Also in this letter:

■ Invesco cuts Swiggy’s valuation again

■ New PLI scheme for IT companies

■ Deadline extended for feedback on private entities using Aadhaar verification

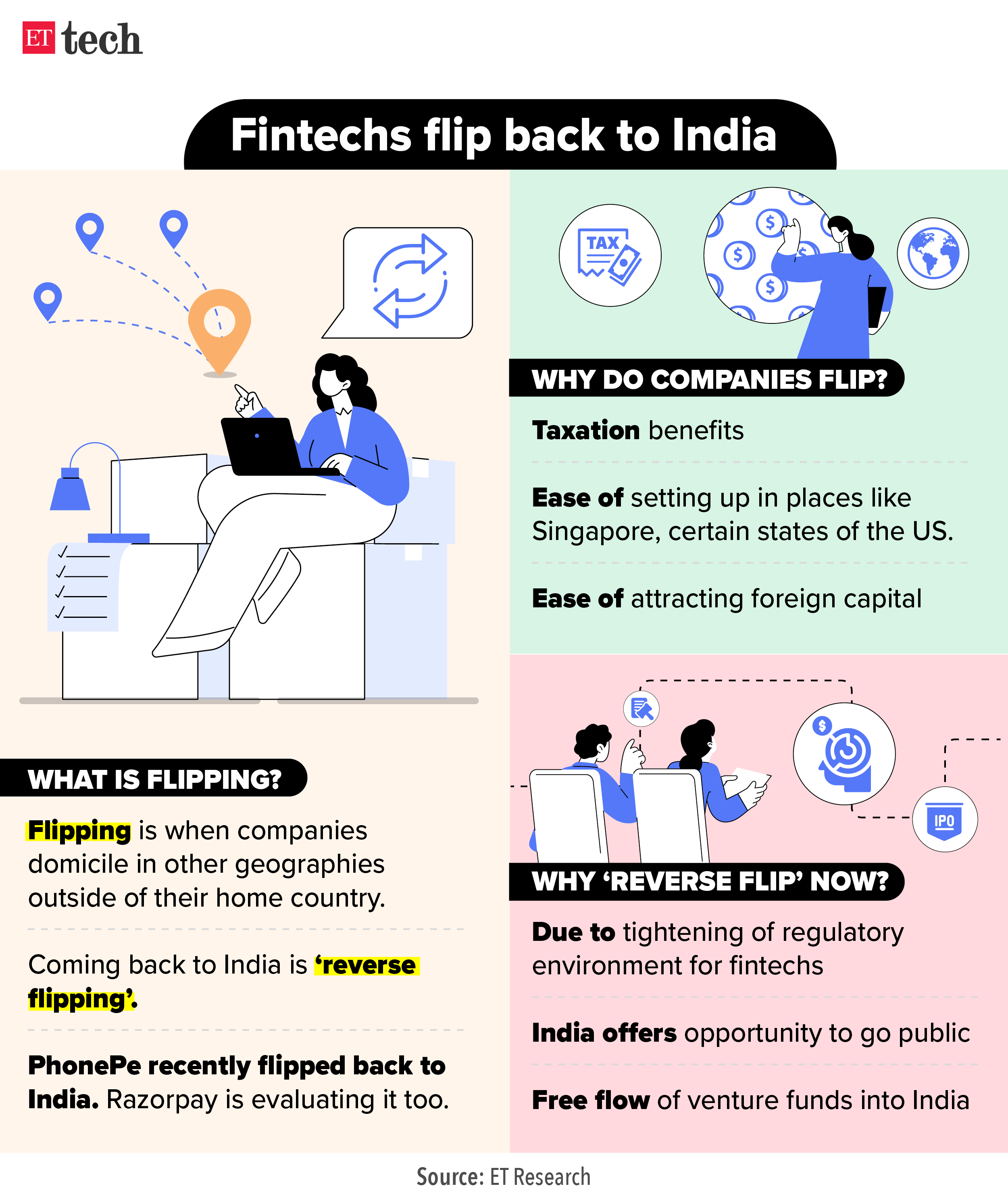

Scoop: In ‘reverse flip’, Razorpay parent entity to move back to India

Razorpay founders Harshil Mathur (left) and Shashank Kumar

Hi, this is Pratik Bhakta in Bengaluru. Today, Samidha and I are breaking an important story on how Razorpay is planning to shift its holding company from the US to India.

