Also in this letter:

- Startups write to FM on GST on online games

- Fintech veterans, angel investor launch $40 million fund

- Swiggy turns decacorn after $700-million round

Fynd and Netmeds team up for Reliance’s beauty platform

Reliance Industries is preparing to launch its omnichannel beauty platform, with two of its recent acquisitions—Fynd and Netmeds—working in tandem to make it a reality, two people aware of the matter told us.

Details: The venture is being built on the marketplace model under Reliance Retail and will compete directly with Nykaa, which went public in November.

Internally called ‘Project Adore’, the venture is likely to be named Tiara.

Netmeds is developing the backend—warehousing and data management—from Chennai, while Fynd is building the frontend, including the customer interface, according to a source.

Reliance Retail has already signed agreements with about half a dozen leading cosmetics and beauty brands, a senior executive directly aware of the developments said.

Isha Ambani, director of Reliance Retail and daughter of chairman Mukesh Ambani, is said to be helming the project and is closely involved in hiring, according to a senior ecommerce executive who was approached by the company.

Reliance Chairman Mukesh Ambani

Why now? Reliance Retail wants to fast-track the beauty marketplace launch since the third wave of the pandemic has not disrupted businesses much and consumer sentiment remains positive.

Besides, other newcomers in this space such as The Good Glamm Group and Purplle are growing rapidly, and the Tata Group is preparing its own blueprint for the beauty business, another executive said.

Beauty boom: The beauty and personal care category has been booming since Nykaa’s public listing last year, though its shares have fallen sharply as part of a wider crash in tech stocks globally and in India.

The rise of online platforms is also expected to disrupt traditional brands, as they have done in China. A 2021 report by PE firm Avendus predicted the online personal care and beauty market in India would touch $4.4 billion by 2025. Online beauty and personal care shoppers are likely to increase by four-fold—from 25 million in FY20 to 110 million in FY25, it said.

Tax games of skill and chance differently, startups urge govt

IndiaTech, an industry association representing consumer internet startups, has urged the government to tax games of skill differently from games of chance.

Driving the news: In a letter to finance minister Nirmala Sitharaman ahead of the budget, IndiaTech asked her to ensure that Rule 31A of the CGST Rules 2017—which apply to lottery, betting, gambling, and horse racing—do not apply to games of skill. Under Rule 31A, the entire transaction value , which includes the winning amount, is taxed.

IndiaTech also proposed that GST be levied only on the money platforms charge for their services and not on the prize pool distributed among players. Its members include online gaming unicorns such as Dream11 and Mobile Premier League.

For instance, four people log in to a gaming site and play Ludo by depositing Rs 100 each. One of the four wins the game and receives Rs 380 as the winning amount. The balance — Rs 20 – is the gaming company’s commission. Currently, the question is whether GST is payable on Rs 20 or Rs 400.

Finance Minister Nirmala Sitharaman

The back story: The GST Council—the apex decision-making body on matters of indirect taxes —formed a group of ministers ast year to address taxation issues for online gaming.

The GoM was tasked to come up with recommendations on the tax rate for online gaming as well as address whether GST is applicable on the total transaction value, which includes the prize money, or the net commissions (revenues) that accrue to gaming firms.

According to two people in the know, there was a view within the group to recommend a blanket 28% GST and club online games of chance and those of skill. It has not yet submitted its recommendations to the GST Council.

Most gaming companies pay 18% GST currently as platform fees. IndiaTech in its letter recommended that this should become a norm for platforms offering games of skill.

As of December, there were more than 900 gaming startups in India, according to Tracxn.

Tweet of the day

Amrish Rau, Jitendra Gupta launch $40 million fund with Sweta Rau

(From left) angel investor Sweta Rau, Pine Labs CEO Amrish Rau and neobank Jupiter’s cofounder Jitendra Gupta.

Fintech veterans Amrish Rau, CEO of Pine Labs, and Jitendra Gupta, cofounder of neobank Jupiter, have joined angel investor Sweta Rau to launch White Venture Capital with a corpus of $40 million. The fund will specialise in backing early-stage fintech startups in India and Southeast Asia, the trio said.

Growing trend: In doing so, they are part of a growing trend of entrepreneurs turning venture capitalists.

- Udaan cofounder Sujeet Kumar and Flipkart Group CEO Kalyan Krishnamurthy are limited partners in Tanglin Venture Partners.

- Freshworks’ Girish Mathrubootham recently launched Together Fund to back SaaS (software as a service) startups.

- Dream Sports cofounder and CEO Harsh Jain is also setting up his fund to back early stage startups.

