Also in this letter:

■ Flipkart jumps into live commerce

■ Zomato to invest $400 million more in quick commerce

■ Crypto tax may hurt social media firms, in-app buys

BharatPe’s Madhuri Jain may sue A&M over leaked report

Madhuri Jain, controller at BharatPe and wife of the company’s cofounder Ashneer Grover, wrote a letter to Alvarez & Marsal (A&M) on Thursday, in which she questioned the consulting firm about recent media leaks and said he was considering taking legal action.

Catch up quick: A&M is one of the companies hired by BharatPe’s board to audit the company. Last week, it was widely reported that its preliminary findings detailed instances of financial fraud at the firm allegedly involving Jain, Grover and other family members.

Hitting back: In her letter, which was also sent to all of BharatPe board members, Jain also questioned the manner in which the probe was being conducted. She said she was considering taking legal action against the firm and had demanded an internal investigation into how the findings of the probe were leaked.

Quote: “It is quite surprising that the report which has been made available to the media is neither available with the company nor has been provided to me,” said Jain in the letter addressed to Manish Saigal, A&M’s managing director in the country. “Even assuming that such a report does exist, it is common practice that where there is a report making allegations or casting aspersions against any individual, the identity of such an individual is kept confidential.”

She said the fact that the findings of the report were leaked to the media made her “firmly believe” that the inquiry was solely aimed at tarnishing her reputation.

Jain is currently on leave from the company, as is Grover.

Also Read | Timeline: The Ashneer Grover audio clip controversy

The BharatPe saga:

- Jan 6: Grover claims audio clip posted online is fake.

- Jan 8: Clip is taken off Twitter and SoundCloud, Grover deletes his tweet.

- Jan 9: Reports say Grover and wife sent a legal notice to Kotak Mahindra Bank in Oct. Bank says it will take legal action over audio clip.

- Jan 17: Grover’s Aug 2020 email spat with Sequoia employee surfaces.

- Jan 19: Grover goes on ‘voluntary’ leave until March-end.

- Jan 29: BharatPe board announces independent audit.

- Jan 30: Grover expects “amicable resolution” but hires a law firm.

- Feb 4: Preliminary audit report finds evidence of fraud, links Madhuri Jain to issue

- Feb 4: Grover’s Feb 2 letter seeking CEO’s ouster is leaked hours later.

- Feb 10: Madhuri Jain writes to A&M questing the audit undertaken.

Now, Flipkart jumps into live commerce

Flipkart has hopped on the live commerce bandwagon, making it one of the latest ecommerce firms to experiment with the new sales format.

What’s going on? Flipkart now conducts live shopping streams on its app with social media influencers.

In-house tech: A company insider said Flipkart was building its technology infrastructure in-house, and that its fashion arm Myntra had invested significant time and resources on this as well. Myntra’s live-commerce product M-live was launched in November last year, ET reported.

It’s getting crowded: Before Flipkart, ecommerce players such as Meesho, Myntra, Nykaa and short video platform Roposo dipped their toes into influencer-led live commerce. Trell, backed by Sequoia’s Surge programme and Mirae Asset Venture Investments, is another player in the space.

Following China’s lead: The efforts of these companies are grounded on the assumption that live shopping will take off in India just as it did in China.

According to a report by McKinsey & Co last year, the value of China’s live-commerce market grew at a compounded annual growth rate (CAGR) of more than 280% between 2017 and 2020 to reach an estimated $171 billion in 2020.

Zomato to invest $400 million more in quick commerce, launch lending biz

Zomato on Thursday announced plans to double down on the quick commerce segment, saying it would invest an additional $400 million in the space in the next two years.

The company said it has invested $225 million across Blinkit (formerly Grofers), Shiprocket and Magicpin and that Blinkit has scaled its operations rapidly. Based on January sales, it is on an annual gross merchandise value run rate of $450 million with more than 400 dark stores across 20 cities in India.

Zomato said the category offers a “huge addressable market” and is also “synergistic to its food delivery business”.

Lending company: Zomato also outlined its lending ambition, saying it plans to set up a non-banking financial company to extend short-term credit to its restaurant partners, delivery partners and even customers. Last November, Zomato launched Zomato Wings to help restaurants secure funding by acting as a conduit between restaurant, cloud kitchen businesses and the investors.

Q3 results: Zomato said its revenue from operations for the December quarter rose from both a year earlier and sequentially, even as its loss shrank.

- Revenue from operations for the fiscal third quarter rose to Rs 1,112 crore from Rs 1,024.2 crore in the July-September period and Rs 609.4 crore a year earlier.

