Credit: Giphy

Also in this letter:

■ Amazon India to remove Cloudtail as a seller soon

■ Unacademy plans retail stores in omnichannel push

■ India’s crypto brain is ‘absolutely crazy’: Polygon founder

RBI tells Paytm Payments Bank to stop taking on new customers

The Reserve Bank of India (RBI) on Friday directed Paytm Payments Bank to stop onboarding new customers immediately.

Concerns: The central bank also told the bank to appoint an audit firm to conduct a comprehensive system audit of its IT system. It said the action was based on “certain material supervisory concerns observed in the bank”.

- “Onboarding of new customers by Paytm Payments Bank Ltd will be subject to specific permission to be granted by RBI after reviewing reports of the IT auditors. This action is based on certain material supervisory concerns observed in the bank,” the central bank said.

Paytm Payments Bank Ltd is a joint venture between Paytm parent One97 Communications, which holds 49%, and Paytm founder Vijay Shekhar Sharma, who holds the remaining 51%.

It reported revenue of Rs 1,987.45 crore for the financial year 2020-2021 (FY21), down from Rs 2,110 crore in FY20.

Amazon India to remove Cloudtail as a seller ‘in about a month’

Amazon will shut Cloudtail as a seller on its platform in India in about a month.

Catch up quick: This comes after the Competition Commission of India (CCI) approved Amazon’s bid to acquire Cloudtail parent firm Prione Business Services, which is a joint venture between the US firm and Catamaran Ventures, NR Narayana Murthy’s investment office.

The contract between Amazon and Catamaran expires on May 19, but Amazon is now expected to close Cloudtail before that, sources told us.

Catamaran holds 76% in Prione while Amazon holds the rest. Amazon used to hold 49% in Prione in 2019 but to comply with the new foreign direct investment rules on ecommerce, it was forced to reduce its stake to 24%.

Significance: Cloudtail plays a critical role in helping Amazon India service the bulk of orders quickly. While Amazon India has been trying to reduce its dependency on Cloudtail following the tightening of FDI rules on ecommerce, it remains one of the largest sellers on the platform.

The current thinking of people briefed on the matter is that Amazon is unlikely to set up another joint venture to house a seller similar to Cloudtail.

Existing regulations prohibit an entity running an online marketplace and its group companies from owning equity in any of the sellers on its platform or having control over their inventory.

Smaller online sellers and offline traders have long complained that Amazon is partial to large sellers like Cloudtail.

Unacademy plans retail stores for omnichannel push

Gaurav Munjal, cofounder, Unacademy

Edtech platform Unacademy is venturing offline and plans to launch physical stores across the country.

Details: Unacademy has already opened its first such outlet in New Delhi. It plans to open three more ‘experience zones’ in Kota, Jaipur and Lucknow over the next six weeks.

- At these outlets, the company will help students and parents who aren’t yet on the platform get a better understanding of its offerings and subscription models.

- Existing Unacademy users will also be able to meet their teachers at these locations. They will also have a counselling area, a library and classrooms.

- But the focus will be on omnichannel retail and not on hybrid learning.

We have no plans of entering a hybrid-learning model yet,” said Gaurav Munjal, chief executive officer and cofounder, Unacademy Group.

Byju’s offline push is different: Archrival Byju’s also recently announced aggressive plans for its offline play with the launch of Byju’s Tuition Centre. In 2021 the company launched 80 offline centres in 23 cities and is looking to increase that to 500 centres across 200 cities this year.

Unlike Unacademy, Byju’s offline foray is focused on hybrid learning. It conceptualised its offline foray last year after acquiring tutorial chain Aakash Education Services for an estimated $950 million.

IPO down the road: Munjal also said Unacademy plans to file for an initial public offering in the coming years, and is currently focussing on turning its core test prep business profitable in the next 12 months.

