Also in this letter:

■ Sebi clears Delhivery IPO, all you need to know

■ Meesho rolls out ‘gender confirmation’ leave policy

■ Palihapitiya’s SPAC to merge with ProKidney

India PE, VC investments, exit deals at an all-time high for 2021: report

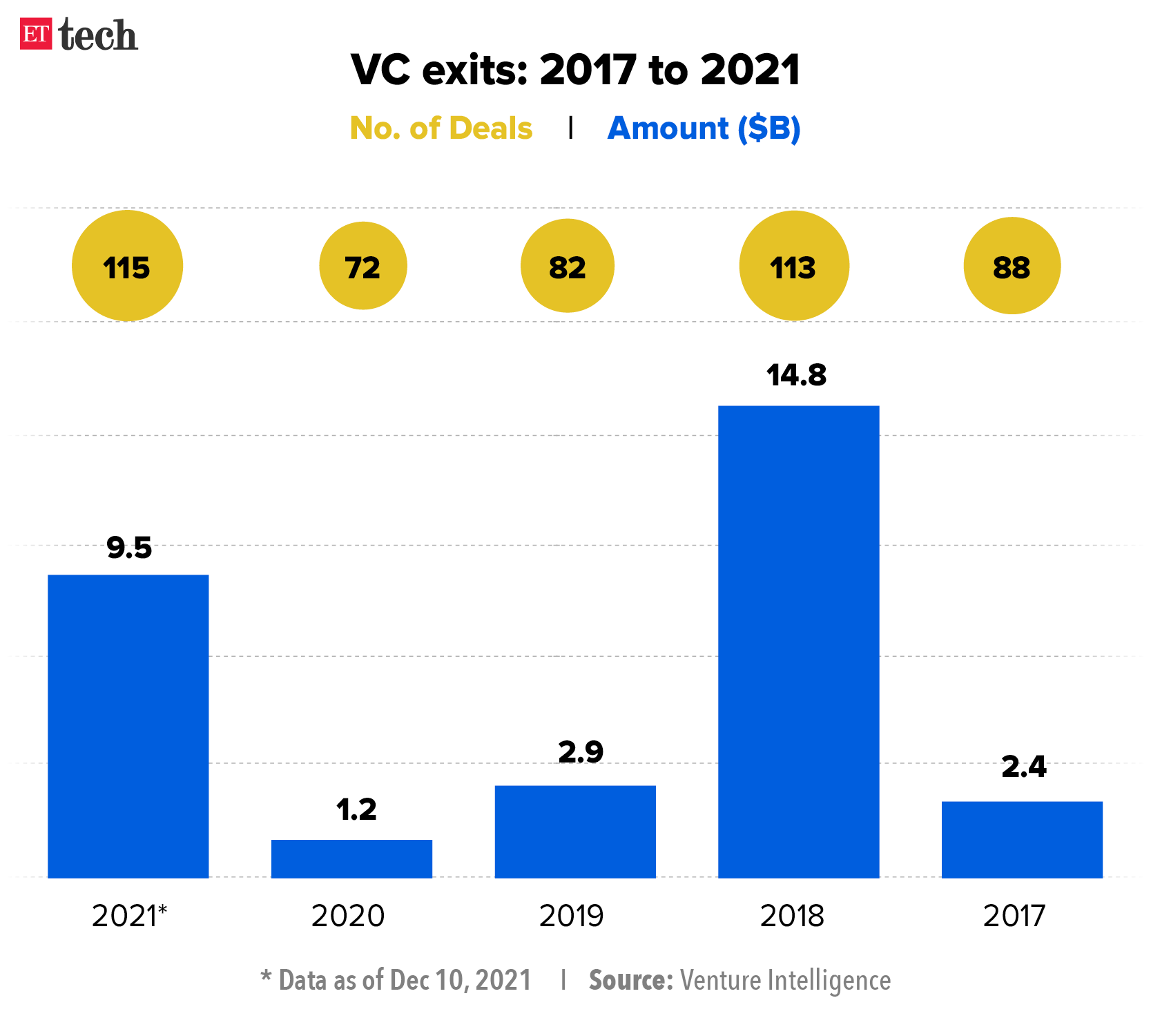

Investment and exit deals hit an all-time high of $77 billion and $43.2 billion in 2021, respectively, an IVCA-EY report said. These investments came across 1,266 deals including 164 large deals worth $58 billion. Exits worth $43.2 billion were made through 280 deals, the monthly PE-VC roundup report said.

