Banks have also increased the interest rates they charge on term deposits as a result of the Reserve Bank of India (RBI) raising repo rates numerous times over the course of the past year. For regular customers, the majority of public sector banks (PSBs) offer interest rates above 6.5%. Senior citizens earn even more from this rate.

The interest rate procured on fixed deposits in banks ((excluding small finance banks) has arrived at 8%, which was just in the scope of 5 to 6.5 percent a year prior. On fixed deposits, seniors receive an additional interest rate of 0.50 percent, which is even better news for them.

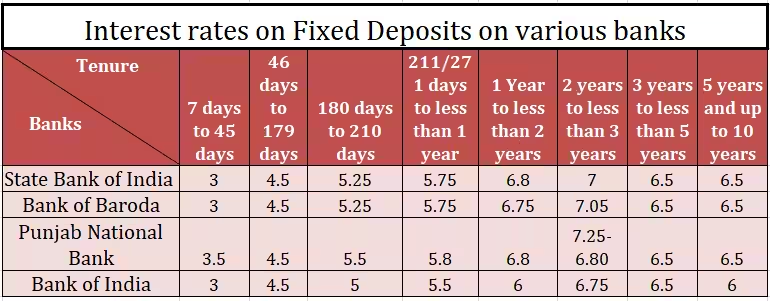

FD rates in public service banks

The Reserve Bank of India (RBI) has increased the repo rate by 250 basis points (bps) in the past year in response to rising inflation. Customers of fixed deposits have also begun receiving the benefits of the rate increase from banks.

Nonetheless, the quantum of interest rate hikes on fixed deposits differs from one bank to another. The liquidity, credit demand, assets, liabilities, cost of funds, and other factors are all taken into consideration by banks when determining the interest rates on their deposits.