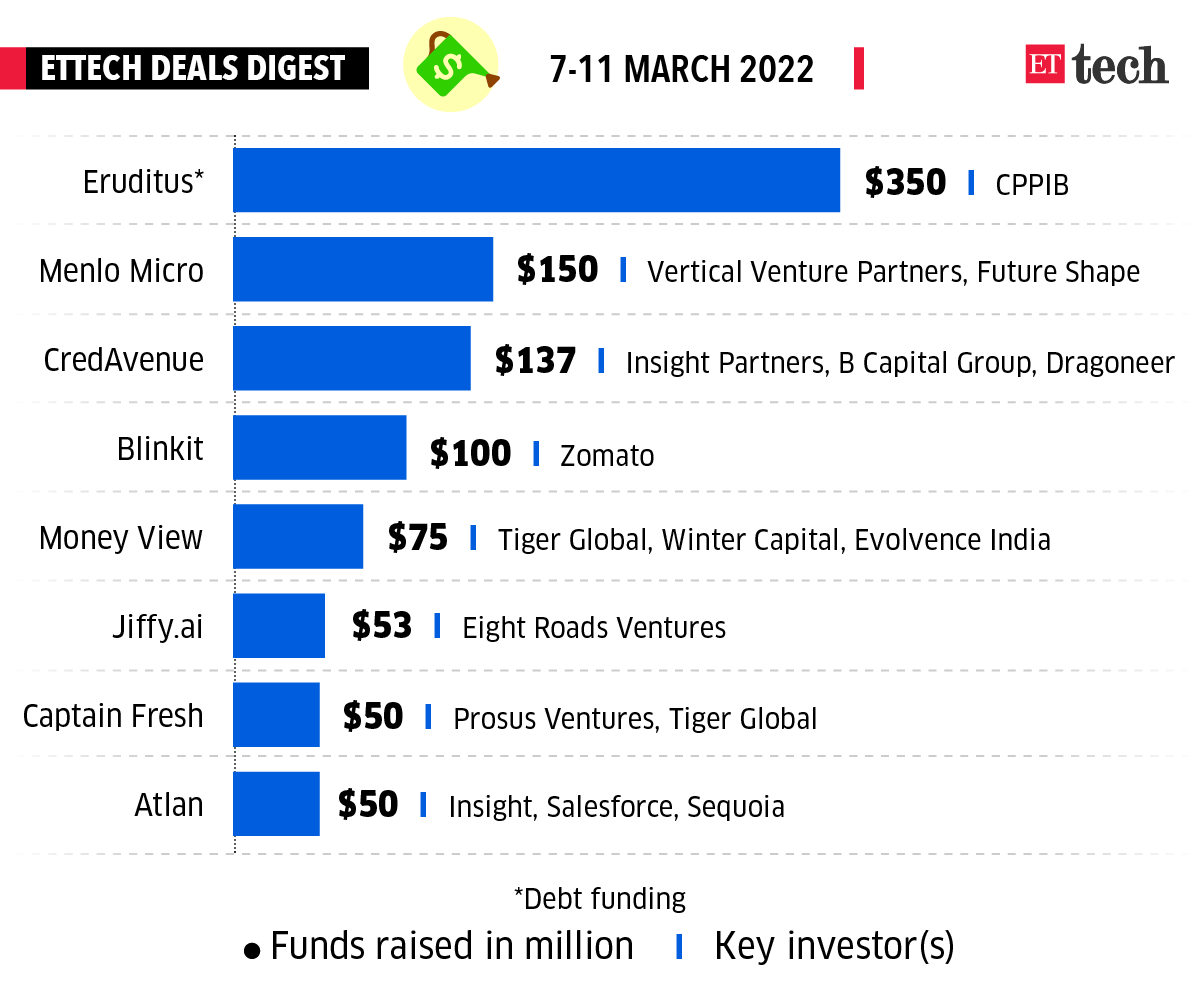

ETtech Deals Digest

SoftBank-backed executive education-focussed startup Eruditus, technology company Menlo Micro and online debt marketplace CredAvenue were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

India’s crypto brain is ‘absolutely crazy’, says Polygon’s Sandeep Nailwal

Polygon cofounder Sandeep Nailwal

India’s dithering on whether to embrace digital assets is causing thousands of developers, investors and entrepreneurs to leave for places with more friendly regulation, according to the cofounder of crypto startup Polygon.

- “The brain drain is absolutely crazy,” Polygon cofounder Sandeep Nailwal said.

Crypto haven: Nailwal, who cofounded Polygon in 2017, relocated to Dubai two years ago. The emirate is aspiring to be a crypto hub for the Middle East and on Wednesday, it adopted a law for regulating digital assets.

Also Read: Why crypto firms are on a flight to Dubai

Regulatory limbo: India, with an estimated 15 million active crypto users, has been stuck in regulatory limbo since the Supreme Court in 2020 overturned a central bank ban on digital tokens. The government this year unveiled a tax on crypto transactions without formally declaring that it won’t ban them in the future, a move that was emblematic of the confusion.

Potential powerhouse: India has the potential to be a crypto powerhouse. Its population of 1.4 billion people skews young, with a growing, well-educated middle class. That, combined with a less-developed traditional financial system, has led to the world’s second-highest crypto adoption rate behind Vietnam, according to blockchain research firm Chainalysis. Overall crypto transactions jumped 641% between July 2020 and June 2021, Chainalysis said in an October report.

Yes, but: Even as Indians embrace digital assets and the government warms to the potential for tax revenue, the industry still faces determined opposition from the central bank.

RBI governor Shaktikanta Das last month compared the asset class to the 17th-century Dutch tulip market bubble, and a few days later his deputy said cryptocurrencies are akin to Ponzi schemes, threaten financial stability and should be banned.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.