Source: Giphy

Also in this letter:

■ Curefit raises $145 million in funding round led by Zomato

■ Facebook India’s FY21 gross ad revenue soars

■ ‘Metaverse won’t be turning point in crypto adoption’

SoftBank biggest foreign investor in India: Masayoshi Son

SoftBank CEO Masayoshi Son

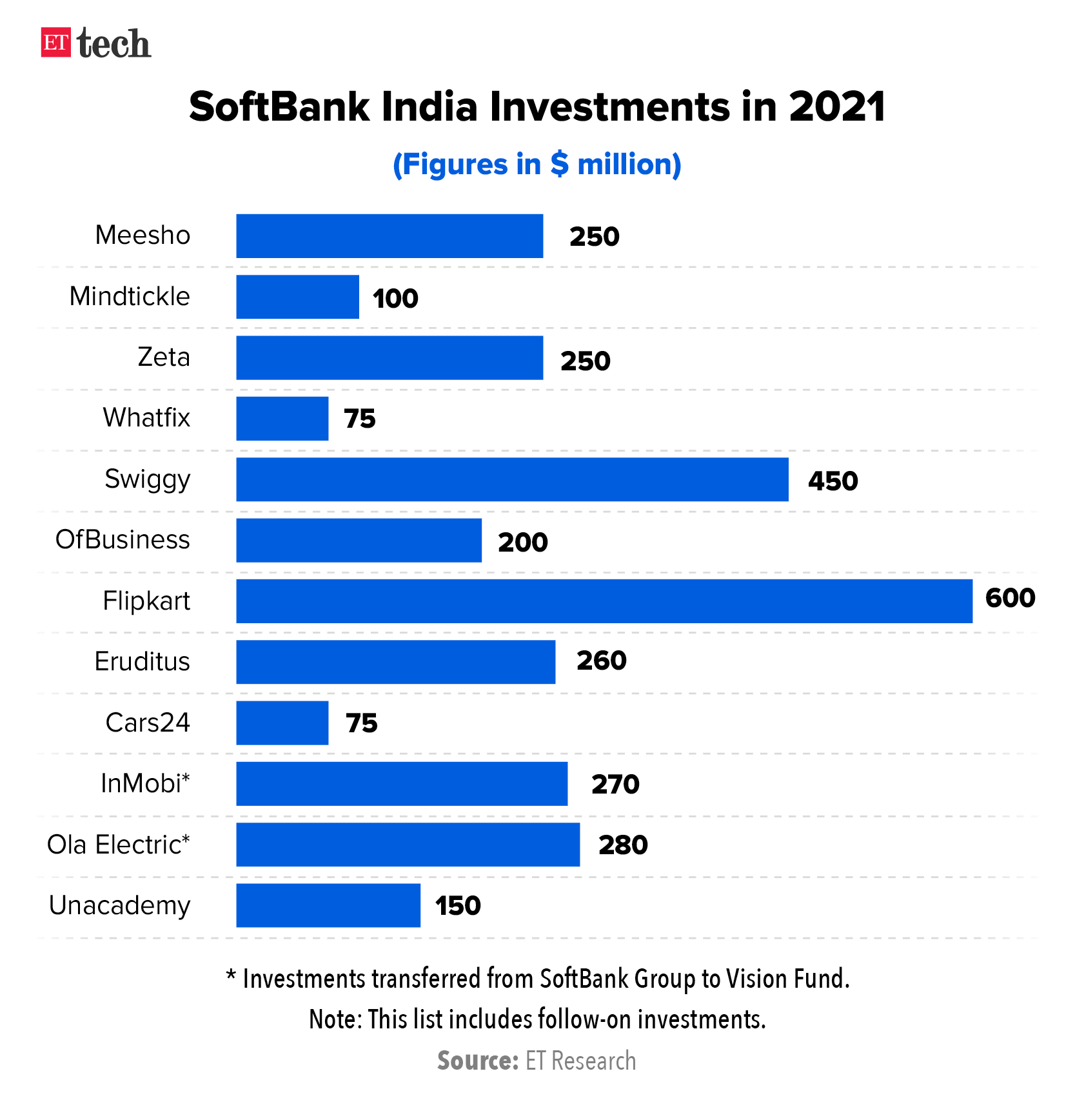

SoftBank founder and CEO Masayoshi Son said the Japanese firm is the biggest foreign investor in India and has already invested around $14 billion here over the last 10 years. Son, while speaking at the India Infinity Forum, said he had met Prime Minister Narendra Modi a few years ago and made a commitment to invest $5 billion in India.

Quote: “Just this year alone, we have invested $3 billion into India. We are the biggest foreign investors in India. We are providers of about 10% of the funding of all the unicorns—firms valued at $1 billion or more—in India,” Son said.

According to him the Indian companies, where SoftBank is an investor, have created one million jobs.

- “I believe in the future of India. I believe in the passion of young entrepreneurs in India. There is a bright future. I tell the young people in India—let’s make it happen, I will support,” he said.

