The algorithmic stable coin is supposed to maintain a one-to-one peg against the US dollar but slumped nearly to $.26 to the dollar on Wednesday night after the complex mechanisms that were supposed to hold the dollar peg failed leading to the UST crash.

And as a result Luna, Terra’s sister token which powers the Terra blockchain, dropped below $0.30 on Thursday from $80 in a matter of 3 days.

A good number of Indian crypto investors had Luna in their portfolio, and the crash wiped off their holdings in a matter of hours.

“It was a good project and had given good returns in the last one year. “Those investors who bought the token at $60-70-80 a few months back have seen their investment evaporate in a day,” said Vishal Gupta, a Noida-based crypto investor.

The Luna crash then added fuel to an already nervous market, pulling down all major digital assets into a freefall.

Discover the stories of your interest

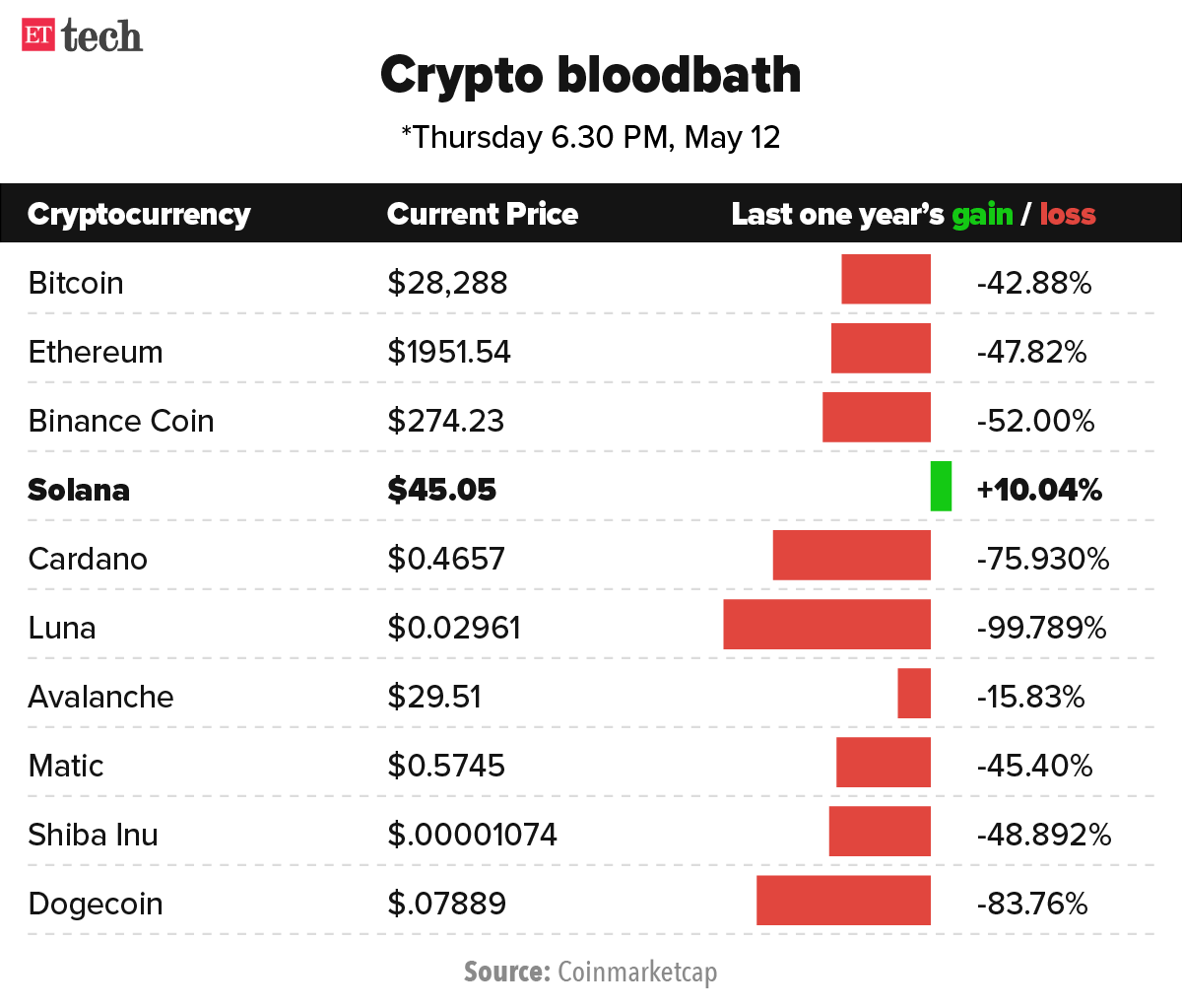

Bitcoin, the most popular cryptocurrency, briefly touched $26,000, its lowest level since December 2020, on Thursday as the cryptocurrency selloff accelerated.

At 5 pm, Thursday, Bitcoin was trading at $ 28,498 (-10.60% in the last 24 hours) on Coinmarketcap.

The pain continued in the smaller cryptos as well.

Ethereum was down 18.88 per cent ($1966.03), Binance coin dipped 12.73 % ($271.54), Solana fell 30.8 % ($44.97), Avalanche was 24.18% lower ($29.52) and Cardano lost 25.437 % ($0.4747).

The popular meme coins were also severely impacted, with Shiba Inu down 27.06% ($0.00001105) and Dogecoin slipping 25.56% ($0.07845).

A big worry for the market for a while was that the biggest stable coins, USD Tether (USDT) and USD Coin (USDC), were also under pressure and lost their $1 peg.

With rising volatility and uncertainty, majority of Indian crypto investors are now caught in a bind.

Their portfolios have shrunk significantly and cashing out would mean incurring big losses, while they don’t have the courage to average out given the massive drops in currencies in the last few days.

“I bought Bitcoin at $54,000 and averaged it until $45,000, but it now appears that the coin is in free fall. The whole portfolio is down by 60 %. Though it is tempting, I do not have the conviction or the funds to purchase more. I am seriously contemplating exiting crypto now if I get an out, “said Gopala Somani, a Delhi-based trader.

