Also in this letter:

■ Net loss of Amazon Seller Services widens 33%

■ Alipay sells entire stake in Zomato

■ No seat for Microsoft, other investors on OpenAI board

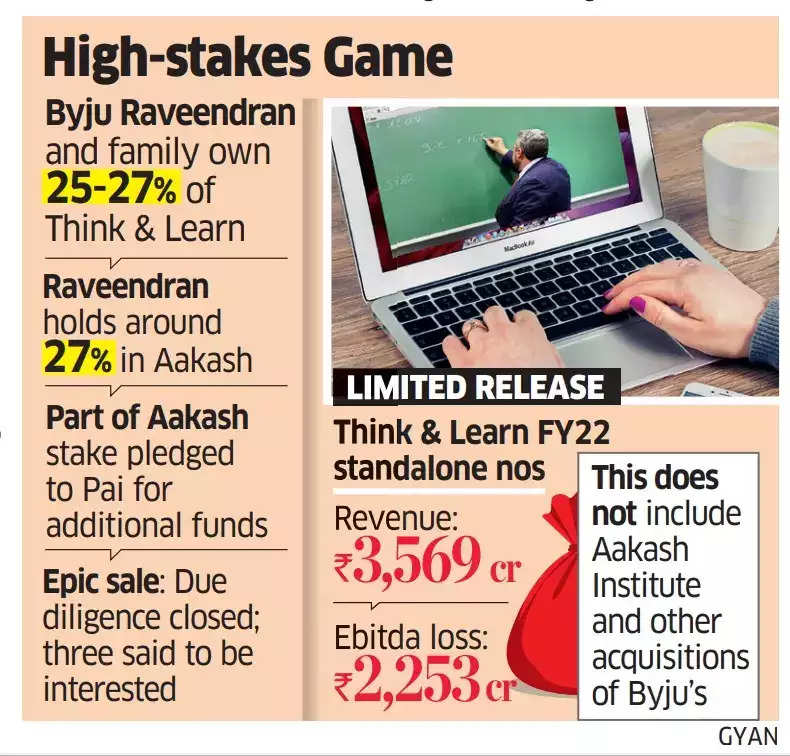

Byju’s valuation below $3 billion, firm facing challenges: Prosus interim CEO

Prosus interim CEO Ervin Tu

Ervin Tu, who took over the reins of technology investor Prosus from Bob van Dijk in September, said the company has marked down Byju’s valuation further, below $3 billion. Tu commented on the edtech’s valuation in an earnings call on Wednesday, after disclosing Prosus’s half-year results.

Quote, unquote: “We are not disclosing the (exact) valuation, but it is sub-$3 billion,” said Tu. “We are in close discussions with the company every day. Byju’s is faced with multiple challenges.”

Large underperformers: Prosus listed Byju’s among the India portfolio firms that were “large underperformers” impacting its internal rate of return (IRR). Further, late last year, Prosus said it had ceased equity accounting of Byju’s as it had lost “significant influence” over the firm after its holding slipped below 10%.

Recent markdowns: This is not the first time an investor has marked down Byju’s valuation. ET reported on July 26 that Peak XV Partners, formerly Sequoia Capital India, had told its limited partners (LPs) it will have to significantly mark down the value of its holding in Byju’s due to a lack of visibility into the firm’s audited financial results.

In April, ET reported that US investor BlackRock slashed the value of its investment in Byju’s by nearly 50%. BlackRock pegged the per-share value of Byju’s at $2,400 at the end of December 2022, down from $4,600 in April last year, putting the company’s valuation at a little over $11 billion.

Byju’s challenges: ET reported on November 29 that top shareholders have demanded the firm meet certain conditions before they consider any future capital infusion. They have also asked the company to file its audited financials for FY23 at the earliest.

They also want founder Byju Raveendran to loosen his control over day-to-day operations.

PayU India H1 FY24 income rises to $211 million; IPO expected next year

PayU India, the Indian subsidiary of Prosus — the Dutch-listed arm of South African technology investor Naspers — recorded a 15% year-on-year rise in its total revenues for the first six months of FY24 at $211 million. Further, PayU India has shuttered its buy-now-pay-later (BNPL) prepaid card business LazyCard.

Financial highlights: Shutting down LazyCard led to narrowing of losses and improved profitability for the overall fintech and payments portfolio of the group. Other factors such as improved profitability in its global payment organisation (GPO) unit also helped.