SoftBank is among the most bullish investors in Indian startups having backed large startups like Paytm, Ola, Grofers, Oyo and others. In 2021, the company re-invested in ecommerce major Flipkart besides birthing new unicorns like Zeta, Meesho, OfBusiness, among others.

Fintech opportunities: Having missed out on taking a wager on fintech, payments and the wider financial services sector due to its $1.6-billion exposure to Paytm, SoftBank is now actively scouting opportunities in the space, we reported in November.

We also reported that SoftBank is in advanced stages of talks to back fintech startup Juspay.

SoftBank shares slide: Shares in Japanese conglomerate SoftBank Group Corp dropped over 3% on Friday after the giant tech investor was hit with three disappointments within 24 hours, including a poor Nasdaq debut for ride-hailing firm Grab.

Its shares fell to as low as 5,423 yen ($47.89) on Friday, before settling slightly higher but with losses of 23% over three weeks.

SoftBank’s triple disappointments

- Didi Global, which is 21.5% owned by the Vision Fund, said earlier Friday it would delist from the New York Stock Exchange and pursue a listing in Hong Kong, after coming under pressure from Chinese regulators over data security.

- A few hours earlier, the US Federal Trade Commission sued to block Nvidia Corp’s more than $80 billion planned acquisition of British chip technology provider Arm, which is owned by SoftBank.

- A few hours before that, shares of Grab, Southeast Asia’s biggest ride-hailing and delivery firm, slid more than 20% in their Nasdaq debut on Thursday following the company’s record $40 billion merger with a blank-check company.

The Vision Fund is Grab’s largest shareholder owning about 18.6% of the company.

The group reported a second-quarter loss last month as its Vision Fund unit took a $10 billion hit from a decline in the share price of its portfolio companies.

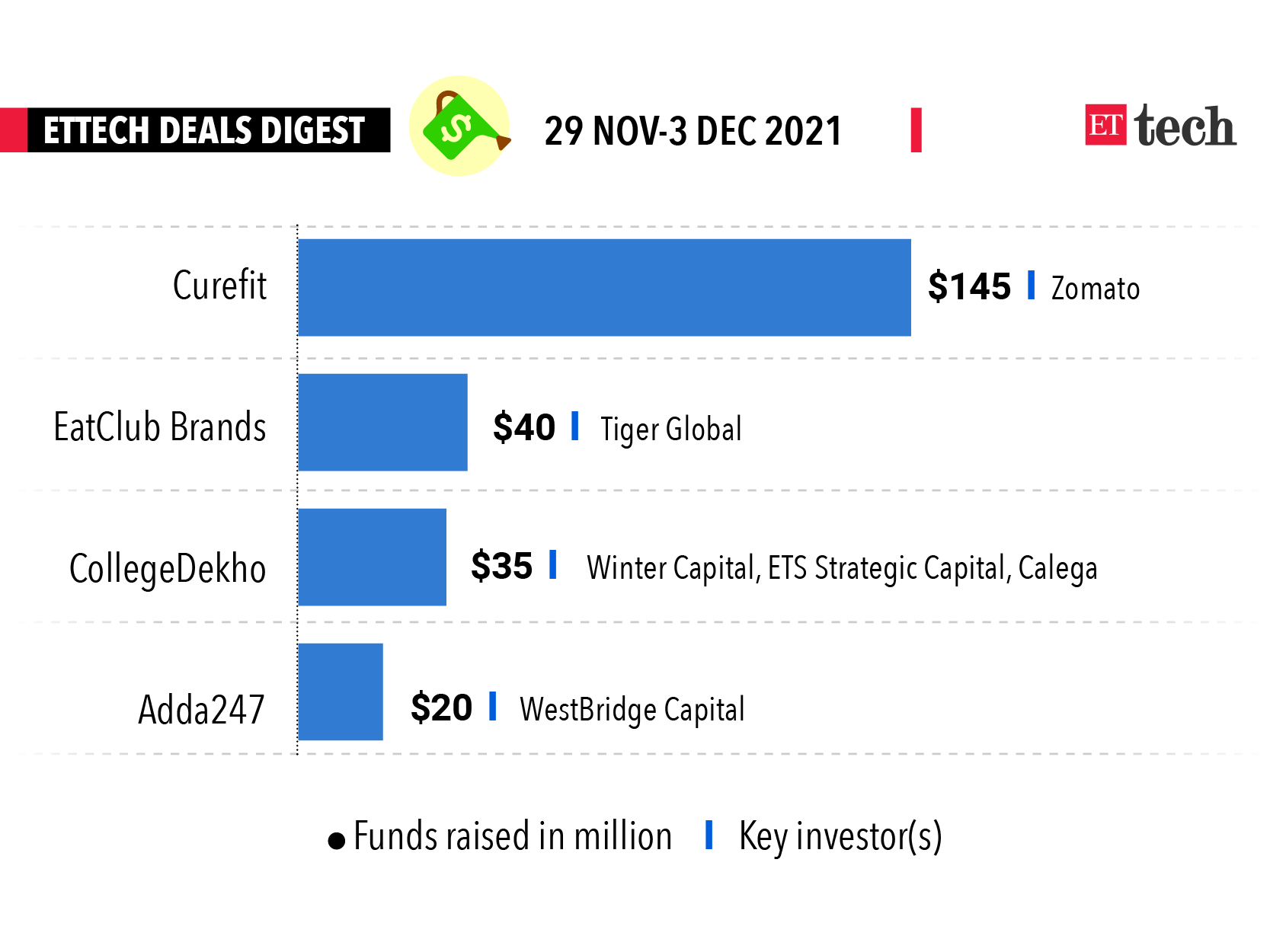

Curefit raises $145 million in funding round led by Zomato

Curefit Healthcare Pvt. Ltd., which operates fitness platform Cultfit, has raised $145 million in a funding round led by food delivery company Zomato Ltd.

