Also in the letter:

■ Govt eases imports for mobile phone parts

■ Microsoft, Google report earnings

■ PB Fintech shares cross IPO price after 2 years

RBI bars Paytm Payments Bank from offering banking services effective February 29

Paytm founder Vijay Shekhar Sharma

In perhaps one of the toughest actions against a listed banking entity in recent times, the RBI has barred fintech major Paytm from offering all forms of banking services to its customers within a month, due to major compliance issues.

Driving the news: In a notification issued Wednesday, the RBI has barred Paytm Payments Bank from all basic payment services including Unified Payments Interface (UPI), Immediate Payment Service (IMPS), Aadhaar-enabled payments and bill payment transactions, effective February 29.

It has also barred the bank from accepting deposits and credit transactions or any form of top-ups in its wallets after February 29. Customers can withdraw or use funds till the time any balance is available in their Paytm bank accounts.

Nodal accounts: According to the RBI order, it has directed the nodal accounts of One 97 Communications Ltd and Paytm Payments Services to be terminated at the earliest, in any case not later than February 29, 2024. This is of significance and unprecedented, several industry executives said.

“When you make a payment to merchant, it goes to nodal account and then later moved to merchant account. RBI is saying this nodal account also needs to be terminated — which is an extremely rare directive,” a top fintech founder aware of the implication of the RBI directive said.

Rationale: The banking regulator said it found major compliance issues in the company. “The comprehensive system audit report and subsequent compliance validation report of the external auditors revealed persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action,” the notice read.

The RBI had asked Paytm Payments Bank to stop onboarding new customers in March 2022.

Continuing duress: This comes weeks after Paytm had to scale down its buy-now-pay later (BNPL) product Paytm Postpaid, and take a cautionary approach towards small-ticket loans going forward.

One 97 Communications, the company that operates Paytm, reported its third quarter results earlier this month. Its net loss shrank 43% from a year earlier to Rs 221.7 crore, while revenue from operations rose 38% to Rs 2,850.5 crore.

ET had reported on December 25 that One 97 Communications laid off more than 1,000 employees at multiple units, impacting around 10% of its total workforce.

Also read | Paytm lending decoded: Where does it stand after slowdown in small-ticket credit?

Exclusive: Wipro to lay off hundreds of mid-level employees to improve margins

Wipro CEO Thierry Delaporte

In a bid to boost its lagging profit margins, IT services major Wipro is trimming “hundreds” of mid-level onsite roles.

Driving the news: This move is a significant one for Wipro as it grapples with the pressure to improve its financial performance. The IT giant, trailing larger Indian competitors in profitability, seeks to narrow the gap with TCS, Infosys, and HCL, whose margins currently sit at 25%, 20.5%, and 19.8%, respectively, compared to Wipro’s December quarter margin of 16%.

Better show: “They have very expensive resources onsite in Capco, and even though the growth is coming back, it is not enough. Aparna (Iyer – Wipro chief financial officer) has been tasked with showing better margins this quarter,” a source said.

Wipro had acquired consulting firm Capco for $1.45 billion in 2021, CEO Thierry Delaporte’s biggest bet. But the business slowed down following the Covid-19 pandemic.

Wipro’s ‘Left-shift’: The job cuts are part of a ‘Left- Shift’ strategy, another source said. “The work of a level 3 employee is shifted to a level 2 employee, who is given appropriate tools. A level 1 employee does the level 2 work, and the idea is that the work of a level 1 employee is automated,” the sources added.

Top deck churn: The job cuts come even as Delaporte is faulted for losing senior talent and impacting employees’ morale. In September last year, CFO Jatin Dalal exited the company to join rival Cognizant. Mohd Haque, senior vice-president (SVP) and head of healthcare and medical devices for the Americas, and Ashish Saxena, SVP, and head of the manufacturing and hi-tech business unit left in May 2023.

Headcount drop: Wipro reported a decline of 4,473 employees for the quarter ended December 2023 compared to the preceding quarter. India’s top two IT majors – TCS and Infosys – also reported a dip on the hiring front in the fiscal third quarter.

Also read | IT services hiring shows signs of traction, intent up 10% in January

Govt cuts import duty for some phone parts to 10% in boost for Apple, Xiaomi

The government has cut import duty on some parts used in making mobile phones to 10% from 15%, a move that will boost exports and benefit companies like Apple and Xiaomi that manufacture in India.

Fine print: The import duty on battery covers, main camera lenses, back covers, other mechanical items of plastic and metal, GSM antenna and others has been reduced to 10%, the finance ministry said in a notification late Tuesday. The import duty on inputs used to manufacture these components has been cut to zero.

Taking on rivals: The BJP government drew in giants like Apple and Xiaomi for smartphone assembly in the country in recent years. However, India’s high import duties on phone parts, compared to major markets like China and Vietnam, posed a major roadblock. This prompted the industry to push for tax reductions.

Exports bump: The India Cellular and Electronics Association (ICEA) hailed the government’s move, saying it will make India’s mobile phone manufacturing more competitive.

