Also in this letter:

■ Byju’s pushes back payments for billion-dollar Aakash deal

■ Zomato market cap down nearly $1 billion in two days

■ Cert-in defers new cybersecurity rules by three months

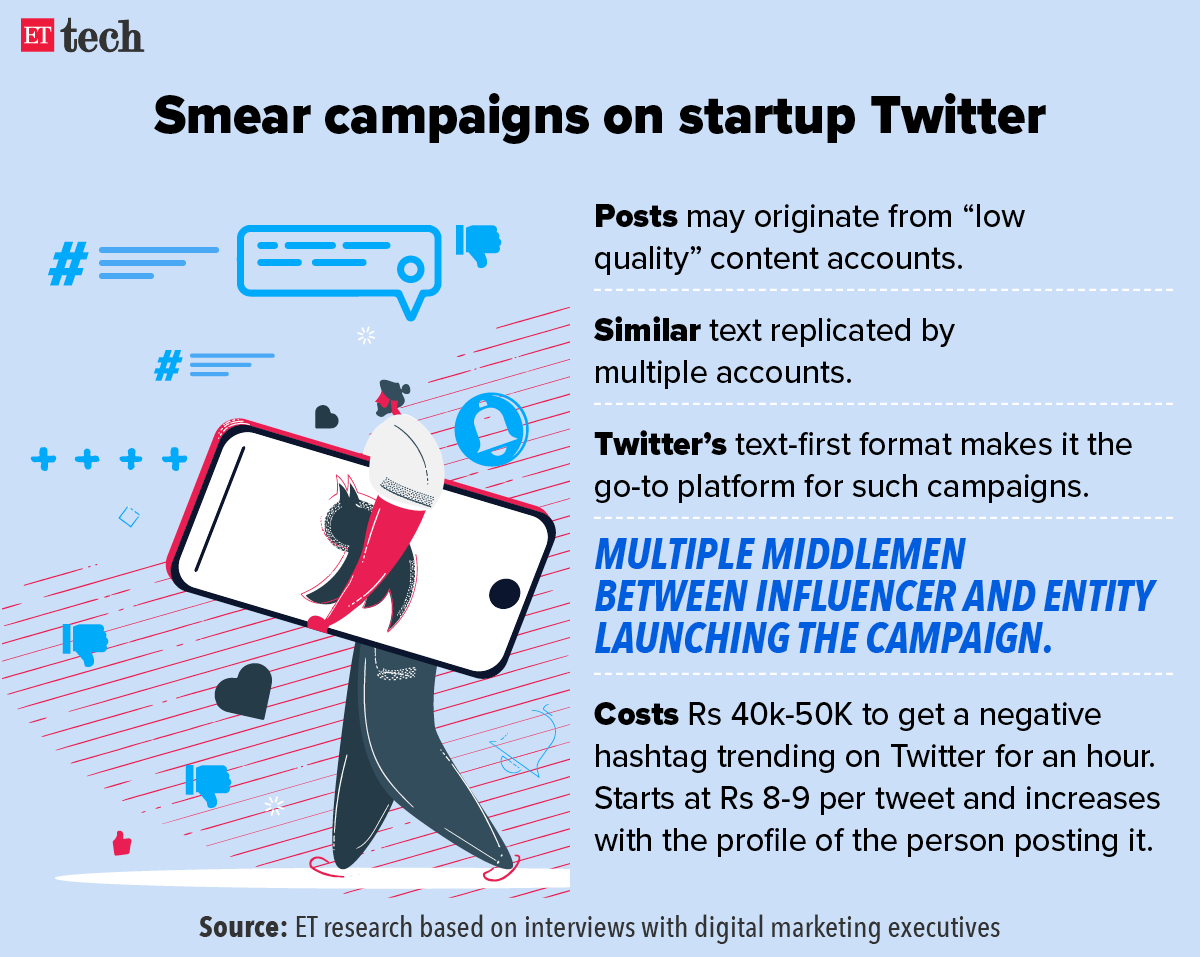

Smear campaigns are rampant on Startup Twitter

What’s common on Political Twitter has spilled over to Startup Twitter, one of the most active communities on the microblogging platform in India.

