28. The fundraising, which is likely to ascribe the firm a valuation of over $10 billion, is part of a re-rating exercise that will double the company’s valuation post rival

Zomato’s bumper IPO.

ETtech

ETtech“It is an exciting category and our commitment to invest is also a function of that. Every time there is a new category that is starting to explode or open up—whether globally or locally— there’s always going to be interest and there will be some funding happening along the way,” Majety said about the flood of investments in the ultra-fast delivery space.

Swiggy’s delivery platform coupled with its existing convenience-seeking user base gives it a competitive edge, he said. “The platform benefit is a clear one. Our user acquisition costs are much lower than any standalone company that’s trying to acquire consumers afresh. As you have seen with any multi-category app where users transacting on two categories actually grow their business in both the categories when there’s more engagement, the whole flywheel of multi-category commerce is a real one.”

Instamart, which aims to deliver groceries in 15-30 minutes through a network of seller-owned dark stores that it operates, emerged from the learnings of Swiggy Stores, a hyperlocal delivery marketplace for groceries and other essentials that shut earlier this year. What has morphed into Instamart, began as an experiment a couple of years ago and is now the second-highest revenue driver for food delivery platforms.

Majety said the company will continue to strengthen its multi-category convenience play.

ETtech

ETtech

Food Delivery Still The Focus

Even as Swiggy pushed ahead aggressively on the grocery delivery front, the company’s food-delivery business hit a $3 billion annualised GMV run rate, a lifetime high for the category, Majety told ET. The company’s food delivery volumes have surpassed pre-pandemic level, he said, without getting into the specifics.

“The food delivery platform is the mothership that drives every other new business which we run and we are very focused on that. I spend majority of my time focusing on food delivery,” Majety said, when asked if Swiggy’s focus had moved away from its core business. “The growth has been very strong for the category overall as the monthly transacting user spends are 50% higher than what it was compared to pre-Covid-19 levels.”

2021 has been a standout year for consumer internet startups like Zomato, Nykaa and Policybazaar, which have tapped the public markets and delivered bumper returns to private investors. Majety said from an IPO-preparedness point of view, things have been underway for a long time and the company will explore the possibility of a listing as more clarity “emerges on our investment calendar”.

“I think we’re definitely watching everything closely. With more information and clarity coming in, on our own investment calendars, we will definitely explore the opportunity,” he said.

Swiggy is also running pilots for multiple services it classifies as “horizon three” that are in an experimental stage. Among them are a pickup and delivery service under Genie, a meat marketplace, and a separate subscription-based platform

SuprDaily which it acquired in 2018. Swiggy’s

newly elevated cofounder Phani Kishan is overseeing that business.

“We are continuing the wandering exploration, fixing tweaks in the business models before we feel comfortable enough to kind of go jet set on some of these journeys. So I think these are three horizons and as a company, we should always be serious about all three horizons,” Majety said.

Both Swiggy and Zomato have in recent months

faced a backlash from gig workers over alleged poor pay, lack of compensation for skyrocketing petrol prices, absence of first-mile pay, lack of long-distance return bonus, and daily earning caps, ET reported in August. Swiggy’s delivery partners led a protest in September last year after the company slashed wages as it absorbed the after-effects of the first lockdown.

“We feel comfortable about how the earnings are trending, we are doing our best. But in addition, I think there’s a lot of inconveniences that we are getting as feedback,” Majety. ”This is something we have to remove for the delivery partners along the journey to make the job easier. And that journey began much earlier than now. It’s a continuous work in progress.”