- Loss narrowed dramatically to Rs 67.2 crore, compared with Rs 434.9 crore a quarter earlier and Rs 351.3 crore in the previous-year period.

- Zomato said it saw 9% growth in revenue from operations on a quarterly basis, while its customer delivery charges shrank 22%.

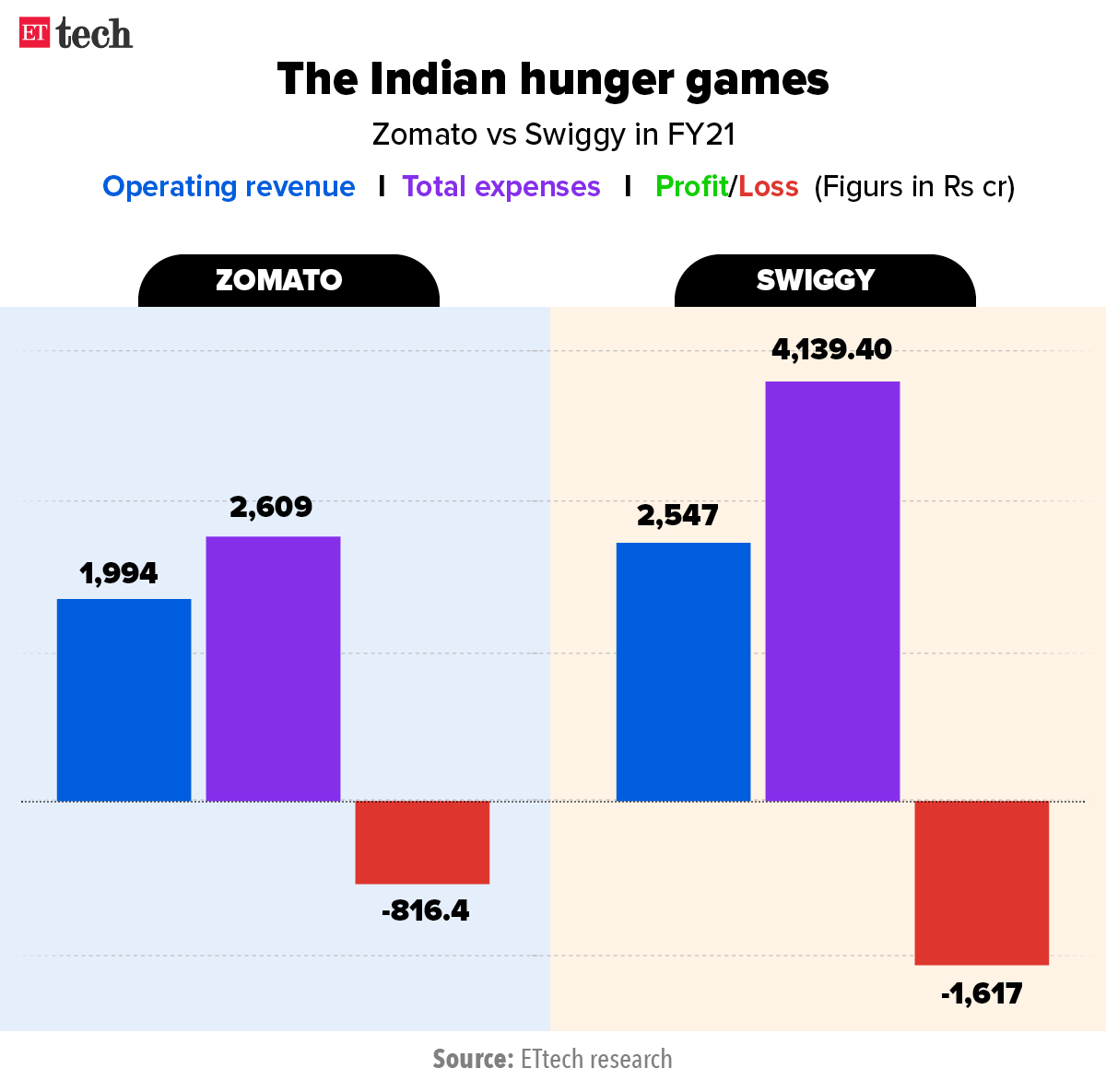

Swiggy results: Zomato’s arch-rival Swiggy reported its financial results for FY21 on Thursday. Its consolidated revenue from operations fell 26.6% from the previous year to Rs 2,547 crore, while net loss shrank almost 59% to Rs 1,617 crore, as the food delivery platform weathered the first year of pandemic.