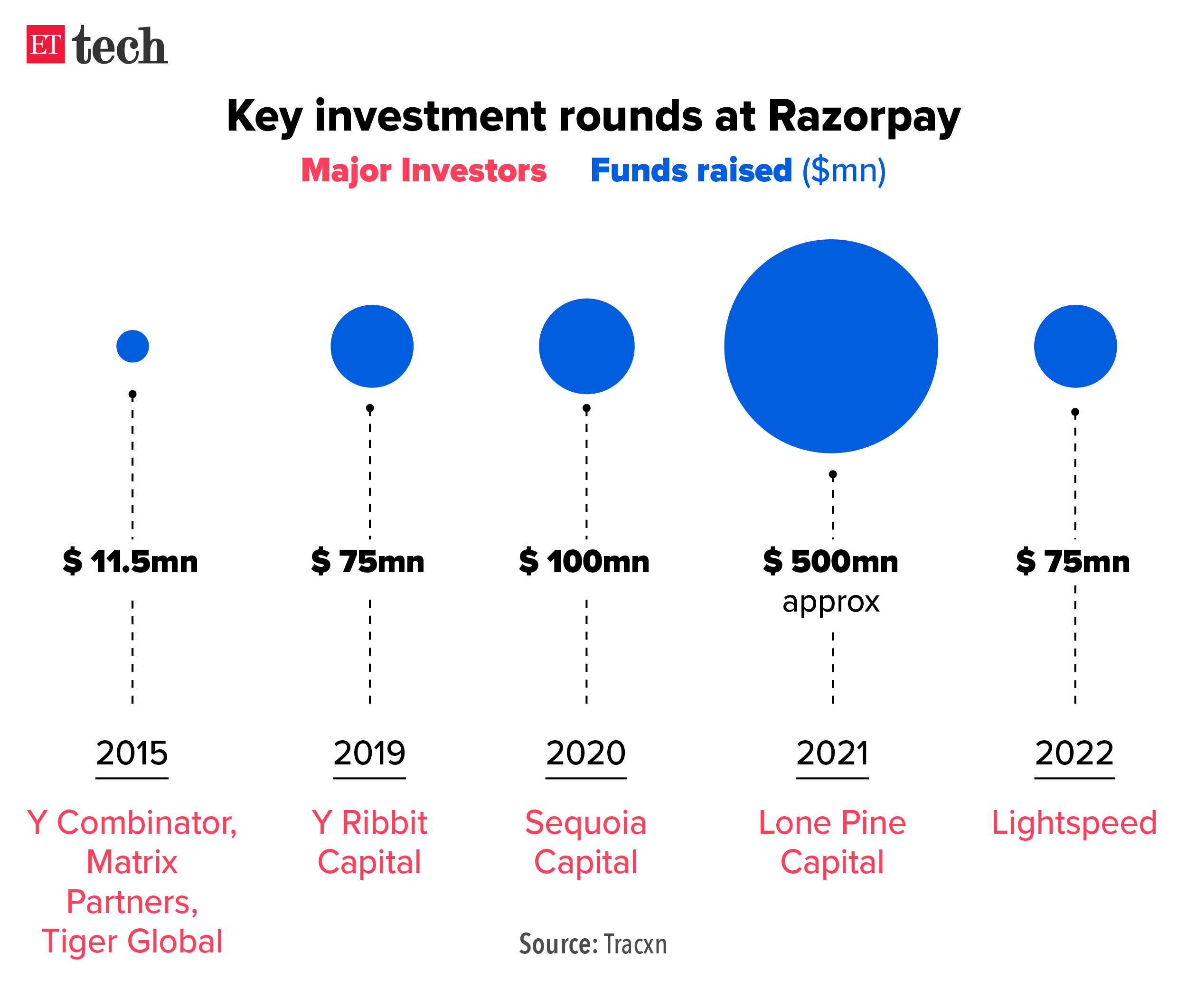

Driving the news: After Walmart-owned PhonePe, Razorpay is the second large fintech unicorn to flip back to India, the company confirmed to ETtech. Eight years ago, Razorpay flipped to the US as it became a part of influential Silicon Valley startup incubator Y Combinator’s 2015 batch.

Why does it matter? Just like PhonePe, Razorpay grew in size during the period it was domiciled abroad. This means there could be a massive tax implication on Razorpay and its investors once it flips back. It could possibly pave the way for an eventual IPO.

