Credit: Giphy

Also in this letter:

■ China-backed fintechs made Rs 940 crore from predatory lending: ED

■ Indian startup funding fell by 33% in Q2: Tracxn report

■ Over 66% of India’s blue-collar workers make under Rs 15k a month: report

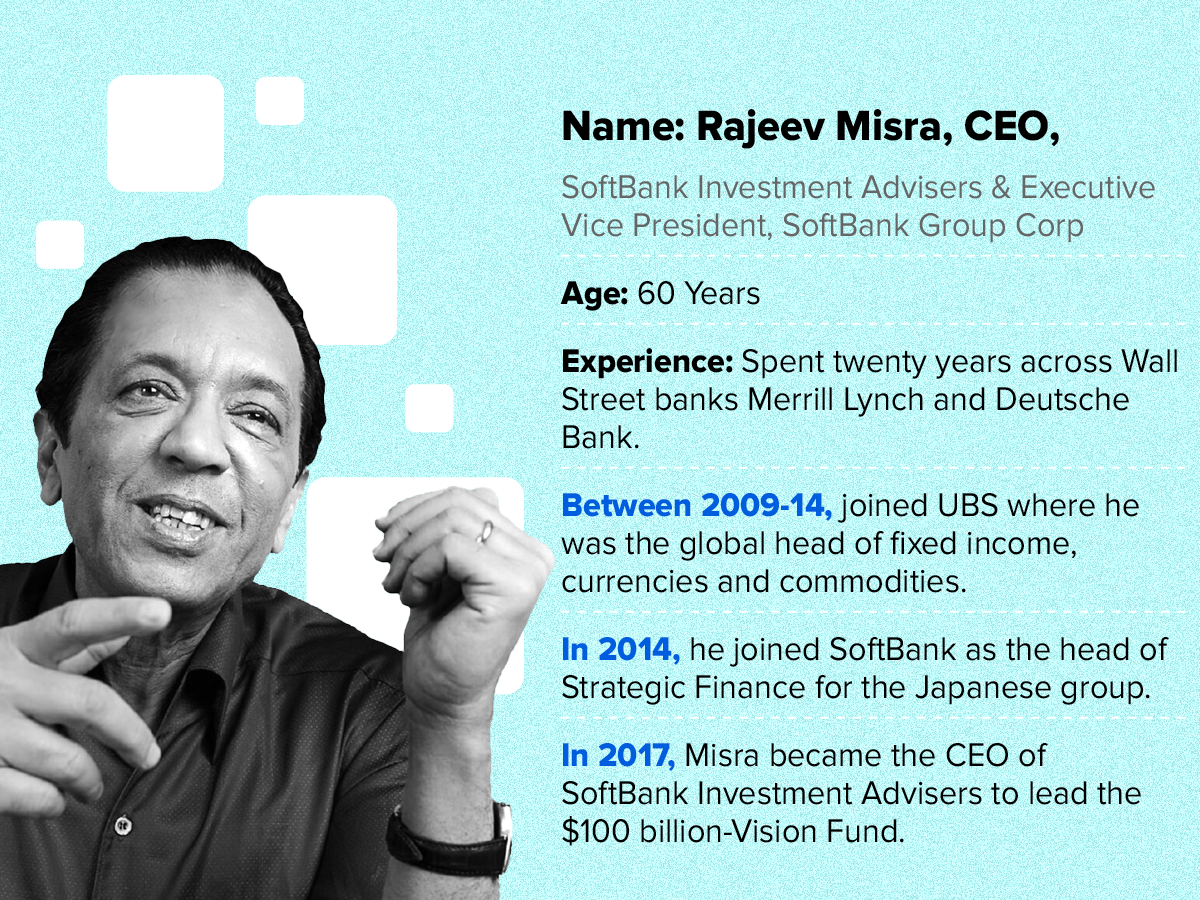

Rajeev Misra steps back at SoftBank to launch new fund

Rajeev Misra, CEO of SB Investment Advisers, which manages SoftBank Vision Fund, will step back from his executive role at the technology fund, according to an email from SoftBank founder Masayoshi Son that we have reviewed.

