Also in this letter:

■ Ola Electric and automotive dealers’ lobby face off

■ BharatPe founder says audio clip shared on Twitter is fake

■ Bulli Bai app: Delhi police arrests app’s creator

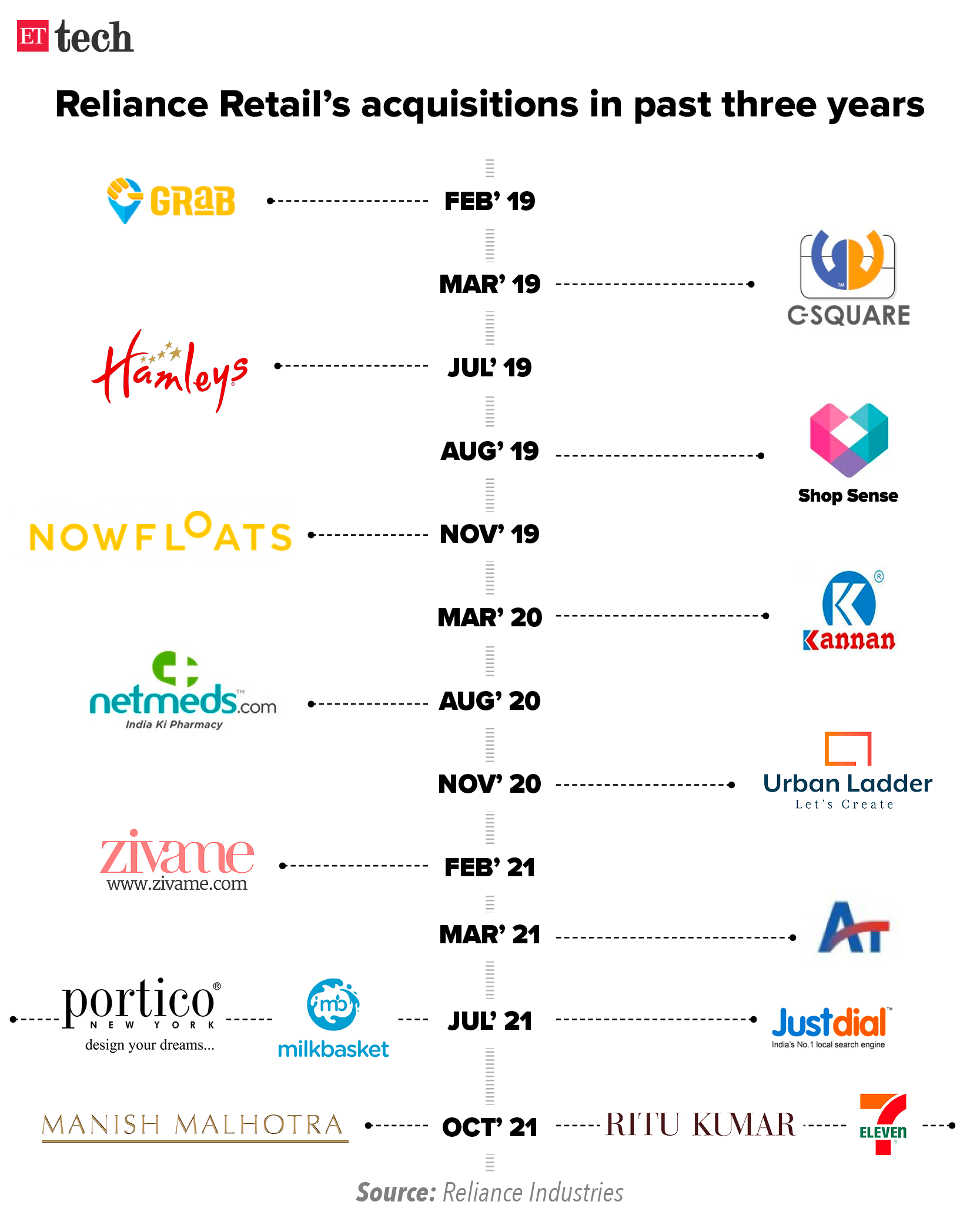

Reliance Retail picks up 25.8% stake in Dunzo

Reliance Retail has led a $240 million funding round in quick commerce firm Dunzo, according to a statement by the company. Reliance Retail said with an investment of $200 million it will own a 25.8% stake.

