Credit: Giphy

Also in this letter:

■ Lenskart buys Japan’s Owndays in $400 million deal

■ Ankiti Bose steps down from to Zilingo board

■ Zomato’s losing streak wipes out nearly Rs 12k crore in four days

Cryptocurrencies a ‘clear danger’ to financial systems: RBI governor

Reiterating his long-held stance against cryptocurrencies, Reserve Bank of India (RBI) governor Shaktikanta Das said in the 25th issue of the RBI’s Financial Stability Report (FSR) that “we must be mindful of the emerging risks on the horizon”.

Sophisticated speculation: “Cryptocurrencies are a clear danger. Anything that derives value based on make-believe, without any underlying asset, is just speculation under a sophisticated name,” Das said in the foreword of the report released on Thursday.

“While technology has supported the reach of the financial sector and its benefits must be fully harnessed, its potential to disrupt financial stability has to be guarded against. As the financial system gets increasingly digitised, cyber risks are growing and need special attention.”

Drastic measures: The report, which reflects the collective assessment of the sub-committee of the Financial Stability and Development Council (FSDC) on risks to financial stability and the resilience of the financial system, said crypto assets are seen as a growing threat that warrants drastic approaches by national authorities.

It noted that global regulatory efforts continue to focus on risks associated with the crypto ecosystem and the “threat of decentralisation”.

Terra collapse: The report also mentioned to collapse of Terra blockchain’s native token Luna in May, which erased over $40 billion of investor wealth.

Also Read: EU seeks tough crypto regulations

Bitcoin set for biggest quarterly drop since 2011: Meanwhile, bitcoin is on track to post its worst quarterly performance in over a decade, as aggressive rate hikes by the US Federal Reserve and recent market turmoil continue to weigh down on the cryptocurrency, Bloomberg reported.

The world’s largest cryptocurrency is 59% down since April — its largest three-month fall since the third quarter of 2011, when it was still in its infancy.

Bitcoin shed another 5% on Thursday, leaving it hovering just above $19,000.

Also read: SEC rejects Grayscale’s spot bitcoin ETF

Tweet of the day

SoftBank-backed Lenskart buys Japan’s Owndays in $400 million deal

Lenskart, the Softbank-backed omni-channel eye-wear retailer, has picked up a majority stake in Owndays – a Japanese direct-to-consumer eyewear brand – the company said. The strategic partnership through this merger will build Asia’s largest omni-channel eyewear retailer, Lenskart added.

Details: The deal is estimated to value Owndays at around $400 million, a source told us. The company declined to disclose the deal size.

The majority shareholders of Owndays – L Catterton Asia and Mitsui & Co., Principal Investments – will sell their stakes to Lenskart as part of the deal.

Owndays cofounders Shuji Tanaka and Take Umiyam will continue as shareholders and lead the management team of Owndays after the deal. It will continue to operate as a separate brand.

ETtech Done Deals

■ Revenue-based finance platform GetVantage raised $36 million in a funding round led by Varanium Nexgen, Fintech Fund, Chiratae Ventures and a few others. It will use the fresh funds to improve its tech, scale its products and venture across Southeast Asia.

■ AquaExchnage, a fintech platform catering to India’s shrimp and fish ecosystem, raised $3 million from Endiya Partners, Accion Venture Lab and a few others. Started in 2020 by Pavan Kosaraju, AquaExchange offers a fintech-enabled e-commerce platform that provides manufacturers with high-quality materials at affordable prices and a ‘hardware-as-a-service’ platform.

■ Urvann, a gardening-focused hyperlocal marketplace, raised Rs 3 crore in a seed funding round led by Inflection Point Ventures (IPV). It plans to use the fresh funds to expand its operations.

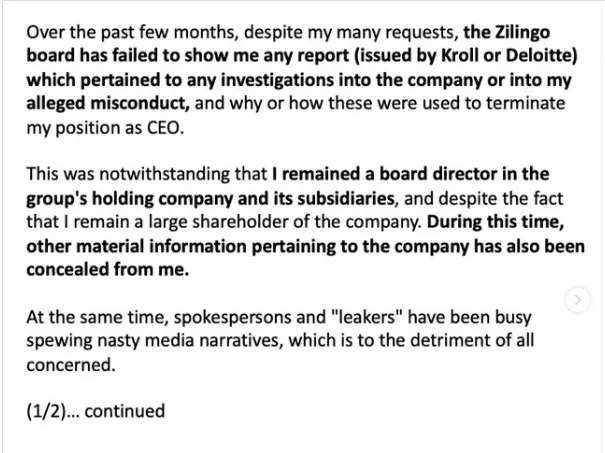

Ankiti Bose steps down from to Zilingo board

Ankiti Bose, the cofounder and former CEO of beleaguered B2B ecommerce firm Zilingo has resigned from her directorships at the company owing to “opacity of information”, she announced in an Instagram post on Thursday.

Credit: Instagram

Zilingo sacked Bose on May 20 after suspending her earlier for alleged financial irregularities, capping a long drawn-out dispute between the Singapore firm’s shareholders, board and cofounder.

The financial discrepancies in its accounting were allegedly discovered during a due diligence process for a new funding round, we reported on April 12.

Bose, who worked at Sequoia Capital India before starting Zilingo, had called her suspension a ‘witch hunt’.

Soon after she was sacked, she told us in an interview that she was not given a chance to answer any of the allegations levelled against her, and that “there is more to this allegation, suspension, termination saga”.

