The first tranche of $75 million from Alpha Wave has already been disbursed, regulatory filings by the company in Singapore show. The news of Pine Labs raising the first tranche was first reported by Dealstreet Asia.

Sources in the know said the financing deal also includes a secondary round in the range of $50-75 million. Typically, in a secondary deal the incoming investors buy shares directly from existing stakeholders who are looking to either dilute or offload their holdings.

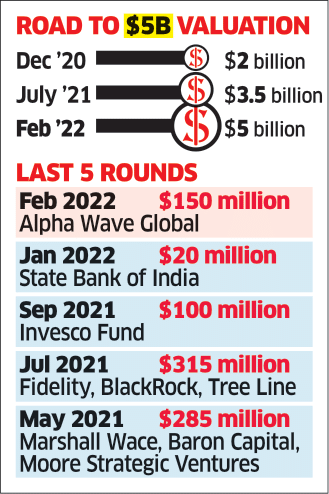

ET was the first to report that Pine Labs was in the final stage of raising at least $100 million from Falcon Edge (now rebranded as Alpha Wave), at a valuation of $5-5.5 billion.

Confirming the investment on Friday, Pine Labs CEO Amrish Rau said, “Alpha Wave Venture has invested $150 million in Pine Labs. We are happy to bring a marquee investor on board.” But he declined to comment on the secondary raise, which is a part of the current round.

Happy to announce that Alpha Wave Ventures has joined us in our journey. They invested a total of $150Mn. We are… https://t.co/WeE7VTxJCo

— Amrish Rau (@amrishrau) 1645191152000

Discover the stories of your interest

IPO seeking valuation of $6-7 b

While the company’s “omni-channel strategy is showing strong revenue growth, we are also seeing strong growth in international markets,” Rau added.

In January, the fintech company filed for a ‘confidential’ initial public offering (IPO) worth $500 million with the US Securities and Exchange Commission, and is seeking a valuation between $6 billion and $7 billion. In the same month it also raised $20 million from India’s largest lender, State Bank of India.

Backed by marquee investors including the likes of Sequoia Capital, Temasek Holdings, Actis, PayPal and Mastercard among others, Pine Labs is expanding its offerings in the domestic market and has increased its footprint across the SE Asian geographies. The company also had plans to enter and Middle East markets this year.

ETtech

ETtechLast year, the merchant-focused fintech firm acquired Singapore-based loyalty payments startup Fave. It plans to offer unified payments interface (UPI)-based payments to consumers.

In a bid to diversify, it also launched a payment gateway, Plural, in 2021, to help new-age direct-to-consumer (D2C) brands accept digital and credit-linked payments.

Earlier this month, ET reported that Pine Labs is negotiating the purchase of API-based infrastructure company Setu in a cash and equity deal for $70-100 million, citing sources aware of the development. .

Separately, the company has announced the acquisition of Mumbai-based online payments startup Qfix Infocomm to bolster its online payments play and offer additional services including billing, invoicing and workflows to merchants.