Credit: Giphy

Also in this letter:

■ TCS Q1 results miss Street estimates amid recession fears

■ Ola lays off 400-500 people, defers appraisal of employees

■ ETtech Deals Digest: Investors continue to exercise caution

Razorpay, Pine Labs get RBI nod for payment aggregator licence

Fintech firms and payment gateways such as Razorpay, Pine Labs, and US-based firm Stripe breathed a sigh of relief as they were the first to get an in-principle nod from the Reserve Bank of India (RBI) to operate as payment aggregators.

Once the central bank comes out with its final list of the shortlisted firms, they will have to conduct an audit within six months to get the final approval – a process that is followed by the RBI for granting all licences.

What now: The firms authorised to operate as payment aggregators in India will come under the direct purview of the RBI while rendering payment services to merchants. This is a step that many industry insiders said would lead to a more standardised and regulated payments ecosystem.

Also, only those firms that will be granted the licence can acquire and offer payment services to merchants from hereon, as outlined in the RBI’s payment aggregator framework.

Only a few made the cut: We had earlier reported that the RBI has been strict in its evaluation of the entities that applied for the payment aggregator licence. Multiple online payment gateways seeking the aggregator licence came under the intense scrutiny of the central bank for – know-your-customer (KYC) related issues, past dealings with cryptocurrency exchanges and gaming apps, as well as for not complying with the net worth criteria that RBI had set out.

At least 185 fintech firms — including big names like Cred, Razorpay, and PhonePe — had submitted proposals seeking payment aggregator licences.

Mixed bag: While the nod from the central bank can be seen as a welcome step for the fintech industry, it makes it mandatory for e-commerce firms to have a licence now. If they don’t have one, they will either have to tie up with a bank that aggregates payments for them, thus increasing costs towards payment collection services, or tap into a payment aggregator and generate more business for them.