In its regulatory filing, sourced from business intelligence platform Tofler, the food and essential delivery services company said lockdowns, restrictions and multiple emergency measures taken in the wake of the Covid-19 outbreak impacted the performance of the company in FY21.

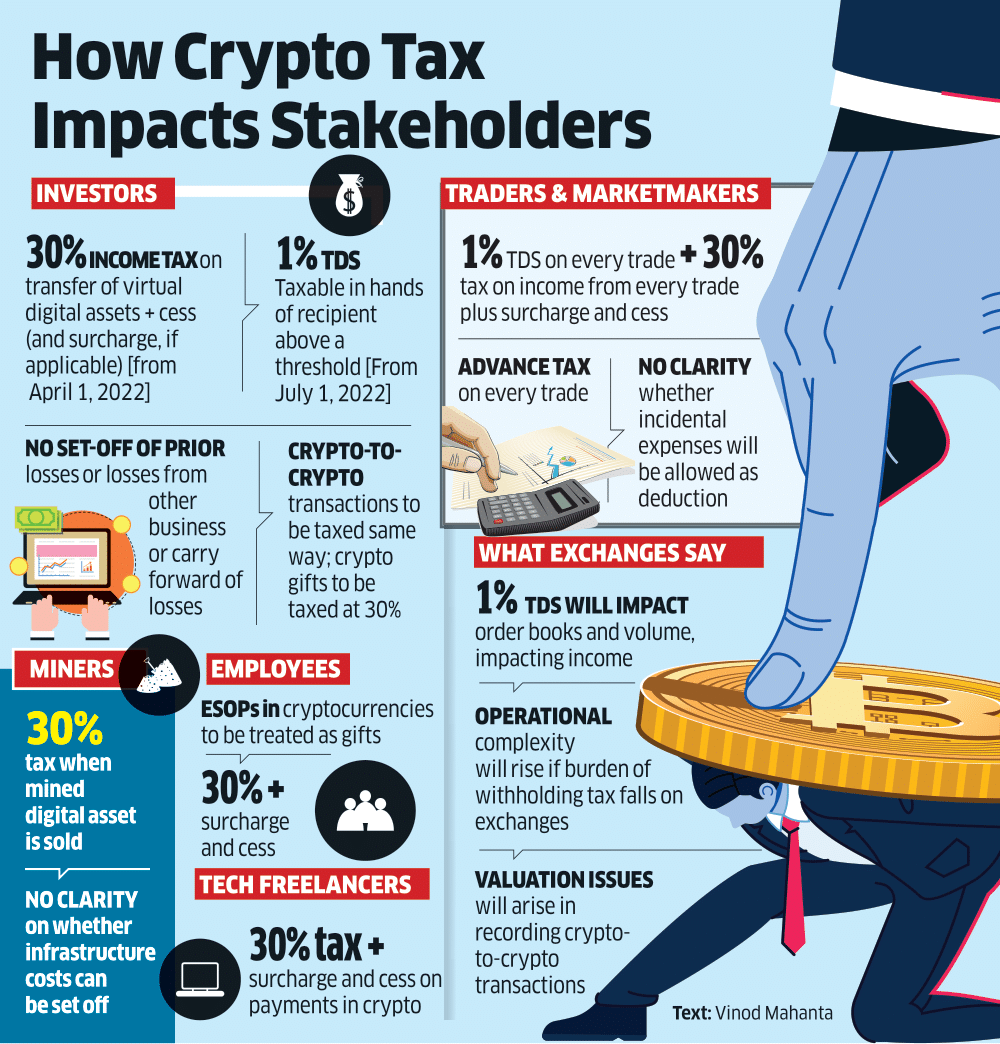

Crypto tax may hurt social media firms with reward points, in-app buys

The newly introduced law aimed at taxing cryptocurrencies is all set to impact reward points and other in-app purchases offered by social media companies, dating and gaming apps, tax experts said.

Social media giants such as Meta or dating apps like Gleeden or even gaming apps could face a 1% tax deducted at source as these would be covered under the government’s broad definition of virtual digital assets.

Quote: “The government has deliberately kept the definition of virtual digital assets broad due to the ever-changing landscape. As it stands today, these in-app purchases or reward points, some of them hosted on blockchain, will face 1% TDS but the burden to comply will be on the buyer,” said Gaurav Mehta, founder, Catax, a cryptocurrency tax and audit firm.

Who else could take a hit? Several gaming apps that allow users to buy guns, bullets and other upgrades could now face the tax as well, experts said.

