Also in this letter:

■ Rupeek lays off 200 employees amid funding slowdown

■ Meesho sends legal notice to influencers

■ Musk can’t claim ‘buyer’s remorse’ on Twitter deal: report

Physics Wallah enters unicorn club while other edtechs lay off workers

Alakh Pandey, founder, Physics Wallah

Physics Wallah, a bootstrapped online education startup, has raised $100 million at a valuation of $1.1 billion in its maiden funding round led by WestBridge Capital and GSV Ventures.

Sweet 16: This makes Physics Wallah the 16th startup to enter India’s unicorn club this year, where it joins fellow edtech companies Byju’s, Unacademy, Eruditus, Vedantu, UpGrad and Lead School.

Founded in 2016 by Pandey and Prateek Maheshwar, Physics Wallah prepares students for competitive engineering and medical entrance examinations.

It plans to use the funds for business expansion, branding, opening more offline learning centres, and introducing more course offerings.

It also plans to launch educational content in nine Indian languages, as it looks to expand its reach and connect with 250 million students by 2025.

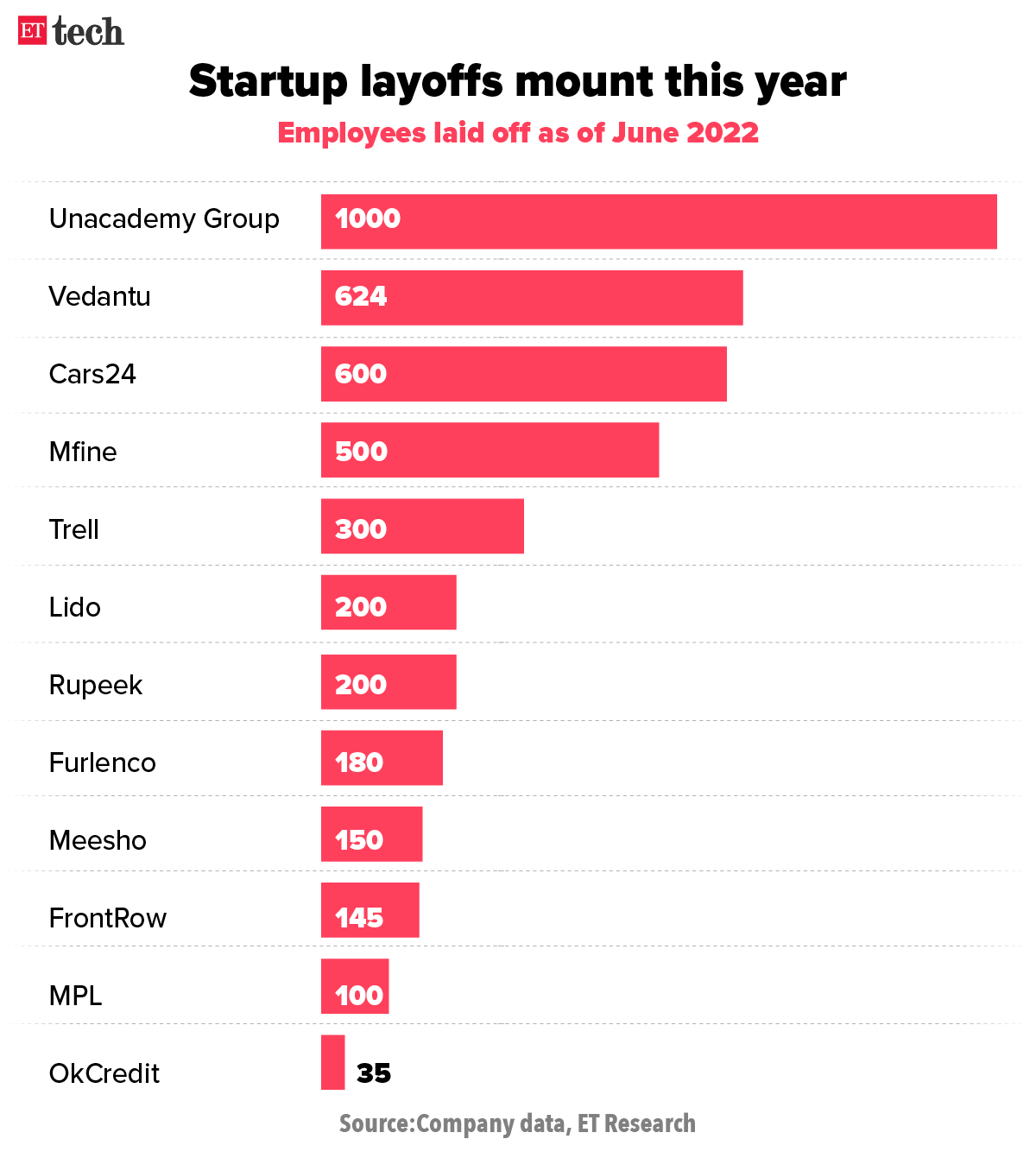

Edtech carnage: The investment comes as other top edtech unicorns in India feel the effects of the slowdown in funding coupled with the reopening of physical schools.