Dunzo’s existing investors Lightbox, Lightrock, 3L Capital and Alteria Capital also participated in this round.

What will the funds be used for? Reliance Retail said the capital will be used to further Dunzo’s vision to be the largest quick commerce business in the country, enabling instant delivery of essentials from a network of micro warehouses. It will also expand its business-to-business (B2B) business vertical to enable logistics for local merchants in Indian cities.

Quote: “We are seeing a shift in consumption patterns online and have been highly impressed with how Dunzo has disrupted the space. Dunzo is the pioneer of Quick commerce in India and we want to support them in furthering their ambitions of becoming a prominent local commerce enabler in the country,” said Isha Ambani, director, Reliance Retail Ventures Limited.

She further said that through a partnership with Dunzo, Reliance will be able to provide increased convenience to Reliance Retail’s consumers and differentiated customer experience through rapid delivery of products from Reliance Retail stores.

Dunzo cofounder and CEO Kabeer Biswas said that the company aims to establish itself as one of the most reliable quick commerce providers in the country. “With this investment from Reliance Retail, we will have a long-term partner with whom we can accelerate growth and redefine how Indians shop for their daily & weekly essentials,” he said.

Quick commerce buzz: Following the accelerated adoption of online grocery aided by the Covid-19 pandemic, platforms are bringing back quick delivery small warehouses within neighbourhoods — what they call dark stores. Dark stores are small warehouses in dense areas of a city from where orders can be serviced quicker.

The hyperlocal delivery model emerged as a fad back in 2015-16 but was short-lived. Startups such as Grofers, Peppertap (which shut down in 2016) were early proponents of the model.

According to a report by RedSeer, the quick commerce market size is expected to grow to $5 billion by 2025.

Ola Electric, auto dealers’ lobby face off over scooter sales figures, issues

The Federation of Automotive Dealers Association ( FADA) has questioned Ola Electric’s transparency in communicating to customers about the delivery of its newly launched electric scooters.

FADA’s president Vinkesh Gulati said the industry grouping is looking to investigate complaints received from customers like the claimed number of deliveries, range, registration charges, insurance charges, and forward them to the Ministry of Road Transport and Highways.

Gulati said that the association has received around 15-20 complaints and said that they will verify those before forwarding them to the ministry. Gulati was referring to the government’s vehicle registration data which shows that sales of Ola Electric scooters are significantly lower than the number of deliveries the company has said it had made.

Discrepancy over numbers: As per the Road Transport and Highways Ministry’s Vahan dashboard, which maintains real-time vehicle registration data, about 439 Ola Electric vehicles had been registered in total as of Thursday morning. This is in stark contrast to about 4,000 dispatches the company has claimed to make in December alone.

Varun Dubey, the chief marketing officer of Ola Electric, said that numbers take time to reflect on the government portal.

Quote: “There are many states that do not report to Vahan,” he said. “Like Telangana, North East, Madhya Pradesh, Chhattisgarh to name a few. Also, Vahan does not register temporary registration. Most states require temporary registration for a month so there is a four-week lag.”

Speed bumps along the way: The company has been facing the ire on social media as well for not providing the claimed ARAI range of 180 kilometres. Many users report a range of 135 km after a full charge. But Dubey said that Ola’s scooters have the lowest variation from the ARAI range compared to industry standards, which he said is at 24%.

He also said that the company does not charge extra for registration or for insurance. The central government had waived the registration fee for electric vehicles. But Ola collects a fee from the customers.

