Silicon Valley Bank had about $209 billion in total assets and about $175.4 billion in total deposits, as of Dec. 31, 2022, a Reuters report said.

The main office and all branches of Silicon Valley Bank will reopen on March 13 and all insured depositors will have full access to their insured deposits no later than Monday morning, according to the statement.

“Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver,” said a statement from FDIC.

Also read: ETtech Explainer: how rising US interest rates caused a pincer movement on Silicon Valley Bank

The federal agency also said that it has created the Deposit Insurance National Bank of Santa Clara (DNIB). To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB). At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank, FDIC added.

Discover the stories of your interest

The startup-focused lender had 17 branches in California and Massachusetts.

ETtech

ETtechEarlier, SVB Financial Group was exploring options, including a sale, after its efforts to raise capital through a stock sale failed.

Shares of SVB were halted on Friday after tumbling as much as 66% in premarket trading.

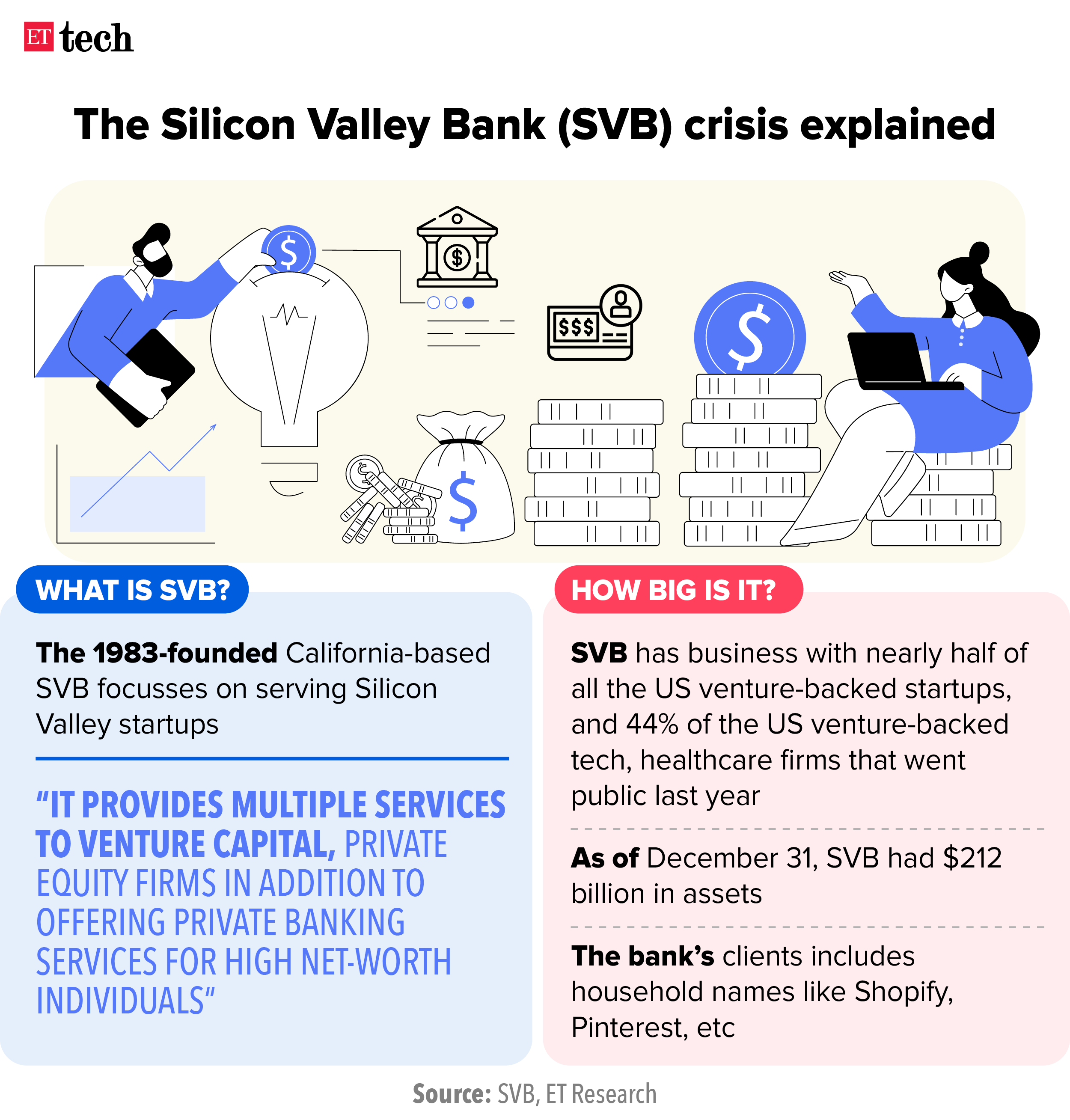

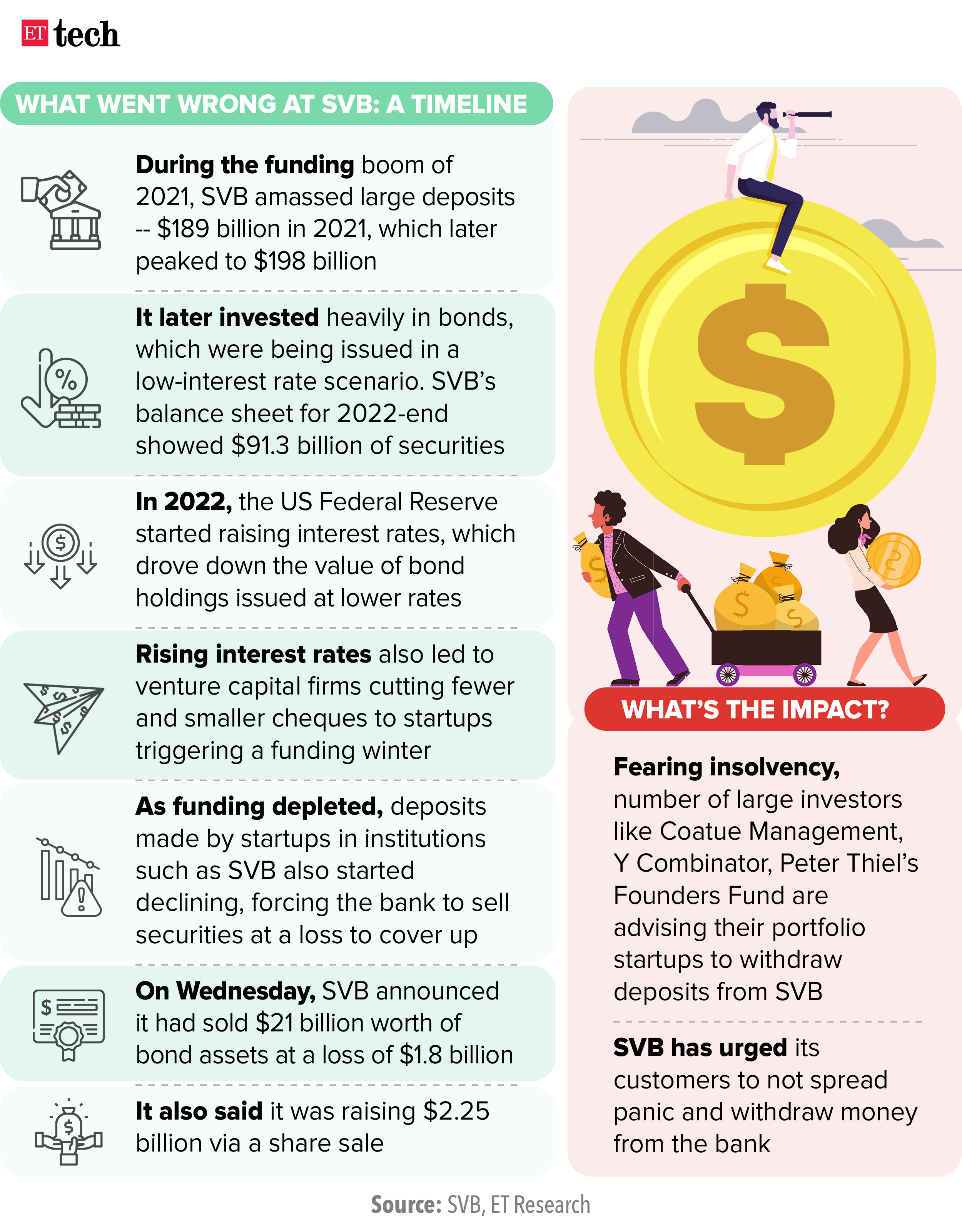

The crisis at SVB started earlier this week when the bank, which lends heavily to tech startups, launched a share sale to shore up its balance sheet after selling a portfolio consisting mostly of US Treasuries at a loss.

On Wednesday, the SVB Financial Group announced that it was raising $2.25 billion in a share sale in addition to having sold $21 billion worth of securities from its portfolio.

ETtech

ETtechThe bank also said it booked a massive after-tax loss of $1.8 billion on sales of these investments.

This led to solvency fears with the lender causing a ripple-effect into its customers pulling out deposits.

According to a report by the Wall Street Journal, venture-capital investors had advised startups to pull their deposits from SVB. Other large investors including Peter Thiel’s Founders Fund and Coatue Management also reportedly instructed their portfolio firms to reduce their exposure to SVB.

Indian SaaS firms on alert

The crisis at Silicon Valley Bank has rattled some Indian investors and founders running SaaS companies with accounts at the lender.

As the bank’s stock lost over 60% of its value on Thursday, venture capital funds checked in with homegrown startups, especially those headquartered in the US, about how much of their capital is held at SVB Financial Group.

While late-stage Indian-origin SaaS (software as a service) firms like Zenoti told ET that they moved out of SVB last year, early-stage SaaS firms do bank with the troubled lender. Saurabh Kumar, founder and CEO of early-stage firm Rezolve.ai, said the company was keeping a close watch on developments but is yet to pull out all the funds.

(With inputs from Reuters)