Also in the letter:

■ NPCI relies on banks to push RuPay credit cards

■ For VCs, renewed angel tax kills devil in details

■ ETtech Deep Dive: System of a down round

Scoop: Tiger Global may pick up stake in IPL franchise Rajasthan Royals valuing it at $650 million

Hi, Samidha Sharma here in Mumbai. I remember covering the first edition of the Indian Premier League (IPL) in 2008, as a rookie television reporter who chased stories in the media and business of sports. From then to now, IPL has come a very long way. Today, I have a scoop on one of the most influential tech investors looking to back an IPL franchise, a very interesting move amid the general inactivity in the tech world– albeit everything AI.

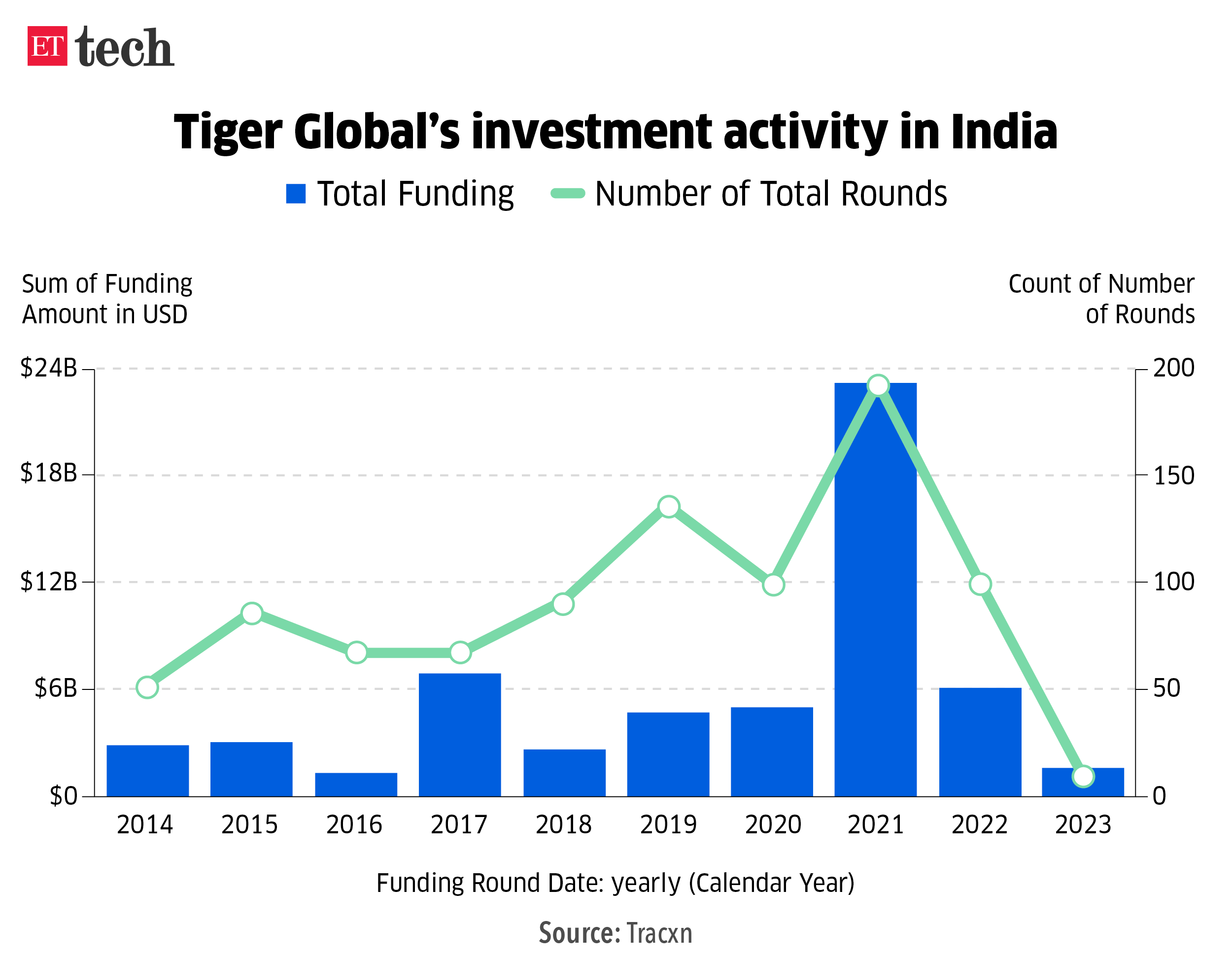

Driving the news: People in the know told me that Tiger is looking to invest around $40 million in Rajasthan Royal at a $650 million valuation and that the deal is nearly complete. “The capital infusion could be a direct or an indirect one, wherein Tiger may back one of the shareholders in Rajasthan Royals..,” said another person who is close to the matter. Rajasthan Royals’ parent entity Emerging Media, is owned by UK-based Manoj Badale who holds more than 60% in the franchise and had bagged the rights in 2008.

Why does this matter? While institutional funds have been big backers of sporting leagues (football, baseball, basketball) across the US, UK and Europe, in India the trend is just about picking up. For the first time, an IPL team was bought by a private equity fund, when CVC Capital Partners, a UK private equity firm, won the rights to operate the Ahmedabad franchise with a bid of Rs 5,625 crore in 2021. “This is an opportunistic move from Tiger and not much to do with the massive correction they’ve seen in their tech portfolio globally,” said another person privy to the deal talks.

