Over the last few weeks, we’ve been reporting closely on the severe stress that Byju’s—once the country’s largest edtech—has been facing. Earlier this week, Doubtnut—another edtech—was sold to Allen Career Institute in a fire sale while buy-now-pay-later startup ZestMoney shut down amid a larger regulatory clampdown on unsecured lending.

Both Byju’s and Doubtnut have something in common. In 2020, Byju’s had engaged with Doubtnut for a potential acquisition, valuing it at around $150 million. The deal didn’t go through. Doubtnut has now been sold for a meagre $10 million, and Byju’s has been marked down to below $3 billion by its investor Prosus. So much for comedowns!

Of course, today, no one will value Byju’s at its peak valuation of $22 billion, but Prosus’ latest estimate signifies the change of fortunes that one of India’s most storied startups has gone through over the past year. It’s rare for the chief executive of a fund (albeit an interim one) like Prosus to mention on a public call that a company of the scale of Byju’s is facing multiple challenges.

As for ZestMoney, besides the immediate reason of NBFC (non-banking financial companies) cutting credit lines, the fintech’s decision to close operations tracks its inability to revive its business after failure of acquisition talks with fintech major PhonePe in March this year.

What’s next?

What this means is that if you thought 2023 has been a year of resets – there’s more coming up in the New Year. Indications are that the recent fire sale and distress deals are only going to get more intense, setting the stage for further corrections in 2024.

“Funding drought aside, it’s clear now companies are having survival issues whether it’s Byju’s, PharmEasy, Dunzo, ZestMoney and others. Companies tried raising bridge rounds and debt, but what’s clear is that more shutdowns and distress sales are on the cards next year as more startups would run out of capital,” the chief executive of a top internet firm said, adding that any change in the ongoing liquidity squeeze is unlikely before the end of the general elections next year.

Consider this: 2023 saw startup investments crash to a five-year low, with new-age tech companies raising just about $7 billion in equity funding—which is less than one-third of last year. In 2022, Indian startups secured close to $25 billion in funding, as per data analysis by research platform Tracxn.

Founders and investors, who we have been talking to, also said companies won’t have the choice to just burn their remaining capital and shut down if it’s clear there is no way a company can be revived.

A top edtech founder said his company has been looking to close a new deal but the broader stress across the ecosystem—especially in edtech—has kept investors away. “We have compliance in place and business is growing but still it would take another few months for us to close a sizeable deal,” he said.

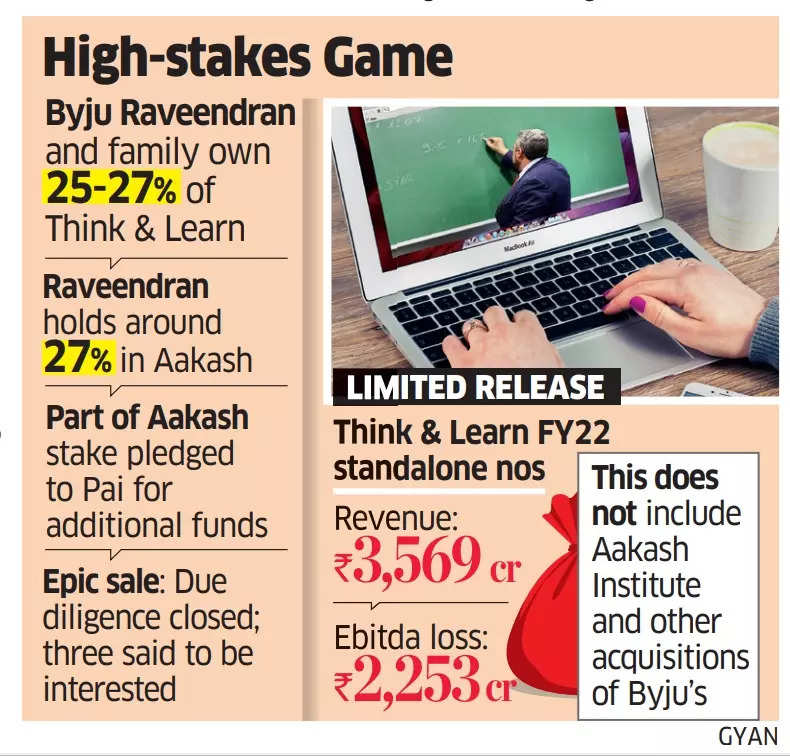

As ET has been reporting, Byju’s is running out of time, and while it has managed so far to arrange funding through different sources, it has become clear its fate will likely be decided over the next month or so.

