Credit: Giphy

Also in this letter:

■ Government employees banned from using VPNs

■ Musk sued for $258B over ‘dogecoin pyramid scheme’

■ Sequoia India grapples with fallout from governance snafus

RBI says digital-only banks would pose systemic risks

The Reserve Bank of India (RBI) has shot down the idea of digital-only banks as they would pose risks to the financial system, governor Shaktikanta Das said on Friday.

Speaking at an event in Mumbai, Das said that there was no proposal at the moment to regulate neobanks and called for existing banks and non-banks to use technology to deliver financial services.

In his words: “We had received suggestions on digital banks, but we felt that the idea came with certain risks. So we have therefore not accepted it at the moment,” Das said.

Last November, government think tank Niti Aayog had proposed setting up digital-only banks.

Eye on BNPL: Das also said while the RBI was keeping a close eye on companies that offer buy-now-pay-later products, it wasn’t keen to regulate the domain just yet.

ZestMoney, Postpe, Simpl, Lazypay are some of the leading BNPL startups while large ecommerce firms like Amazon, Flipkart offer their BNPL services to consumers too.

“Buy-now-pay-later, which is offered by several e-commerce companies, is a lending activity, but we have to be careful and calibrated in our approach and not start interfering everywhere,” the governor said.

Big Tech worries: According to Das the entry of Big Tech into the financial sector also poses concerns.

He said a wide range of companies, in domains such as social media, search engine, ecommerce and even ride hailing, have started offering financial services.

“These companies have an enormous amount of data which has helped them offer tailored financial services to entities or individuals lacking credit history or collateral,” he said.

Also Read | Explained: Neobanks, the next evolution of banking

Govt employees banned from using VPNs

The Indian government has barred its employees from using third-party virtual private networks (VPN) offered by companies such as NordVPN and ExpressVPN.

They are also banned from using Tor and other anonymisation services.

Tor is free and open-source software that directs Internet traffic through a free volunteer overlay network to conceal a user’s location and usage from anyone performing network surveillance or traffic analysis.

The directive also urges government employees not to save “any internal, restricted or confidential government data files on any non-government cloud service such as Google Drive or Dropbox”.

Catch up quick: The mandate comes just days after ExpressVPN, Surfshark and NordVPN said they were shutting down their servers in India in protest against the Indian Computer Emergency Response Team’s (Cert-In) new rules.

These rules require VPN companies to store names, addresses and other details of every customer for five years and hand them over to the government when asked to.

Govt’s rationale: The National Informatics Centre (NIC), which is under the Ministry of Electronics and Information Technology, said it had put out the new guidelines for government employees to improve the government’s “security posture”.

There’s more: The NIC also asked government employees to not ‘jailbreak’ or ‘root’ their mobile phones or use any external mobile app-based scanner services such as CamScanner to scan “internal government documents”.

CamScanner was among several Chinese apps the government banned in July 2020 following border hostilities between the two countries.

Tweet of the day

Elon Musk sued for $258 billion over ‘dogecoin pyramid scheme’

Created in 2013 as a ‘joke’, dogecoin has become one of the most popular crypto tokens in the past two years thanks in large part to Elon Musk, who has repeatedly tweeted about the meme-based crypto.

Now, Musk is being sued for a whopping $258 billion by a man who claims he used his power and influence to run a ‘dogecoin pyramid scheme’.

What’s the matter? Plaintiff Keith Johnson accused Musk of racketeering for repeatedly touting dogecoin and driving up its price, only to let it tumble later.

Johnson said, “Defendants were aware since 2019 that dogecoin had no value, yet promoted dogecoin to profit from its trading; Musk used his pedestal as the world’s richest man to operate and manipulate the dogecoin pyramid scheme for profit, exposure and amusement.”

Johnson is seeking $86 billion in damages, representing the decline in dogecoin’s market value since May 2021, and wants it tripled.

Twitter love story: Dogecoin gained prominence in 2021 after the Tesla CEO repeatedly tweeted about it.

“That’s why I’m pro Doge”, he tweeted in response to dogecoin creator Shibetoshi Nakamoto’s tweet saying his goal was to “build stuff and make money and have fun”.

Musk has also said he believes that the meme crypto token has the potential to become a currency.

The value of dogecoin jumped about 27% after Twitter announced it struck a takeover deal with Musk in April. Musk has hinted at integrating dogecoin with Twitter and that he has been working with dogecoin’s team to improve system efficiency.

