Also in the letter:

■ Startups in the creator economy space struggle to survive

■ Sneaker reselling platform Mainstreet Marketplace raises $2 million

■ Bribes-for-jobs scandal at TCS ‘tip of the iceberg’

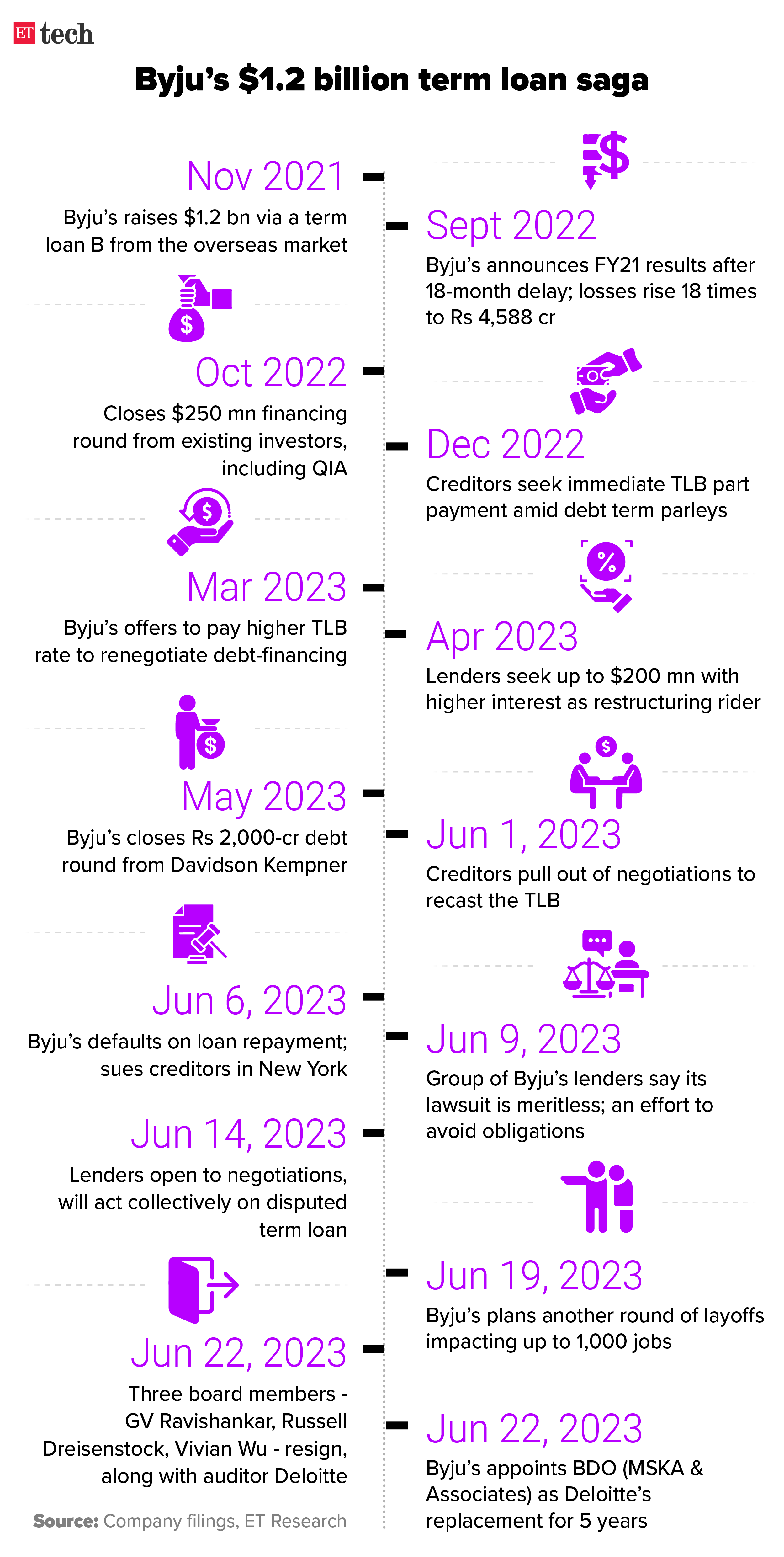

Byju’s crisis plays up digital lenders’ asset quality problem

The stress at edtech major Byju’s could impact the digital lending space as many non-banking financial corporations (NBFC) have extended credit to users of Byju’s’ multiple platforms. If the platform itself is in trouble, its customers might not repay the loans they took for those products, fear lenders.

Driving the news: The Reserve Bank of India has been keeping a close watch on the exposure of lenders towards the edtech sector. Sources told ET that many NBFCs were questioned by the central bank a couple of months back about the credit they had extended in this space.