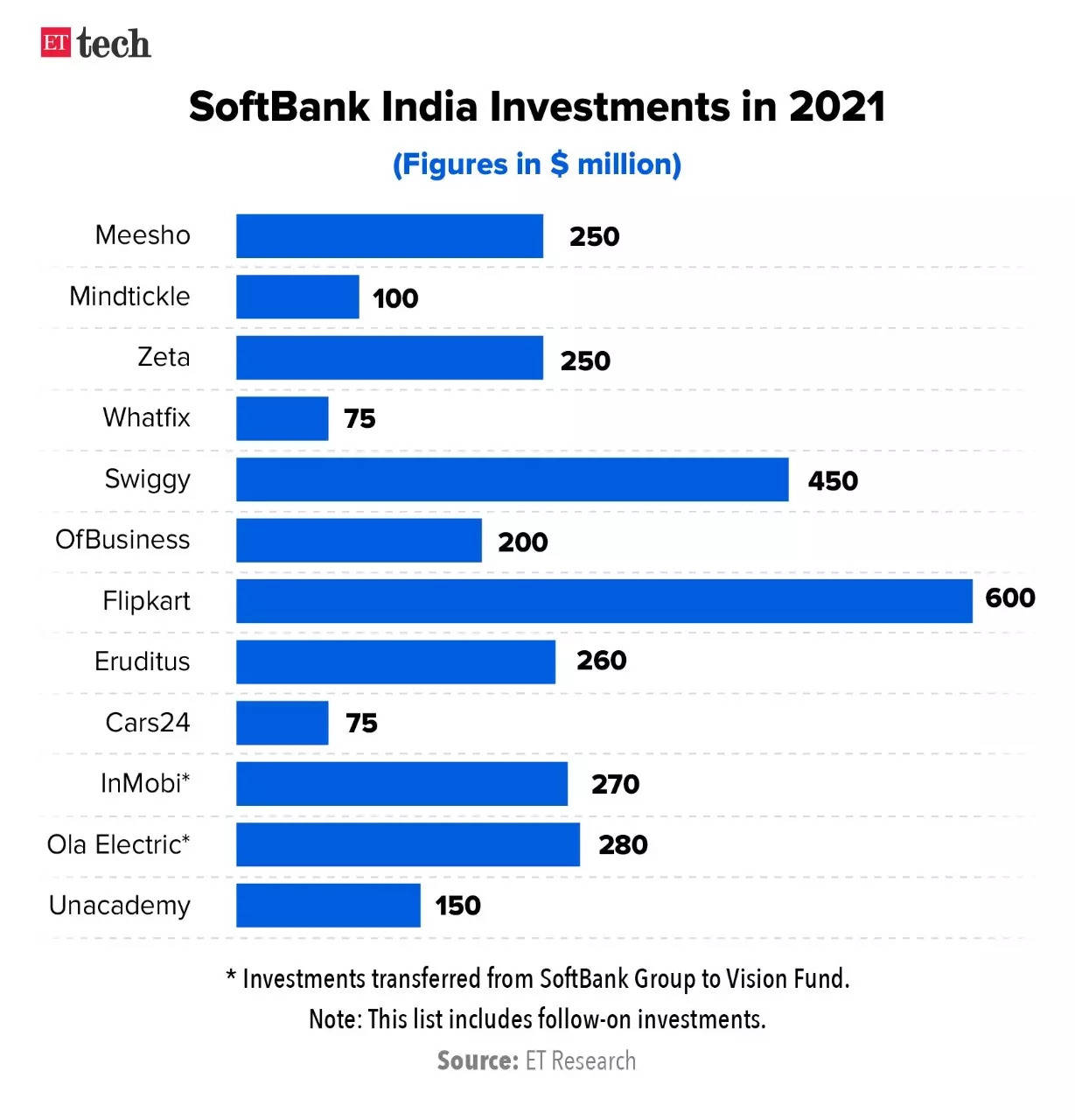

New fund: Misra is likely to launch a new fund backed by Middle Eastern investors, sources said. He has led the Vision Fund since 2017 when it raised $100 billion, its largest pool of private capital.

The 60-year-old former Deutsche Bank AG executive made the Vision Fund one of the biggest champions of high-flying Silicon Valley startups before public stumbles and internal strife dimmed its star.