Coming back to India may improve its chances of securing licences from the Reserve Bank of India at a time when the fintech sector is being regulated tightly. Recently Pine Labs CEO Amrish Rau told ETtech that he is evaluating if their product is fit for a global market and will then decide on domicile shift accordingly.

Tell me more: This comes as the government is trying to get Indian fintechs abroad to come and set up headquarters in the International Financial Services Centre (IFSC) housed in the Gujarat International Finance Tec-City (Gift).

Expert committee set up: The government has asked a cross-section of stakeholders including fintech founders from companies like Groww, Zerodha, venture capital investors, and representatives from the central bank to draw up a plan as it looks to push the following objectives:

• To suggest measures to encourage Indian fintechs/startups domiciled abroad to relocate to Gift IFSC.

• To identify issues that may be critical for the development of Gift IFSC as a global Fintech hub.

• To encourage new fintechs with global outlook to set up commercial presence in Gift IFSC.

Blinkit back on track as staff strike dissipates, some Delhi-NCR areas still disrupted

As Blinkit operations slowly return to normalcy, a few pockets of Delhi-National Capital Region (NCR) continue to face disruption after several delivery partners quit the platform following protests over a reduction in wage payouts.

Driving the news: This unrest led to increased delivery times and sporadic store closures across localities in Delhi, Gurgaon, Noida, Faridabad and Ghaziabad, people aware of the developments told us. A Blinkit executive said average order volumes are improving gradually even though they remain below pre-protest levels.

Quote, unquote: “There are several new delivery partners that are being onboarded every day to meet the demand, which has sustained throughout the protests,” the executive said. “Some of the older riders who were protesting have also returned to work.”

Catch up quick: Last month, Blinkit’s delivery executives began protesting against the company’s move to reduce the minimum pay from Rs 25 per trip to Rs 15 per trip saying it would reduce their earnings. Protests forced several dark stores, or micro warehouses, of Blinkit across Delhi-NCR to shut down for a few days.