What’s going on? Over the past few weeks, the chatter has been about how startups in India are using paid marketing tools to defame competitors.

It all started when ecommerce platform Meesho sent out legal notices to some social media accounts and certain people, according to sources, for allegedly running smear campaigns against the company. These include Jaymin Shah, who runs influencer marketing digital agency SocialGrid.

Last week, online travel portal Easemytrip became the latest to face a targeted attack on the platform.

VC firm Sequoia Capital India came under attack in May, after its fallout with Zilingo cofounder Ankiti Bose. Bot-generated Twitter hashtags like #Sequoialeakedtapes #SexistSequoia trended on Twitter.

Smear central: Running smear campaigns against competitors is an age-old marketing tactic.

But industry executives say Twitter, with its short, text-first format and well-known tactics for making posts trend on its platform, is a go-to medium for such campaigns.

Influencers told us they have been approached by agencies or entities to make targeted attacks against certain brands.

Modus operandi: Industry executives said it is fairly easy to spot fake posts and trends, since they replicate a version of the same text. These are typically posted from “low-quality content” accounts or those that are outright bots, they said.

Mostly operating as an informal industry, these smaller digital marketing agencies leverage college students looking for some easy money and who may not understand the intention behind these campaigns.

Typically, a series of middlemen are involved in generating fake trends, thus safeguarding the ultimate beneficiary.

Byju’s pushes back payments for billion-dollar Aakash deal

Byju’s sought a two-month extension from Blackstone and other shareholders of test-preparation provider Aakash Educational Services on payments that were due this month, sources told us.

The payment deadline has been extended to August, they said.

Denial: A spokeswoman for Byju’s denied that there was a delay in payments. “The acquisition process is fully on track and all payments are expected to be completed by the agreed upon date – August 2022,” the spokeswoman said.

Also Read: Accessing all kinds of capital to close large multi-billion dollar buys: Byju Raveendran

Mega deal: The Aakash acquisition was worth $950 million and touted as the largest in the Indian edtech space. It helped Byju’s get a foothold in the offline learning market and provided access to quality teachers for the test preparation segment.

Offline play: Following the acquisition, Byju’s has been firming up plans to bolster its growth offline, eventually launching tuition centres to cater to students from grades 4 to 10.

In February, the company said it was looking to invest $200 million to grow these tuition centres across 200 cities.

Fundraising machine: Byju’s, which was last valued at $22 billion making it the most valuable Indian startup, has been on the frontend of raising capital during the funding boom last year. It was also in talks with several special-purpose acquisition companies, to go public.

It mopped up $1.7 billion in equity funding last year.