Details: Gupta and Amrish Rau will serve as limited partners (LPs) and advisors in White Venture, while Sweta Rau will be its sole portfolio manager. The three have put $15 million of their own money into the fund.

White Venture’s LPs also include Sequoia Capital India, one of its largest sponsors. Others that have backed the fund include Japan’s Credit Saison, TVF Capital, Hummingbird Ventures, and Cred founder Kunal Shah.

While White Venture is a fintech-focused fund, Sweta Rau said that it has kept 30% of the fund open for investments in non-fintech startups too. “For any company or founder we like and feel they are building good companies and we can add value, we will back them,” she said.

It will write cheques between $250,000 and $1 million and double down on best performing bets with follow-on cheques totalling investments to the tune of $3-5 million, she said.

Indian IT firms gear up to tap metaverse opportunities

India’s top software exporters are racing to prepare for a surge in demand for technology services aimed at the metaverse, which is widely regarded as the next phase of the internet.

Tata Consultancy Services, Infosys, HCL Technologies and Wipro are among those piloting new initiatives, building proof-of-concept and virtual laboratories in a bid to equip themselves for the fast-approaching transition.

- TCS is “piloting and investing a lot” in this emerging area, said COO N. Ganapathy Subramaniam who expects “metaverse coupled with 5G and 6G technologies to revolutionise the way” business is done.

- At Infosys, efforts to construct the “building blocks for metaverse” began at the start of the pandemic when it built out “living labs that allow its clients to connect through a virtual environment, interact with people and create prototypes”.

- Wipro CEO Thierry Delaporte said that his company is already working with clients who are leading investments in the metaverse.

- HCL Technologies has a few projects underway in AR/VR and metaverse areas, according to CEO C. Vijayakumar. A research team in the company’s engineering and R&D service is working on early-stage projects in this area with customers in the “technology and retail sector”.

Globally, with anywhere between 60% and 80% of new digital transformation deals being won by Indian IT firms, industry analysts estimate the rise of the metaverse will open up even bigger opportunities for the sector. Bloomberg Intelligence pegs the size of market opportunities around the metaverse at about $800 billion by 2024.

