Also in this letter:

■ Automakers tap cleantech to fuel future

■ Aditya-L1 is now collecting scientific data

■ India committed to Foxconn: IT minister

Bob van Dijk steps down as CEO of Prosus and parent Naspers

Bob van Djik, former CEO, Prosus and Naspers

Bob van Dijk has stepped down as the CEO and board member of Dutch-listed technology investment firm Prosus, and its parent, South African conglomerate Naspers, according to a statement from the Amsterdam-based company. His sudden departure, after spending ten years at the group, marks a significant top-deck change.

What now? Van Dijk will remain as an advisor to both boards until September 30, 2024, to support them through the transition. Ervin Tu, the group’s chief investment officer, has been appointed as the interim CEO. Tu joined Prosus two years ago from SoftBank Vision Fund, where he was a managing partner and led investments in Uber and TikTok-parent Bytedance.

Impact of exit: On Monday evening (IST), Prosus shares were trading almost 3% down in Amsterdam at 28.72 euros, while Naspers’ shares were 2.5% lower in Johannesburg, South Africa. Shares of Tencent—in which Prosus owns a 26% stake—ended 1.6% lower in China.

Naspers on Tencent: During a call with analysts on Monday, Koos Bekker, chair of the Naspers board, said there are no plans to divest its holding from Tencent. Bekker said Tencent is one of the ‘best tech companies in the world.’

A decade at Naspers: Van Dijk oversaw Prosus going public after the parent group wanted to unlock value by listing the investment arm in 2019. Naspers owns a 43% stake in Prosus. Van Dijk’s exit comes at a time when the firm has been making multiple large-scale exits from global markets. India is among its largest remaining markets, through PayU and other investments.

Pullout: As global liquidity came under pressure, the van Dijk-led Prosus pulled out of a mega $4.7-billion deal in India to acquire payments processor BillDesk in October 2022, over a year after it was announced in August 2021, in what was seen as another abrupt decision given that it had secured the antitrust regulator’s clearance for the merger.

India bets: Prosus, under Van Dijk, has invested over $10 billion in India and is one of the largest investors in the country. Its portfolio includes investments in top startups such as Swiggy, Flipkart, Urban Company. Byju’s, Meesho and others. Prosus’ fintech arm, PayU, is one of the biggest online payment processors in the country.

Global rejig: Van Dijk’s exit comes at a time when a global restructuring is underway at Prosus. In August, it had undertaken an internal revamp, separating edtech and food delivery into two discrete segments with dedicated leadership.

Also read | Two managing partners leave early-stage investment firm Orios; expected to start new fund