Quote: “The aggressive pace of deal making helped drive investment activity across all deal types, sizes and sectors. For the year 2021, PE-VC investments were 62% higher than 2020 (154% higher than 2020, excluding the one-off RIL deals), principally propped up by pure-play PE-VC investments that increased by 79% y-o-y (200% over 2020, excluding RIL deals),” Vivek Soni, partner and national leader private equity services, EY said.

Startups lead the way: The report said investments in startups was the defining feature in 2021. India overtook the UK as the third-largest ecosystem for startups with the year minting as many as 44 unicorns, which are companies valued at $1 billion or more. While most sectors registered a bump up in investments, ecommerce and technology were the top categories each witnessing record levels of capital flows with $15 billion and $14.3 billion being raised by them, respectively.

Exit routes: Exits via sale to strategics were the highest at $16.9 billion (93 deals) in 2021 as large, cash rich corporates as well as PE/VC backed category leaders/platforms used the pandemic induced opportunity to consolidate market share and acquire new capabilities.

Exits via secondary sales were second in line with $14.4 billion recorded across 56 deals.

Also Read: Indian startups clock $9.5 billion via exits, among its largest ever

Expert speak: “Ecommerce, fintech, and edtech were clearly the largest and most mainstream themes of the year. Interest in these areas will continue. We expect SaaS, Consumer tech, and Digital Media to become more prominent next year. We hope new areas such as climate tech will also see more mainstream attention next year,” said Pranav Pai, founding partner, 3one4 Capital.