The investors: Accel, South Park Commons, Singapore-based investment company Temasek Holdings Ltd, a few individuals, and Curefit’s cofounder Mukesh Bansal also participated in the fundraising, according to regulatory filings sourced from business intelligence platform Tofler.

Zomato infused $100 million, as part of its broader strategy to invest $1 billion in young firms. Bansal, who previously founded online fashion retailer Myntra, invested $5 million.

- Curefit’s valuation now stands at about $1.5 billion, up from $800 million in March 2020.

Tata bets on Curefit: In June, Tata Digital Ltd., a wholly owned subsidiary of the Tata Group, entered into a memorandum of understanding to invest $75 million in the company. As part of the deal, Bansal, also the chief executive of the Bengaluru-based startup, joined Tata Digital as president.

About Curefit: Curefit Healthcare operates several subsidiaries under an umbrella entity to offer a gamut of fitness and health services. It owns almost 74% of Sugar.Fit, a diabetes management and reversal platform, which was slated to raise $10 million in a seed round led by Curefit in September. The company has expanded to offer online and offline fitness classes, doctor consultations, lab tests, and fitness gear.

Here’s a quick look at the top funding deals of the week.

Facebook India’s FY21 gross ad revenue soars to Rs 9,326 crore

Facebook India Online Services has reported a net profit of Rs 128 crore for 2020-21 on revenues of Rs 1,481 crore, regulatory filings showed.

By the numbers: During the pandemic, Facebook’s gross ad revenue from the Indian market grew to Rs 9,326 crore, recording a year-on-year growth of 41%.

The company ended up paying a Rs 518 crore equalisation levy to government on the gross ad revenue, according to the filings to the Registrar of Companies.

For Facebook India, these revenues consist primarily of ad revenues generated by displaying impression-based ads on Facebook, Instagram, Messenger, and third-party affiliated websites or mobile applications.

In FY19-20, the social media giant clocked a Rs 136 crore net profit on revenues of Rs 1,216 crore.

Last month, Google India reported net profits of Rs 808 crore for the year ended March 31, 2021, on revenues of Rs 6386 crore.

Advertising accounts for approximately 27% of Google’s total revenue.

Experts say that both Google and Facebook have multiple platforms that have extremely high traction with consumers, and the size and scale of their audiences are only increasing year on year.

Tweet of the day

Metaverse won’t be turning point in crypto adoption, investor Chesnais says

The growth of online virtual worlds will help advance the mainstream adoption of cryptocurrencies for payment transactions but it won’t be a game-changer, according to Frederic Chesnais, chief executive of French fintech company Crypto Blockchain Industries.

Tell me more: In blockchain-based 3D virtual worlds, often referred to as metaverses, users can purchase and trade virtual assets and services using cryptocurrencies. Some analysts have argued the growing popularity of metaverses will drive an explosion in digital tokens.

Also Read: What is the metaverse and why is everyone talking about it?

Quote: “I think it will be important but I don’t think this is the key turning point,” Chesnais, who was until earlier this year the CEO of videogame company Atari told Reuters.

Chesnais said that the mainstream adoption of cryptocurrencies will be driven by the more than one billion people globally who do not have access to a bank account because they may not have an address or an official identity.

- “The only way for these people to have access to a better way of life and be part of the economic system is to have a wallet and to be paid in cryptocurrency,” he said.

Elon Musk exercises more options, sells Tesla shares worth $1.01 billion

Tesla CEO Elon Musk

Tesla Inc chief executive Elon Musk has sold another 934,091 shares of the electric vehicle maker worth $1.01 billion to meet his tax obligations related to the exercise of options to buy 2.1 million shares, regulatory filings showed.

Back story: In early November, Musk had asked his followers whether he should sell 10% of his stake in Tesla to meet tax obligations. “Much is made lately of unrealised gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock,” he tweeted, adding, “I will abide by the results of this poll, whichever way it goes.”

A majority of them had agreed with the sale.

Since November 8, Musk has exercised options to buy 10.7 million shares and sold 10.1 million shares for $10.9 billion.

Musk still has an option to buy about 10 million more shares at $6.24 each, which expires in August next year.

The richest man: With a $284.1 billion fortune, Musk is richer than anyone else in the world, according to the Bloomberg Billionaires Index. Musk’s wealth has surged $128.1 billion this year as Tesla shares have soared 54%.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.