Edtechs firms that have sacked employees this year include Unacademy, Vedantu, Lido Learning, FrontRow. On June 1 we reported that edtech startup Udayy had fired 100-120 employees and shut down after its business slowed following the reopening of schools. The company had raised $10 million from investors as recently as February.

Last month, Unacademy founder Gaurav Munjal, whose company has laid off over 1,000 on-roll and contractual staff in recent months, told employees in an email that “winter is here”. He said cost-cutting would be the company’s key focus as funding would remain scarce for at least the next 12-18 months.

Rupeek lays off 200 employees amid funding slowdown

Gold loans provider Rupeek is the latest startup to lay off employees in what has been a turbulent 2022.

Driving the news: Sources told us the company has sacked almost 200 employees (10-15% of its workforce) as it looks to cut costs.

Rupeek’s founder and chief executive Sumit Maniyar announced the layoffs in a note to employees on Tuesday morning.

“Globally, all the emerging markets including India are facing an extraordinary situation that has been caused by rising inflation, a hike in US treasury rates, and the Russia-Ukraine war. The subdued macro economic environment has compelled us to re-calibrate our strategy, relook at our costs and make our organisation structure leaner, so as to support our sustenance and growth,” Maniyar said in the note.

Founded in 2015, Rupeek provides gold loans at consumers’ doorsteps. It operates in more than 35 cities, and claims to have disbursed loans worth over Rs 6,500 crore since inception.

The company raised $34 million in January in a round led by Lightbox. Other investors include GGV Capital, Binny Bansal and Bertelsmann India Investments.

Several prominent venture capital firms including Beenext, Sequoia and Y Combinator have warned their portfolio founders to prepare themselves for a ‘funding winter’.

Layoffs: Other Indian startups that have laid off workers this year include edtech firms Unacademy, Vedantu, Lido Learning, Frontrow; gaming startup Mobile Premier League; social commerce startup Meesho; healthcare platform Mfine; and car retailer Cars24.

Meesho sends legal notice to influencers over alleged ‘smear campaign’

Vidit Aatrey, cofounder, Meesho

Ecommerce company Meesho said it has sent a legal notice to social media influencers and certain people in contact with them for allegedly running smear campaigns against the company.

The company said that on June 2, a Twitter user “exposed a concerted campaign against Meesho” in which several influencers put out a series of tweets tagging the company’s investors. Meesho claimed their aim was to malign the company’s reputation by spreading lies. “Following the exposé, some influencers acknowledged that said tweets were paid promotions while others deleted their posts,” Meesho said.

The company said this was not the first time it had been targeted by “those with vested interests looking to defame the company”.

Several Twitter users came forward claiming they were asked to put out negative tweets about Meesho in return for money earlier this year.

Meesho said it would continue to monitor the situation and consider taking legal action against “those spreading misinformation and lies about the company”.

Musk can’t claim ‘buyer’s remorse’ to walk away from Twitter deal: report

Elon Musk, who threatened to abandon his takeover of Twitter on Monday, can’t walk away from the deal due to “buyer’s remorse” under the terms of his agreement with the social media platform, legal experts told Bloomberg.

Catch up quick: Musk had put the Twitter deal temporarily on hold last month as he sought clarity on the number of fake accounts on the social media platform. On Monday, he upped the ante, saying in a letter to Twitter that he would walk away from his $44 billion deal if it fails to provide data on spam and fake accounts.

Twitter was in “clear material breach” of its obligations and Musk reserves the right to terminate the agreement, the letter said.

“He’s jockeying here — he’s trying to create a paper trail,” said Andrew Freedman, a partner at the law firm Olshan Frome Wolosky LLP, who is an expert in activist investment. “The unfortunate thing for Musk is that termination provisions under merger agreements don’t allow for buyer’s remorse,” Andrew Freedman, partner at law firm Olshan Frome Wolosky, told Bloomberg.

Twitter meanwhile reiterated that it would hold Musk accountable to the terms of his proposed takeover, suggesting that even the company believes he may be trying to blow up the deal.

Tweet of the day

Anicut Capital raises Rs 110 crore to double down on startups

Investment management company Anicut Capital scooped up Rs 110 crore for its Rs 500 crore Anicut Opportunities Fund I, which it will use to invest in up to 15 growth-stage startups.

The 10-year-old company also appointed Dhruv Kapoor as its new partner for driving growth via equity investments.

Anicut Capital has invested in 72 companies so far, including Bira, Wow Momo and Lendingkart.

“Our understanding is that massive compounding of returns is yet to happen and we are sitting on early equity positions with tomorrow’s market leaders. We firmly believe that once invested, we prefer to exit along with the founders,” said Ashvin Chadha, founding partner, Anicut.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.