Also in this letter:

■ Byju’s bags math platform GeoGebra for $100 million

■ RBI looks to make digital payments more affordable

■ 37% of Indian firms use outdated cybersecurity tech: report

Cybersecurity, digital fraud are major challenges for digital currency: RBI

Reserve Bank of India (RBI) governor Shaktikanta Das said on Wednesday that cybersecurity and digital fraud were major areas of concern in rolling out a central bank digital currency (CBDC).

What’s a CBDC? A central bank digital currency is a virtual form of a country’s fiat currency – a digital version of bank notes. CBDCs are not cryptocurrencies. In some ways, they are the complete opposite.

The RBI is in the process of launching a pilot for digital currency but Das said that the central bank needs to first set up a robust system to thwart cyber fraud before any launch.

RBI deputy governor T Rabi Shankar said the CBDC would comprise separate wholesale and retail portions. While most of the work on the wholesale part has been done, the RBI needs more time for the retail part, he said.

Retail vs wholesale CBDC: A retail CBDC would be used like a digital extension of cash by people and companies, while a wholesale CBDC could be used only by permitted institutions as a settlement asset in the interbank market.

Australia to regulate crypto: On Wednesday, Australia became the latest country to announce plans to regulate cryptocurrencies. It said it would create a licensing framework for crypto exchanges and consider launching a retail central bank digital currency as well.

The move would represent the biggest overhaul of Australia’s $463 billion-a-day payments industry in 25 years.

The use of cryptocurrency and non-cash payments has exploded in Australia during the pandemic as people’s lives shifted online. The number of Australians transacting in cryptocurrency has surged 63% so far this year, compared with last year.

The country will also broaden its payment laws to cover online payment providers such as Apple and Google, as well as buy-now-pay-later (BNPL) providers such as Afterpay, which until now have run without direct supervision.

Visa launches crypto advisory service: Meanwhile Visa, the world’s largest payment processor, has launched a global crypto advisory service for clients such as banks and merchants. The company’s latest offering is geared towards:

- Financial institutions eager to attract or retain customers with a crypto offering

- Retailers looking to delve into non-fungible tokens (NFTs)

- Central banks exploring digital currencies

Services include educating institutions about cryptocurrencies, allowing clients to use the payment processor’s network for digital offerings, and helping manage backend operations.

Visa currently uses its network to allow buying, selling, and custody of digital currency. It also offers a credit card that lets users earn Bitcoin on purchases and also allows the use of USD Coin, a stablecoin cryptocurrency whose value is pegged directly to the US dollar, to settle transactions on its payment network.

In demand: A new global study by Visa showed that nearly 40% of crypto investors surveyed would be likely or very likely to switch their primary bank in the next 12 months to one that offers crypto-related products. However, for cryptocurrencies such as Bitcoin to be used as a medium of exchange, price stability is needed, Visa’s chief financial officer Vasant Prabhu said.

Byju’s bags math platform GeoGebra for $100 million

Byju Raveendran, cofounder, Byju’s

Edtech firm Byju’s said on Wednesday that it has acquired Austria-headquartered GeoGebra. While the company did not disclose the size of the deal, people briefed on the matter told us it was a $100 million cash-and-stock deal.

Under the terms of the deal, GeoGebra will continue to operate as an independent unit within the Byju’s group under the leadership of its founder Markus Hohenwarter. GeoGebra, with an expanding community of over 100 million learners across more than 195 countries, has a dynamic, interactive and collaborative mathematics learning tool, Byju’s said.

“This acquisition complements Byju’s overall product strategy and integrates GeoGebra’s capabilities to enable the creation of new product offerings and learning formats to its existing mathematics portfolio,” the company added.