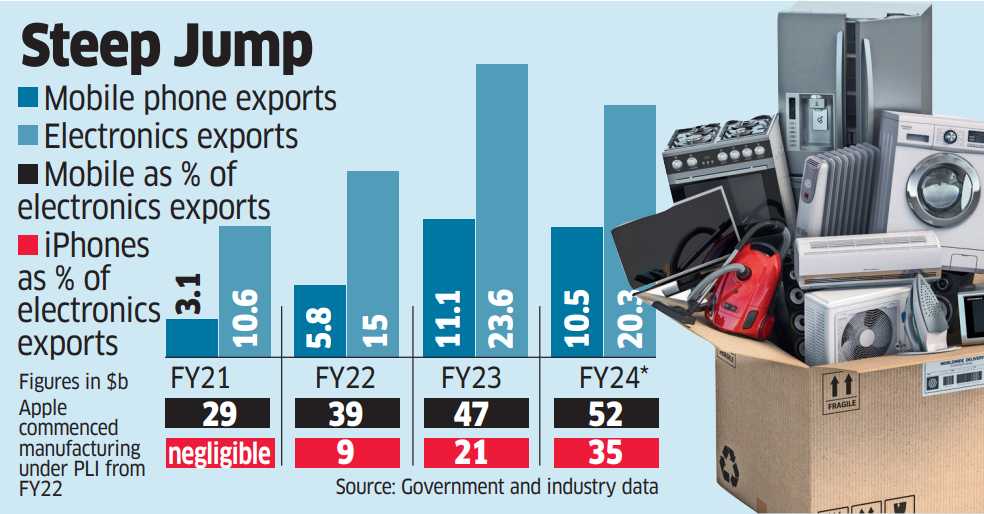

ET reported on January 21 that India’s electronics exports grew at a record 22.24% to cross the $20 billion mark in the first nine months of FY24, propelled by booming smartphone shipments, spearheaded by Apple’s iPhone.

Also read | Import duty cut to lower cost pressure, push exports: Industry

Microsoft, Google report earnings: Demand for AI pushes up revenues

Tech giants Microsoft and Google’s parent Alphabet saw their earnings soar in the October-December quarter, thanks to booming demand for artificial intelligence (AI) services. Powered by AI advances like generative AI, which requires more expensive computing resources, their cloud computing businesses experienced a significant uptick.

Microsoft’s numbers: Microsoft said its profit for the October-December quarter soared 33%, with the increase largely reflected growth in its cloud-computing unit, Azure.

Key numbers:

- Net income for the quarter stood at $21.87 billion

- Revenue rose 18% on year to $62.02 billion

- The cloud-focused business segment saw revenue expand 20% on year to $25.88 billion

- Revenue from the Office suite, plus LinkedIn, grew 13% to $19.25 billion

Alphabet’s report card: The Google parent reported strong numbers, buoyed by its cloud computing unit and YouTube, but markets were disappointed by the tech giant’s holiday ad revenues, which missed estimates.

Let’s take a look at key metrics:

- Revenue for the quarter stood at $86.3 billion, with profit at $20.7 billion

- It recorded $65.5 billion in ad revenue, against $59 billion a year ago

- Google Cloud revenue in the latest quarter was $9.2 billion

Also read | Google braces for more layoffs after thousands fired in New Year: report

Markets react: Wall Street was quick to react, with AI-related companies losing nearly $190 billion in stock market value late on Tuesday after the tech titans’ numbers failed to impress investors.

Alphabet dropped 5.6% after the Google-parent’s December-quarter ad revenue missed expectations. Microsoft also fell a little under 1%.

Also read | Focused cuts and fewer layers: Tech layoffs enter a new phase

Policybazaar parent shares cross IPO price after 2 years on first-ever profit

The stock of insurance aggregator PB Fintech breached a fresh 52-week high of Rs 1,044.90 on the BSE, catapulted by the announcement of its first-ever quarterly profit on Tuesday. The stock ended the day up 10% at Rs 1,002.8.

It also crossed its initial public offering (IPO) issue price of Rs 980, more than two years after its D-Street debut.

Strong numbers: PB Fintech, which operates insurance aggregator Policybazaar and credit marketplace Paisabazaar, clocked a net profit of Rs 37.2 crore for the third quarter ending December 31, 2023. The company has also reported a profit of Rs 4.2 crore for the nine-month period ending December 31.

Revenue from operations rose 43% on year to Rs 871 crore, while that from its core online marketplaces – Policybazaar and Paisabazaar – grew 39% to Rs 593 crore.

What helped? PB Fintech’s profitability was driven by increased quarterly revenue, better margins and keeping expenses in check.

“We had previously also guided that we will touch premiums of Rs 35,000 crore in FY27 and we think we can achieve that considering our last two year growth has been 2.5x,” chairman and cofounder Yashish Dahiya told analysts.

Also read | SoftBank fully exits Policybazaar parent, fetching $650 million in returns

Today’s ETtech Top 5 newsletter was curated by Vaibhavi Khanwalkar in Bengaluru.