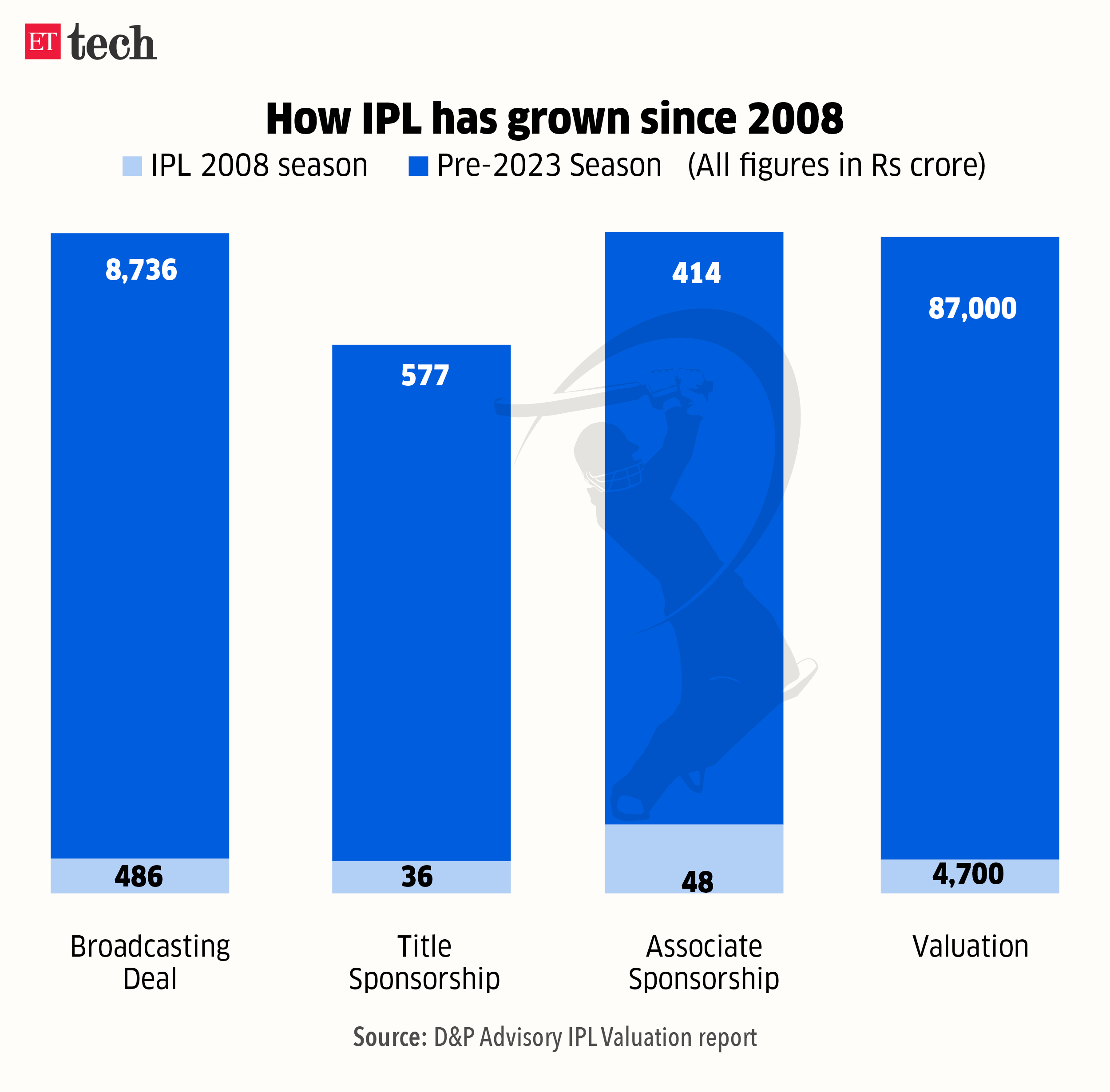

The big picture: The IPL franchise was valued at $10.9 billion in 2022, per a report by consulting firm D and P Advisory. This is a 75% growth in dollar terms since 2020 when it was valued at $6.2 billion, said the report. In rupee terms, the growth is 90%, per D and P Advisory, as ET reported on December 21, 2022. The big spike in IPL valuation is on the back of a $6.2-billion media rights deal inked by the Board of Control for Cricket in India (BCCI) last year and the auction of two new teams — Gujarat Titans and Lucknow SuperGiants — for a combined value of $1.6 billion subs subsequently.

Exclusive: Flipkart founder Binny Bansal eyes stake in Bengaluru volleyball team

_Bangalore%20Torpedoes_ETTECH_2.jpg)

Hi, Digbijay Mishra here in Bengaluru. Singapore-based Flipkart’s cofounder Binny Bansal has been making frequent visits to Bangalore over the past few months. That’s resulted in more investments from the entrepreneur-turned-investor, today we are telling you about one of them.

On the courts: Bansal recently attended a volleyball match during his India trip, Not surprising then that he is ready to pick up around 10% stake in the Bangalore franchise of the Prime Volleyball League, sources told us. Bansal is likely to invest about Rs 10 crore in the Bengaluru Torpedoes, valuing the team at about Rs 100 crore.

Bansal’s former Flipkart colleague Ankit Nagori, is one of the primary owners of the team with an under 50% stake. Nagori runs Curefoods now, where Bansal invested Rs 240 crore, as ET first reported, and sits on the company board as well. Baseline Ventures is another shareholder of the team.

Rise in viewership: According to reports citing BARC data, PVL’s viewership in its last season grew by over 50% to 206 million. Bansal is making the investment when non-cricket tournaments are catching the attention of Indian viewers. Bansal is known to invest and double down on his bets all the way to later stages. The Flipkart cofounder is looking to invest anywhere between $100-150 million in PhonePe, ET reported first in March.

NPCI leans on bank partnerships to push RuPay credit cards

The National Payments Corporation of India (NPCI) is eyeing partnerships with banks to push up usage of RuPay credit cards in the market, sources told us. Axis Bank, HDFC Bank and SBI Card are frontrunners for this tie-up.