Also read: Fintech Startup 1Pay gets RBI payment aggregator nod

TCS misses Street estimates as tech spending dwindles

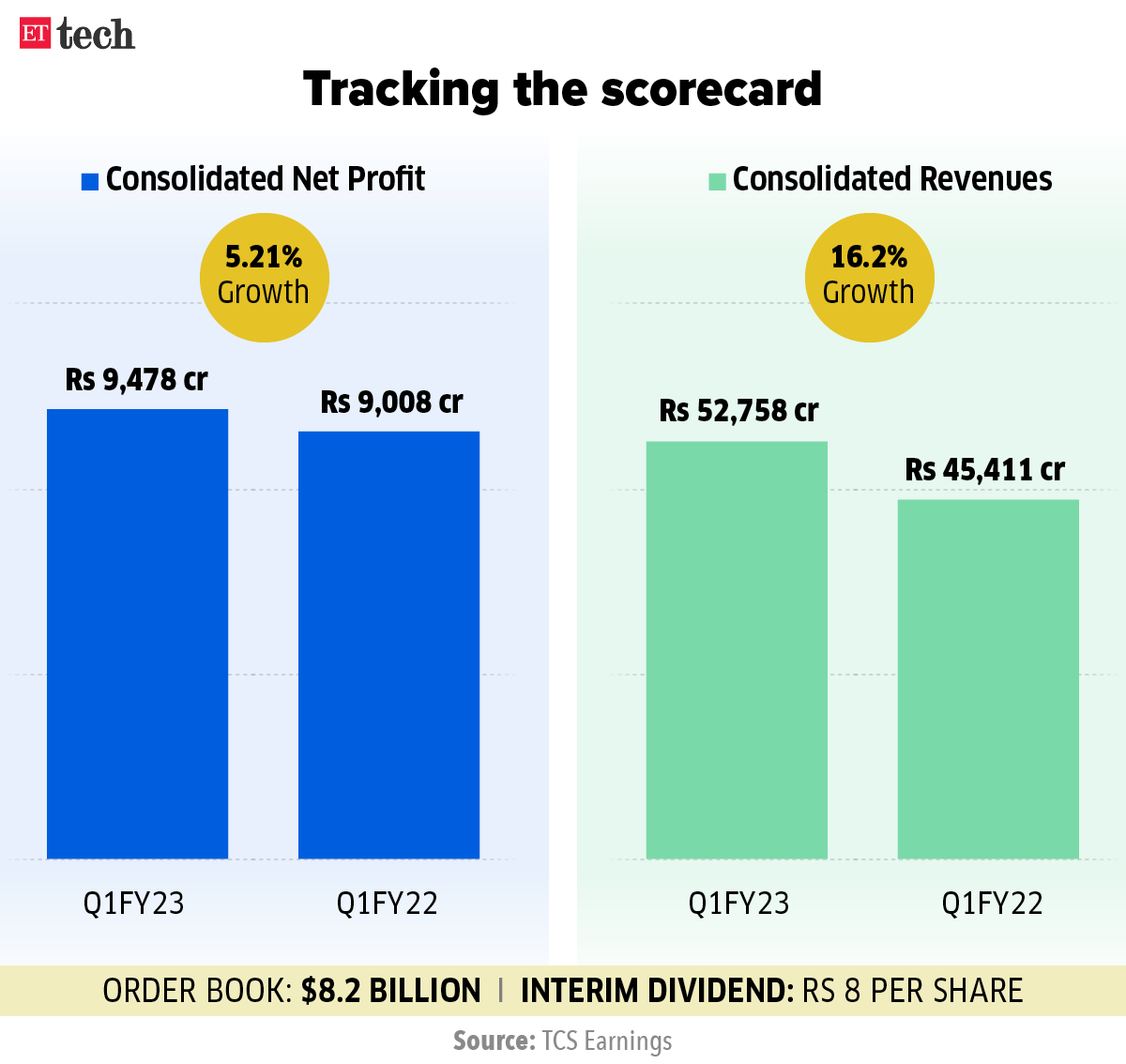

India’s largest information technology firm TCS announced its Q1 results for FY23, and they were disappointing as the numbers widely missed the Street estimates.

It reported a 5.21% year-on-year (YoY) rise in consolidated net profit at Rs 9,478 crore in the June quarter compared with Rs 9,008 crore in the year-ago period. An ET NOW poll of analysts had anticipated the profit figure at Rs 9,910 crore.

Decoding the numbers: Consolidated revenue for the quarter grew 16.2% YoY to Rs 52,758 crore compared with Rs 45,411 crore in the year-ago quarter, the company said in a BSE filing. Constant currency revenue growth stood at 15.5% YoY.

Operating margin stood at 23.1% in the quarter under review compared with 25% in the March quarter and 25.5% in the June quarter last year.

The board of the IT firm has announced an interim dividend of Rs 8 per share.

Attrition, a pain point: While the headcount addition by the IT firm stood at 14,136 for the quarter, taking the total workforce strength to 6,06,331, the attrition rate stood at 19.7% for the company. All major IT firms are witnessing soaring attrition levels, which has had a domino effect on the IT industry. It has already led to lower operating margins and stock prices, and piled pressure on the top IT service providers to hire more freshers and expand into tier-II tiers and beyond.

Management views: “It has been a challenging quarter from a cost management perspective. Our Q1 operating margin of 23.1% reflects the impact of our annual salary increase, the elevated cost of managing the talent churn, and gradually normalising travel expenses,” said Samir Seksaria, the company’s chief financial officer.

Headwinds on the rise: IT companies have started seeing margin erosion due to higher employee-related costs and moderation in deal wins as the macroeconomic environment remains uncertain due to the prolonged Russia-Ukraine war, higher inflation, and rising interest rate environment to curb liquidity.

Important to understand RBI objective, we’re well-capitalised: Slice CEO

Rajan Bajaj, founder, Slice

According to an internal memo, Rajan Bajaj, the founder and chief executive of credit card startup Slice, has urged his team to understand the Reserve Bank of India’s (RBI’s) recent objectives as the company tries to build a platform in a highly regulated sector seen by us.

His note comes a month after RBI issued a circular barring non-banks from loading prepaid payment instruments with credit lines. The letter, which had sent fintech firms into disarray, is reportedly set to hit Slice and its rival Uni Cards the hardest.

Verbatim: “Their (RBI) main purpose is always to serve the Indian citizens better. At Slice, our whole basis of existence is providing world-class customer experience in India. There’s a huge overlap in our objective with that of RBI. We are committed to complying with an ever-expanding set of laws and regulations, as well as upholding the highest standards of governance and ethical business conduct,” wrote Bajaj in an email to Slice employees.

“Today, we are very well-capitalised, our credit risk numbers are one of the best globally and our word of mouth customer acquisition is stronger than anyone else in our space,” the note, reviewed by ET, read.

Earlier in May, Slice said it’s shifting its focus to unified payments interface (UPI) as it sought to diversify operations beyond the existing credit card business.

Why the trouble: We had reported that RBI’s communication on PPIs had the backing of the government and had come after commercial lenders raised concerns over alleged flouting of rules by fintech companies.

These concerns included slackened know your customer (KYC) norms and breaches in anti-money laundering (AML) guidelines by the fintech firms, ET reported citing sources.

Ola starts handing out pink slips, defers appraisal

Ride-hailing giant Ola has become the latest startup to lay off employees as poor macroeconomic conditions and a tightening of VC funding force startups to cut costs and rethink strategies.

According to sources, Ola has started laying off employees across verticals and has also stopped an impending appraisal, sparking employee concerns. While the exact number of the people fired isn’t known, reports peg it around 400-500.

Growing troubles: The company is already under intense pressure, having recently closed down its used car, food and grocery delivery business, along with witnessing a decline in the sales of its much-publicised electric scooter, Ola S1 Pro.