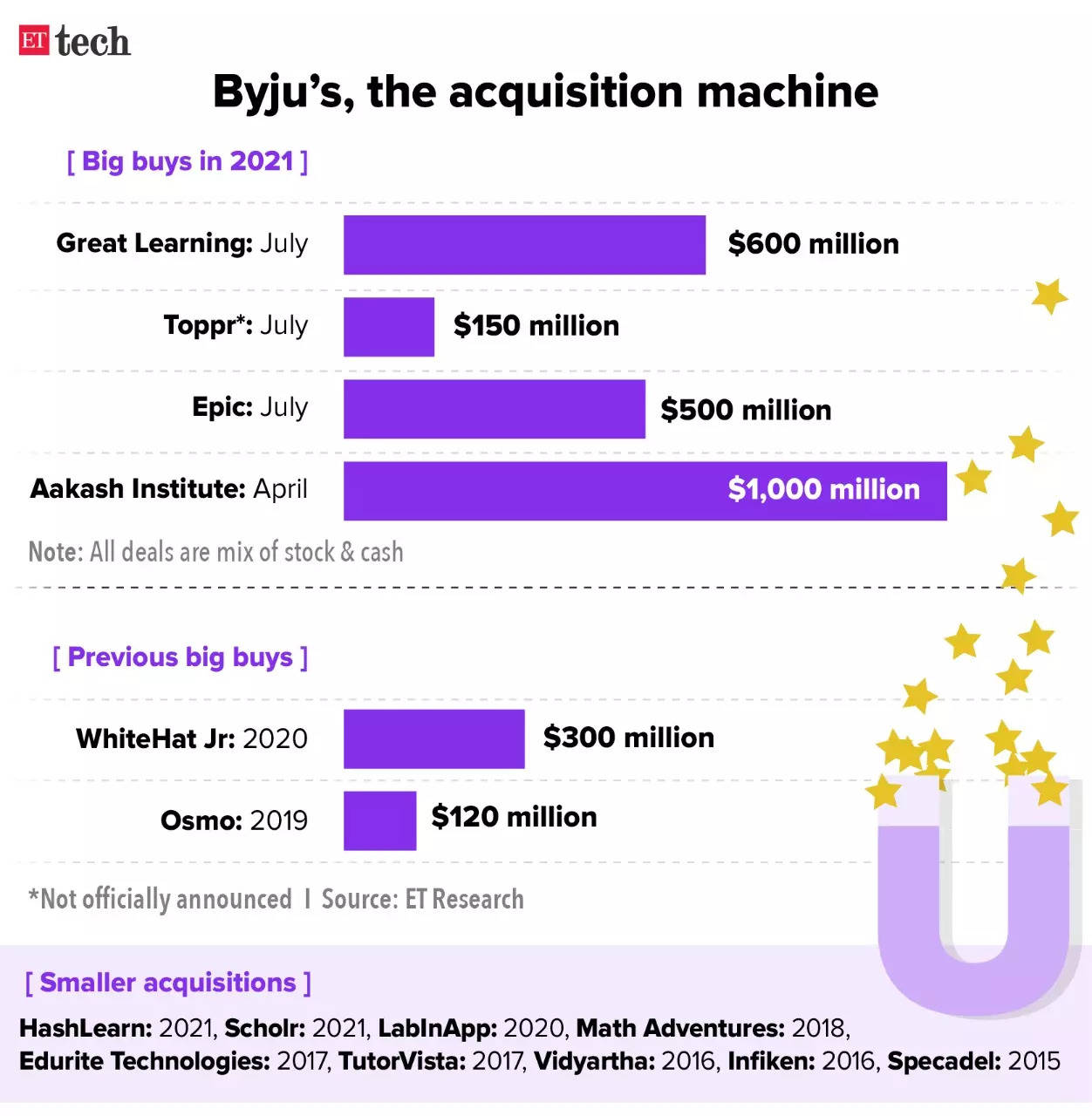

Buy-buy-buy: Byju’s has already spent more than $2 billion on acquisitions this year, including $1 billion on brick-and-mortar coaching network Aakash Institutes in April, a $500 million on kids’ learning platform Epic in July, and $600 million on Great Learning. In September, it acquired US-based coding platform Tynker for $200 million.

India’s highest-valued startup at $18 billion, the company raised $1.2 billion via a term loan from the overseas market last month.

Other done deals

■ Ola Electric has raised Rs 398.26 crore (about $52.7 million) in a financing round led by Temasek, regulatory filings sourced from Tofler showed. According to the filings, Ola Electric has allotted 371 Series C preference shares at an issue price of Rs 1.07 crore each to raise Rs 398.3 crore in the round.