Caution, precaution: Several large lenders took steps to reduce their exposure. Many of their fintech partners became cautious too. But the problem was that a significant number of loans had been disbursed already and quite a few lenders had reasonable exposure in this area. They are now keeping a close track of repayment trends.

Default: Byju’s has been accused of mis-selling its products on credit. Fintech lender CapitalFloat had faced massive defaults after many unsuspecting customers of Byju’s were sold products on credit without proper explanations. However, industry insiders feel that this time such problems will not be that hard to contain.

Byju’s promises to file FY21-22 financial results by September

Close on the heels of its erstwhile auditor Deloitte Haskins walking off, Byju’s has promised its investors that it will file the FY21-22 financial results by September, sources have told ETtech.

Troubled past: The edtech major filed its FY20-21 financial results in September 2022, after a delay of 18 months. The results revealed a larger drop in revenues than expected, and losses had swelled as well. The company reported revenues of Rs 2,280 crore along with a loss of Rs 4,588 crore, up from just Rs 262 crore in the previous fiscal. One of the key changes that Byju’s had to make in its FY20-21 results was to report revenues for only the period under consideration — fiscal 2021— and not include multi-year payments.

Exodus not coordinated: According to a shareholder who spoke to ETtech, Byju’s told its investors that “the exit of Deloitte (Byju’s’ former audit firm) and three board members was not coordinated’’. Last Thursday, ETtech broke the story about three of Byju’s’ board members resigning. These investors were the representatives of Peak XV Partners, Prosus, and the Chan Zuckerberg Initiative.

Staffers in a spot as recruiters fail to match pay: Byju’s employees have voiced their concerns about the uncertainty of their jobs and the company’s ability to sustain its operations. Staffers at the Bengaluru-based firm, which recently laid off another 500-1000 employees, have been struggling with increased workload after the staff-cuts.

Sales professionals at the Tencent-backed firm have been reaching out to prospective buyers of K-12 and test prep products with discounted offers, where they themselves bear the cost partially so as to meet internal targets, ETtech has learnt.

Foxconn pings other business houses as Vedanta chip JV stalls

Trouble with its year-old joint venture (JV) partner Vedanta has pushed Taiwanese contract manufacturing firm Foxconn to hunt for a new collaborator in India to further its semiconductor manufacturing ambitions in the country, multiple sources told ET.

Driving the news: “There are differences between the two. We have been in touch with both, and have suggested that Foxconn on-board a new partner’’, a senior government official told ET. The government is concerned about the “financial stability” of the Vedanta group, the official added. However, they added that it is ultimately Foxconn’s call who they partner with.

Vedanta’s woes: Vedanta Resources Ltd (VRL), the parent entity of Vedanta Limited, recently pledged equity to raise $450 million from two of its principal rivals — Trafigura and Glencore — to repay debt. This, analysts say, underlines the dire financial straits of the promoters and their inability to tap more traditional sources of funding.

Vedanta Group, which is the lead partner in Vedanta Foxconn Semiconductors Limited (VFSL), holds 67% stake in the JV, with Foxconn holding the rest.

‘Partnership intact’: The Vedanta Group, however, maintained that its partnership with Foxconn is intact. “There is no change in the status of our JV. Vedanta is in a very comfortable position with respect to meeting its debt obligations’’, a spokesperson for the company told ET.

Flashback: ETtech had reported earlier that the government had asked Vedanta-Foxconn to onboard a technology partner which has a manufacturing-grade licence. ET had also reported that the government had asked Foxconn to take the lead in the JV.

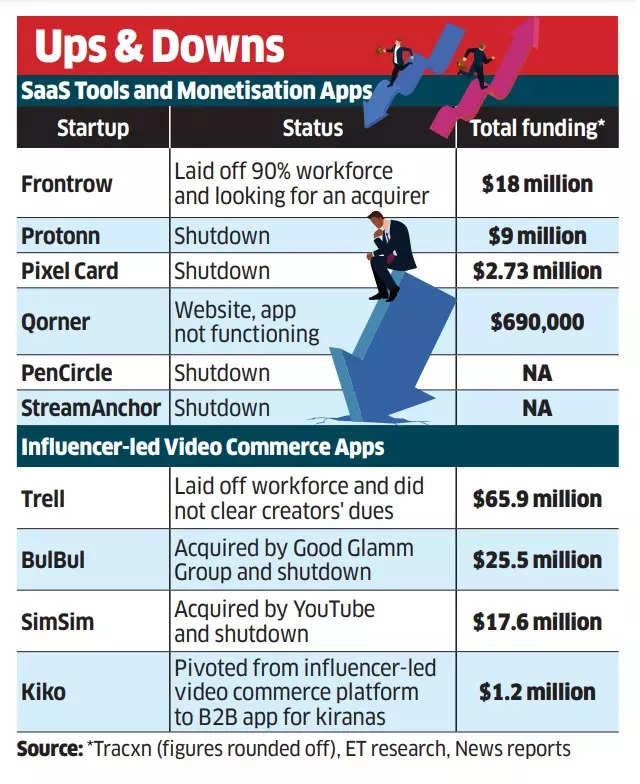

Startups in creator economy struggle to survive

Even though your Instagram handles are filled with successful influencers and creators with hundreds and thousands of followers, startups managing them are barely surviving.