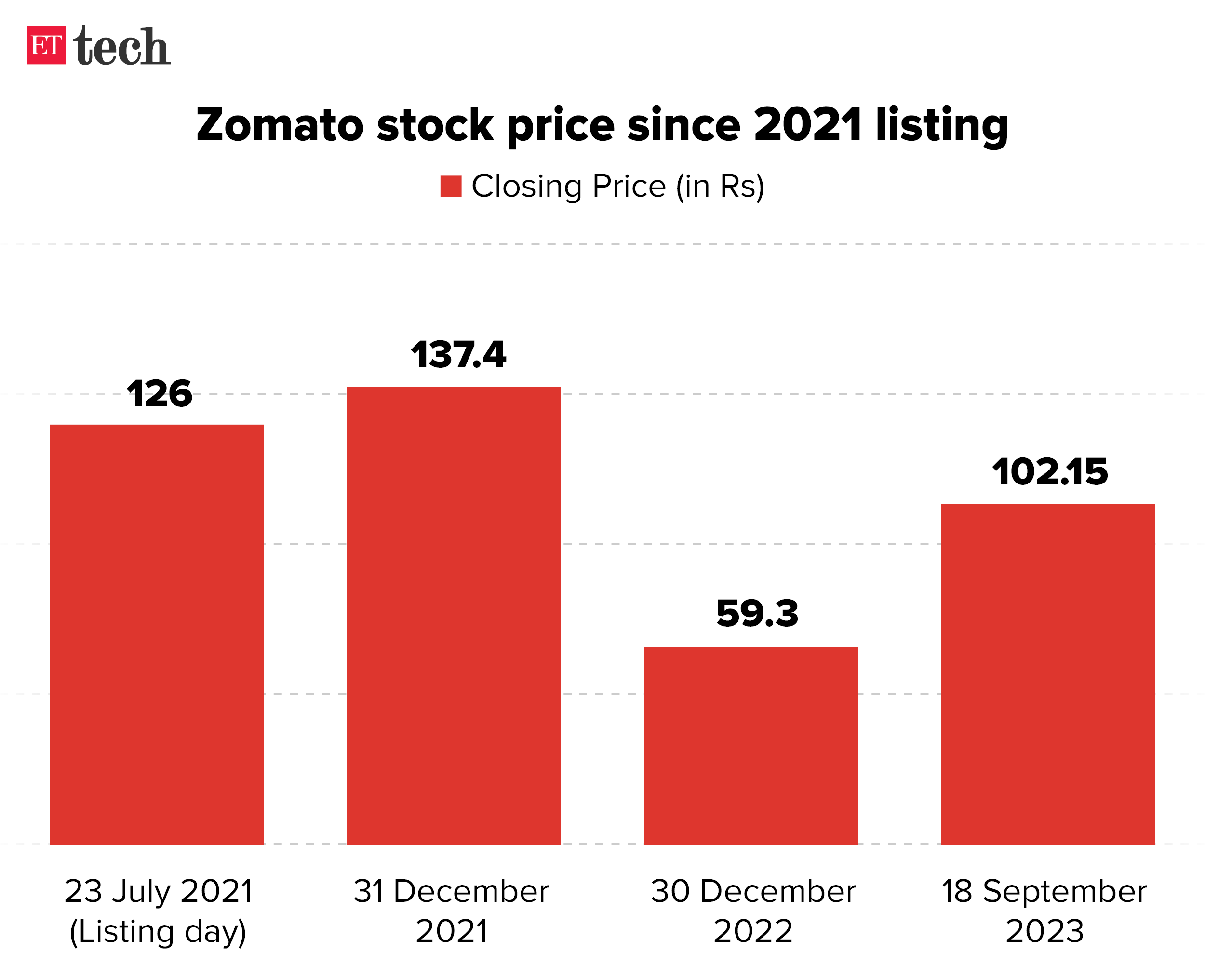

Zomato hits 52-week high, m-cap nears $10.7 billion

Online food and grocery delivery platform Zomato’s shares hit a 52-week high on the BSE during trading on Monday, taking the company’s market capitalisation close to $10.7 billion. The stock has given solid returns to investors in the last six months and has drawn interest from mutual fund houses.

Stock movement: The stock reached Rs 105 apiece in intraday trade on the NSE to hit the 52-week high mark but ended down 2.8% to close at Rs 102.15. Over the past six months, the stock has risen about 95% and attracted interest from investors and mutual fund houses alike.

Preferred pick: Mutual funds have doubled down on their bets on Zomato and it was among the top buys of domestic fund houses in August, as they bought over 80 million shares. This is an increase of 30% over the preceding month. Mutual funds currently hold 789 million shares in the company, worth Rs 7,700 crore.

Strong Q1 numbers: The new-age tech company posted a surprise net profit of Rs 2 crore for the June quarter, compared to a loss of Rs 186 crore in the year-ago period, and a loss of Rs 189 crore a quarter earlier. This was on the back of a 71% surge in revenue to Rs 2,416 crore. Analysts suggest the strong earnings were supported by healthy revenue growth and a sharp improvement in margins.

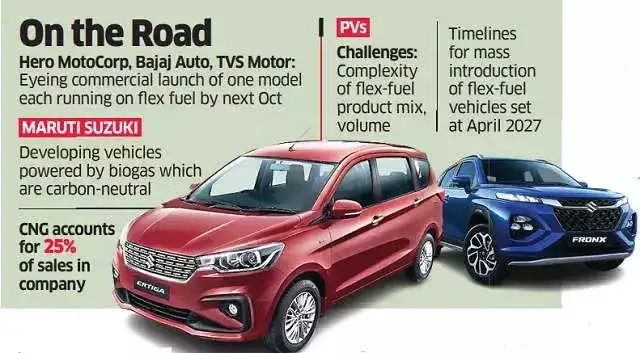

Top automakers readying cleantech to power up future vehicles

Indian automakers such as Maruti Suzuki, Bajaj Auto, TVS Motor Company and Eicher Motors are working on clean and eco-friendly technologies, including biogas, flex-fuel and ethanol, to achieve the government’s goal of clean mobility.

Who’s doing what? Two-wheeler makers Hero MotoCorp, Bajaj Auto, and TVS are looking to commercially launch one model each on flex fuel by October 2024. Meanwhile, carmakers, including Maruti Suzuki, are developing vehicles powered by biogas, which would be carbon neutral. For passenger vehicles, the timeline for mass introduction of flex fuel vehicles is April 2027.

Quote, unquote: “We also see significant potential for incentivising dense public mobility such as high-capacity buses on dedicated bus lanes, and lighter footprint personal transport such as two-wheelers. These will go a long way to improve access and equity of mobility as we reduce emissions,” said Siddhartha Lal, MD, Eicher Motors.

Global estimates: The International Energy Agency (IEA) estimates that global production of sustainable biofuels would need to triple by 2030 to put the world’s energy system on track towards net zero emissions by 2050.

Aditya-L1 has begun collecting scientific data: Isro

Aditya-L1 has begun collecting scientific data, the Indian Space Research Organisation (Isro) said in its update on Monday.

Mission update: The sensors of the STEPS (Supra Thermal and Energetic Particle Spectrometer) instrument have begun measuring supra-thermal and energetic ions and electrons at distances greater than 50,000 km from Earth, the space agency said, adding that the data will help scientists analyse the behaviour of particles surrounding Earth.

Tell me more? The STEPS instrument is a part of the Aditya Solar Wind Particle EXperiment (ASPEX) payload. Aditya L1 has seven payloads.

STEPS was activated on September 10, at a distance greater than 50,000 km from Earth, which is equivalent to more than eight times the Earth’s radius, placing it well beyond Earth’s radiation belt region.

The next manoeuvre for the Aditya-L1 mission is scheduled for September 19.

Govt committed to facilitate Foxconn’s expansion plan in India: Ashwini Vaishnaw

Ashwini Vaishnaw, Union IT Minister

The government is “fully committed” to help aid iPhone maker Foxconn’s expansion plan in India, minister for electronics and information technology Ashwini Vaishnaw said on Monday.

Quote unquote: “Fully committed to support and facilitate”, Vaishnaw said on X (formerly Twitter) and quoted the Foxconn India representative V Lee’s LinkedIn post. The Taiwanese contract manufacturer aims to double its workforce and investment in India by next year, Lee had said in the post.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Gaurab Dasgupta in New Delhi.