PayU India IPO: Ervin Tu, interim CEO of Prosus, said he is hopeful of a public listing for PayU India by the second half of next year. “We are working very hard to prepare the business (PayU India) to be in a listable form and aim to have it (ready) by the second half of next year,” Tu said.

India’s contribution: With the growth seen in India payments and credit business, Prosus said PayU has seen its consolidated revenue grow 21% on a yearly basis to $497 million, in the first half of FY24. As of September-end, India contributes 48% of PayU’s core payments revenues, its largest market.

Swiggy’s losses narrow: Prosus, Swiggy’s largest shareholder with a 32.7% stake, said its share of the food-delivery major’s loss narrowed 35% from a year ago to $208 million for the period under review. Going by Prosus’ stake size, Swiggy’s overall loss for the first half of FY24 amounts to about $636 million.

Amazon Seller Services net loss widens 33% in FY23

Amazon Seller Services, the marketplace arm of Amazon India, has recorded a 33% jump in its net loss for the year ended March 2023 to Rs 4,854 crore.

About the company: Amazon Seller Services earns revenue from third-party seller services, subscription services, including Amazon Prime comprising services Prime Video and Prime Music, and other marketplace-related services, including advertising revenue and marketing support services to related parties.

Key numbers:

- Revenue from operations grew only 3.42% to Rs 22,198 crore

- Earnings from the sale/rendering of marketplace services rose 33% to Rs 12,548 crore

- Expenses jumped by almost 8% to Rs 27,283 crore

- Spending on delivery charges rose 1.6% to Rs 6,863 crore

- Advertising and sales promotion spending declined 6.3% to Rs 3,209 crore

Fund infusion: The company received a fund infusion of Rs 7,850 crore in FY23 through the allotment of 7,850 million shares of Rs 10 each to its parent companies Amazon Corporate Holdings and Amazon.com Inc.

Quick catch-up: ET reported earlier in November that Amazon has slashed its subscription fee for Indian exporters newly joining its global selling programme ahead of the festive sales around Thanksgiving, Black Friday and Christmas. The reduced prices are available to Indian exporters till March 2024.

Also read | Appario looks for a new way to keep selling on Amazon

Alipay said to have sold 29 crore Zomato shares in bulk deal

Chinese payments group Alipay, owned by financial services giant Ant Group, is likely to have sold at least 29 crore shares in food delivery company Zomato at Rs 112 per share in a large block deal on the BSE on Wednesday.

Tell me more: ET reported on Wednesday, citing the term sheet released by the deal broker, BofA Securities, that Alipay Singapore Holdings had proposed to sell the shares in Zomato. Further, the offer price of the sale is at a 2.2% discount to Zomato’s closing price on Tuesday.

Shares of Zomato rallied around 4% to hit an intraday high of Rs 118.5 on the BSE before closing the day up 2.55% at Rs 116.7.

Source: BSE via Google Finance

Recent exits: On October 20, SoftBank, through its affiliate SVF Growth Singapore Pte, sold 93.6 million shares, constituting a 1.09% equity stake in Zomato, in a deal valued at Rs 1,041 crore. In a previous transaction on August 30, SoftBank sold 100 million shares worth Rs 947 crore.

New York-based investment firm Tiger Global sold its remaining 1.44% stake in the online food delivery platform for Rs 1,124 crore in August.

Shares rebound: Stocks of new-age tech companies such as Zomato, Nykaa, Paytm, among others, have staged a rebound after a drubbing last year amid a market meltdown when investors also raised questions about sky-high valuations following their market debut in recent years.