Sebi clears Delhivery IPO; top takeaways for potential investors

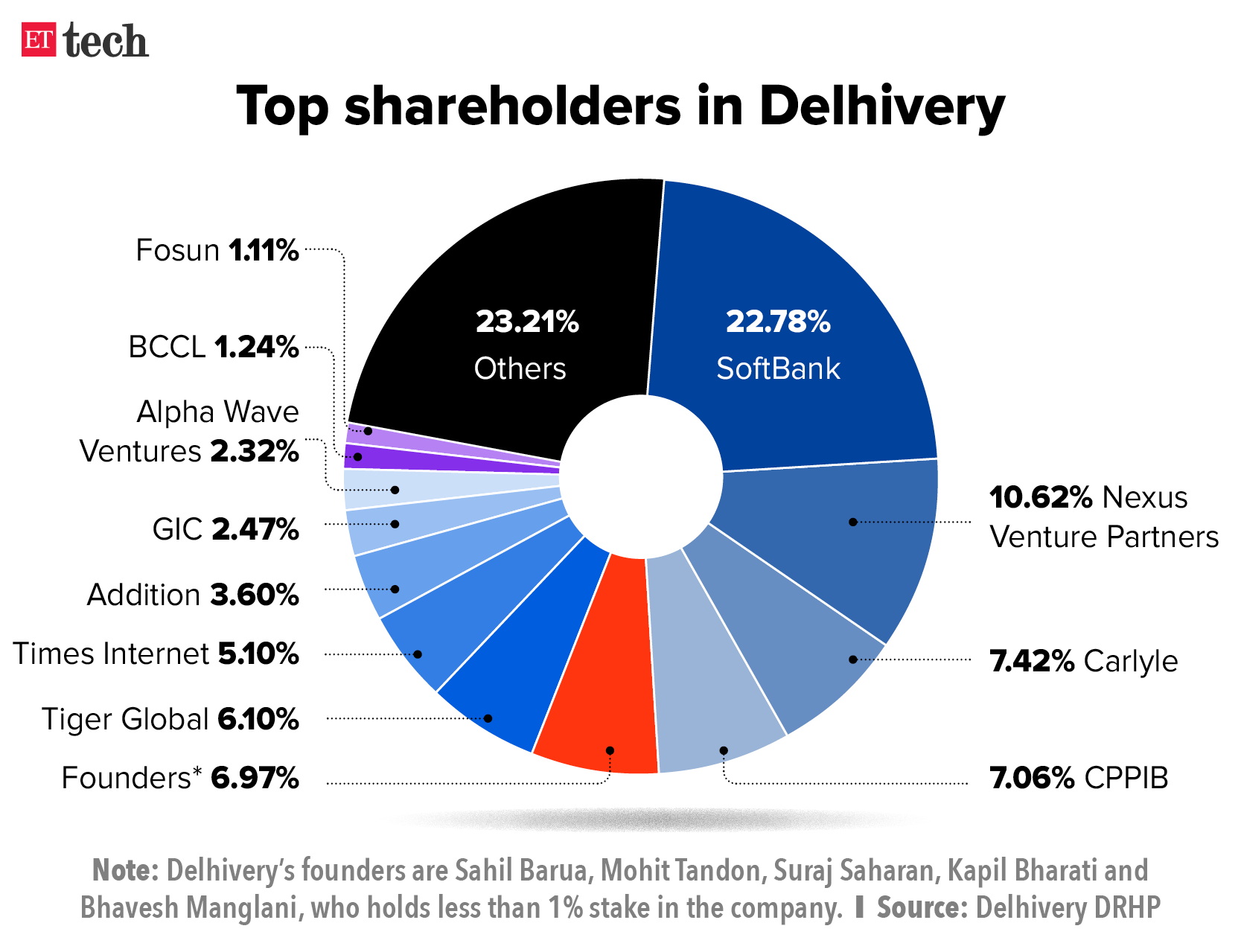

The Securities and Exchange Board of India (Sebi) has cleared new-age logistics player Delhivery’s proposal for an initial public offering (IPO). The markets regulator gave its nod to Delhivery on January 13 and issued its observation letter to the Gurugram-based company, according to a notification issued on Monday evening.

ET first reported last week saying Sebi had approved the proposed Rs 7,460-crore Delhivery IPO.

This makes the Gurugram-based company the first top-tier startup this year to have received clearance to go public.

IPO details: Delhivery, which is backed by SoftBank and Carlyle, said in its draft IPO filing in November that it planned to raise Rs 5,000 crore by issuing new shares. The IPO will also include a Rs 2,460 crore offer-for-sale (OFS) component, it said, in which existing investors will sell some of their shares.

Offloading stakes: These include private equity fund Carlyle, Japan’s SoftBank Vision Fund and Times Internet. Kapil Bharati, Mohit Tandon and Suraj Saharan — who are among the five founders of Delhivery — will also sell shares in the OFS. (Disclosure: Times Internet is part of the Times Group, which also owns ETtech.)

Brokerage firm Motilal Oswal put out a detailed analysis of the company’s core businesses and what holds in the future based on its draft red herring prospectus (DRHP).

Delhivery is growing at 48.5% compound annual growth rate (CAGR) over FY19-21 and has clocked a revenue of Rs 3,646.5 crore in FY21, the report compiled by Motilal Oswal said.

Click here to read the full story

Palihapitiya’s SPAC to merge with ProKidney in $2.6 billion deal

Chamath Palihapitiya, founder and CEO of Social Capital.

A blank-check firm started by serial dealmaker Chamath Palihapitiya and Suvretta Capital is merging with medical technology company ProKidney, Bloomberg reported.

Deal details: Social Capital Suvretta Holdings Corp. III and ProKidney will have a combined equity value of $2.64 billion, the companies said. The transaction also includes a $575 million equity placement that will provide ProKidney with as much as $825 million in cash proceeds, assuming investors in the special purpose acquisition company don’t redeem their shares.

The $575 million private investment in public equity is led by a $125 million investment from Palihapitiya’s Social Capital, and includes $50 million from ProKidney’s existing investors, about $30 million from Suvretta Capital’s Averill strategy and the remainder from institutional investors and family offices, the statement shows.

What will the funds be used for? Proceeds from the transaction will fund the phase three development of the company’s lead product candidate, accelerate manufacturing build-out and ultimately prepare for a global commercial launch.

Quote: “For decades, health-care providers have been limited to addressing the symptoms of chronic kidney disease – largely through burdensome regimens like dialysis – with no cure for the underlying disease,” Palihapitiya said in the statement. “ProKidney has the opportunity to change the way we approach and treat chronic kidney disease.”