Nothing new: Ola’s attrition has intensified over the past few months. Yashwant Kumar, senior director and business head, charging network, Ola Electric, was the latest executive to put in his papers. He followed the footsteps of Arun Sirdeshmukh, the chief executive of Ola Cars, who stepped down in May this year, as reported by ET.

Same story in the west: Twitter has fired 30% of its talent acquisition team as it struggles to contend with growing challenges, reports the Wall Street Journal. The microblogging site had already announced a hiring pause in May to focus on reducing its cash burn.

On the other hand, the Washington Post reported that the company’s potential $44 billion takeover by Elon Musk is now in danger. Musk has been unable to fathom the exact number of fake accounts on the platform despite getting access to internal data, which can jeopardise the deal.

Tweet of the day

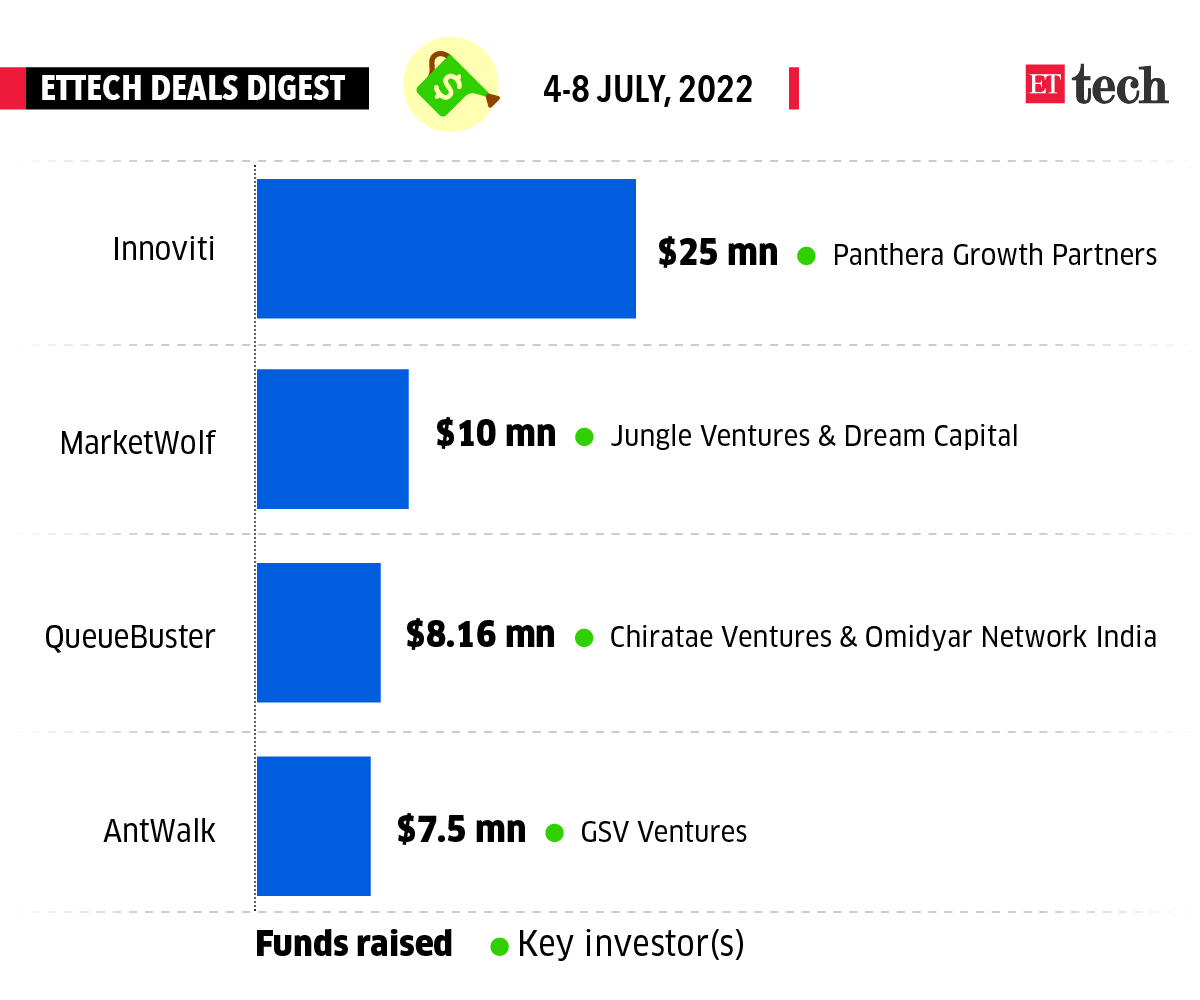

ETtech Deals Digest: Investors continue to exercise caution

For the second week, no big funding took place as VCs continued to exercise caution in an uncertain economic environment. A few startups, however, landed moderate amounts to ease the funding gloom.

Here’s a list of all the deals from this week.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.