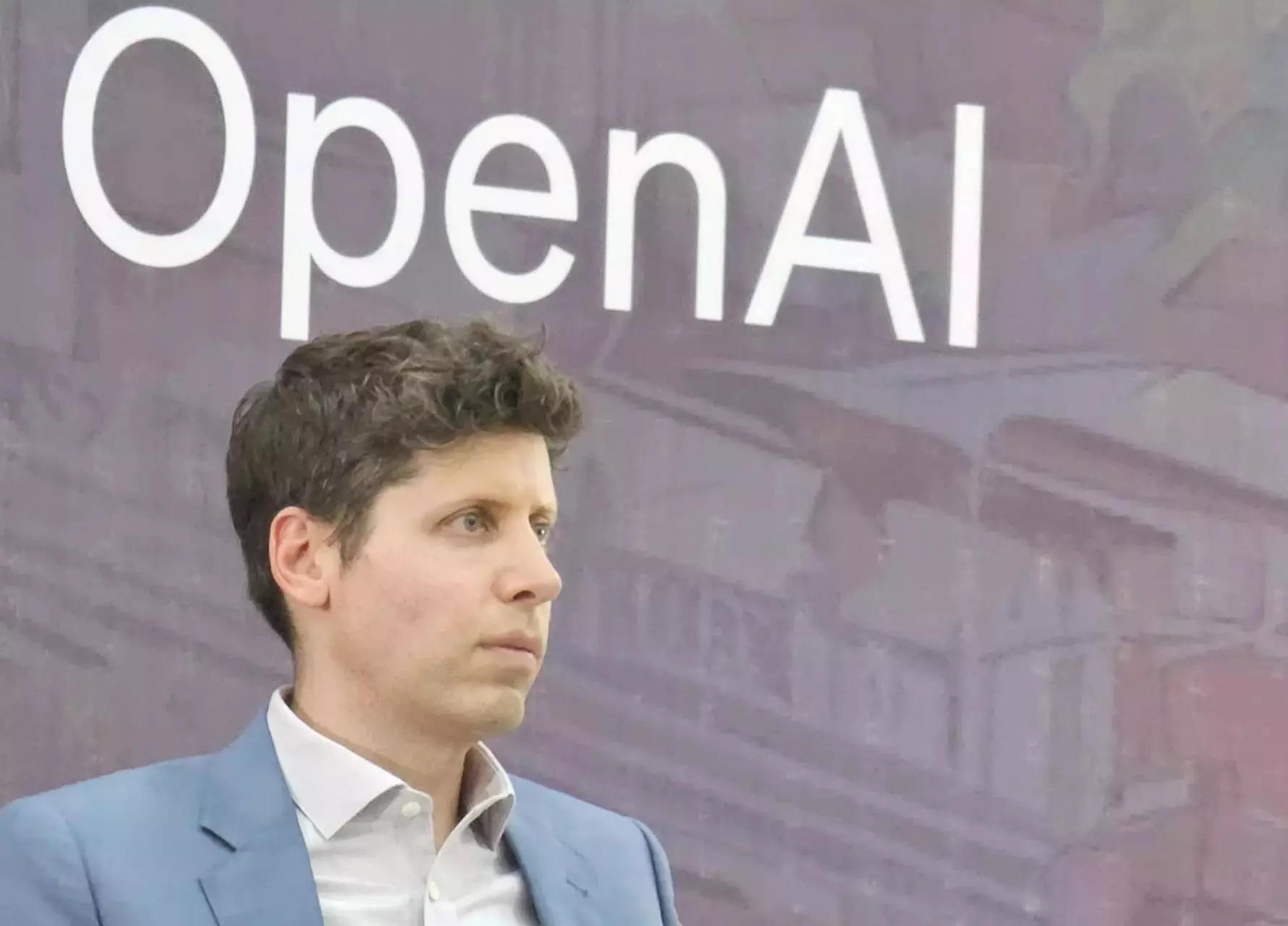

OpenAI unlikely to offer board seat to Microsoft, other investors

OpenAI CEO Sam Altman

Artificial intelligence company OpenAI is not expected to offer Microsoft and other investors including Khosla Ventures and Thrive Capital seats on its new board, reported news agency Reuters. Microsoft, which has invested more than $10 billion in OpenAI, is one of the biggest backers.

Expert take: “I do not know that it’s going to be the choice of OpenAI to leave Microsoft off the board,” Thomas Hayes, chairman of hedge fund Great Hill Capital, told Reuters. “Microsoft will have something to say about it, given the amount of money that they have put behind them.”

Board composition: The new OpenAI board will be led by former Salesforce co-CEO Bret Taylor. The other members will be former US Treasury Secretary Larry Summers and question-and-answer website Quora’s CEO Adam D’Angelo, the only carryover from the previous board.

Catch-up quick: OpenAI cofounder and CEO Sam Altman was ousted by the previous board on November 17. He returned five days later after efforts from investors, including Microsoft, to reinstate him and an open letter from OpenAI employees threatening to quit if Altman was not brought back, bore fruit.

Today’s ETtech Top 5 newsletter was curated by Vaibhavi Khanwalkar in Bengaluru and Gaurab Dasgupta in New Delhi.