Son wrote in his email, “I’m pleased to share that Rajeev will continue as the CEO of SoftBank Investment Advisers leading our activities for SVF1, and as a trusted senior adviser and integral part of the SoftBank family… To afford Rajeev the time to focus on his new venture, he will transition from his current role as CEO of SoftBank Global Advisers, the manager for SVF2, to become vice chairman, and I will take on a more direct leadership role supported by our existing leadership team who already manage SVF2 on a day-to-day basis.”

Raft of exits: Misra’s decision to step back at SoftBank will complete a hollowing out of the conglomerate’s most senior investing ranks, which had been bolstered over the years by a raft of hires from bulge-bracket banks.

In March, we reported that SoftBank had given him responsibility for its Latin American fund. The change came after the January departure of COO and SoftBank Group International CEO Marcelo Claure, who was responsible for the Latin American fund. His exit ended a tumultuous tenure capped by a clash over compensation with Son.

The firm said at the time that Michel Combes would take over Claure’s responsibilities.

China-backed fintech firms made Rs 940 crore from predatory lending: ED

The Enforcement Directorate (ED) said that several fintech firms and non-banks backed by Chinese funds have made more than Rs 940 crore through predatory lending, violating Reserve Bank of India (RBI) guidelines.

The ED said decisions on fixing interest rates, processing fees, platform fee and so on were made by fintech companies that were taking instructions from people in China and Hong Kong.

Details: The non-banks included Kudos Finance and Investments Pvt Ltd, Acemoney (India) Ltd, and Pioneer Financial and Management Services Pvt. Ltd.

The agency is conducting a money-laundering probe against a number of NBFCs that offer instant personal micro-loans. The agency said its probe had revealed that various fintech companies backed by Chinese funds have agreements with these NBFCs to provide loans for terms ranging from seven to 30 days.

According to the agency, fintech companies brought in funds to be lent to the public and piggybacked on defunct NBFCs for their lending licences.

Vivo probe: Meanwhile, Indian agencies are probing the local support that two Chinese nationals allegedly received to incorporate a company that projected itself as a subsidiary of smartphone maker Vivo. Two chartered accountants and a company secretary are already in the crosshairs of investigators, sources told us.

On Tuesday, the ED raided nearly four dozen locations linked to Vivo and its related entities including. It is looking into whether any shell companies were used to launder money.

Indian startup funding fell by 33% in Q2: report

The Indian startup ecosystem saw a 33% decline in venture funding to $6.9 billion in the second quarter of this year thanks to poor macroeconomic conditions, according to a report from Tracxn.

Quote: “Though investors are a little wary due to the current environment, it hasn’t dampened the investment spirit of the community. They have become more decisive about the startups they want to nurture and are focusing extensively on a long-term perspective,” said Abhishek Goyal, cofounder, Tracxn.

Dailyhunt parent VerSe Innovation, Delhivery, Udaan, ShareChat and upGrad raised the largest sums in Q2. In terms of cities, Bengaluru, Delhi and Mumbai raked in the most money from investors.

Tweet of the day

Over 66% of India’s blue-collar workers make under Rs 15k a month: report

A report by employee management platform Salarybox has revealed that over two-thirds of India’s blue-collar workers earn less than Rs 15,000 a month. The report analysed the data of over a million employees across 850 districts.

Tell me more: Less than 15% of employees earn Rs 20,000-40,000 a month, the report said. The average woman worker earns Rs 12,398 — 19% less than her male counterpart.

Women also accounted for just 27% of the workforce, it said.

Quote: “For a long time, the topic of jobs — or rather, the lack thereof — has dominated India’s economic discourse. While the headline employment/unemployment numbers get a lot of attention, another set of numbers is equally significant — who gets paid how much. It is time companies bring in interventions that highlight this huge gap,” said Nikhil Goel, CEO and cofounder of SalaryBox.

