Credit: Giphy

Also in this letter:

■ Expect festive buying to continue into next year: Nykaa CEO

■ Parliamentary panel to meet crypto stakeholders

■ Chinese hackers may have targeted Zoho, says US firm

Policybazaar shares end 22.74% higher on market debut

Alok Bansal and Yashish Dahiya, cofounders of Policybazaar

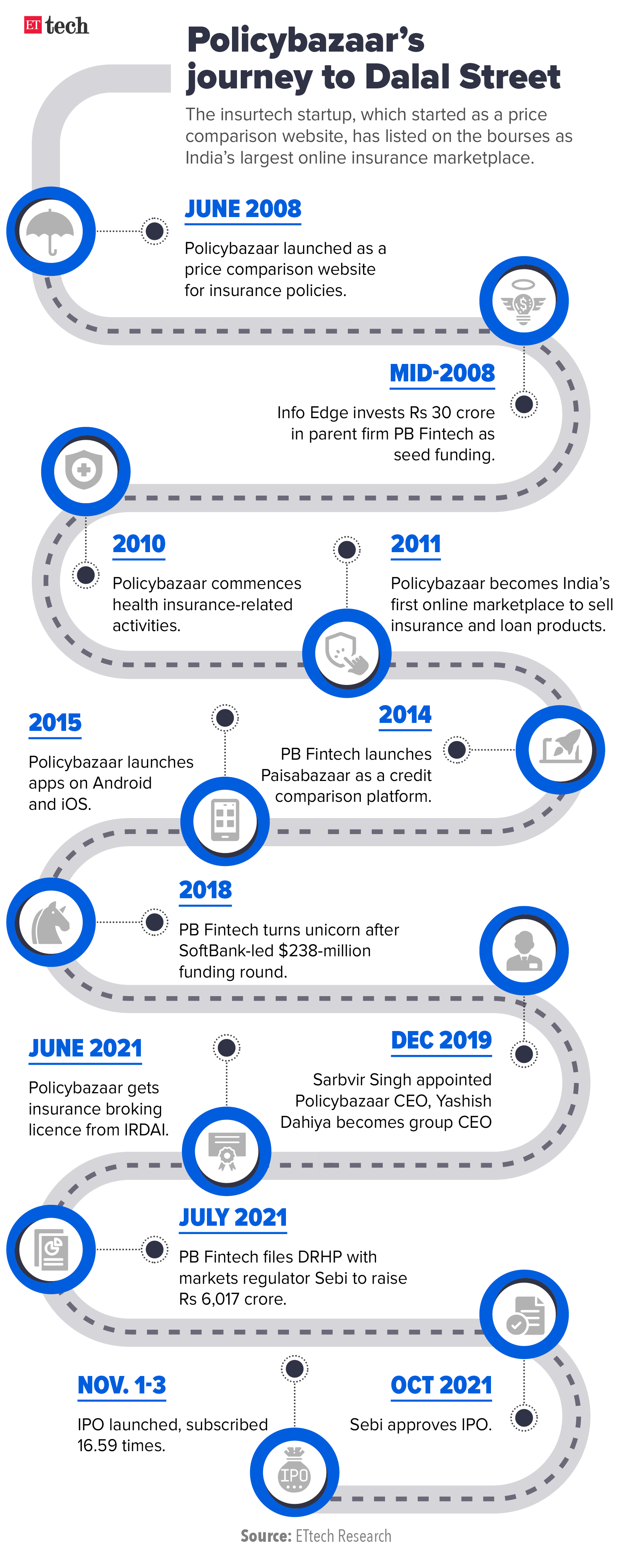

Shares of PB Fintech, the parent company of Policybazaar and Paisabazaar, rose more than 20% over the IPO price on its stock market debut today, in yet another stellar listing for a new-age internet company in India.

Details: The stock listed at a 17.35% premium on the BSE and hit an intraday high of Rs 1,249 before ending the day at Rs 1,202.90 — 22.74% higher than the issue price. This gave the firm a market capitalisation of Rs 54,070.33 crore.

In comparison, the market cap of Zomato Ltd. and Nykaa parent FSN E-Commerce Ventures had topped the Rs 1 lakh-crore mark within the first few hours of trading on their stock market debuts.