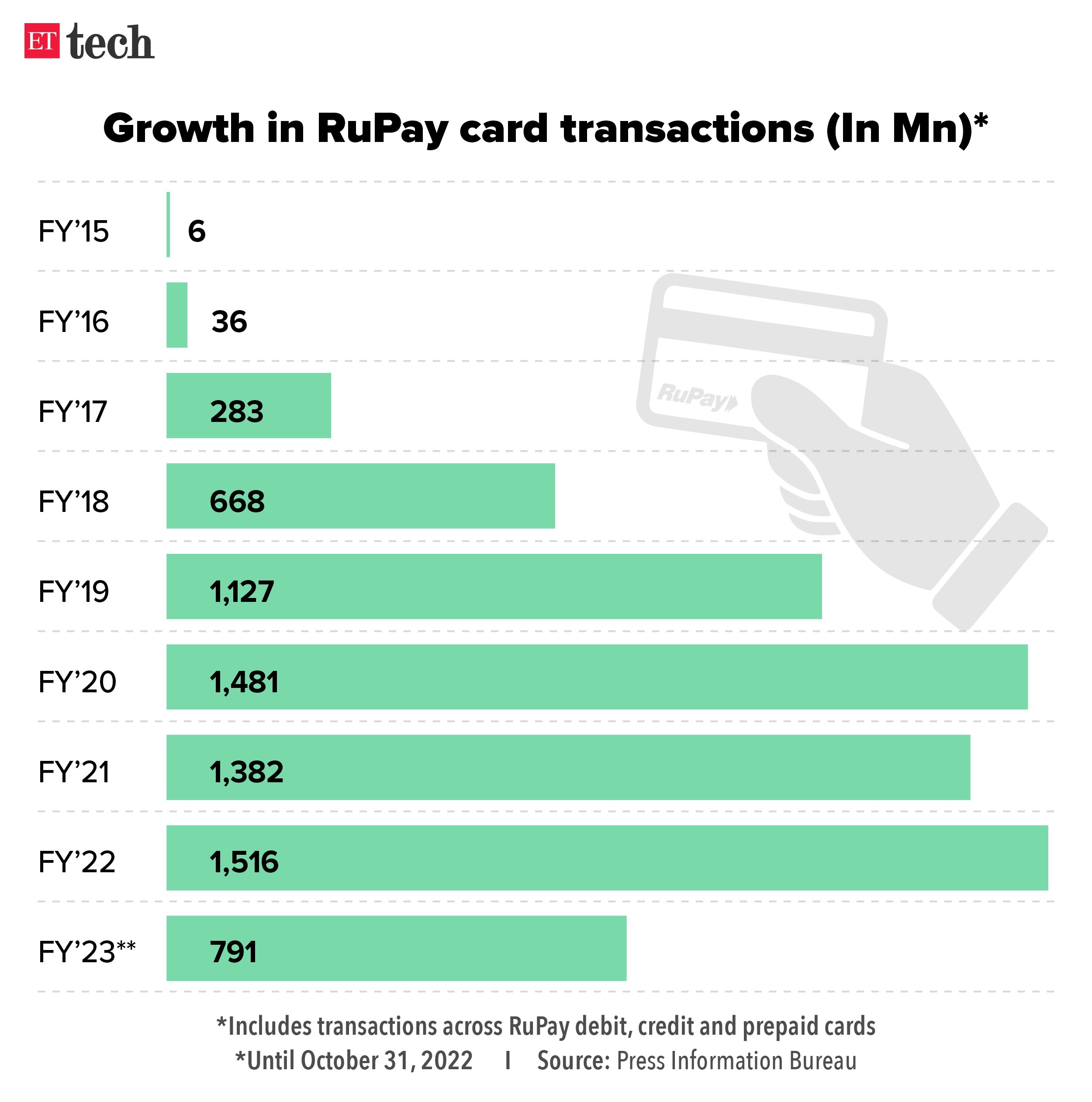

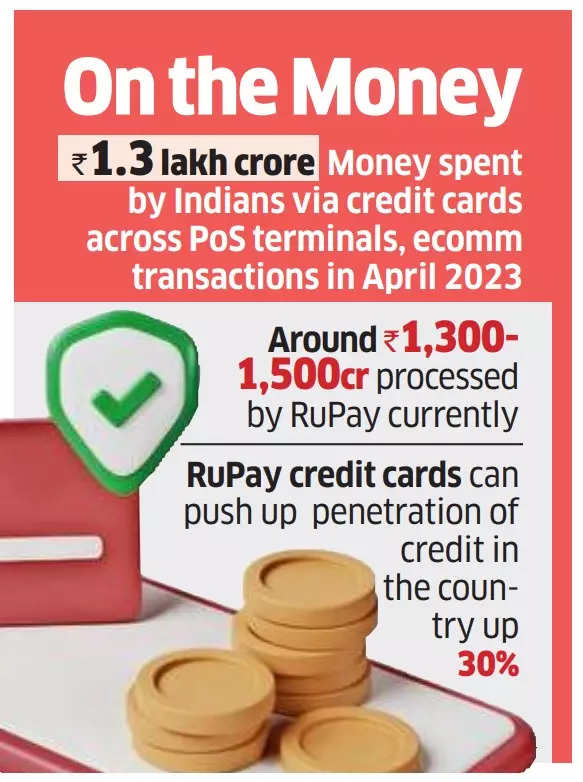

RuPay’s numbers and targets: NPCI is expecting RuPay credit cards to process 10% of the overall monthly credit card spends within a year. Of the Rs 1.3 lakh crore Indians spent through credit cards in April 2023, RuPay processed around Rs 1,300 crore to Rs 1,500 crore. The target is to take this up to Rs 15,000 crore per month.

Tell me more: “RuPay has hardly moved the needle in its credit card business, but the recent regulatory nod for RuPay credit cards on UPI transactions is opening up fresh use cases,” one of the sources told us. With RuPay credit cards on UPI, fintechs are also sensing fresh business opportunities. A bulk of them like Slice and Uni were impacted when last year the RBI cracked down on credit offerings through prepaid cards. Now, with a co-branded proposition, fintechs are hoping to get back into the card game.

The bottom line: NPCI is riding the wave in terms of the adoption of its products with UPI, but with the government making MDR zero for all RuPay debit card transactions and UPI, the growth of NPCI’s card products has been slow. ET reported recently that the Payments Council of India wrote to the finance minister asking her to consider bringing back MDR on RuPay debit card transactions.

For VCs, renewed angel tax kills devil in details

Venture capital (VC) investors lauded changes proposed by the government to angel tax provisions originally announced in the Union budget for 2023-24, saying they provide much-needed clarity on tax incidence and prevent arbitrary application.

Driving the news: The Central Board of Direct Taxes (CBDT) proposed that startups or companies exposed to angel tax be allowed more flexibility in accounting for valuations. It suggested five valuation methods instead of the older two methods – the discounted cash flow method and the net asset value method – a move welcomed by VCs.

“Measures such as safe harbour for a variation of 10% of price, different valuation methodologies, exempting investments from a broader set of investors, reflect market practices and lay to rest fears of investors,” Siddarth Pai, founding partner at VC firm 3one4 Capital, told us.

Tell me more: Experts say that investors will still face scrutiny while raising money and tax consultants will still be engaged, even if chances of being taxed are lower than before. Angel tax also remains a challenge for non-institutionally funded companies, which are the vast majority of early-stage startups.

Tweet of the day

ETtech Deep Dive: System of a down round

2.jpg)