BharatPe’s founder Ashneer Grover says audio clip shared on Twitter is fake

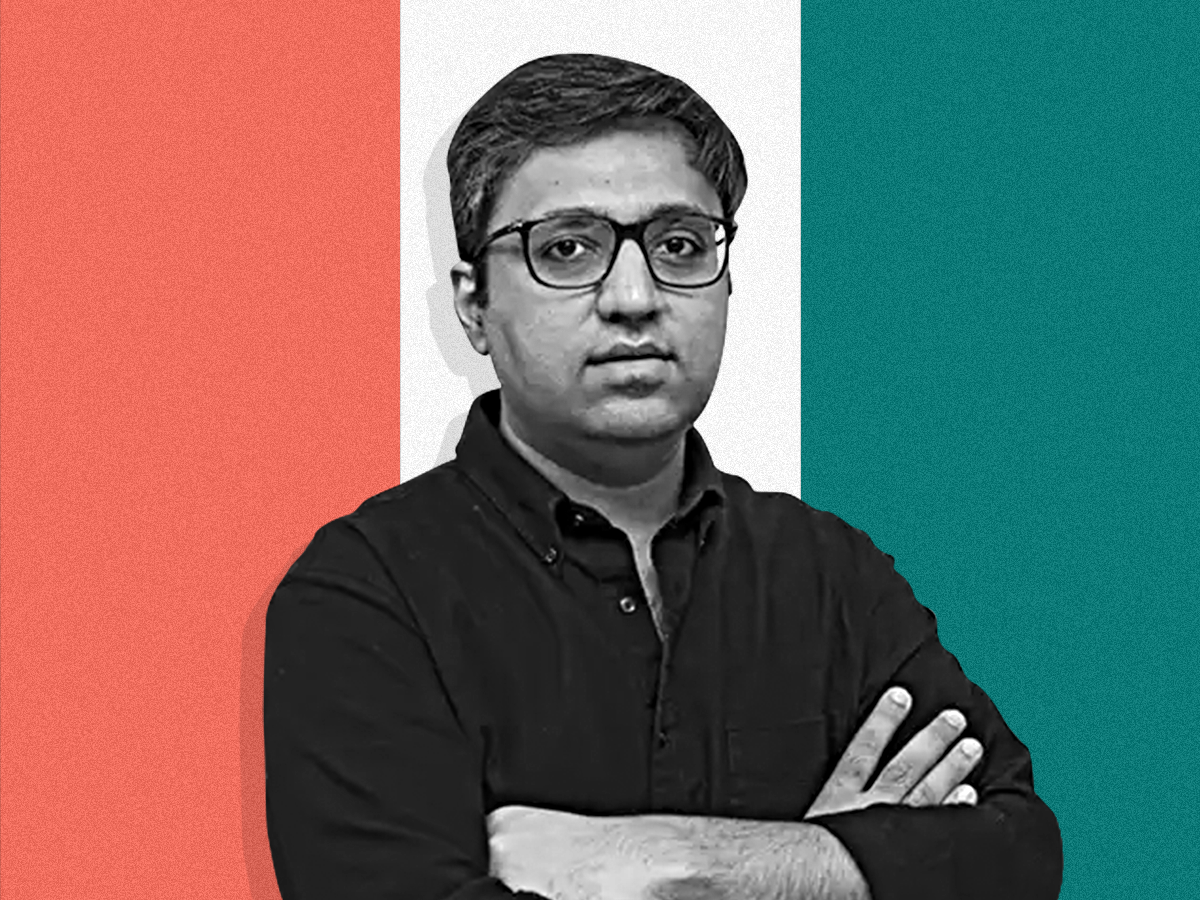

BharatPe cofounder and CEO Ashneer Grover

BharatPe cofounder and CEO Ashneer Grover today tweeted saying an audio clip circulating on social media, which allegedly has him talking to a bank executive, is fake. Grover went on to add that “some scamster” is trying to extort funds ($240,000 in Bitcoins) through this clip.