“We are lucky we got to solve a problem where we could educate people about the need for life insurance,” PB Fintech’s cofounder Yashish Dahiya said during the listing event at the National Stock Exchange on Monday. “We have a long way to go”.

Also read: Who are Yashish Dahiya and Alok Bansal, founders of Policybazaar?

NSE CEO Vikram Limaye welcomed the company at the national bourses. “The listing of PB Fintech propels the story of new-age tech companies,” he said. “Indian markets have accepted the models of these companies which cannot be evaluated in conventional ways.”

Analysts speak: Analysts expect PB Fintech’s stock to do well going forward. “The insurance industry and the online market is underpenetrated — and the company has a strong market share,” Rajnath Yadav, senior research analyst at Choice Broking, told Reuters. “We are anticipating growth in the online insurance segment and the company is expected to benefit.”

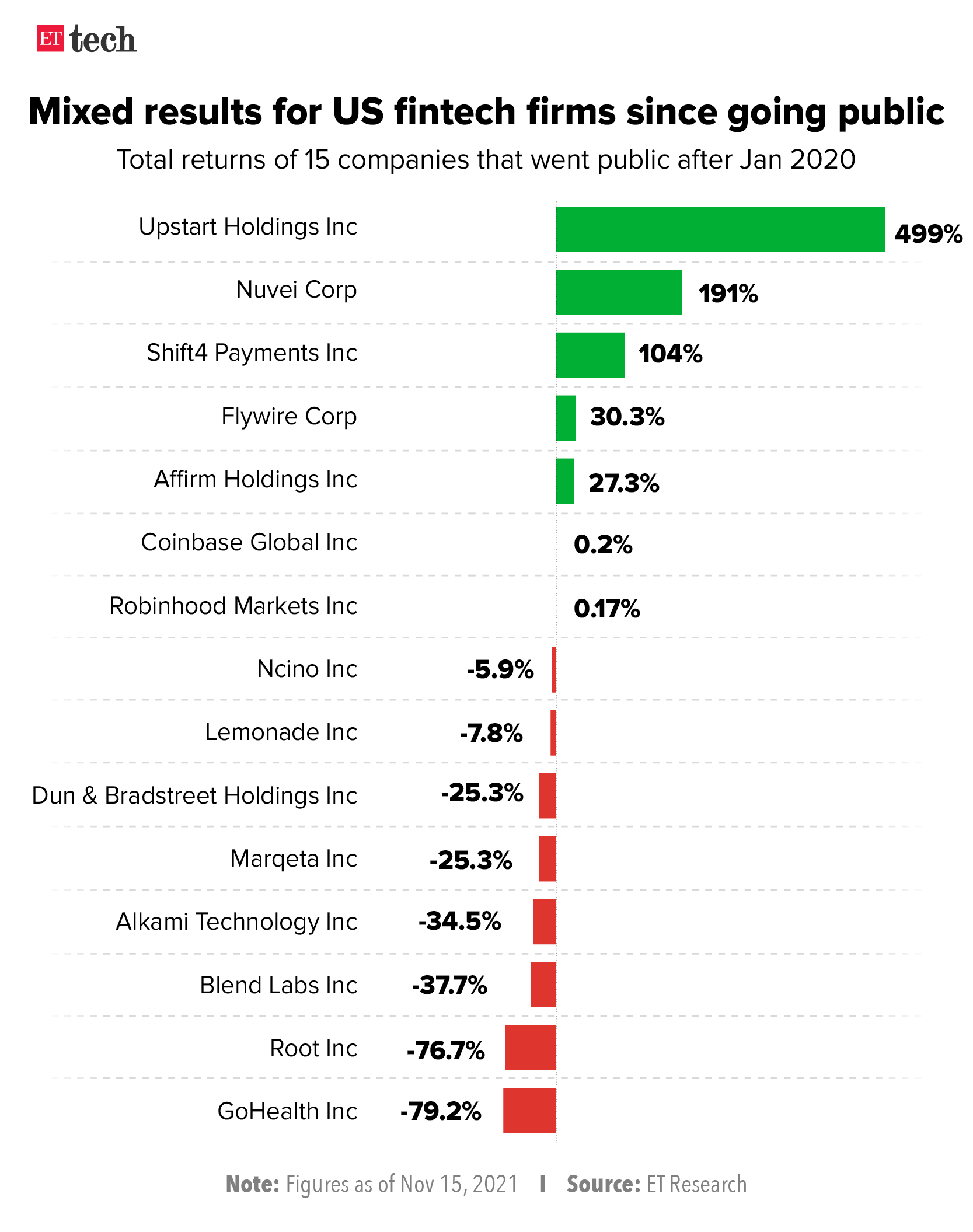

Yes, but: While this represents another stellar listing for an Indian tech startup, PB Fintech, Paytm and other fintech firms in India will have one eye on their counterparts in the US. That’s because some of these US fintech companies, which were embraced by private investors, have seen lukewarm trading in the public market.

Of 15 US fintech companies that conducted initial public offerings (IPO) since January 2020, eight were trading below their listing price as of November 15, two were trading flat and only five were trading above their listing price, according to data compiled by ET. This reflects a possible disconnect between enthusiastic private equity and venture capital investors and more measured portfolio managers and traders. As a result, excitement at other US fintech firms planning listings has cooled. Whether PB Fintech, Paytm, Mobikwik mirror or buck this trend remains to be seen.

Stellar IPO: PB Fintech’s IPO, held from November 1 to 3, was subscribed 16.59 times. The IPO comprised a fresh issue of stock worth Rs 3,750 crore and an offer for sale valued at Rs 1,960 crore. The SoftBank-backed firm had raised more than Rs 2,569 crore from 155 anchor investors on Oct. 29. The price band was set at Rs 940-980 per share.

We expect festive buying to continue into next year, says Nykaa CEO

Nykaa founder Falguni Nayar

Nykaa will focus on growth and profitability while investing significant sums in marketing and to acquire customers, founder and CEO Falguni Nayar told us earlier today.