Also read | Fresh trouble for Blinkit as over 1,000 riders join rivals

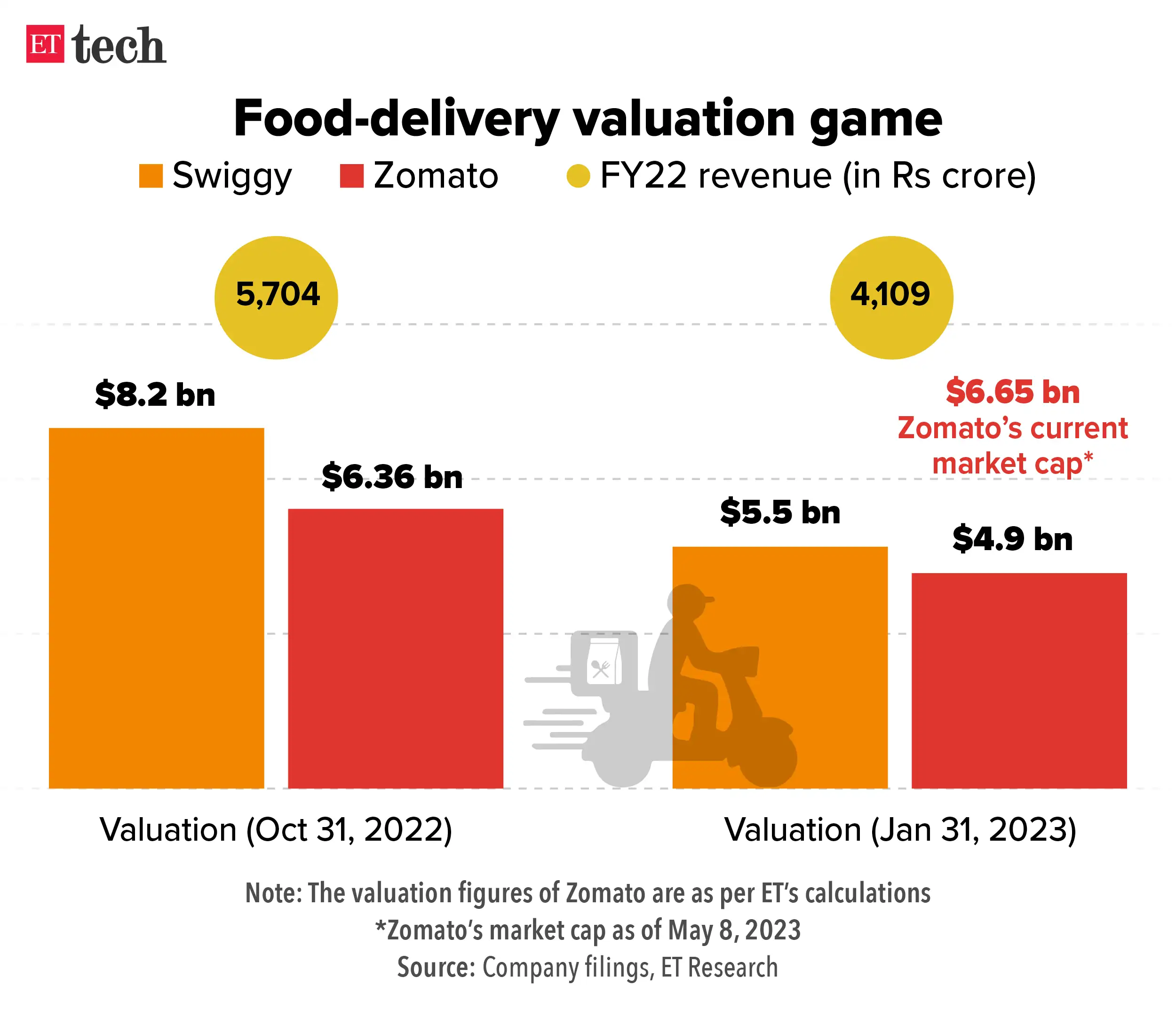

Invesco slashes Swiggy’s valuation to $5.5 billion from $8.2 billion

US asset manager Invesco, which led a $700 million fundraising round in Swiggy in January 2022, has cut the food delivery firm’s valuation by 33% to $5.5 billion from $8.2 billion in its latest markdown.

Tell me more: As per the latest filings, Invesco valued Swiggy’s shares at $3,305 as of January 31, 2023, down from $4,759 in October last year, when it first trimmed the company’s share value amid an overall correction of the global technology market. We had reported last month that Invesco had marked down its investment in Swiggy by 23%.

Invesco said that it looks at other market participants to value its portfolio. Swiggy was valued at $10.7 billion after it closed the $700-million round in January 2022.

Invesco’s rationale: “Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used,” the asset manager said in its filings.

Valuation challenges: The consecutive drops in Swiggy’s valuation come amid challenges for the SoftBank-backed company. It fired 380 employees so far this year as the core food-delivery business slowed.

