SBI or the State Bank of India, a public sector bank, offers several benefits for Indians living abroad or to keep it simple, the NRIs (Non Resident Indian).

To access NRI benefits from SBI, one needs to set up an account. Here are a few simple ways in which an NRI can open an account with SBI from home, ditching the long que.

Also read: SBI announces completion of $1 billion Syndicated Social Loan Facility

Open an NRI account with SBI online

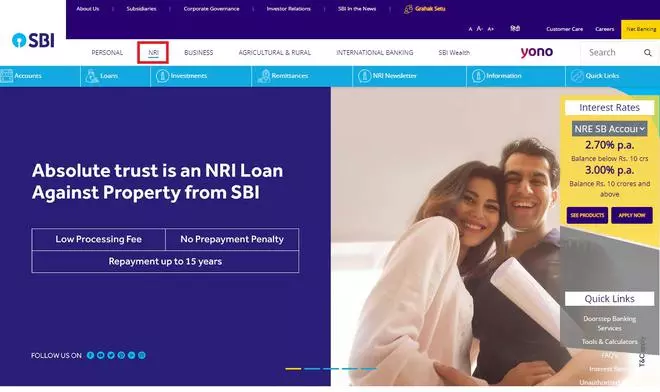

- Visit the SBI website or the mobile app for opening an NRI account.

- Click on the NRI tab from the above panel, as shown in the image.

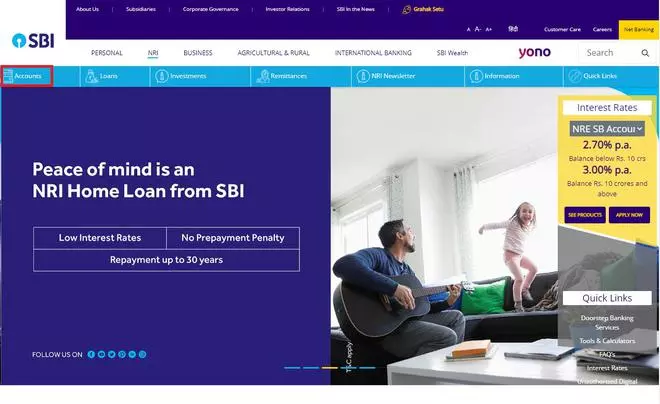

- As the next step, click on the Accounts tab.

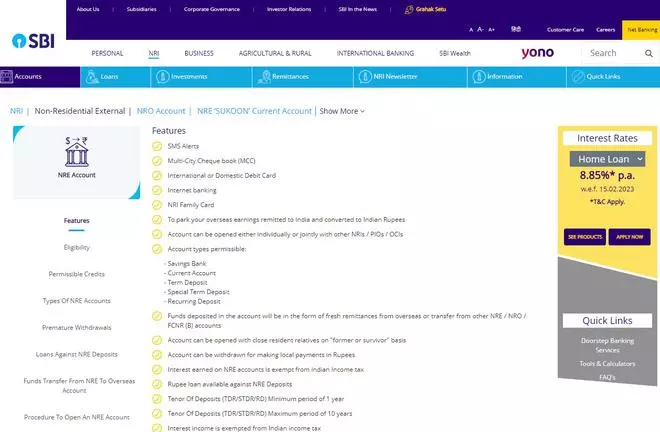

- Go to Non – Residential External link under Accounts tab.

- Scroll down the page, and click on Apply Now tab to apply for account opening.

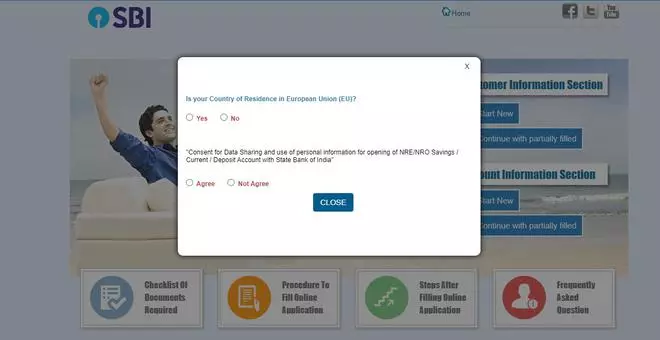

- On the next page, click on Apply Now to start.

- Click on Start New under Customer Information section.

- Continue to provide the required details to proceed further.

Documents needed

Here’s a list of all the documents needed to open an NRI account.

- Identity proof (Passport).

- Non-Resident Status Proof (Visa/Work Permit, etc.)

- Overseas/Communication Address Proof (Passport, Utility Bills, Rent Receipt, etc.)

- Permanent address (Overseas/ Indian).

- Photograph.

- PAN Card.

Also read: NRI deposits grow 38% to $3.6 billion during April-November 2022 period

Attestation

One is required to self-attest the common documents and then visit any of the following entities for further attestation:

- Notary

- Embassy/High Commission

- Overseas Branch of Indian Bank

- Foreign Bank with Indian Presence