Profit down: The remarks came after the newly listed company registered a 96% fall in profit to Rs 1.2 crore in the second quarter. Revenue, however, rose 47% to Rs 885 crore year on year and 8% sequentially, the company said in stock exchange filings late on Sunday.

The company’s marketing and advertising expenses shot up to Rs 121.4 crore in the quarter ended September 30, from Rs 31.5 crore in the corresponding period last year.

Earnings before interest, tax, depreciation and amortisation (Ebitda) in the September quarter stood at Rs 28.8 crore, a 48% decline from the same period last year.

Shares of FSN E-Commerce, the parent company of Nykaa, dropped about 8% to Rs 2,185.05 in early trade today. It closed the day 3.32% lower on the BSE at Rs 2,280.6 a share.

Founder responds: “We will continue to invest in the future and maintain a strong balance between growth and profitability,” Nayar said. “Last year, the marketing costs were unusually low and there was revenge buying seen in the market post the first wave of the pandemic,” she said. “We will push the pedal on acquiring more customers.” There has been phenomenal growth in the current festive season and the December quarter will reflect that, she added.

“This year, July, August and September were muted but we expect the festive buying to continue well into next year till February-March when the wedding season kicks in,” she said.

The Mumbai-based e-tailer said on Sunday that its gross merchandise value (GMV) for the June-September period rose 63% year on year and 10% sequentially. The company’s total GMV stood at Rs 1,622.9 crore for the quarter as against Rs 997.1 crore in the same period last year.

“Our half-yearly numbers show that we registered a profit of Rs 4.7 crore for the current financial year over a loss of Rs 25.1 crore in the same period last year, which to us is a key change,” Nayar said.

Nykaa hit the Indian stock exchanges on November 10 and its market capitalisation went past Rs 1 lakh crore after the stock started trading at a nearly 80% premium to its issue price of Rs 1,125.

Crypto finance: Parl panel to meet exchanges, stakeholders

Representatives of crypto exchanges, the Blockchain and Crypto Assets Council (BACC), industry bodies and other stakeholders were to make their submissions on crypto finance today before a parliamentary panel chaired by BJP leader Jayant Sinha.

