New Delhi: Maintaining affordable balance in the present period calls for cautious monetary preparation. For a financially protected future, one necessities to contribute at the hour of acquiring as after retirement it will give practical help. Contributing some place has likewise turned into the go-to strategy.

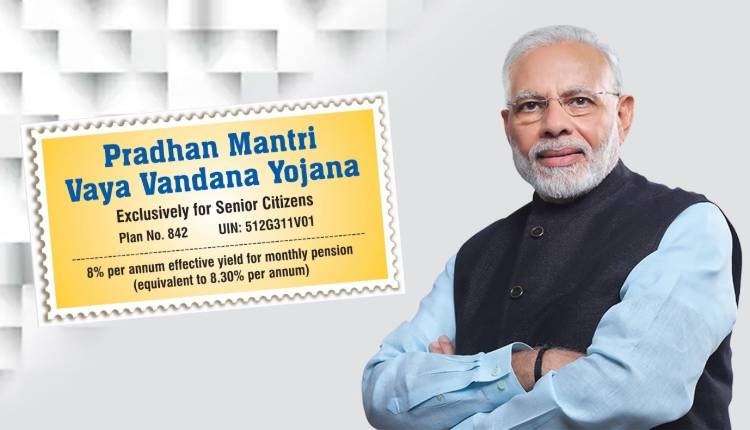

There are numerous venture choices accessible on the lookout. Presumably, you are searching for the choice from where you can get a protected, secure, and greatest return. Thus, here’s the government’s plan Pradhan Mantri Vaya Vandana Yojana.

Here are the finished subtleties including every single star and con of the arrangement.

What is Pradhan Mantri Vaya Vandana Yojana?

Pradhan Mantri Vaya Vandana Yojana is a government backed retirement plot. Under which the recipient will get a month to month benefits. It has been welcomed by the Government of India on May 26, 2020, while the plan is being worked by the Life Insurance Corporation of India (LIC).

The people who have crossed 60 years old can contribute a limit of Rs 15 lakh.

Prior as far as possible was Rs 7.5 lakh, which has now been multiplied. Contrasted with different plans, senior residents get more interest in this plan. In this plan, individuals of 60 years or above can pick a month to month or yearly benefits plan.

Growth strategies

Under the plan, you will get 7.40 percent yearly premium. Appropriately, the yearly premium on the venture will be Rs 111000. In the event that it is partitioned into a year, a measure of Rs 9250 is shaped, which you will get as a month to month benefits. To take a month to month benefits of 1000 rupees, you should contribute 1 lakh 50 thousand rupees.

Sum refund

This plan is for a considerable length of time. A month to month benefits will keep on being gotten on your saved cash. In the event that you stay in the plan for a considerable length of time, your put away cash will be gotten back to you. You can give up this plan whenever.