Infographic Insight

Swiggy turns decacorn after $700-million round

Swiggy’s founder Sriharsha Majety

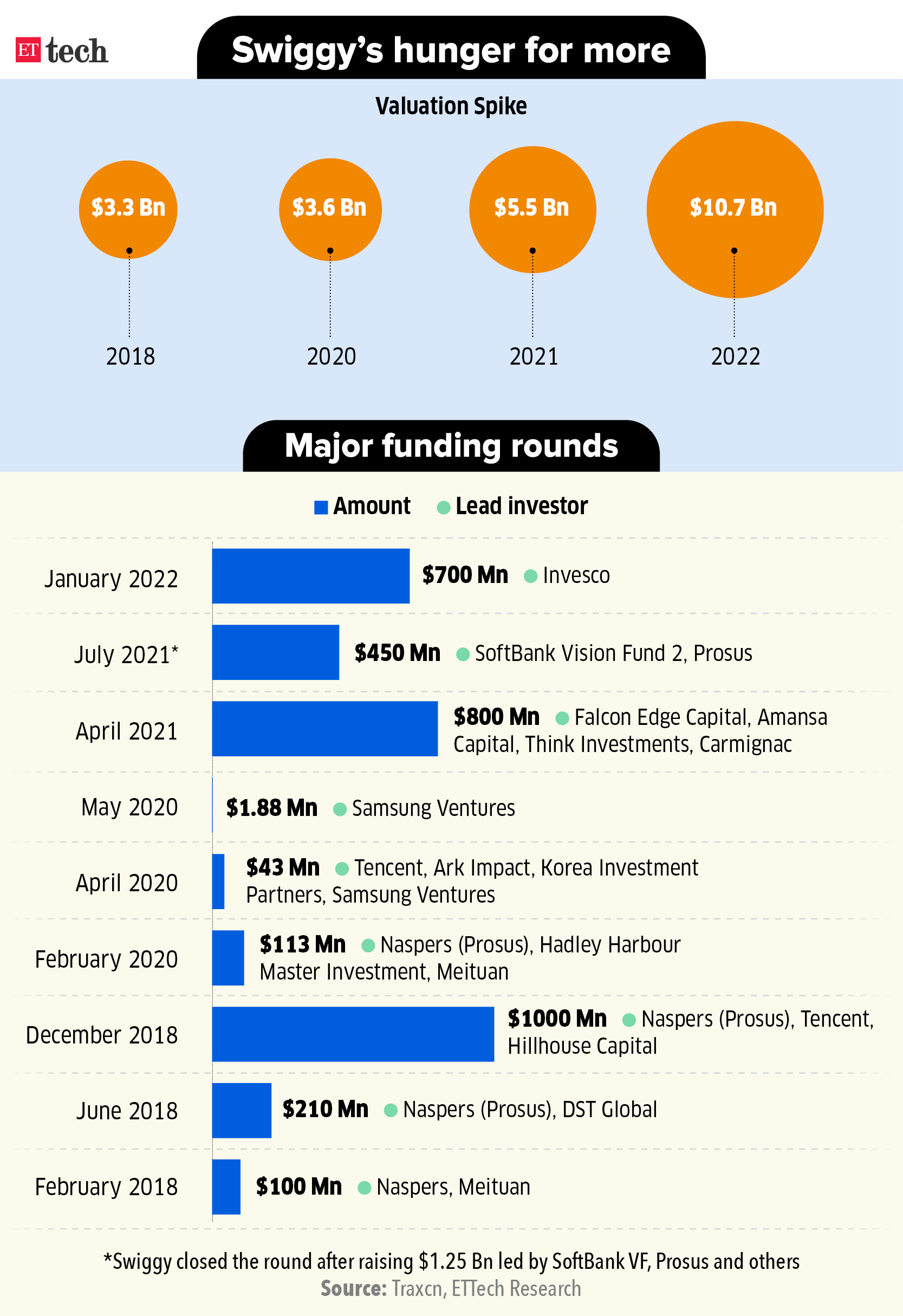

Swiggy has closed a $700 million funding round led by asset manager Invesco, confirming what we reported last September.

Details: The round values the company at $10.7 billion, making Swiggy a ‘decacorn’, two sources told us. It involved a host of new investors, including Baron Capital Group and Sumeru Venture, as well as existing backers Prosus, Qatar Investment Authority, Alpha Wave Global and ARK Impact.

- We had reported in September that the company’s valuation jump was a rerating exercise for the firm, then valued at $5.5 billion, on the back of Zomato’s listing in July. However, Zomato’s stock has been slipping amid a broader dip in the markets.

Last April, Swiggy had raised $1.25 billion from SoftBank, Accel, Prosus and others.

Quick commerce push: Swiggy is making inroads into the highly contested instant grocery delivery space with Instamart. In an interview with ET last month, founder Sriharsha Majety said that the company was committing $700 million to push Instamart. On Monday, Swiggy said it expects Instamart’s annualised GMV run rate to cross $1 billion in the next three quarters.