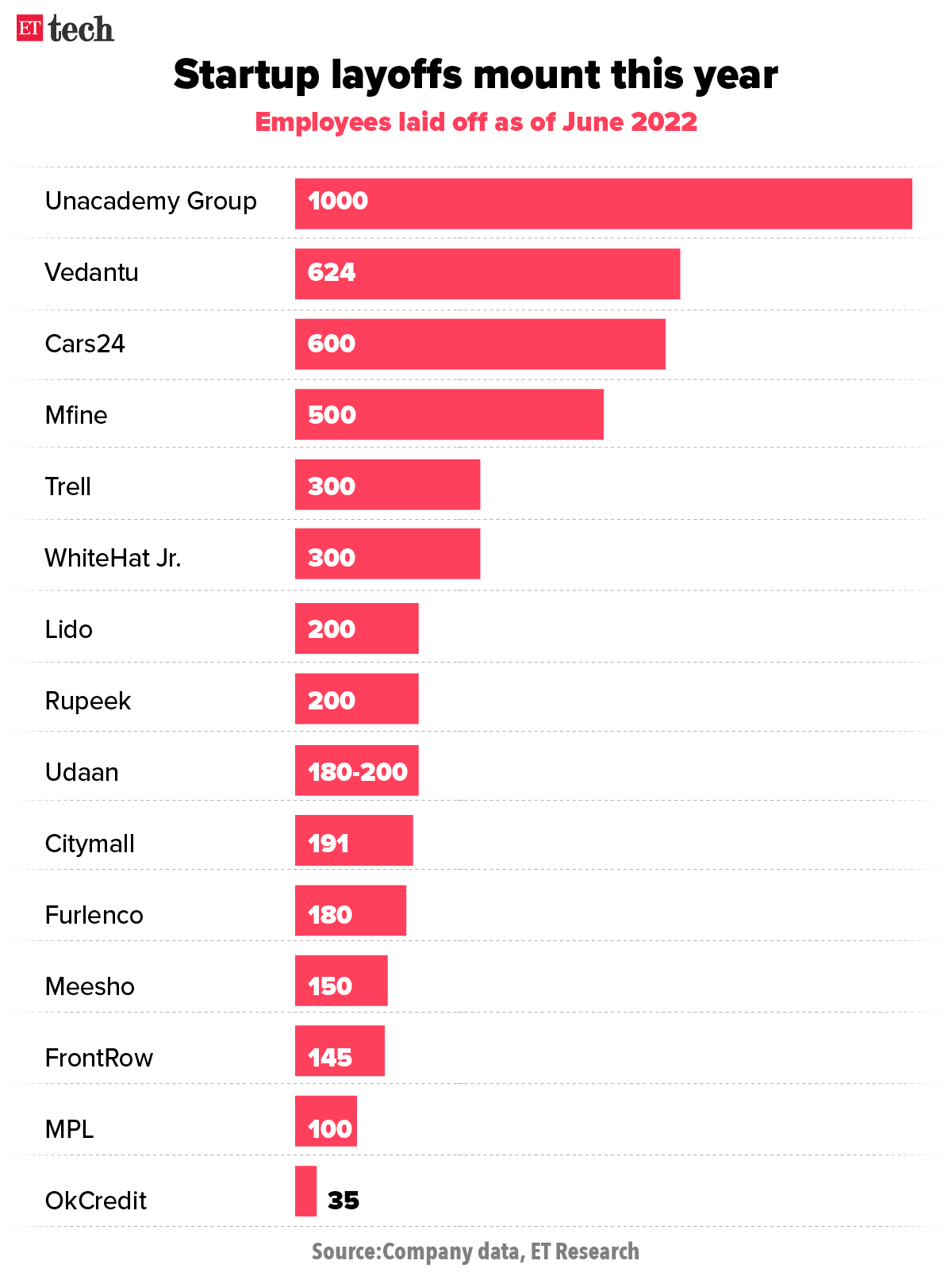

WhiteHat Jr lays off 300: Meanwhile, Byju’s subsidiary company, WhiteHat Jr, on Tuesday laid off 300 people across departments. Byju’s had acquired the company in August 2020 for $300 million.

Over the past few months, several edtech firms including Unacademy group, Vedantu, and Lido Learning have undertaken layoffs to streamline costs and reduce overall cash burn.

