Also in this letter:

■ Govt asks Vedanta-Foxconn JV for info on chip expertise

■ Social media marketing firm serves Trell notice for ‘unpaid dues’

■ IT rules should balance security with furthering rights: study

Funding for Indian startups fell almost 40% in Q2

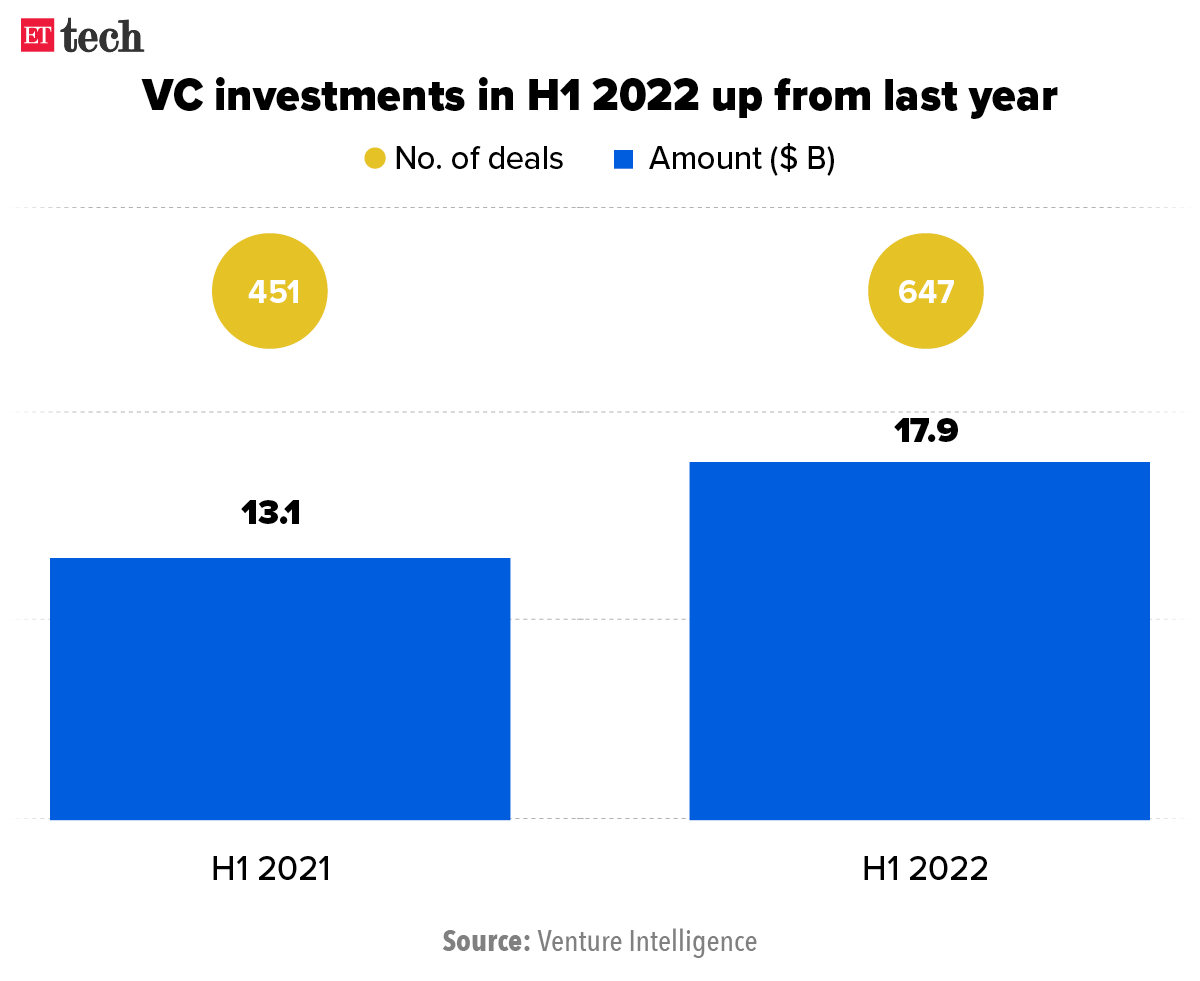

Venture capital funding into Indian startups dipped 37% in the second quarter of this year to $6.9 billion, according to data from Venture Intelligence.