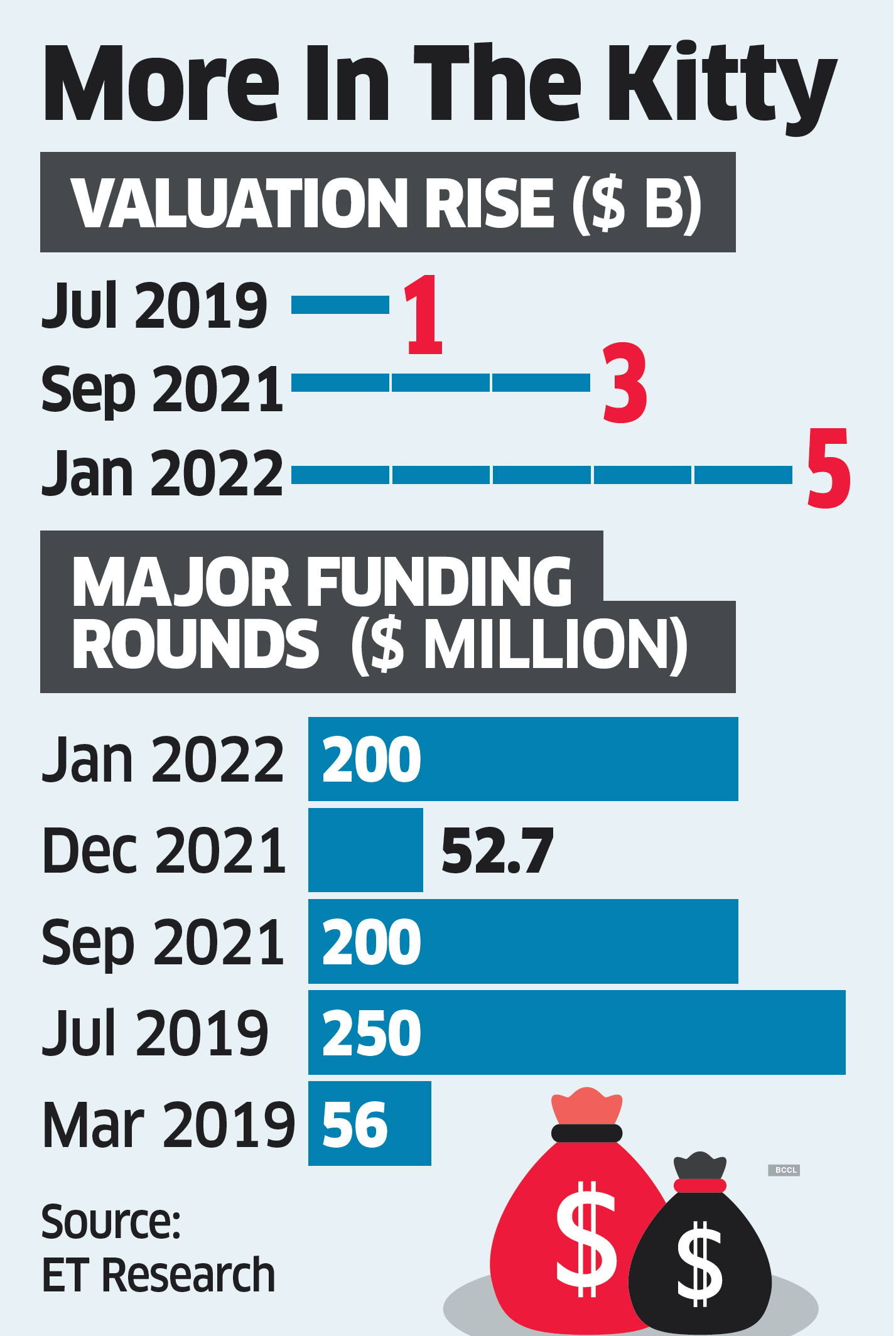

Ola Electric raises $200 million at $5 billion valuation

Ola Electric has raised $200 million from Tekne Private Ventures, Alpine Opportunity Fund, Edelweiss and others, at a post-money valuation of $5 billion.

In September last year, the EV unit of the ride-hailing startup had said that it had raised a similar amount from Falcon Edge, SoftBank and others at a $3-billion valuation.

This is Ola Electric’s seventh fundraising—excluding the $100 million it received from Bank of Baroda—since inception. The company counts Hyundai Motor Co. Ltd., Tiger Global, Matrix Partners India and Ratan Tata as among its investors. In December, the company raised Rs 398.26 crore (about $52.7 million) in a financing round led by Temasek.