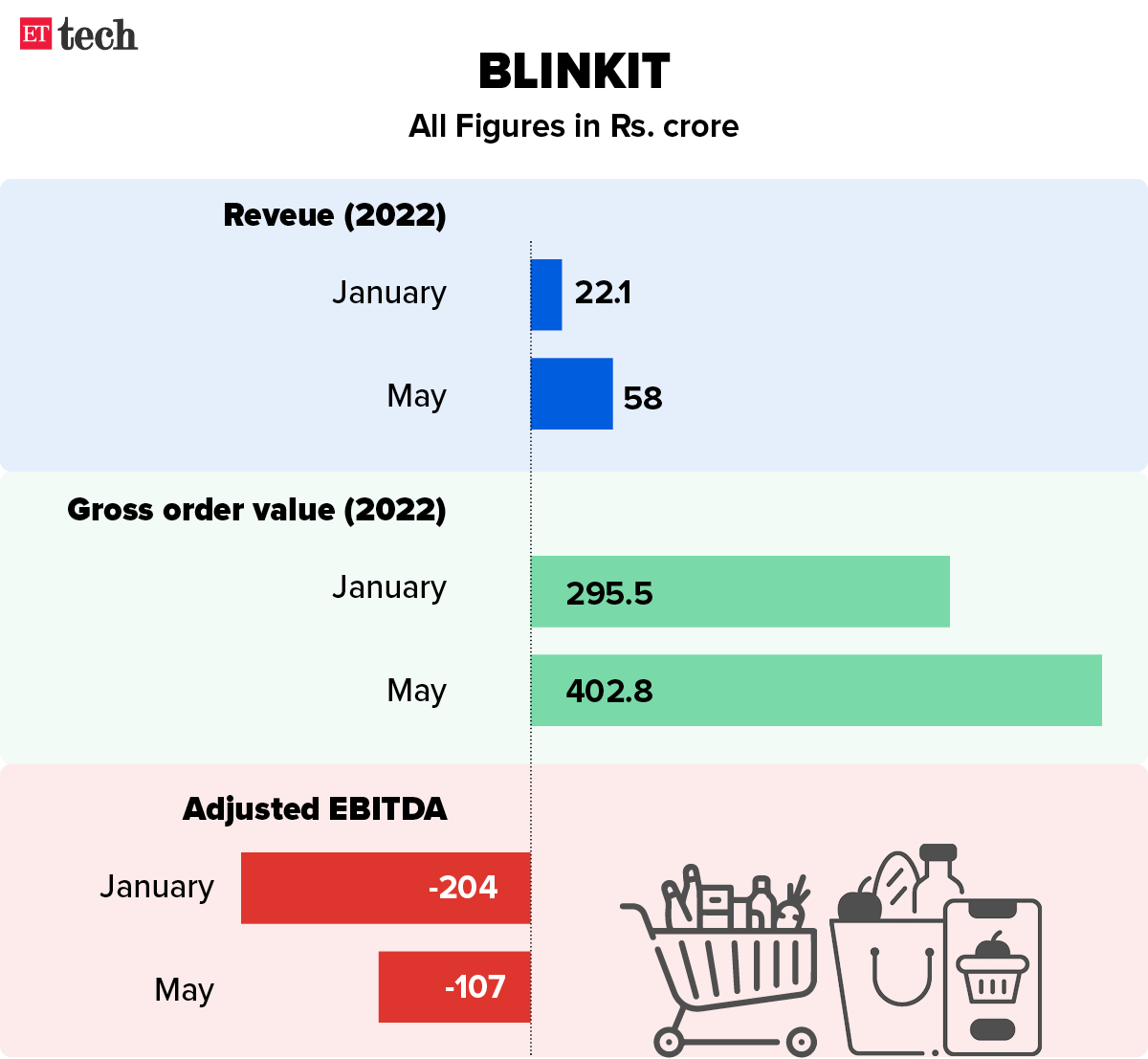

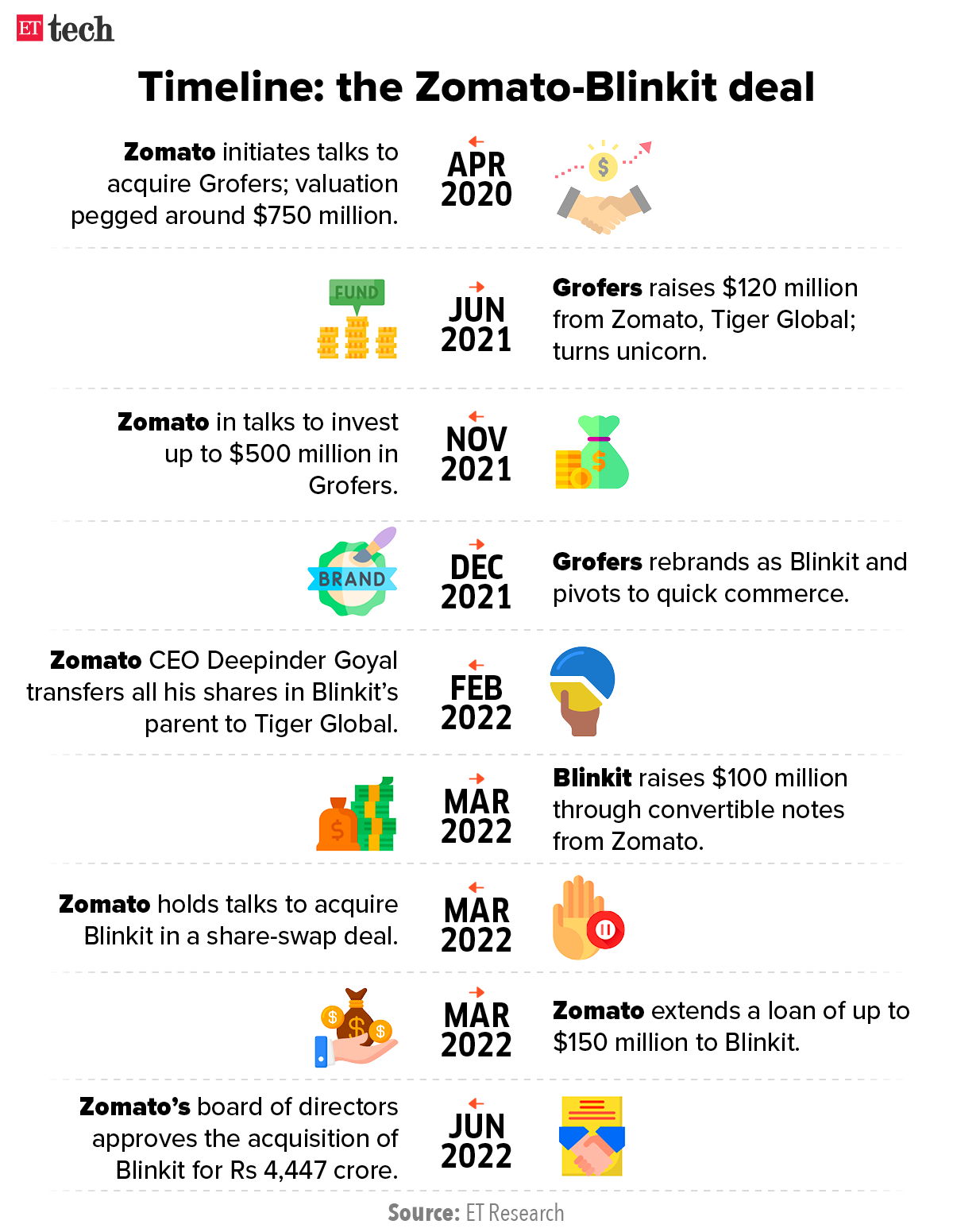

Zomato market cap down nearly $1 billion in two days after Blinkit deal

Shares of Zomato fell as much as 8.2% on Tuesday, extending losses for a second straight day as investors questioned its purchase of quick commerce startup Blinkit.

Zomato said on Friday it would acquire Blinkit for Rs 4,447 crore ($568.16 million) in stock as it tries to gain a foothold in the fiercely competitive quick delivery market.

The company’s shares have fallen as much as 14% since then, shedding nearly $1 billion in market capitalisation. They are also down nearly 48% since going public last July.