Also Read: ETtech Explainer-The phenomenon that is SPACs

Tell me more: ProKidney is developing a technology to treat chronic kidney disease by using the patient’s own cells to restore kidney function, according to its website. The company was started by a group of investors led by Pablo Legorreta, the founder and chief executive officer of Royalty Pharma Plc.

The partnership between Palihapitiya and Suvretta Capital has so far resulted in four SPACs that have each raised $250 million. The SPACs are each targeting a different sub sector within biotechnology: neurology, oncology, organs and immunology.

Tweet of the day

Meesho rolls out ‘gender confirmation’ leave policy

Ecommerce firm Meesho has rolled out a ‘gender confirmation’ leave policy, under which employees looking to transition their gender can get up to one month of paid leave for gender reassignment surgery and other medical procedures.

New age policies: The new policy is an addition to the Bengaluru-based company’s recent initiatives towards driving better inclusivity within the organisation. The firm, which entered the unicorn club last year with a valuation of over a billion dollars, is also looking to allow employees to include same-sex and live-in partners under their insurance coverage.

Quote: “Over the past six months or so, we have been revisiting our policies through a lens of inclusivity and changing them, or adding new ones, when required,” Ashish Singh, chief human resources officer at the Bengaluru-headquartered company which has 1,700-odd employees in India, told ET. “With this new policy, we want to support employees going through gender transition and ensure they have the required time off.”

Setting an example: With this new move, Meesho joins other companies like Cisco, IBM, Amazon, Accenture, Godrej and Sapient that have similar policies.

Diversity experts, however, say there is still a long way to go.

Expert speak: “It’s a year-long process, if not more, of ‘transitioning’ from one gender to another, starting from psychological counselling and hormonal treatments to the different stages of surgery and recovery,” said Shachi Irde, a consultant at Sisa Consulting, which helps companies define their DEI (diversity, equity and inclusion) strategy.