Tell me more: On Wednesday evening, an anonymous handle on Twitter–’bongo babu’– had put up a SoundCloud link which had Grover allegedly hurling expletives to an employee of Kotak Mahindra Bank. The audio clip suggested the argument between Grover, his wife and the unidentified bank representative, was due to the BharatPe founder missing out on share allotment during Nykaa’s IPO.

Grover’s response: “Folks. Chill! It’s a FAKE audio by some scamster trying to extort funds (US$ 240K in bitcoins). I refused to buckle. I’ve got more character. And Internet has got enough scamsters :)” Grover tweeted.

He also shared a couple of email exchanges between himself and a startup marketer that goes by the name of UniconBaba seeking money.

“You can expect 800-1,000 potential startup deals in 2 years easily. Also, I will help you in image building strategy that will change the narrative. And give 20-25 positive shoutouts and PR plus in the same period,” the alleged email shared by Grover read.

On December 25, 2021, Unicon Baba tweeted that BharatPe’s work culture was toxic and urged employees of the company to tweet their resignations.

BharatPe is valued at $2.85 billion and counts Tiger Global, Insight Partners, among others as its investors.

‘Bulli Bai’ case: Delhi Police arrests 21-year-old ‘mastermind’ from Assam

An engineering student believed to be the “mastermind” and creator of the “Bulli Bai” app was arrested today from Jorhat in Assam. He was brought to the national capital where he confessed his role, Delhi Police officials said.

The fourth arrest in the case: Niraj Bishnoi, 21, is the fourth person to be arrested for their alleged involvement in the app that has listed hundreds of Muslim women for “auction”. The other three, nabbed by Mumbai Police, include a 19-year-old woman from Uttarakhand, also alleged to be a prime accused in the case.

Tell me more: Bishnoi is the creator of the “Bulli Bai” app on the platform GitHub as well as the main Twitter account holder of “Bulli Bai”, police said. He was arrested by the Intelligence Fusion and Strategic Operations (IFSO) unit of the Delhi Police.

Quote: “He is the mastermind and the person who had created this application on Github. He has confessed about the creation of the application… forensic remnants of the creation have been found in his laptop. He has been brought to Delhi and will be produced in court today (Thursday) for police custody and further investigation,” said Deputy Commissioner of Police, IFSO, K P S Malhotra.

Other arrests in the case: On Wednesday, the cyber cell of Mumbai police arrested a student (Mayank Rawal) from Uttarakhand. The cyber cell of Mumbai police had earlier arrested Shweta Singh (19), alleged to be the main culprit, from Uttarakhand, and engineering student Vishal Kumar Jha (21) from Bengaluru in connection with the case.

According to a senior Mumbai Police officer, Singh is a prime accused who had created the Twitter handle of the app.

Bitcoin, Ether near multi-month lows following hawkish Fed minutes

Bitcoin fell below $43,000 on Thursday, testing multi-month lows after minutes from the Federal Reserve’s last meeting showed it leaning toward more aggressive policy action, which sapped investor appetite for riskier assets.

The world’s largest cryptocurrency was last at $42,700, down 1.7%, having lost 5.2% on Wednesday. A break below last month’s trough of $42,000 would make it the weakest since September.

The token hit a record high of $69,000 in November.

Ether, the world’s second-largest cryptocurrency which underpins the ethereum network, lost 5.2% on Wednesday, and touched its lowest level since October, before bouncing back slightly to $3,460.

Market trends: Moves in cryptocurrency markets are becoming more aligned with those in traditional markets as the number of institutions trading both crypto and other assets grows.

The Nasdaq plunged more than 3% overnight in its biggest one-day percentage drop since February, after Fed minutes showed US policymakers had discussed reducing the bank’s balance sheet at their December meeting when they also decided to accelerate finishing their bond-buying programme. Share markets in Asia sold off on Thursday as well, while US Treasury yields edged higher.

Expert speak: The fall “correlated with the ‘risk off’ move across most traditional asset classes,” said Matt Dibb, COO of Singapore-based crypto fund distributor, Stack Funds, pointing to the declines in the Nasdaq in particular.