The Blinkit deal came after Zomato bought a more than 9% stake in the SoftBank-backed firm for nearly Rs 518 crore in August 2021, and promised to invest as much as $400 million in the Indian quick-commerce market over the next two years.

Analysts weigh in: “We believe Blinkit will require investments beyond the $400 million envisaged by Zomato, given rising competitive intensity,” analysts at Kotak Institutional Equities wrote in a note.

Issuance of new shares by Zomato to Blinkit, including employee stock option pool, would amount to dilution of about 7.25% of total outstanding shares post acquisition basis, according to a Morgan Stanley client note.

“E-grocery economics have been tough to crack given price competition, relatively lower margin nature of the category, high number of products per order which need efficient fulfilment, and very high competition,” Kotak analysts said.

Stiff competition: India’s quick-commerce sector is growing at a rapid clip, with rivals Swiggy, Reliance-backed Dunzo, Tata-backed BigBasket and Zepto making big investments. The industry was worth $300 million last year and is expected to grow 10-15 times to $5 billion by 2025, according to research firm RedSeer.

TWEET OF THE DAY

Cert-in gives a three-month breather to VPN providers, small businesses

The Indian Computer Emergency Response Team (CERT-in) has given a three-month extension to VPN providers, small and medium businesses, and data centres to comply with its cybersecurity rules.

Issued on April 28, the rules were to come into effect today (June 28). They will now come into force on September 25.

Brief relief: Cert-In’s extension will come as a relief to small businesses, which had asked the government for more time to comply with the rules, which require them to report any data breach within six hours.

Meanwhile, VPN providers ExpressVPN, Surf Shark and NordVPN have already shut down their servers in India, refusing to comply with the new rules, which require them to store customer data for five years and hand it over to the government when asked to.

This marks the first time the government has made a concession on the issue, having said earlier that companies unwilling to adhere to the guidelines were free to leave India.

Bertelsmann India raises $500 million to make early-stage bets

Bertelsmann India Investments, the VC arm of the German media giant, Bertelsmann, has raised $500 million to back more early-stage Indian startups, Pankaj Makkar, managing director, Bertelsmann India Investments, told us.

Quote: “We will be writing larger cheques owing to the increased entry level-valuations. The larger pool gives us the ability to back portfolio firms longer,” Makkar said.

The company, which has invested in over 16 Indian startups, including unicorns Licious and Eruditius, plans to make six to eight additional investments each year.

Early-stage buzz: Amid a drop in large funding rounds, early-stage funding has become the flavour of the season among venture capital firms. We reported earlier that Seed and Series A investments had risen 88% and 22% year-on-year in this year’s January-March quarter. A few days ago, Sequoia’s accelerator programme Surge announced it’s raising the ceiling for its investments in seed-stage Indian startups.

Other Top Stories By Our Reporters

Almost half of ads ASCI reviewed in 2021-23 were digital: Digital ads comprised 48% of the 5,532 ads processed by the Advertising Standards Council of India (ASCI) processed across print, digital, and television in 2021-22, according to its latest report, titled Complaints Insights 2021-22. In total ASCI processed 62% more ads than in the previous year, the report said.

Risky Android apps: A separate report by security testing platform Appknox revealed that about 75 of India’s top 100 Android apps contain security risks. While about 79% were affected by network security misconfiguration, 78% lacked sufficient code obfuscation, it said.

Redington on digital pivot to ride cloud wave: Supply chain solutions provider for technology products Redington will have half of its business streaming in through its e-commerce platform within two years, a top executive told ET, as it transitions to a digital-centric business framework.

Global Picks We Are Reading

■ The iPhone at 15: an inside look at how Apple transformed a generation (WSJ)

■ This deported hacker used his tech skills to re-enter the U.S. (Rest of World)

■ The rise and precarious reign of China’s battery king (Wired)