In the first quarter, overall investments in startups stood at $11 billion.

For the first half of the year, the overall investments stood at $17.9 billion, a 36% increase from the same period last year.

Unicorn rounds also slowed to a crawl in the second quarter, which saw only four new unicorns compared to 12 in the same period last year, according to data from Tracxn.

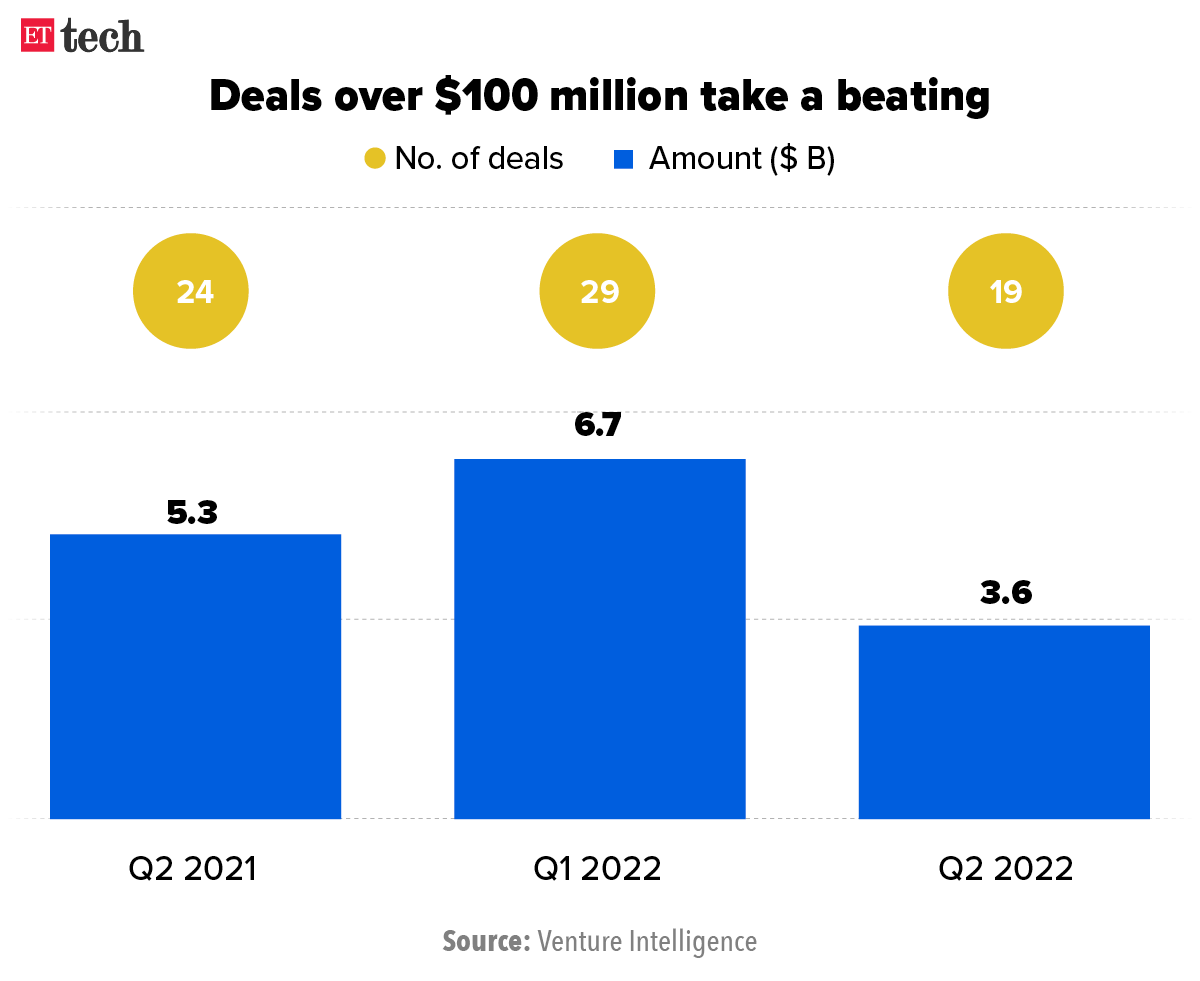

Late-stage deals plummet: Late-stage rounds remained rare as investors reassessed valuations amid tepid public market listings.