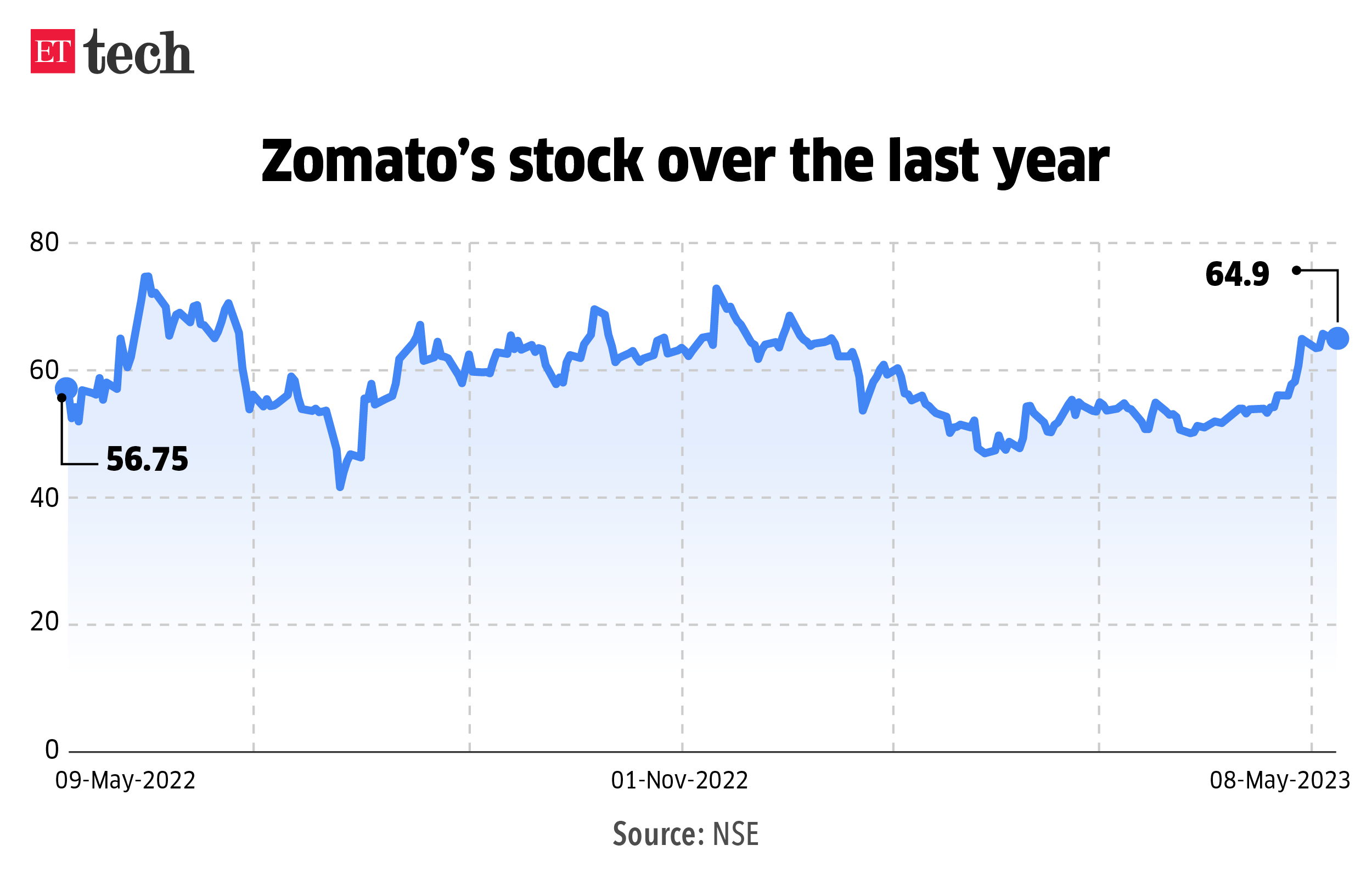

Swiggy’s arch-rival Zomato, which listed during the tech boom of 2021, has also seen its stock plummet 48% since it made its debut in the public market almost two years ago. On Monday, Zomato’s shares closed at Rs 64.89 apiece on the BSE.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

