Zooming out

But first, let’s take a step back and see how we got here. In 2021, a low interest rate scenario saw markets flush with cash, resulting in technology companies raising record amounts in both private and public markets. The year also saw bumper IPOs for US tech companies including electric vehicle maker Rivian, cloud software firm GitLab and share trading app Robinhood. This was also the year when the posterboys of the Indian startup ecosystem – Zomato, Freshworks, Policybazaar, Paytm and Nykaa – started going public.

As per a report by EY, globally, there were 631 IPOs in the technology sector in 2021, and this number fell to less than half (310) in 2022, as central banks started tightening monetary policies and investors started pulling money from the markets. The proceeds of these public offerings also fell drastically from $149.1 billion in 2021 to $35.2 billion in 2022.

But even as some of these large companies return to raise funds from the public market, the sentiment today is a far cry from the highs of 2021.

Getting realistic on valuations

On Friday, following a stellar debut by chip designer Arm Ltd, grocery delivery firm Instacart raised the proposed price range of its IPO to target a valuation of $10 billion. This was higher than the initial $8.6-$9.3 billion range that it had aimed for, and was a pointer to the improved investor sentiment that reflected in Arm’s listing.

However, it is noteworthy that the $10 billion valuation is still only about a fourth of Instacart’s peak valuation of $39 billion – which was first cut to $24 billion by March last year, and by another 50% by the end of 2022.

The Arm IPO — touted as being highly successful at its $54.5 billion valuation — is a comedown from the $64 billion valuation at which Japanese investment giant SoftBank bought the remaining 25% stake in the company from its investment unit Vision Fund last month.

According to a Reuters report, Klaviyo is aiming for an $8.4 billion valuation in its IPO, which comes close to its last private market valuation of $9.5 billion in 2021.

Good times, bad times

The steep cut in Instacart’s valuation is as much about tech stocks as it is about online grocery. The Financial Times reported on September 28 that Istanbul-based quick commerce firm Getir is raising new cash at a $2.5 billion valuation – down from $12 billion in March 2022.

After raising tons of cash, the industry saw major consolidation with Getir’s $1.2 billion deal to acquire Berlin-based rival Gorillas.

“Even now at $2.5 billion it is a highly-valued company. Instacart has been at it for a while as well. This shows egrocery is one of the hardest problems to solve profitably,” a senior ecommerce executive working in the sector said. The unit economics of Indian peers in the same space are yet to be proven, though claims are being made about profitability timelines.

For major ecommerce firms, grocery is still the biggest area of spend in India. And they are all trying to figure out how to optimise on costs further while showing some growth, as they prepare for public listings over the next two years.

Right-sizing is key

“The time for bumper tech IPOs (in India) has gone,” an early-stage venture investor, with several portfolio companies in the late stage of their lifecycle, said. “The market has its finger on the pulse, and it has rewarded right-sized offerings.”

“If investors try to rationalise by artificially pushing valuations upwards, while trying to justify how it can rise even more, and then attempt listing the company at a premium, they’re asking for trouble,” the investor said.

Yatra Online’s IPO was subscribed 11% on the first day of bidding on Friday. The Rs 775 crore IPO received bids for 33,63,675 shares against 3,09,42,356 shares on offer, according to NSE data. Yatra Online on Thursday said it has mobilised Rs 348.75 crore from anchor investors.

While many of the stocks listed in 2021 and early 2022 in the Indian tech and new economy space have recovered in the last six months with an upswing in the market, they are still a good length away from their listing prices.

Honasa Consumer, the parent company of direct-to-consumer brand Mamaearth, recently received the market regulator’s nod to go ahead with its public offering. Food and grocery delivery firm Swiggy is also gearing up for an IPO.

On August 9, Navneet Govil, executive managing partner and chief financial officer at SoftBank Vision Fund, told ET that Swiggy, Lenskart, FirstCry and OfBusiness were among its portfolio firms from India readying to go public next year.

“This serves a lesson for the upcoming IPOs…look at how well the market received companies like (drone maker) Ideaforge and (high-end computing solutions firm) Netweb. That’s an indicator that, at the right valuation, there is enough appetite,” the person cited above said.

Written by Pranav Mukul in New Delhi & Digbijay Mishra in Bengaluru.

ET Startup Awards 2023: And the winners are…

On Thursday, we announced the winners of the Economic Times Startup Awards 2023 The distinguished jury awarded firms that stood out for their empirical metrics, and for deliverables such as profitability, exits and effectiveness of innovation in a year which has proved to be testing for the technology and startup ecosystem.

Who won? Business-to-business (B2B) ecommerce company OfBusiness edged out the competition to become the big winner at the ninth edition of ETSA, India’s most prestigious awards for entrepreneurship.