■ Direct-to-consumer dental-tech startup Snazzy said it has raised a $2.2 million in a funding round from YCombinator, Form Capital, Goodwater Capital, and ANIM Fund. The funding round also saw participation from angel investors such as CRED founder Kunal Shah, Bobby Goodlatte (Stripe and coinbase angel investor), Verod Capital partner Eric Idiahi, and others.

■ Exponent Energy, a startup developing fast-charging battery and charger technology for electric vehicles, has raised $5 million in funding led by YourNest VC, along with participation from 3one4 Capital, AdvantEdge VC and automotive component maker Motherson Group.

■ Social commerce startup Stage3 announced that it has raised Rs 20 crore in a funding round co-led by Inflection Point Ventures and LC Nueva Investment Partners LLP along with Let’s Venture and Stanford Angels. Blume Ventures, Stage3’s existing investor has also participated in the round.

■ Logistics services provider Delhivery said it has acquired Transition Robotics Inc (TRI), a California-based company focused on developing Unmanned Aerial System (UAS) platforms. The deal size was not disclosed.

Tweet of the day

RBI looks to make digital payments more affordable

The RBI is set to form a panel to study the charges on digital payments and find ways to make them “more affordable”.

Why? The move signals that the central bank isn’t happy with the current charges, which many believe are too high, given the surge in online payments since the start of the pandemic last year.

The plan: The RBI said it would release a discussion paper on various charges levied by banks and institutions for digital transactions through credit cards, debit cards, wallets and the Unified Payments Interface (UPI) “to have a holistic view of the issues involved and possible approaches to mitigating the concerns to make digital transactions more affordable”.

What else? The central bank also said it would launch UPI-based payment products for feature phone users. It said it would also help make small-value UPI transactions simpler through the use of an ‘on-device’ wallet in UPI apps.

It also proposed to enhance the transaction limit for payments through UPI for initial public offering (IPO) applications and the retail direct scheme for investment in government securities from Rs 2 lakh to Rs 5 lakh.

More than one in three Indian firms use outdated cybersecurity tech: report

A report by Cisco has found that 37% of Indian companies use cybersecurity technology that’s considered outdated by security and privacy professionals working at these very organisations.

Respondents from India also considered their companies’ cybersecurity infrastructure to be unreliable and complex, with 33% and 40%, respectively, saying so in the survey.

Nearly 89% of respondents in India said their company was investing in a ‘zero trust’ strategy, with 44% saying their organisation was making steady progress in adopting it and 45% saying they were at an advanced state of implementing it.

And 88% of respondents said their company was investing in Secure Access Service Edge (SASE) architecture, with 44% making good progress with adoption and a similar number saying their implementation is at mature levels.

These two approaches are crucial to building a strong security posture for companies in the modern cloud-first and application-centric world.

Quote: “Cisco’s Security Outcomes Study indicates where the biggest gaps lie in India Inc.’s cybersecurity posture. In response, nearly 60% of companies are expanding their investments in cloud-based security technology plans. As they ramp up these efforts, they must focus on building a robust cloud-based, integrated, and highly automated architecture to ensure agility and intelligence in threat remediation and enable visibility and management of newly distributed users and applications,” said Vishak Raman, director, security business, Cisco India and SAARC.

AWS outage hits major websites, streaming apps in the US

A major outage disrupted Amazon’s cloud services earlier today, temporarily knocking out streaming platforms Netflix and Disney+, Robinhood, a wide range of apps and Amazon’s own ecommerce website in the US.

“Many services have already recovered, however we are working towards full recovery across services,” Amazon said on its status dashboard.

Amazon’s Ring security cameras, mobile banking app Chime and robot vacuum cleaner maker iRobot, that use Amazon Web Services (AWS), reported issues according to their social media pages.

Trading app Robinhood, Walt Disney’s streaming service Disney+ and Netflix were also down, according to Downdetector.com.

“Netflix, which runs nearly all of its infrastructure on AWS, appears to have lost 26% of its traffic,” Doug Madory, head of internet analysis at analytics firm Kentik, said.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.