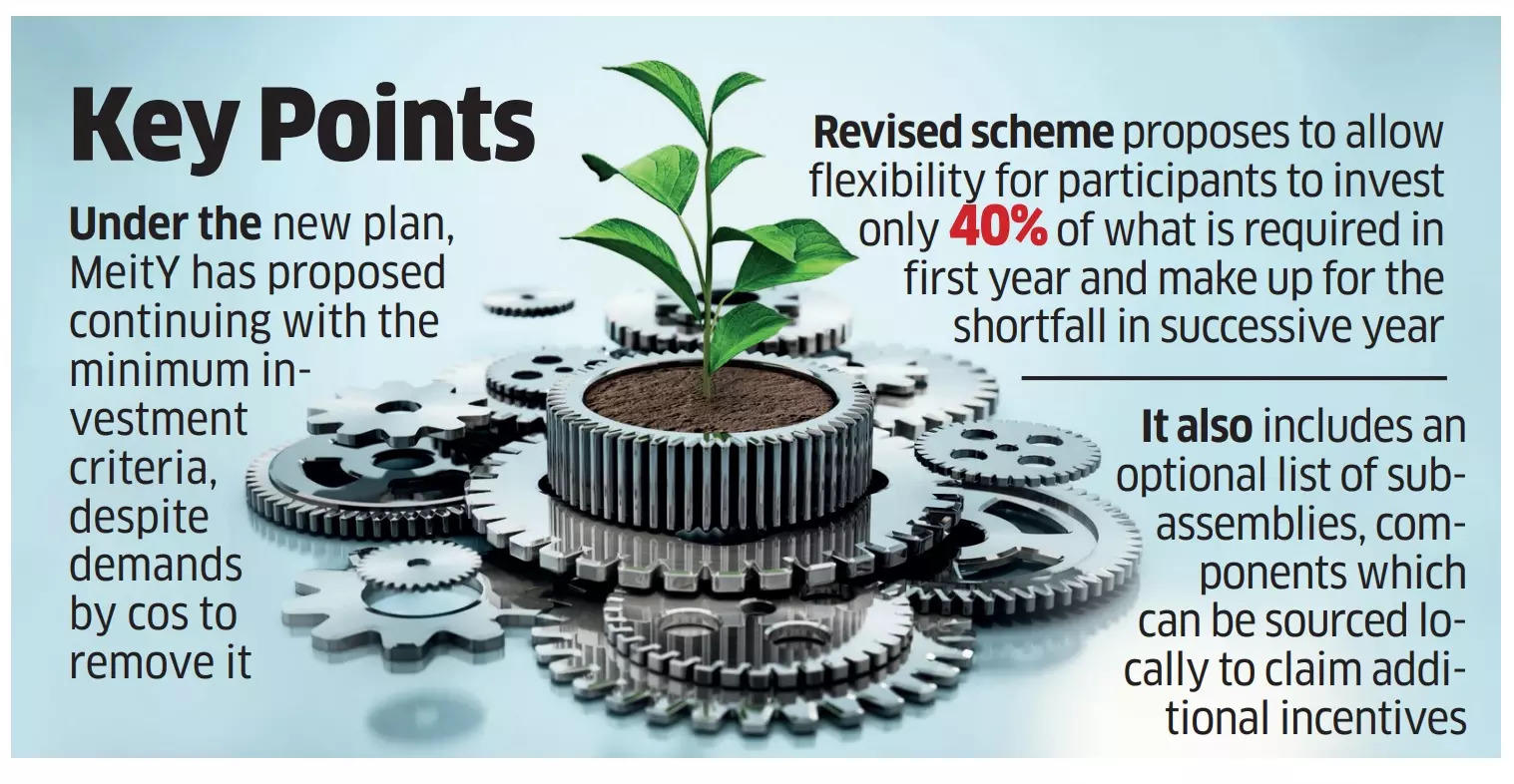

Government may hike IT hardware PLI sops to Rs 17,000 crore in new plan

In a bid to attract global IT companies for expansion in India, the government is planning to introduce a revised production-linked incentive (PLI) scheme. The PLI 2.0 scheme will look to target major players like Apple and Samsung, who gave the first scheme a miss.

What’s in PLI 2.0? Sources told ET that PLI 2.0 is likely to have an outlay of Rs 17,000 crore, much higher than the ongoing scheme’s Rs 7,350 crore. The average incentive over six years will be about 5.3% compared with 2.2% over five years offered now, they said. The revised scheme will also have an increased validity of eight years.

What’s wrong with PLI 1.0? The scheme didn’t see much success as only two out of the 14 approved companies, Dell and Bhagwati (Micromax), met their first year (FY22) targets. Insufficient incentives were the primary cause of the scheme’s failure in the IT hardware sector.

Tweet of the day

Aadhaar private vetting proposal feedback allowed till May 20

The Centre has extended the deadline for public feedback on its proposal to allow private entities to conduct verification of Aadhaar numbers by 15 days to May 20.

The proposal: The Ministry of Electronics and Information Technology (MeitY) released a draft proposal on April 20 to allow non-government and state entities to authenticate Aadhaar. As per the proposal, entities other than the central and state government can now seek permission for Aadhaar authentication in certain cases.

Experts oppose: Legal experts deem the proposal for amendments to the Aadhaar Authentication for Good Governance (Social Welfare, Innovation, Knowledge) Rules, 2020, to enable private entities access to Aadhaar vetting as unconstitutional and violative of the Supreme Court’s 2018 Aadhaar judgment.

Other Top Stories By Our Reporters

Cuemath announces layoffs, Manan Khurma is CEO again: Online math class startup Cuemath has cut 12.5% of its workforce across functions and roles. The decision has impacted 100 out of about 800 roles across functions, a spokesperson for the startup told ET.

Happiest Minds Tech Q4 profit up 11% YoY: Mid-cap IT firm Happiest Minds Technologies posted a year-on-year consolidated net profit growth of 10.7% at Rs 57.7 crore in the March quarter due strong growth across business units and robust demand for digital deals.

Global Picks We Are Reading

■ The Data Broker That Targeted Abortion Clinics Landed a US Military Contract (Wired)

■ Something Awful is racing to save the best and worst of web history (The Verge)

■ Has Twitter discovered a better way of correcting online falsehoods? (FT)