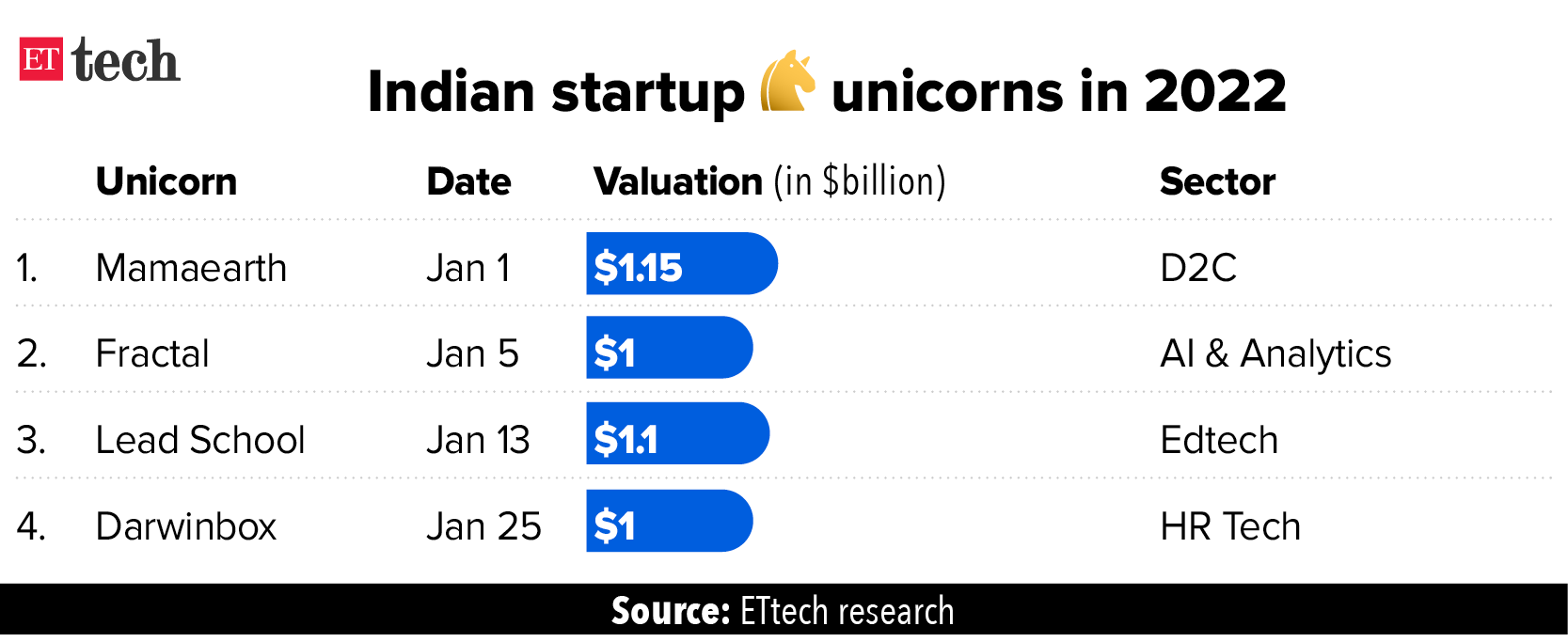

Netflix investor takes Darwinbox to unicorn club

Darwinbox has raised $72 million in a funding round led by Netflix backer TCV at a valuation of more than $1 billion—thus becoming the fourth Indian unicorn so far this year.

US-based investor TCV is known for its bets on major US firms, including Airbnb and Netflix. It had recently backed Indian startups Dream11 and Razorpay.

Darwinbox cofounder Jayant Paleti

About the company: Founded in 2015 by Chaitanya Peddi, Rohit Chennamaneni and Jayant Paleti, Darwinbox provides end-to-end enterprise HR software that enables firms to automate entire employee lifecycles in one HR platform.

Quote: “We are looking to enter the US markets this year. It will be a super force multiplier, but could become a substantial contributor to revenue in the next three-four years,” Paleti said.

Other Done Deals

■ Dentalcare startup Smiles.ai has raised $23 million in a funding round led by Alpha Wave Incubation, along with participation of existing investors Sequoia Capital India and Chiratae Ventures.

■ Chennai-based babycare startup Baby Amore has raised an undisclosed amount from GetVantage to expand its business by providing customers an omnichannel shopping experience, and go aggressive with its brand-building strategy.

■ Raise Financial Services, a fintech startup based in Bengaluru, has received $22 million in a new funding round led by Beenext and Mirae Asset Venture Investments.

Delhi issues draft scheme for regulating aggregators

The Delhi government has issued a draft scheme to regulate the transportation activities of various tech companies, spanning food delivery, mobility and e-commerce, in the National Capital Region.

The regulation applies to all such vehicles plying in Delhi.

The draft was prepared by the transport department in consultation with 40 firms, including Ola, Uber, Flipkart, Amazon, Bluesmart, Bounce, and Ninjacart. All the aggregators will be given a licence to operate in the region.

- It focuses on electrification, bringing transparency in pricing and access to data, like the number of drivers on the road, the quality of vehicles, drivers’ ratings, monitoring movement, and ensuring adequate customer care service is in place is some of the other areas the government is looking to regulate.

The government has given three weeks for public feedback.

Other Top Stories By Our Reporters

NITs track IITs in record placement season: Most offers are coming from IT companies or for tech roles, driving average salaries up. “This is due to high demand (for engineers) and a greater number of recruiters visiting the campus this year,” said Anil Kumar Choudhary, professor-in-charge for training and placement at NIT Jamshedpur. (read more)

Sequoia Surge launches 6th edition with 20 early-stage startups: With the sixth cohort, the Surge community now includes 246 founders from 112 startups across more than 15 sectors, including SaaS, developer tools, cybersecurity, edtech, D2C and fintech. (read more)

Aavishkaar launches $250-million ESG First Fund: The fund will focus on strengthening the environmental, social and governance practice of midcap businesses, while offering them flexible capital to expand to newer markets in Africa and Asia. (read more )

Global Picks We Are Reading

■ Wall Street braces for new streaming reality (Axios)

■ Big Tech headlines key earnings week amid Nasdaq slide (WSJ)

■ Tesla now runs the most productive auto factory in US (Bloomberg)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant. Graphics and illustrations by Rahul Awasthi.