In the second quarter, there were 19 funding rounds of $100 million or more, cumulatively amounting to $3.6 billion, compared to 29 such deals worth $6.7 billion in the January-March period this year, according to Venture Intelligence data.

This is also a decline from the second quarter of 2021, when Indian startups raised $5.3 billion across 24 deals worth $100 million or more.

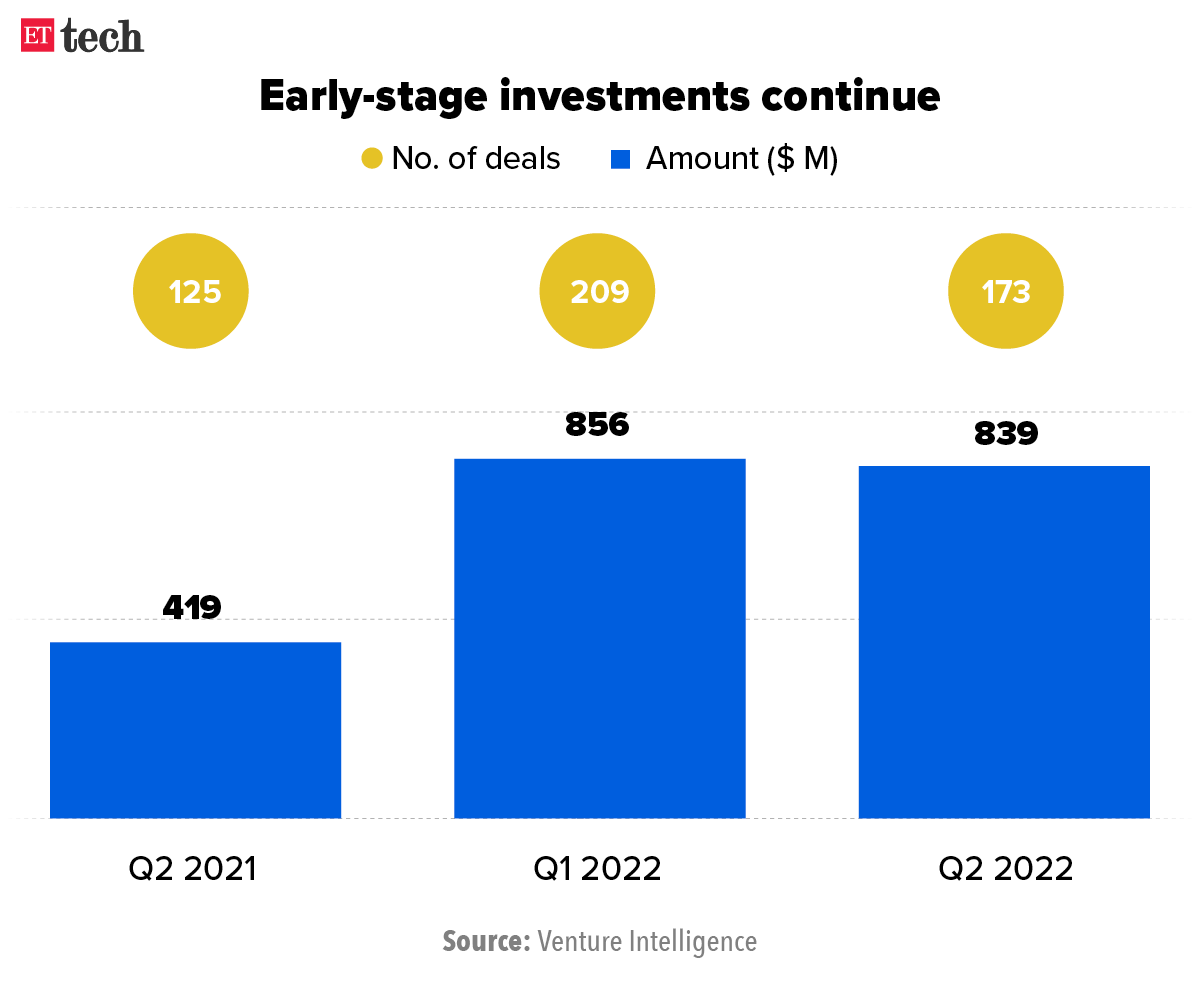

Early-stage momentum: Early-stage funding was the silver lining in the second quarter.

Funding for early-stage startups dipped marginally to $839 million in the April-June period, from $856 million in the previous quarter, but this was still 30% higher than in the last quarter of 2021, according to Venture Intelligence.

Lean times: We reported on May 30 that VC firms had started tightening the funding tap of Indian startups, as adverse macroeconomic situations – especially interest rate increases by the US Federal Reserve and a rout in technology stocks worldwide – continued to depress sentiment.

Over the past few months, several top-tier global venture capital firms including Sequoia Capital, Y Combinator and Beenext have asked their portfolio companies to cut costs to survive the ‘funding winter’.

Govt asks Vedanta-Foxconn JV for info on chip expertise

The union government is “unsure” if the Vedanta-Foxconn joint venture has the “appropriate technical knowhow” for semiconductor manufacturing and fabrication, multiple sources told us.

The ministry for electronics & information technology (MeitY) wants the Anil Agarwal-owned Vedanta and Taiwan-based Foxconn Technology Group to provide more details on how they plan to acquire the required expertise, or get a third partner with demonstrated technical capability, said the sources, who declined to be identified.

“We are not very sure on how they (Vedanta-Foxconn) plan to achieve the scale that the government envisions. We want the companies to clarify on this,” said one senior government official, while noting that “Foxconn has not really been involved in large-scale fabrication of semiconductor chips”.