ETtech

ETtechExperts say that investors should be careful about investing in altcoins like Luna.

“Luna’s meteoritic fall from grace has undoubtedly exposed significant shortcomings in what could be described as unregulated financial instrument investments. Whilst cleverly constructed, packaged and marketed to a mass retail customer base, otherwise described in the crypto glossary as ‘the community’ that consisted of in excess of 4 million wallet holders, it was clearly based on an upward trajectory with little consideration being given to potential negative market conditions,” said Tony Gilbert, CEO, Coinweb.

The Indian investors hadn’t previously experienced the fall of a high-flying crypto project like Luna, even in this volatile asset class.

Most new investors are in panic mode right now and the social media is filled with news about people losing huge sums of money due to the current crash.

“A lot of Indians have invested heavily into altcoins, but most of them fail to realise that in such deep bear markets, altcoins take the biggest hit and some don’t even get back up,” said Chahal Verma, a Gurgaon-based crypto investor. “The best way to invest is to hold fundamentally strong decentralised cryptos.”

Experts say that the current Luna fiasco is a great learning opportunity for the global crypto community as it has revealed the weak links within the algorithm-based stablecoin ecosystem.

“It is important to note that the Terra network is one of the most tech-savvy in the crypto industry, and Terra UST is a pioneer in the algo-based stablecoin race. The Luna crisis reiterates the fact that crypto as an asset is highly volatile and investors need to trade with caution with a long-term horizon of 2-3 years to stay profitable. The Luna Guard Foundation, with a reported massive Bitcoin reserve, is trying its level best to stabilise UST once again to gain investors’ confidence. As we speak, Luna is trading below the $1 mark and it may take a substantial period of time for LUNA to recover from this, considering the many projects building on Luna will also be affected,” said Charles Tan, Chief Marketing Officer at Atato, a licenced MPC crypto custodian wallet.