MX Takatak to merge with ShareChat’s Moj in $700 million deal

MX Media, the parent company of India’s leading short-format video platform MX Takatak, and Mohalla Tech, the parent company of Moj and ShareChat, have entered into an agreement to merge Moj and MX Takatak.

The merger will create the largest short video platform for Indians with 300 million monthly active users (MAU), a 100-million-strong creator community and nearly 250 billion monthly video views.

Largest shareholders: As part of the strategic transaction, MX Media and its shareholders will become the largest shareholders of Mohalla Tech, while the two platforms will be controlled by ShareChat. The cash and stock deal will value MX Takatak at over $700 million, said a source with direct knowledge of the development.

Quote: “MX has always strived to build superior, world-class products, and Takatak is no exception. This combined with Moj’s AI and execution capabilities makes the combined business a truly world-class short video platform,”

Milestone: MX Takatak was launched in July 2020 and reached 150 million MAUs, across 10 languages. The platform’s deep access to content talent, understanding of the MX Media user base and AI-driven technology has led to high growth in a short span of time, according to the statement.

Disclaimer: MX Media is owned by Times Internet, the digital arm of the Times Group, which publishes The Economic Times newspaper and ETtech.

Other done deals

■ Used car retailing platform Spinny has acquired AI-powered connected car startup Scouto for an undisclosed sum. Scouto has built an end-to-end connected car technology suite that provides detailed intelligence on a car’s health and performance and connects the vehicle owner to automotive service providers such as insurers and Fastag issuers.

■ Electric commercial vehicle manufacturer Altigreen has raised Rs 300 crore ($40 million) in a fresh funding round led by Sixth Sense Ventures, along with Reliance New Energy (a wholly-owned subsidiary of Reliance Industries Limited), Xponentia Capital, Accurant International, USA and Momentum Venture Capital, Singapore.

■ Runo, a new age call management CRM has raised $500,000 in a funding round led by Unicorn India Ventures and said it plans to use the funds raised for the product roadmap and expand to the Middle East, SEA, and the US market in a phased manner.

Top IT firms to start bringing employees back to office

Top IT services providers have begun the process of getting employees back to offices.

Who’s doing what: Wipro has asked managers and above to return by March 3 for two days in a week. Cognizant is planning to open its offices for a voluntary return to premises by April.

- Infosys will open its offices to a larger share of employees in the next 3-4 months even as it expects to continue with the hybrid work model through 2022.

- TCS has put out a comprehensive remote working policy which entails mandatory work from the base location even if associates are working from home.

- Wipro, which had shut down India campuses mid-January because of the surge in Covid-19 cases, will adopt a flexible, hybrid approach in its return to office policy, a spokesperson told us.

Odd one out: At Infosys, over 96% of employees are still working remotely and the company does not see a sudden shift from this mode as it continues to take precautions, said Richard Lobo, executive vice president, head HR.

Other Top Stories By Our Reporters

Meta says it has a ‘comprehensive’ strategy for state elections: Social media giant Meta said on Thursday that it has a ‘comprehensive’ strategy in place to keep people ‘safe’ and encourage civic engagement for the state elections in Uttar Pradesh, Punjab, Uttarakhand, Goa and Manipur starting February 10. Meta said it will be activating its Elections Operations Center so that it can watch out for potential abuses that could emerge across the platform related to these elections. (Read more)

Quess Corp likely to appoint new CEO from within its top leadership team: Suraj Moraje, the managing director and CEO at Quess Corp, is likely to step down at the Bengaluru-based Fairfax-controlled business solutions provider after a stint of about 26 months. The Quess Corp board will name his successor as the company does not want to delay a decision in the interest of operational continuity, a source briefed on the matter said. (Read more)

Indian startups raised more than $7 billion in Q4 2021: Indian startups raised more than $7 billion in funding during the fourth quarter of 2021 (October- December) up 18% compared to the third quarter, while 14 of these companies entered the ever-expanding unicorn club, a report by Nasscom-PGA Labs said. Unicorns are privately-held startups valued at $1 billion or more. (Read more)

SaaS firms using AI could create $500 billion of value by 2030: Indian software-as-a-service (SaaS) startups that harness artificial intelligence (AI) could create $500 billion of market value by 2030, according to a report by early-stage venture capital firm Stellaris Venture Partners and IFC, the investment arm of the World Bank. (Read more)

Global Picks We Are Reading

■ YouTube Plans to Make Gaming Videos Immersive in Metaverse Push (Bloomberg)

■ Twitter misses ad revenue and user growth estimates; revenue forecast light (Reuters)

■ Crypto exchange Binance to invest $200 mln in U.S. media firm Forbes (Reuters)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.