No prior experience: According to the MoU signed between the two companies, Vedanta will hold a majority equity stake in the JV, while Foxconn will be the minority shareholder. Vedanta chairman Anil Agarwal is slated to be the chairman of the joint venture company.

ET had earlier reported that Vedanta plans to invest up to Rs 66,000 crore in the semiconductor chip manufacturing plant. The company had then said that it would target smartphones and electronics with the 28-nanometre (nm) fabrication.

Akarsh Hebbar, global managing director of Vedanta Group’s display and semiconductor business, told us in February that despite having no prior experience in semiconductor manufacturing, Foxconn was the perfect partner owing to its global footprint in electronics manufacturing.

Yes, but: Companies need to demonstrate clear expertise in the specialised field of semiconductor manufacturing to qualify for incentives under India’s ambitious Rs 76,000 crore scheme aimed at creating a comprehensive semiconductor ecosystem, our sources said.

Social media marketing firm serves Trell notice for ‘unpaid dues’

Creatify Web Services, which operates social media and influencer marketing agency Idiotic Media, has sent a legal notice to Bimal Kartheek Rebba, cofounder of influencer-led video commerce platform Trell, for unpaid dues amounting to about Rs 47 lakh, including GST.

Idiotic Media has also demanded compensation of Rs 5 lakh from Trell for causing mental agony and harassment.

We have reviewed a copy of the legal notice and the email the agency and its lawyer sent to Trell on June 21.

Other recipients of the legal notice include Shreya Goel and Siddharth Vasishtha of Trell, who oversaw the engagement between the two firms.

“Trell hasn’t received any legal notice from the vendor. The company has paid more than 90% of all its vendors barring a few where there are disputes on delivery. These are contractual discussions and are confidential…,” a spokesperson for Trell said in a statement.

We reported on June 27 that Trell had not paid its dues to a section of content creators for the last six to seven months.