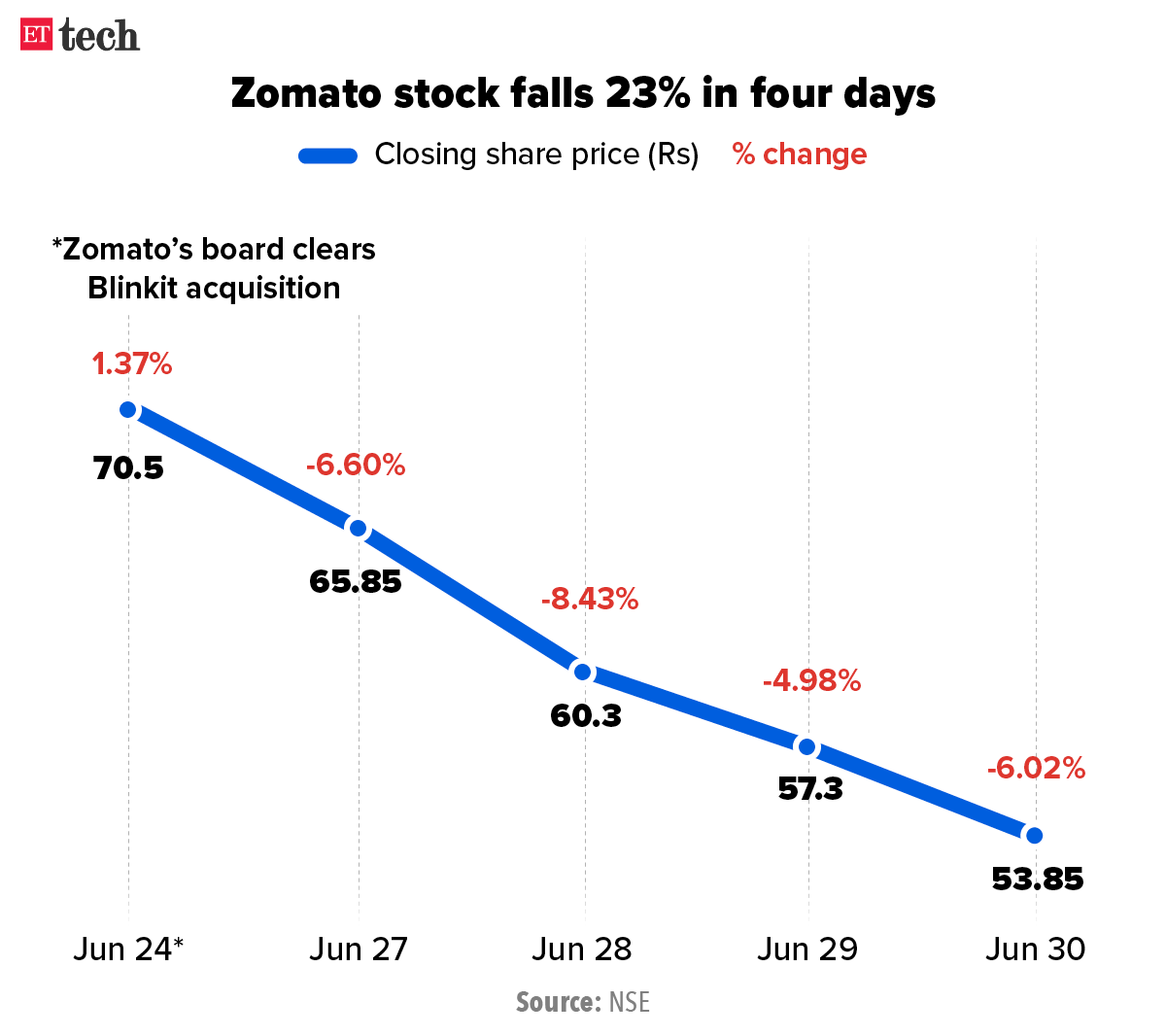

Zomato’s losing streak wipes out nearly Rs 12,000 crore in four days

Shares of food delivery giant Zomato fell for the fourth successive day on Thursday, wiping out about Rs11,680 crore of investors’ wealth as analysts’ concerns about its Rs 4,447.5 crore Blinkit acquisition continued to weigh on the stock.

Zomato shares ended the day over 5% down to Rs 54 — about 23% down since last Friday and a massive 67% below its 52-week high of Rs 169.10 last November. The company’s market capitalisation stands at Rs 35,686 crore.

Low hopes: Experts believe Blinkit’s high cash burn will impede Zomato’s path to profitability as it tries to gain a foothold in the fiercely competitive quick-commerce market.

Swiggy Esop liquidation: Meanwhile, rival Swiggy announced that its employees would have the option to receive liquidity of up to $23 million against their stock options — marking the first milestone in its two-year liquidity plan.

Over 900 employees will be eligible to participate in the program, Swiggy announced last year. The next round will be held in July 2023 and will likely have over 1,800 eligible employees.

Also read | ETtech Explainer: What are Esops and what do they mean for employees and employers?

Intuit is closing Quickbooks in India

Global technology giant Intuit will shut down its financial management suite Quickbooks in India on January 31, 2022, as per a company email.

Quickbooks, which offers services like cloud accounting, invoicing, inventory and cash flow management, launched in India in 2012. The company has about four million customers globally, with less than 1-2% in India. Its local competitors are Zoho and Tally.

Details: “As of July 1, 2022, no new sign-ups to QuickBooks products in India will be accepted. Prior to July 31, all existing customers will be switched to a free subscription that will enable them to continue using QuickBooks until January 31, 2023, with no charges applied. Customers who paid an annual subscription will receive a pro-rata refund for the unused part of their subscription,” a company executive told us.

Quickbooks’ exit from India won’t affect Intuit, which employs around 14,200 people globally and reported a revenue of $9.6 billion last year.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.