Here’s a complete list of the winners:

ETSA 2023 jury members

The Jury’s view: Strong revenue growth and profitability along with good corporate governance practices were key themes that found approval with the jury. Several of the discussions were intense, requiring at least a couple of tiebreakers before the final winners were chosen.

The methodology: A lot goes into the whole process — from reaching out to hundreds of entrepreneurs, filtering their nominations by going through financials and other data, to putting together a jury dossier and holding a final meeting with the entire jury.

Here is a timeline of the effort that went into making the process most rigorous and detailed.

Top Stories

Dunzo further delays salaries, more layoffs likely as it vacates headquarters: Quick commerce startup Dunzo, which has been struggling to shore up fresh funds, has now told employees that pending salaries for June and July would be paid in November.

The Bengaluru-based startup is also looking to move out of its headquarters on Wind Tunnel road as part of further cost-cutting measures, founder and CEO Kabeer Biswas told employees in an internal all-hands call on Friday.

Byju’s puts Epic, Great Learning on the block, seeks $800 million to $1 billion: Troubled edtech company Byju’s has put two of its key assets — Epic and Great Learning — on the block, hoping to generate $800 million to $1 billion in cash, to help meet its commitment to clear a $1.2-billion term loan B.

Meanwhile, lenders alleged that Byju’s allegedly hid $533 million in an obscure three-year-old hedge fund that once said it operated from a pancake restaurant in Miami. However, Byju’s denied the allegations and said it has invested the residual money from its term loan B (TLB) into ‘high-grade fixed income assets’ in the US.

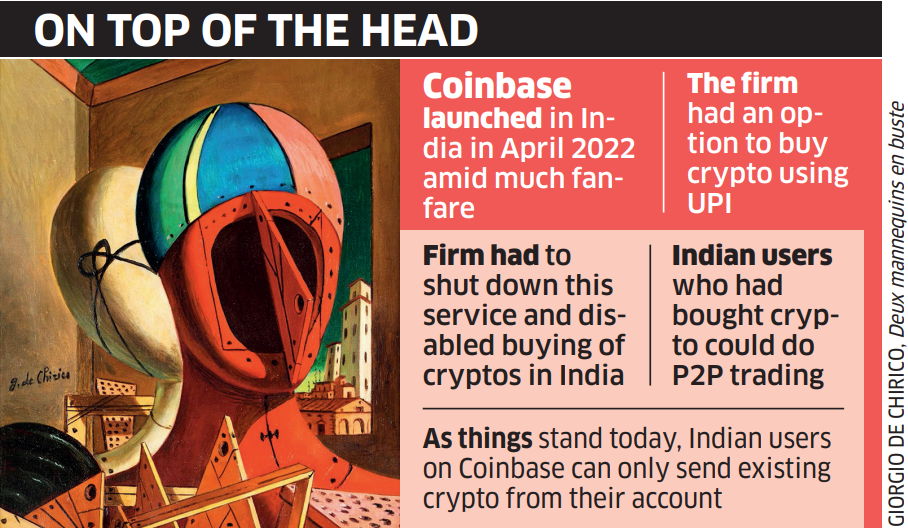

Coinbase is stopping ‘all services’ for Indian users: Cryptocurrency exchange Coinbase Global is discontinuing “all services” for its remaining registered users in India, according to an email it sent to users.

The exchange said it is committed to India over the long term and is exploring ways to strengthen its presence in this important market.

People come to India for its talent, not to cut costs: Capgemini CEO Aiman Ezzat | India is a fast-growing market for French IT major Capgemini and a solid base for it to service clients globally, Capgemini global CEO Aiman Ezzat told ET. The firm, which has more than half of its 360,000 employees in India, is hopeful of the demand situation improving over two-to-four quarters but is waiting for an inflection point.

Startup hiring from campuses to hit the slow lane this year: Leading startups and ecommerce companies in India may significantly draw back from campus hiring from the Class of 2024 compared to last year.

This is due to a lack of visibility amid a prolonged funding crunch, layoffs and various other belt-tightening measures are prompting companies to narrow their hiring funnel, said recruiting managers and investors.

Tech Policy

Rajeev Chandrasekhar, minister of state for electronics and information technology