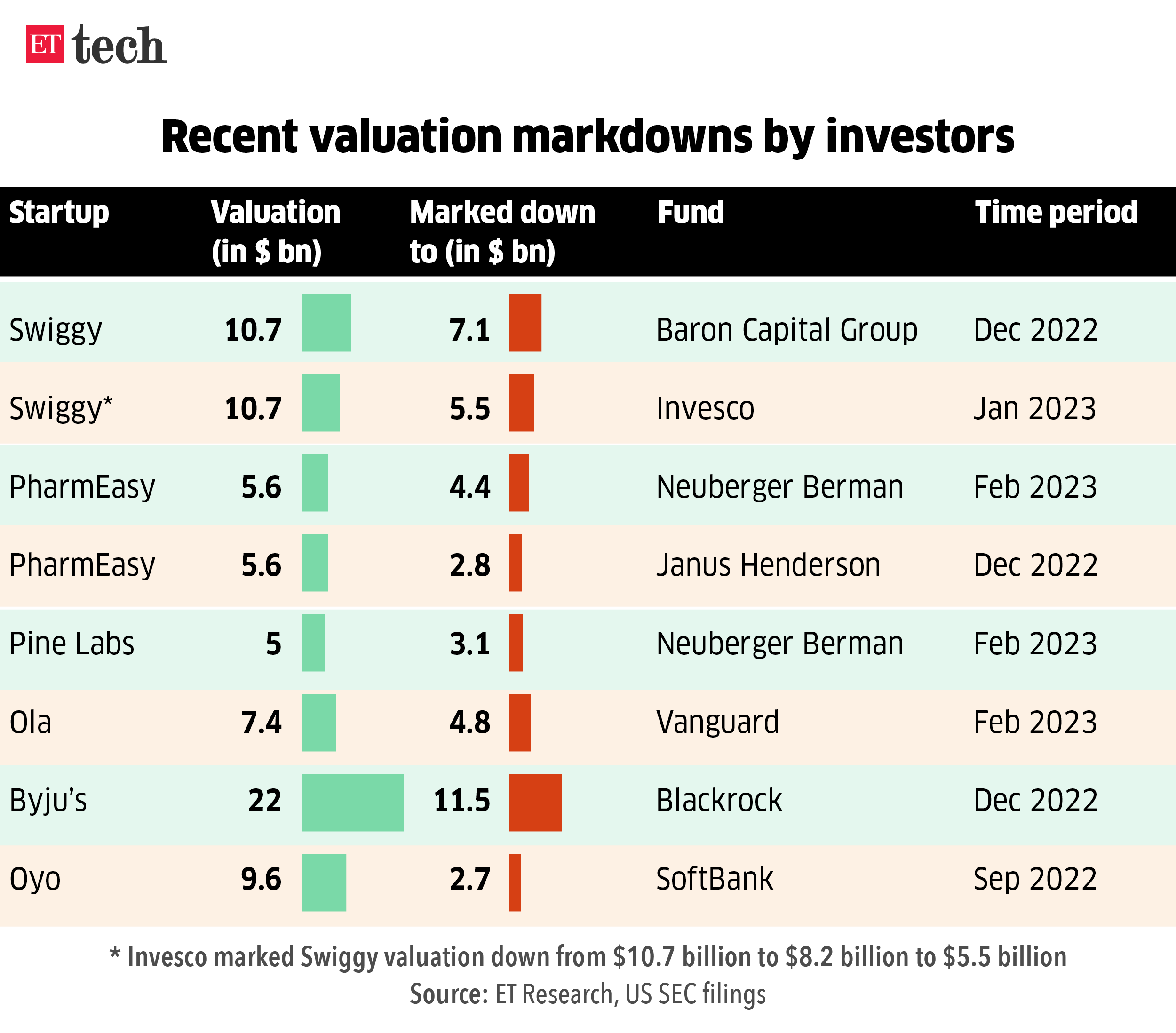

In the last few weeks, ET has reported extensively on international fund managers slashing valuations of unicorns and decacorns including Pharmeasy, Swiggy, Ola, Oyo and Byju’s, by 30-70%. The bad news is that experts believe more corrections are likely to come.

What’s going on? Macroeconomic factors, investors benchmarking startups to their local and international listed counterparts, and other circumstances unique to each of these companies have led to valuation resets. For instance, Swiggy raised funds in January 2022 at a $10 billion valuation, and the latest valuation ascribed to it by US-based Invesco is $5.5 billion.

Edtech unicorn upGrad and electric mobility startup BluSmart recently raised funds via rights issues at the same valuation as the last round from existing investors. Investors are also of the view that startups must cut down on cash burn and push for sustainable topline growth to avoid raising money at lower valuations, advice heeded by social commerce platform Meesho, ShareChat and online pharmacy PharmEasy.

Other Top Stories By Our Reporters

Here’s how Google is taking the next step with generative AI: Google has been applying AI to make its products more helpful for a while but with generative AI, it’s taking the next step.

HUL-Genpact launch accelerator to scale diversity in business: With an aim to advance diverse and sustainable sourcing, the initiative will enable minority businesses to be absorbed into the supply chains of large consumer goods companies, including HUL.

Delhivery invests in ecommerce SaaS startup Vinculum in direct-to-consumer push: The investment is the first part of a potential two-stage deal, under which Delhivery can further increase its shareholding in the company after six months.

Global Picks We Are Reading

■ The Senate’s hearing on AI regulation was dangerously friendly (The Verge)

■ You’re probably underestimating AI chatbots (Wired)

■ Can AI be regulated? (Financial Times)