Also in this letter:

■ Paltry hikes for LTIMindtree employees

■ Zomato shares jump 5% amid block trade

■ ITC partners startups to stay ‘agile and nimble’

PhonePe enters stockbroking segment, launches Share.Market app

PhonePe cofounder & CEO Sameer Nigam

Walmart-owned PhonePe is venturing into the stockbroking space. On Wednesday, the startup launched Share.Market, an app that enables users to open trading accounts and invest in stocks, mutual funds, and ETFs.

Details: PhonePe said in a statement that Share.Market will elevate discount broking through ‘WealthBaskets’, a market research-based technology platform that will provide stock market intelligence

Offerings: Share.Market will be available as a mobile app and also as a dedicated web platform for retail investors to buy stocks, carry out intra-day trades, buy curated ‘Wealth Baskets’ and mutual funds, the company said. The platform will also host a dedicated Markets section to track the stock market, indices, stocks, and sectors with an intuitive ‘Watchlist’ tracker.

What else? While PhonePe’s strategy of entering stockbroking is no different from that of arch-rival Paytm, the Bengaluru-headquartered company is looking to actively target the passive investing use case with ‘WealthBaskets’, a basket of stocks curated by registered professionals and entities. They align with specific themes, sectors or market trends enabling active equity portfolio building with great convenience, and at a low cost, the company claimed.

Appointments: Ujjwal Jain, cofounder and chief executive of WealthDesk, has been appointed as the chief executive officer of Share.Market while Sujit Modi, founder of OpenQ, will be the chief investment officer.

Rivals: PhonePe will face stiff competition in the stockbroking arena from Zerodha and Groww, among others.

Also read | Stock broking startups Groww, Upstox eye lending, payments to expand revenue base

Swiggy approaches banks, telcos to explore ‘One’ subscription bundling

Sriharsha Majety, CEO, Swiggy

Food-delivery platform Swiggy is working with banking and telecom firms to roll out bundled plans that include Swiggy One subscriptions.

Driving the news: In order to push One subscriptions, Swiggy also said that it is experimenting with different pricing and service tiers for the subscriptions.

Buyers of telecom subscriptions and banking products such as credit cards will get Swiggy One as part of their package under a B2B programme called Swiggy One Lite.

What is Swiggy One? Swiggy One users get discounts and benefits such as free delivery across most offerings, including the food app, quick commerce vertical Swiggy Instamart, restaurant search and booking offering DineOut, and hyperlocal porter service Genie.

Pricing strategy: Swiggy also plans to test the One subscription with different pricing tiers, wherein higher-priced tiers will provide discounts and offers across multiple verticals, while a lower-priced tier will do the same for just one or two verticals.

Swiggy One’s bundling exercise comes after rival Zomato reintroduced its ‘Gold’ subscriptions in January. Swiggy One costs Rs 1,299 for three months without any discounts, while Zomato Gold costs Rs 999 for the same duration.

Also read | ETtech Explainer: how restaurants responded to Zomato Gold’s comeback

Nil to 1% hikes for LTIMindtree employees after months of delay

Employees at LTI-Mindtree, India’s sixth largest IT company, saw salary hikes around a meagre 1%, sources told ET. A significant number of employees got no increments.

Low to no hikes: Even top achievers saw minimal salary increases, with some receiving hikes as low as 0.1%, sources told ET. Only a few people received increments of up to 2%, but nothing higher than that, according to the source.

Delayed hikes: After Q1 results, LTIMindtree had initially announced the rollout of promotions and annual hikes in July. However, it was postponed to August. The company did not provide guidance on fresher hiring for the remaining year.

In the first quarter, the company reported a 4.1% growth in net profit, falling short of estimates due to a “challenging macroeconomic environment”.

Also read | LTIMindtree CEO Debashis Chatterjee says deal delays consistent across all business sectors

Hikes across IT firms: India’s largest software company Tata Consultancy Services (TCS) said it would hike salaries from April by a substantial 12-15% for those deemed “exceptional” performers.

HCLTech chose to skip wage hikes for senior management this fiscal. On the other hand, Infosys and Wipro are yet to implement their annual salary increments. Infosys last introduced annual hikes in July 2022, while Wipro indicated that it would be done in the October-December quarter.

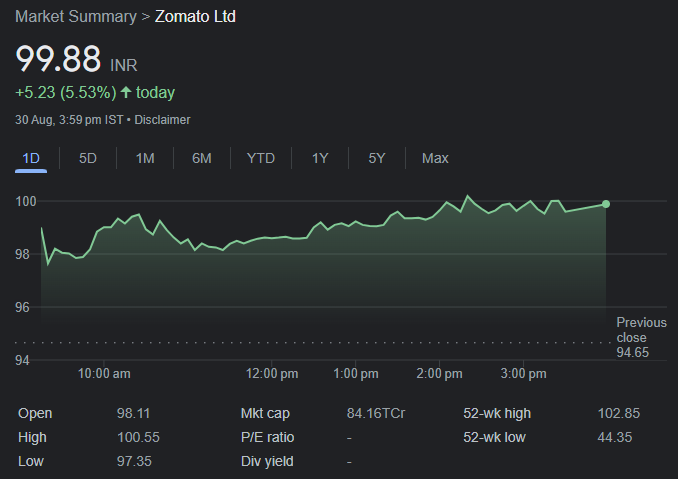

Zomato shares jump 5% as 1.16% equity is traded via block deal; SoftBank likely seller

Zomato CEO Deepinder Goyal

Shares of food-delivery company Zomato jumped over 5% in intraday trading to the day’s high of Rs 99.60 on a likely block deal in pre-opening trade on Wednesday, which saw a 1.16% stake changing hands. The stock ended the session on the BSE up 5.23% at Rs 99.88.

Who’s the seller? Japanese technology investor SoftBank’s Vision Fund is likely to have offloaded its shares in the food and grocery delivery company. The block deal is expected to be worth approximately Rs 940 crore, indicating that SoftBank will sell the shares at Rs 94 apiece.

Following in Tiger’s wake: SoftBank’s sale of Zomato stock comes after the complete exit of New York-based Tiger Global from the company. Tiger sold a 1.44% stake, or 12.35 crore shares of Zomato, on Monday for Rs 1,124 crore.

M-cap recovers: Earlier this month, Zomato announced its first quarterly net profit of Rs 2 crore for April-June, much ahead of its guidance. Following its maiden profit announcement, Zomato’s market cap breached the $10-billion mark. At the time of its initial public offering in 2021, the food and grocery delivery company’s valuation was $12 billion.

ITC partners startups to stay ‘agile and nimble’

Sanjiv Puri, chairman & MD, ITC

ITC chairman Sanjiv Puri said the conglomerate has partnered with about 45 startups as it looks to help employees develop agility and an entrepreneurial mindset. This comes at a time when small companies are increasingly disrupting large businesses.

Details: The cigarettes-to-hotels conglomerate is working with startups in the consumer space, social commerce, content creation, distribution, packaging and agritech solutions, among others.

Quote, unquote: “As an organisation, the focus is on how we remain consumer centric and resilient; how do we dial up on the digital journey and press the accelerator on purposeful innovation,” Puri told ET. “All these multidimensional initiatives come together to make the organisation agile and nimble, paving the way for sustained growth.”

Investments: Puri said the company has invested in startups directly as well as through venture capital funds. So far, ITC has directly invested in startups such as YogaBar in the food health category; Mothers Sparsh, a baby care and mother care products firm; and Mylo, a content-community-commerce platform for baby care and mother care.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Megha Mishra in Mumbai.