Early-stage impact

The changes in the ecosystem have affected early-stage startups too. And with survival at stake, a rethink of the way they go about their business is slowly setting in.

“The evaluation of PMF (product market fit) is a constant thing companies need to keep doing. In the early stage, investors are signing up for a long-term journey with the founders and helping the company discover PMF is the first step in creating an enduring institution,” said Chirag Chadha, principal, Elevation Capital. He had invested in edtech Frontrow, which shut operations earlier this year.

“The most important thing is that you don’t stop tracking and re-evaluating PMF irrespective of capital available and time spent in the market. If companies have stopped doing that and gotten swayed away to say that we’ll solve this problem later…that’s where the issues begin,” he said.

Written by Digbijay Mishra in Bengaluru and Pranav Mukul in New Delhi

Shutdowns, resets amid funding squeeze

Funding in Indian startups sinks to its lowest since 2017: Funding to Indian startups fell steeply in calendar year 2023 to $7 billion — less than one-third of the estimated $25 billion received in the previous year, industry data showed.

This marks a seven-year nadir for the sector since 2017, amid a worsening global macroeconomic environment buffeted by geopolitical conflicts.

ZestMoney to shut ops, lays off 150 employees: Financially-beleaguered fintech startup ZestMoney is shutting down its operations by the end of this month, employees were informed on Tuesday.

Allen Career Institute buys problem-solving platform Doubtnut in slump sale: Allen Career Institute said it has acquired problem-solving platform Doubtnut for an undisclosed amount. A statement from Allen Career Institute said the acquisition will help the tutoring institute build on its technology-led learning solutions.

Byju’s may have to dip into Epic sale funds to keep the lights on: As the troubled edtech firm continues to grapple with a severe cash crunch, it may have to explore the possibility of using a portion of the proceeds from the planned sale of its unit, Epic, to sustain operations at Think & Learn,

Byju Raveendran says will tide over liquidity crisis in 45-60 days: Amid the ongoing cash crunch at Byju’s, founder and CEO Byju Raveendran told a group of senior executives that he is aiming to address the crisis over the next 45-60 days.