But why? Industry officials said that about half a dozen startups in this space — which have raised more than $12 million in funding — have shut shop, while many others have pivoted or gotten acquired in fire sales over the last 12-18 months.

Who all have been hit? Fan patronage startup PenCircle has shut down, its co-founder Jayan Nair confirmed to ETtech. Nithin Kamath-backed community monetisation platform StreamAnchor is “operationally inactive”, sources said. Qorner, a fintech platform for digital creators, last posted on Instagram in April 2022.

Community management platform Scenes — which offers tools for creators to launch and manage courses — was acquired by Unacademy’s Graphy in an all-cash deal. ET had reported that Protonn, a Matrix Partners-backed startup that provides audience management and monetisation tools to freelancers, shut down six months after it raised $9 million.

Rise of digital creators: A bunch of these companies sprung up in 2020-2021 as the pandemic gave a fillip to digital creators. Startups swiftly emerged to cater to these creators, offering solutions such as product sales, content subscriptions, and community and payment management tools.

Hard problems: Experts believe that most of these players focused on administrative issues and not on “hard problems facing content creators”. Also, popular platforms such as Instagram rolled out creator-centric features like shopping and subscriptions, rendering several community monetisation startups redundant.

Brands tap young influencers: Whatever the state of the companies managing them, the influencers and creators themselves are the new heroes for younger brands who rely on them to take their products to new audiences, without breaking the bank. To stand out on cluttered social media feeds, saturated with advertisements and promotions, young brands are going beyond a one-time collaboration with digital creators.