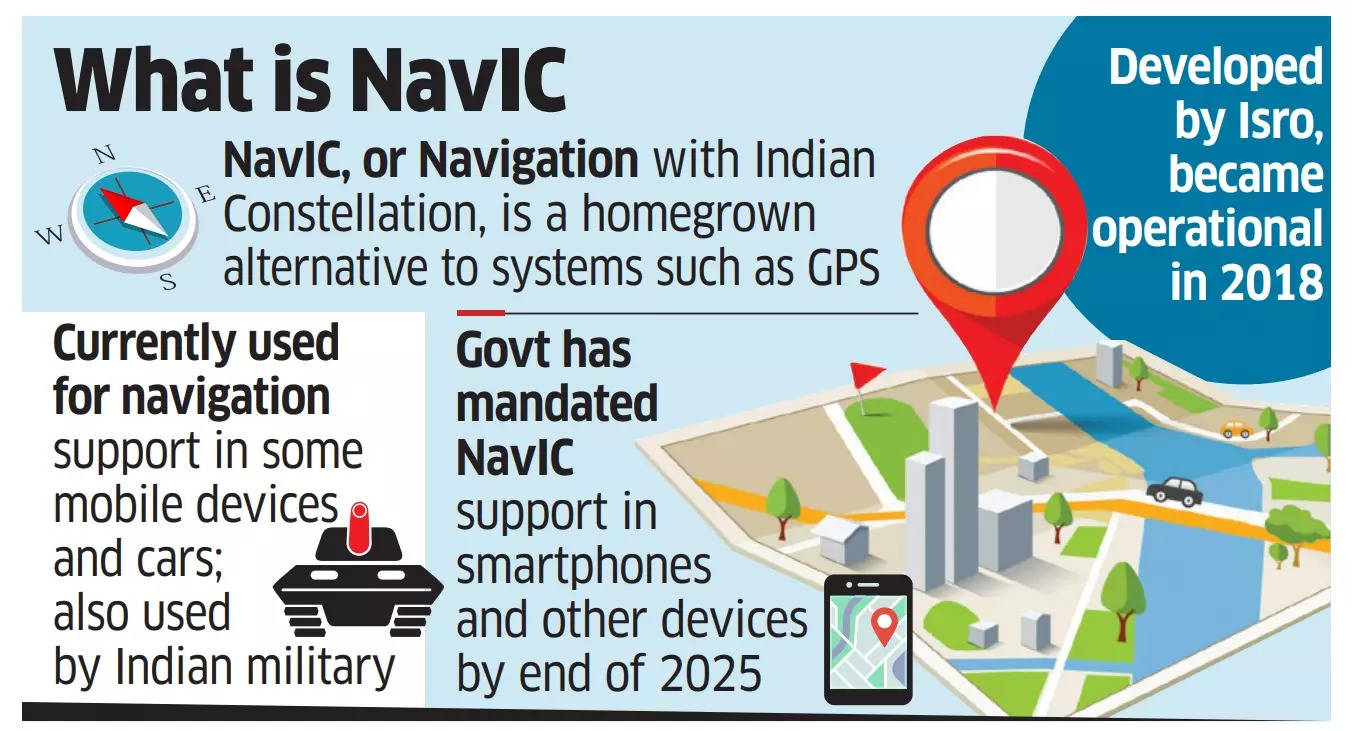

NavIC support to become must for all smartphones: The government will make it mandatory for smartphones to integrate with the made-in-India navigation system NavIC, the minister of state for electronics and information technology Rajeev Chandrasekhar said on Thursday. The devices can either provide support for NavIC-powered chips or use NavIC chipsets, he added.

Also read | ETtech Explainer: What is NavIC? Indian GPS alternative will be mandatory in all smartphones by 2025

First volume of BIS standard for Indian space industry out: The first set of 15 standards for the Indian space industry, aimed at streamlining processes and technologies used by industry players, was introduced on Thursday. Bureau of Indian Standards (BIS), Indian Space Research Organisation (ISRO), and Indian National Space Promotion and Authorisation Centre (IN-SPACe) jointly launched the catalogue.

States don’t have powers to constitute fact-check bodies: legal experts | The IT Act, 2000 is the primary legislation governing online content in the country and it does not provide any powers to states for constituting fact-checking bodies like the one Karnataka has proposed to create, policy lawyers and experts told ET. Karnataka’s decision to set up a fact-checking unit to curb fake news may not be legally enforceable.

Apple’s New Offerings

Apple unveils all-new iPhone 15, Apple Watch Series 9: Apple on Tuesday announced the launch of its Apple Watch Series 9, Apple Watch Ultra 2 and the all new iPhone 15. The iPhone 15 starts at Rs 79,900) and iPhone 15 Plus at Rs 89,900. While the iPhone 15 Pro starts at Rs 1,34,900 and iPhone Pro Max at Rs 1,59,900, the Apple Watch Series starts at Rs 41,900 and the Ultra 2 is priced at Rs 89,900

Read about all the key announcements here

Apple to manufacture iPhone 15 Plus in India from next quarter: Apple will locally produce the iPhone 15 Plus in the next quarter, having successfully started production in India of the lower-priced base model of the series. Foxconn’s plant near Chennai has started preparations to make iPhone 15 Plus, two industry executives said.

Huge price gap greys the market for iPhone 15 Pro models in India: The price difference of over Rs 35,000 for the more expensive iPhone 15 Pro and Pro Max models in India compared with other countries such as the UAE, Thailand and the US is set to drive direct imports by holidaying consumers from these overseas markets.