Fintech Corner

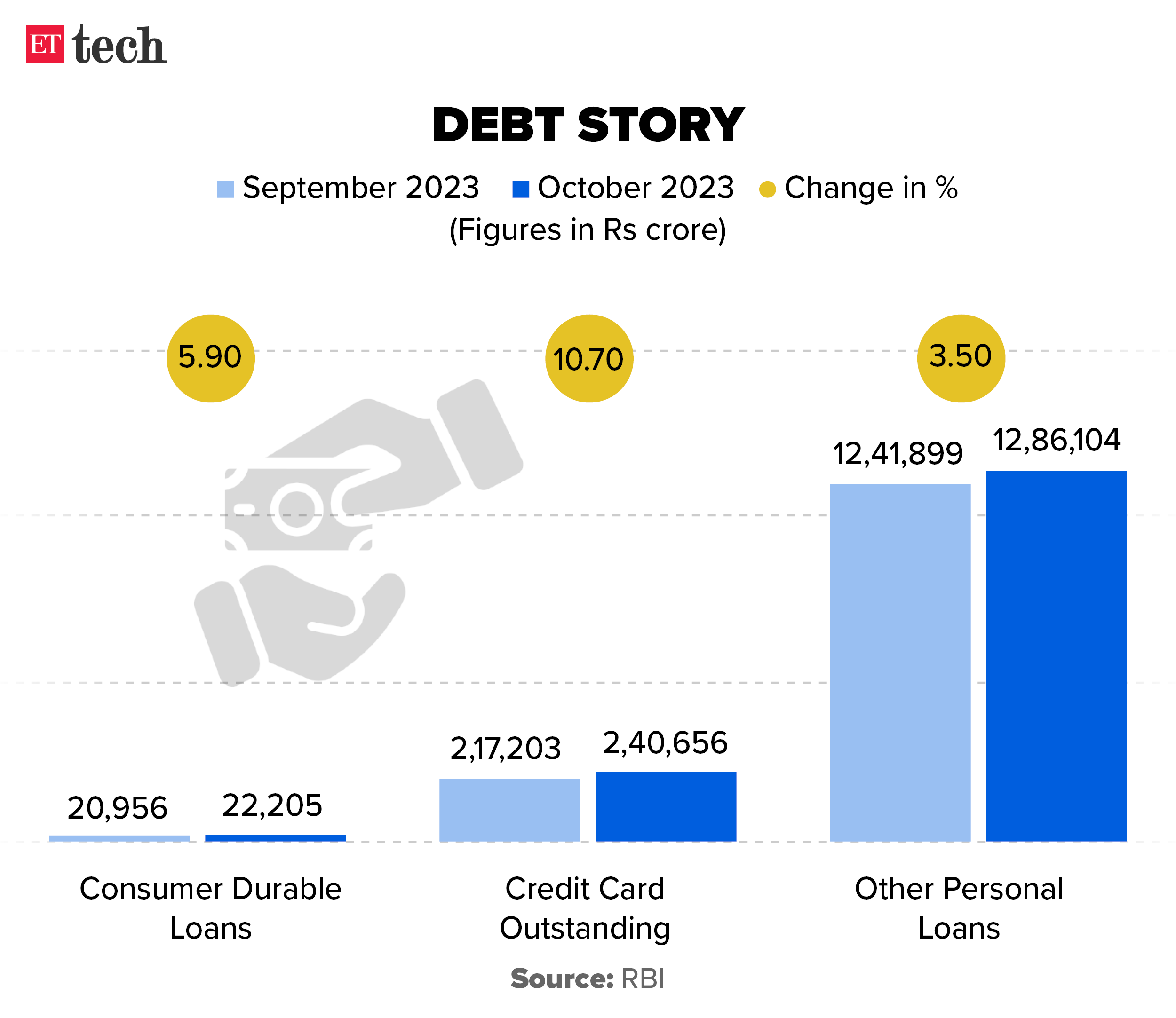

Unsecured loans in focus, fintechs see NBFC credit taps drying up: NBFCs are tightening norms for credit disbursal to lending startups, especially those offering small, unsecured loans, industry executives said.

ZestMoney saga highlights drying NBFC credit flow: Three founders of major consumer lending applications said overall, there is a slowdown in unsecured small-sized loans.

Paytm scales down small-ticket loan business amid regulatory hurdles: Financial services major Paytm will scale down its BNPL product Paytm Postpaid, and take a cautionary approach towards small-ticket loans going forward.

RBI ban makes online payment aggregators seek alternative business lines: To offset the opportunity lost, these payment aggregators are focusing on international markets, offline payments and remittances.

Banks leverage Bharat Billpay for loan, credit card repayments: Bharat Bill Payments (BBPS), the platform built by the National Payments Corporation of India (NPCI) to digitise the country’s large utility bill payments market, is now increasingly being used for loan repayments and clearing credit card dues.

Other Top Stories This Week

Zomato, Swiggy seek a route to reach bottom of the pyramid: Bengaluru-based Swiggy launched a pilot called ‘Pockethero’ in about 15 cities that will mainly target students and freshers looking for more affordable food delivery options. Zomato rolled out its ‘Everyday’ programme to provide affordable home-cooked meal options.

Online gaming startups call for three-tier oversight mechanism: The industry is proposing a three-tier regulatory mechanism, where SRBs are brought under an oversight committee formed by the government, Dream11 cofounder and CEO Harsh Jain and Games24x7 cofounder and CEO Trivikraman Thampy told ET.

App-store level age verification most effective solution: Meta’s Joel Kaplan | Social media and internet intermediaries should opt for an “app-store” level check for age verification and consent management of users below the age of 18, vice president of global policy at Meta Joel Kaplan said.

Foxconn’s Bharat FIH will invest Rs 400 crore in Indian arm: The investment is scheduled to be made this month, FIH Mobile said in a stock exchange filing, dated December 5, in Hong Kong.

Apple taps companies in India, Taiwan, South Korea, Japan for critical parts: This comes on the back of delayed government approvals for imports from existing suppliers — primarily of Chinese origin — of batteries, camera lens, chargers and other equipment required to make its flagship iPhones and iPads in India.

India’s tech chops help GCCs to look within for solutions: One out of four technology functions required by global capability centers or captives in India has been insourced from an IT firm, as per data sourced by ET.

Indian talent gets senior-level roles as GCCs mushroom: The boom of Global Capability Centres (GCCs) in the country has led to a 40-50% increase in the number of global and senior-level roles based out of India in the last five years, numbers sourced by ET show.

ETtech Deals Digest: Boosted by investment in Sarvam AI, Indian startups raise $108 million this week