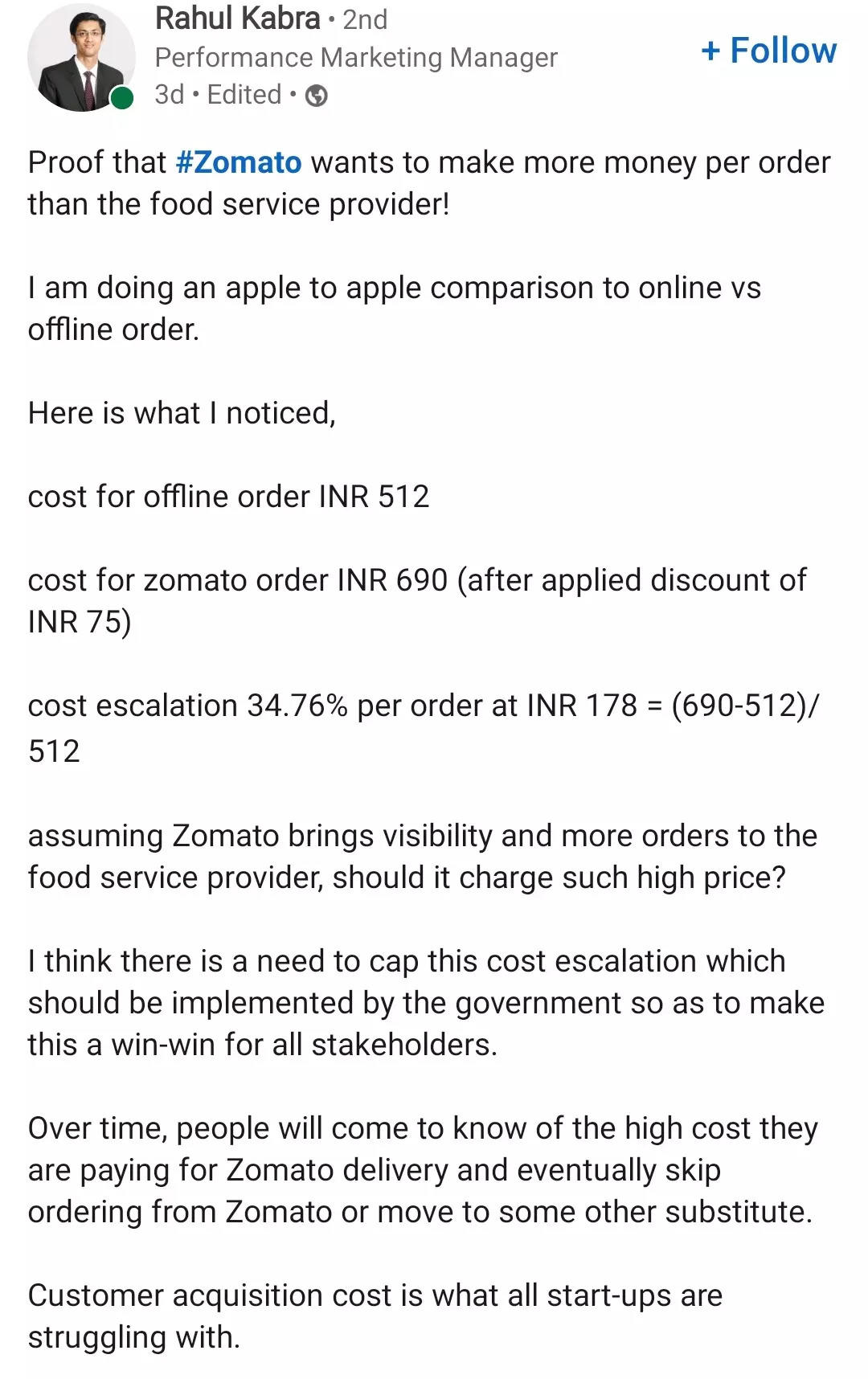

Zomato responds to customer who complained about ‘inflated bill’

On July 4, a Zomato customer took to LinkedIn to complain about the high cost of ordering food on the platform and accused the company of charging exorbitant commissions from partner restaurants.

Rahul Kabra shared a photo showing that his order on Zomato, which cost Rs 690, would have cost Rs 512 offline. “They take 35-50% cut from hotels. So, hotels increase the prices to compensate. Indirectly, Zomato is the one who’s leading to this increase. Trying to rip its customers off by acting as the good guy, let’s see for how long”, Kabra wrote.

Credit: LinkedIn

Response: Zomato – which was earlier accused by the Competition Commission of India of charging unfair prices — told Kabra it was looking into the issue.

“Hi Rahul, Zomato, being an intermediary platform between a customer and a restaurant, does not have any control over the prices implemented by the restaurant partners on our platform. That said, we have conveyed your feedback to the restaurant partner and have requested them to look into this,” it said.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.