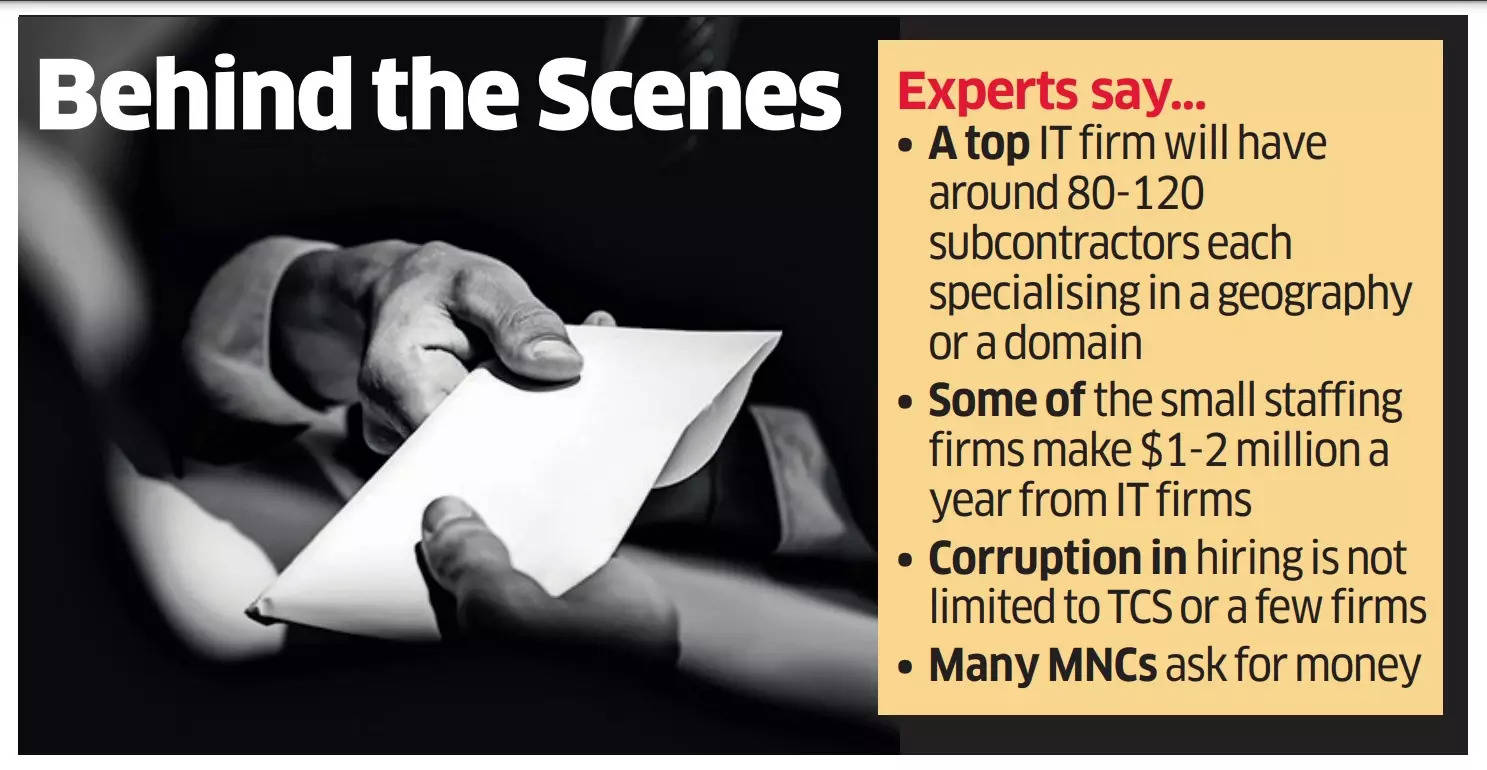

Industry needs guardrails to weed out corruption: staffing experts

A recruitment scandal roiled IT major Tata Consultancy Services (TCS) last weekend, where executives were found to be giving preferential treatment to certain recruiters, leading to multiple sackings and much finger-pointing. Experts warn there may be more to come.

Tip of the iceberg: HR executives told ETtech that what happened at TCS may be just the “tip of the iceberg” as a lot of companies which deal with small staffing firms have such unholy nexuses at work.

Experts suggested that the number of firms under scrutiny could be higher, as the investigation is currently ongoing. The incident may also spark a greater scrutiny of hiring processes within other IT firms that hire in large numbers.

Tell me more: Experts also said that corruption in recruitment could have gone up during 2021-22, when there was accelerated demand for tech talent and attrition hit record highs.

“This will make other IT companies scrutinise their hiring strategies, especially those who have rushed to meet talent requirements in recent times without a fair assessment of how that is being achieved’’, an HR executive said.

Brace for impact: India’s $245 billion IT industry employs over 4.5 million people. During fiscal 2021-22, the top four Indian IT service firms — TCS, Infosys, Wipro, and HCLTech — hired more than 2,20,000 people, a significant number of them from campuses.

Some of the small staffing companies make $1-2 million a year from IT firms, one of the sources said. Experts said that corruption in hiring is not limited to TCS or a few firms and could be the sign of a bigger rot.

No Biz Like Shoe Biz: Sneaker reseller Mainstreet Marketplace raises $2 million

Vedant Lamba, founder, Mainstreet Marketplace

Mumbai-based Mainstreet Marketplace, a platform for sneakerheads to buy and resell shoes, has closed a $2 million (around Rs 16 crore) seed funding round from a clutch of investors.

The investors: Participants in the round include Zomato CEO Deepinder Goyal’s First Lap LLP, Zerodha cofounder Nikhil Kamath and Abhijeet Pai’s venture fund Gruhas Proptech, Udaan co-founder Sujeet Kumar, Spotify India MD Amarjit Singh Batra, and several other angel investors and social media influencers.

Celeb Quotient: Founded by 24-year-old Vedant Lamba as a YouTube channel in 2017, Mainstreet Marketplace, according to Lamba, is a customer-to-business-to-customer (C2B2C) marketplace such as Olx, Spinny, CarDekho, etc., but for status-driven commodities.The platform offers brands such as Nike, Adidas, Yeezy, Supreme, Drewhouse, and claims to have an exclusive clientele comprising Bollywood celebrities such as Ranbir Kapoor, Karan Johar, Ranveer Singh, etc.

Other Top Stories By Our Reporters

How exactly does Generative AI impact IT jobs? According to a study by market intelligence firm Unearth Insight, India’s $245 billion IT services industry employs around 3,00,000 people in sales and support functions. AI will impact the work of around over 50,000-60,000 of them over the next three to five years.

EVs or iPhones, India is Foxconn’s new home: The Taiwanese company, which is best known as the largest contract manufacturer for Apple and assembler of the iconic iPhone, has ambitious plans for India.

Global Picks We Are Reading

■ Why we should worry about the technological pessimists (Financial Times)

■ Meet the AI protest group campaigning against human extinction (Wired)

■ Nigerian engineering students’ favourite teachers are Indian YouTubers (Rest of World)