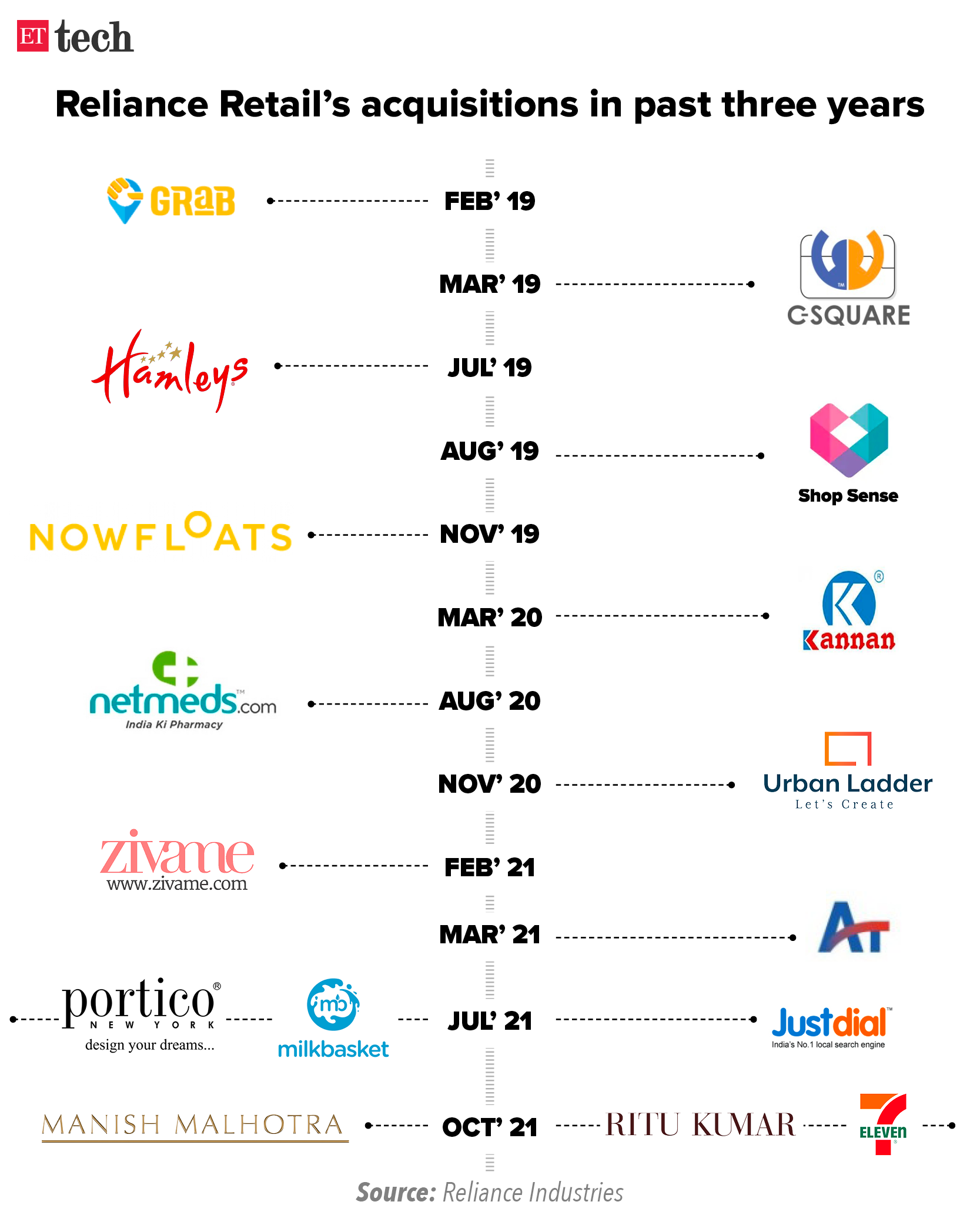

Reliance Retail acquires 54% stake in robotics firm Addverb Technologies

The retail unit of Reliance Industries, Reliance Retail Ventures Ltd, has picked up a 54% stake in robotics company Addverb Technologies for $132 million.

Deal details: This round of funding, a mix of primary and secondary capital, will accelerate the company’s expansion in Europe and US and enable it to set up a large robotic manufacturing facility. With this strategic partnership, the six-year-old company has raised $143 million in all till date. Addverb had previously raised $11 million in funding led by Jalaj Dani, co-promoter of Asian Paints.

“The company is valued at $270 million post this transaction,” Sangeet Kumar, cofounder and CEO, Addverb Technologies said.

How’s the business? Currently, the company is expecting to close the financial year with revenues over Rs 410-415 crore and expects it to grow to Rs 2,000 crore over the next 24 months. Kumar added that he expects the revenue to reach Rs 7,500 crore over the next five years.

Earlier this month, Reliance Retail said it led a $240 million funding round in quick commerce firm Dunzo and now owns 25.8% stake in the Bengaluru-based startup, marking the oil-to-technology conglomerate’s entry into the ultra-fast commerce sector.

Also Read: Mukesh Ambani-led Reliance’s recent deals: From Mandarin Oriental hotel to funding Dunzo

Other done deals

■ Gaming and sports media company Nazara Technologies announced that it has acquired a 55% stake in programmatic advertising and monetisation company Datawrkz. The transaction will value the company at around Rs 225 crore, around $30 million linked to its Ebitda performance for calendar year 2022.

■ Evenflow Brands, an aggregator of third party online sellers, has acquired four consumer brands in India. The acquisition includes two sports and fitness brands Vifitkit and Yogarise, Frenchware, a kitchen label and Cingaro, a gardening brand – all with an annual run rate between $500k- $2 million.

■ Online mentoring platform, MyCaptain, has raised $3 million in a fresh funding round led by Ankur Capital. The round also saw participation from Inflection Point Ventures, Firstport Ventures, IIM Calcutta Angels Network, Singapore Angel Investors and other super angels.The company plans to use the proceeds to scale its course offerings, acquire more users as well as grow its team with a focus on expansion.

■ HUVIAiR Technologies, which provides software solutions for construction projects, has raised $3.2 million (around Rs 23.82 crore) in a funding round led by Chiratae Ventures to expand and grow its business. Other investors SOSV, RMZ Management LLP, and Artesian Venture Partners also participated in the round.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.