AI Action

Indian IT firms rally for AI safety measures: Indian IT firms such as Wipro, Genpact and Tech Mahindra are attempting to build ethical safeguards in AI products on their own even as they remain open to industry collaboration on establishing standards. This comes in the absence of regulatory frameworks around AI in the country so far.

Telcos see jump in share of AI/ML workforce: People involved in AI/ML-led work now make up 20% of the workforce of telecom service providers as compared to 7% in the July-September 2022 period on the back of 5G rollout, staffing experts have said. The proportion of AI/ML-led jobs is expected to reach 23% by the end of fiscal 2024.

SAP Labs India to double AI talent base by next year: Sindhu Gangadharan | SAP Labs India, the local R&D arm of the world’s biggest enterprise resource planning (ERP) software company, will look to double by next year its artificial intelligence talent base, stretching its repertoire of services beyond bespoke ERP solutions, said Sindhu Gangadharan, managing director, SAP Labs India.

ETtech Deals Digest

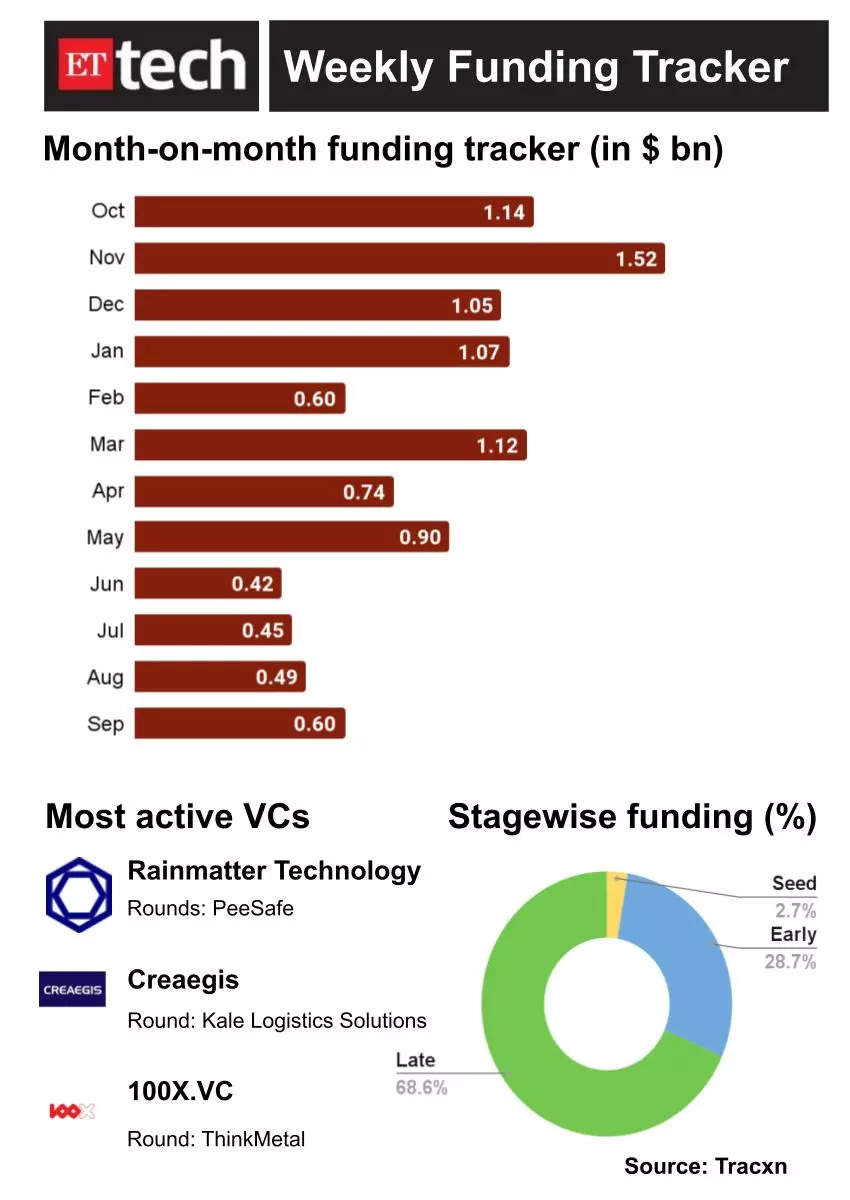

Indian tech startups and emerging companies secured $334 million in funding this week, driven mainly by a substantial late-stage investment in the B2B SaaS firm Perfios, according to data from market intelligence firm Tracxn.

Funding activity was up 26% in the September 11-15 week, from $264 million raised in the corresponding week last year. However, it was flat on a sequential basis, rising a miniscule 1%.

The lion’s share of late-stage funding during the week, amounting to $229 million, came from Keedara Capital’s investment in Perfios, accounting for more than two-thirds of the overall funding activity.