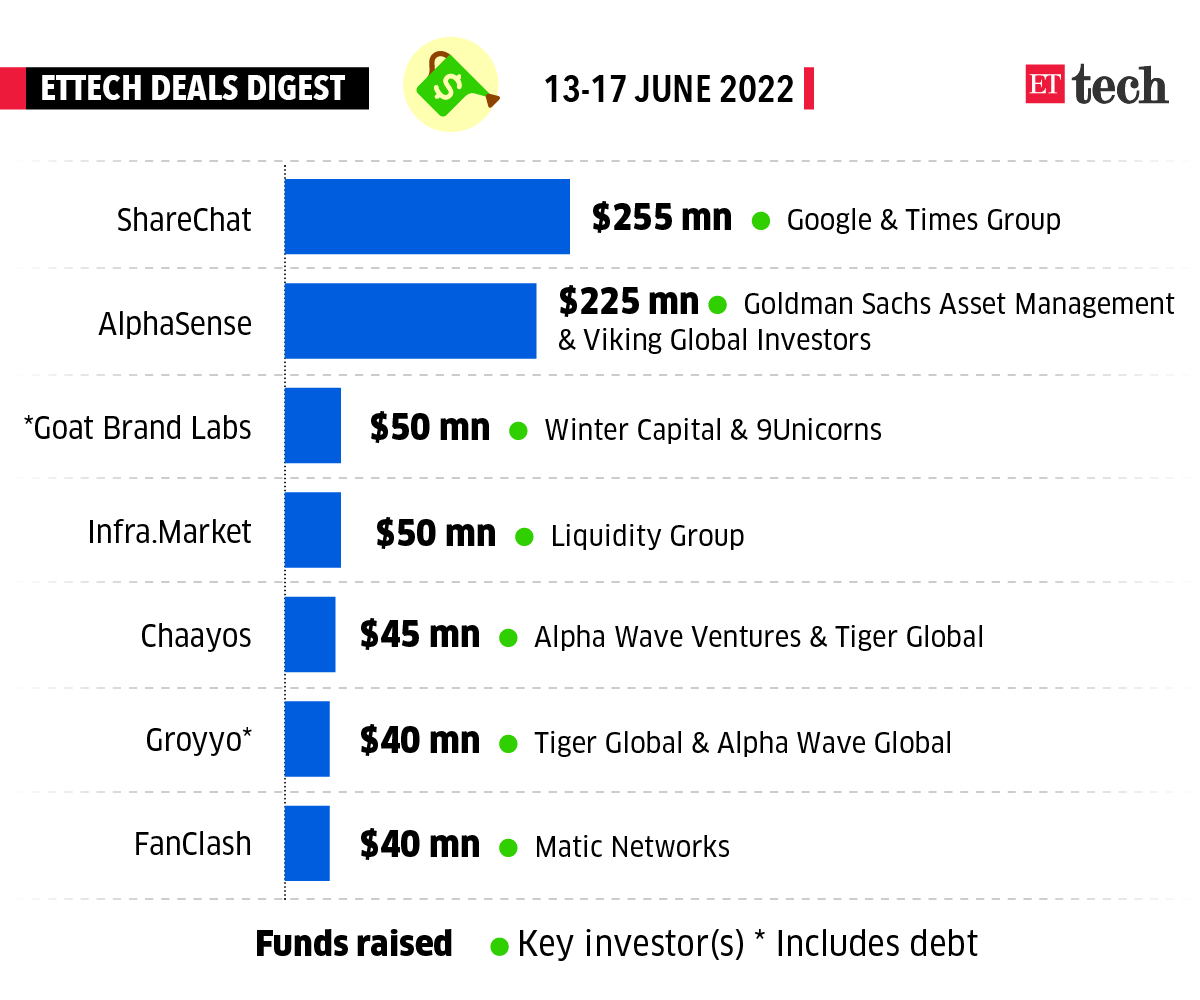

ETtech Deals Digest

Despite an overall slowdown in large funding rounds, some startups are still attracting interest from investors. ShareChat and AlphaSense were two startups that raised big rounds this week, while Infra.Market, Chaayos and others raked in smaller sums.

Here is a full list of all deals this week.

Sequoia India grapples with fallout from governance snafus

Sequoia, a major venture capital player in India, is still grappling with complaints from startups about damaged trust and a defamation lawsuit by a former general counsel. The closing of its $2.8-billion India and South East Asia fund was delayed due to a governance issue.

Two-month lull: Caught out early this year by governance scandals at startup companies in its portfolio, Sequoia Capital’s India partners had assured investors at an April meeting in London that these “lowlights” were mostly behind it.

It promised it would respond ‘strongly’ against ‘wilful misconduct and fraud’ after several of its high-profile startups, such as fintech firm BharatPe, social commerce firm Trell and Singapore-based business-to-business (B2B) ecommerce firm Zilingo came under the scanner for alleged lapses in corporate governance and financial irregularities.

Out of the loop: But the CEO of a Sequoia-funded startup, who declined to be identified, said the company had not kept them in the loop about governance-related issues that made headlines in India — and worried that the incidents could reflect poorly on them as well.

“As an entrepreneur you raise money from Sequoia because of their reputation to work with founders closely,” the CEO said.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant and Aishwarya Dabhade Mumbai. Graphics and illustrations by Rahul Awasthi.