This was to be the first meeting on the subject to be convened by the Parliamentary Standing Committee on Finance on the subject, which has generated a lot of interest and concern. The panel, headed by Sinha, who is also a former minister of state for finance, also sought inputs from academics from IIM Ahmedabad.

Sinha had said he would discuss with crypto stakeholders the various opportunities and challenges the fast-evolving industry presents to regulators and policymakers.

The panel’s meeting is significant as it comes days after Prime Minister Narendra Modi chaired a high-level meeting with officials from various ministries and RBI on the issue of cryptocurrency.

Middle path: Last week we reported that India may take the “middle path” on cryptocurrencies as it finalises legislation on these virtual assets for the upcoming winter session of Parliament.

A source told us that a growing view among policymakers is that the law should take into consideration technological developments in the space.

“A balance has to be found,” the person said, adding that a final call on the contours of the law will be taken shortly. “A middle path that balances the concerns of all stakeholders is more likely.”

Tweet of the day

Chinese hackers may have targeted Zoho, says US cyber security firm

Enterprise software maker Zoho was targeted by hackers, possibly of Chinese origin, who exploited a vulnerability in its self-serve password management tool ManageEngine from late September to early October, according to a blog post by Palo Alto Networks.

Major sectors hit: The US-based cyber security firm’s Unit 42 said last week that the hackers exploited the known vulnerability to successfully infiltrate at least nine global organisations in critical sectors such as defence, energy, healthcare, education and technology.

The attack, which it said began on September 22 and likely continued until early October, targeted at least 370 of Zoho’s ManageEngine servers in the United States.

Chinese hackers? Palo Alto Networks said the tactics and tooling used in the attacks were similar to that of Chinese hacking group Emissary Panda, though it has not been able to validate the actor behind the campaign. It said it had detected over 11,000 servers running Godzilla Webshell, the malware that was deployed in the cyberattack.

The issue was first reported by the US Cybersecurity and Infrastructure Security Agency on September 16. Palo Alto Networks noticed the hacking campaign days after this alert.

The vulnerability, in Zoho’s ManageEngine ADSelfService Plus solution, has since been patched.

Elon Musk hits back at Bernie Sanders, offers to sell more Tesla stock

Tesla CEO Elon Musk

Tesla Inc chief executive Elon Musk got into yet another Twitter spat today. This time it was with Bernie Sanders, after the US senator demanded the wealthy pay their “fair share” of taxes.

“We must demand that the extremely wealthy pay their fair share. Period,” Sanders wrote on Twitter. Taking a jibe at the 80-year-old senator, Musk responded by saying “I keep forgetting that you’re still alive.”

Keyboard war: Musk even offered to sell more of his Tesla shares, which would require him to pay capital gains tax. Musk was still tweeting hours later, saying Sanders “is a taker, not a maker.”

The billionaire CEO has already offloaded a combined $6.9 billion worth of shares in the electric car company as of November 12.

Tax the rich: Sanders’ tweet comes amid the backdrop of Washington’s efforts to hike taxes for the super-wealthy.

US Senate Democrats have unveiled a proposal to tax billionaires’ stocks and other tradeable assets to help finance President Joe Biden’s social spending agenda and close a loophole that has allowed them to defer capital gains taxes indefinitely.

It’s game over for Fortnite in China: Meanwhile, Epic Games pulled the plug on its Chinese version of Fortnite today, with its three-year effort to penetrate the world’s biggest gaming market derailed by Communist Party crackdowns against online addiction and the broader tech sector.

Epic Games had announced two weeks ago that it would shut down the Chinese version of the game on November 15, noting that “Fortnite China’s Beta test has reached an end” and that servers would be closed.

Chinese regulatory hurdles: The move ends a long-running test of Fortnite created for China, where content is policed for excessive violence. The action-packed shooter and world-building game is one of the most popular in the world, boasting more than 350 million users. Its Chinese test version was released in 2018, but ‘Fortnite’ never received the government’s green light to be formally launched and monetised as approvals for new games slowed.

Tech crackdown: The Chinese government has pressed a broad crackdown on the wider technology sector over the past year, citing concerns that tech giants were getting too big and powerful.

Saying children were spending too much time playing online games, regulators also targeted the huge gaming sector with new age and playing-time restrictions, while approval of new titles has slowed.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.