Trell had earlier been probed by a forensic team from EY India, which was looking into alleged related-party transactions, incorrect reporting of business numbers, and other financial irregularities.

IT rules should balance security with furthering rights, says study

The Information Technology Rules, 2021, which are currently being reviewed by the Ministry of Electronics and Information Technology, should strike a balance between “furthering fundamental rights in the digital realm, ensuring user safety and security, and holding intermediaries accountable,” tech policy group The Dialogue and the Internet and Mobile Association of India said in a report on Monday.

Driving the news: The Regulatory Impact Assessment Study of the IT Rules of 2021, jointly conducted by The Dialogue and IAMAI, noted that the safe harbour protection accorded to intermediaries must be provided in accordance with the Supreme Court judgement in the Shreya Singhal versus Union of India case.

“The attempt to reimagine the IT Act must entail the alignment of the intermediary liability regime with the jurisprudence established by the Supreme Court of India and global best practices. This entails that the standard of ‘actual knowledge’ prescribed in the Shreya Singhal case is adhered to, and that no criminal responsibility is imposed on employees of the intermediaries in adherence to the global best practices,” the report said.

The study also noted that key stakeholders, including three-fourths of the intermediaries, said mandates under part two of the IT Rules might create an entry barrier and make it harder to do business in India.

Digital tech, DBT system helped India save Rs 2.23 lakh crore, says PM Modi

India has prevented Rs 2.23 lakh crore from going to middlemen by using digital technologies and the direct benefit of transfer into the accounts of beneficiaries, Prime Minister Narendra Modi said on Monday.

Addressing the inaugural session of the Digital India Week, being celebrated in Gandhinagar, Modi said that though India was left behind during the third industrial revolution, it was guiding the world in the fourth Industrial revolution.

“With the passage of time, the country which does not adopt modern technology, time moves ahead leaving it behind. India was a victim of this during the third industrial revolution. But today we can proudly say that India is guiding the world in the fourth industrial revolution,” Modi said.

He also launched a slew of new initiatives to be launched under the Digital India programme, including announcing the first batch of 30 Institutions to be supported under the Chips to Startup (C2S) Programme.

TWEET OF THE DAY

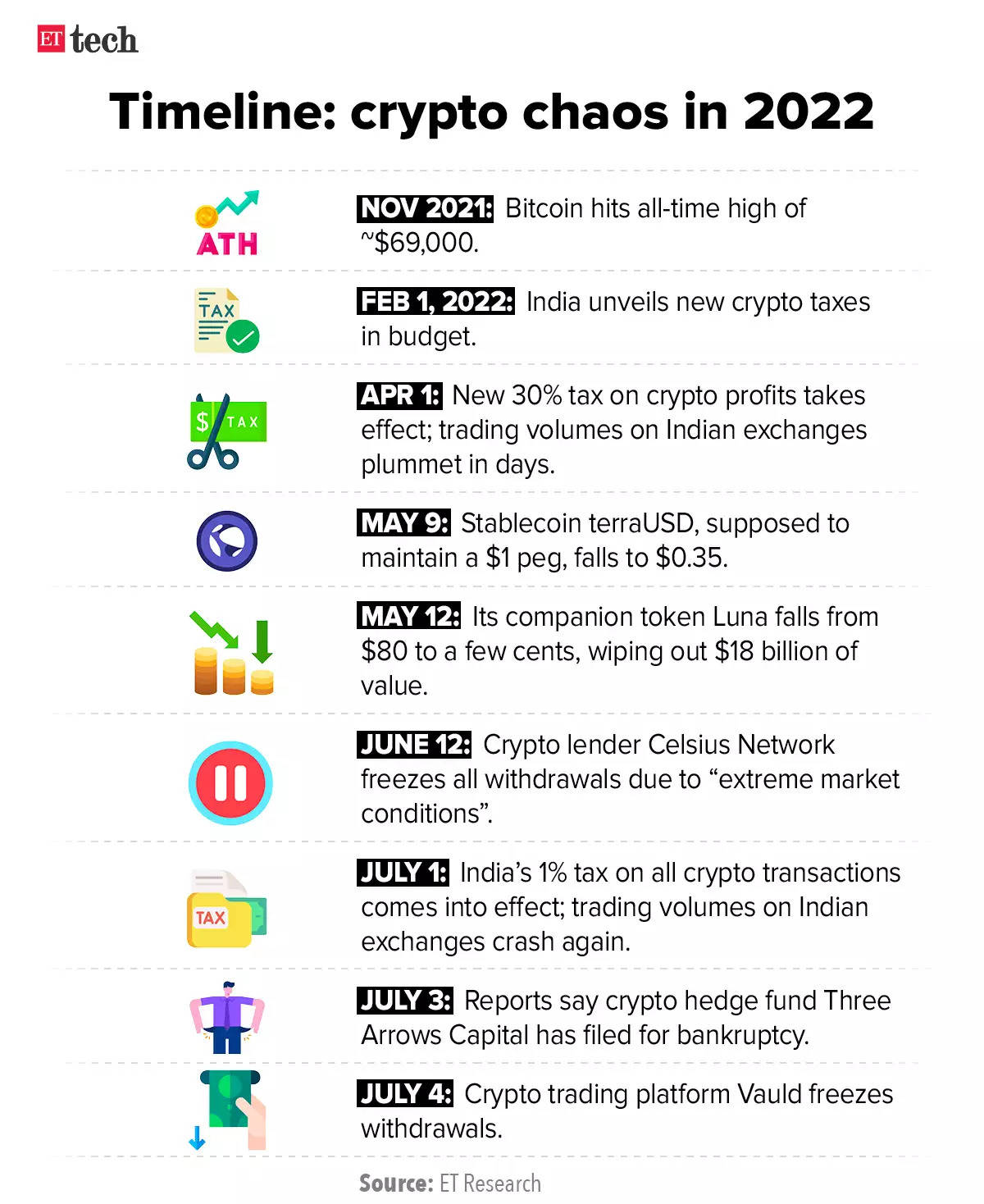

Crypto lending platform Vauld freezes withdrawals as winter bites

Crypto platform Vauld has suspended withdrawals and trading and is seeking new investors as the 2022 crypto winter takes its toll.

Driving the news: In a blog post on Monday, Vauld CEO Darshan Bathija said it was facing “financial challenges” because of volatile market conditions, financial difficulties at its key business partners, and the current market climate.

Founded in 2018 by Bathija and Sanju Kurian, Vauld provides a suite of products to crypto investors, including ‘fixed deposits’ and asset-backed lending and borrowing. It said customers have withdrawn crypto worth more than $197.7 million from the platform since June 12.

Last month, Vauld announced it had laid off 30% of its workers, most of whom were based in India.

Crypto chaos: The crypto industry has been shaken by a series of collapses in recent months, including:

- The failure of so-called stablecoin TerraUSD

- Large US-based lender Celsius network pausing withdrawals and laying off 150 employees

- Singapore-based crypto hedge fund Three Arrows Capital entering into liquidation

Other Top Stories By Our Reporters

Byju’s completes Aakash payments: Edtech giant Byju’s said on Monday it has completed pending payments for the acquisition of Aakash Educational Service Ltd. (AESL), and received the majority of a $800-million fundraise announced in March.

Large tech firms see uptick from public sector: Large technology companies such as Microsoft and Oracle are seeing an upswing in their public sector business as government departments and state-run companies are undertaking technology-led transformation projects.

Guj, K’taka among best states for startups, says report: Gujarat, Karnataka and Meghalaya have been voted among the best performing states for developing the startup ecosystem in India, according to a ranking of states and union territories released by the Department for Promotion of Industry and Internal Trade (DPIIT).

Global Picks We Are Reading

■ Chip boom loses steam on slowing PC sales, crypto rout (WSJ)

■ The worst hacks and breaches of 2022 so far (Wired)

■ No bids on Chevy’s first NFT, even though it came with a free Corvette Z06 (The Verge)