Also in this letter:

■ Unacademy to slash 12% of workforce in another round of layoffs

■ CCI gets powers to penalise tech firms based on global turnover

■ Elon Musk, other tech leaders call for AI pause

ETtech Exclusive: PhonePe calls off deal to acquire ZestMoney amid due diligence concerns

PhonePe CEO Sameer Nigam and ZestMoney CEO Lizzie Chapman

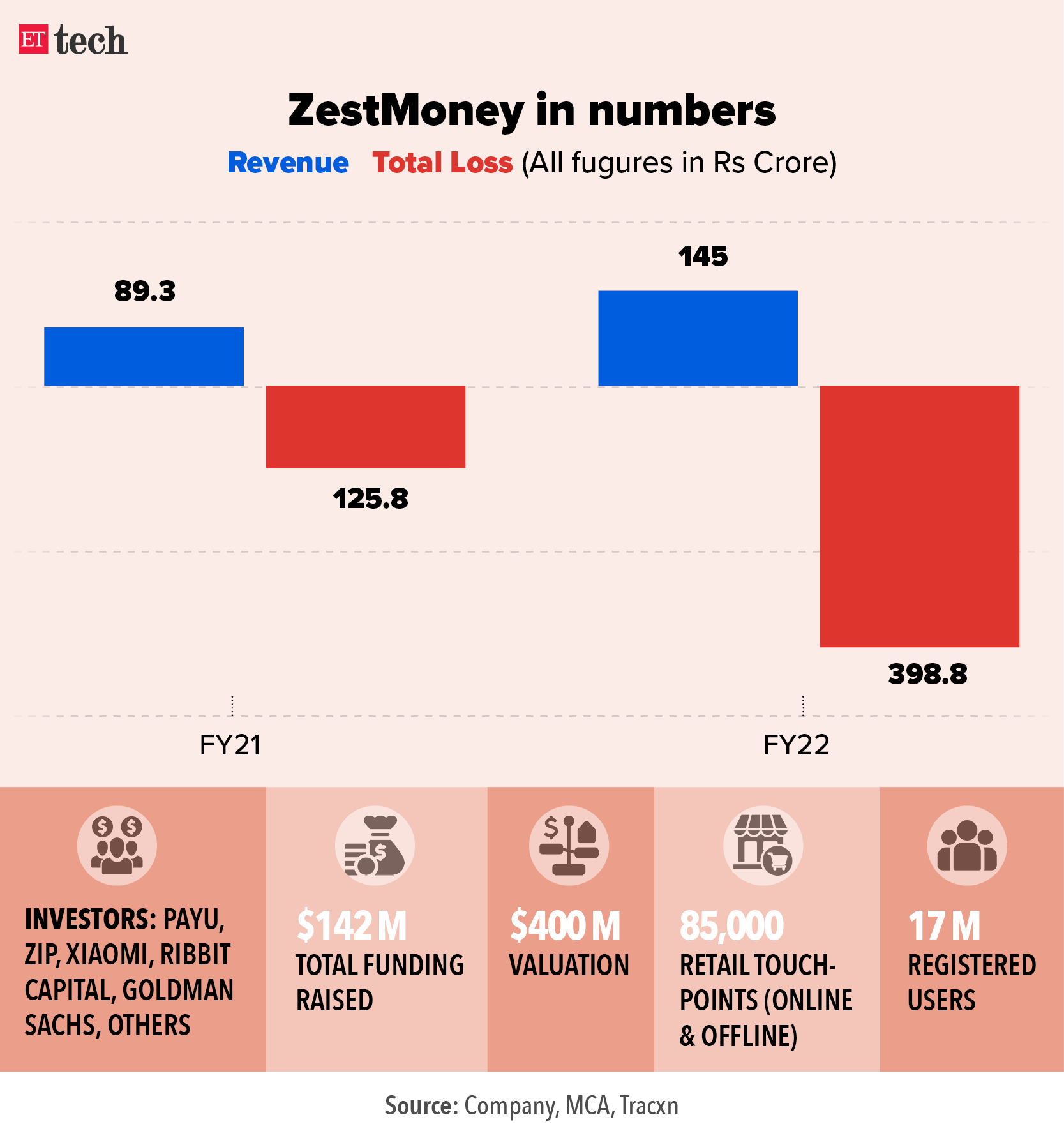

It’s official. Deal talks between payments major PhonePe and credit startup ZestMoney have been called off after months of deliberation, dealing a huge blow to the BNPL player’s hopes of a big funding infusion.

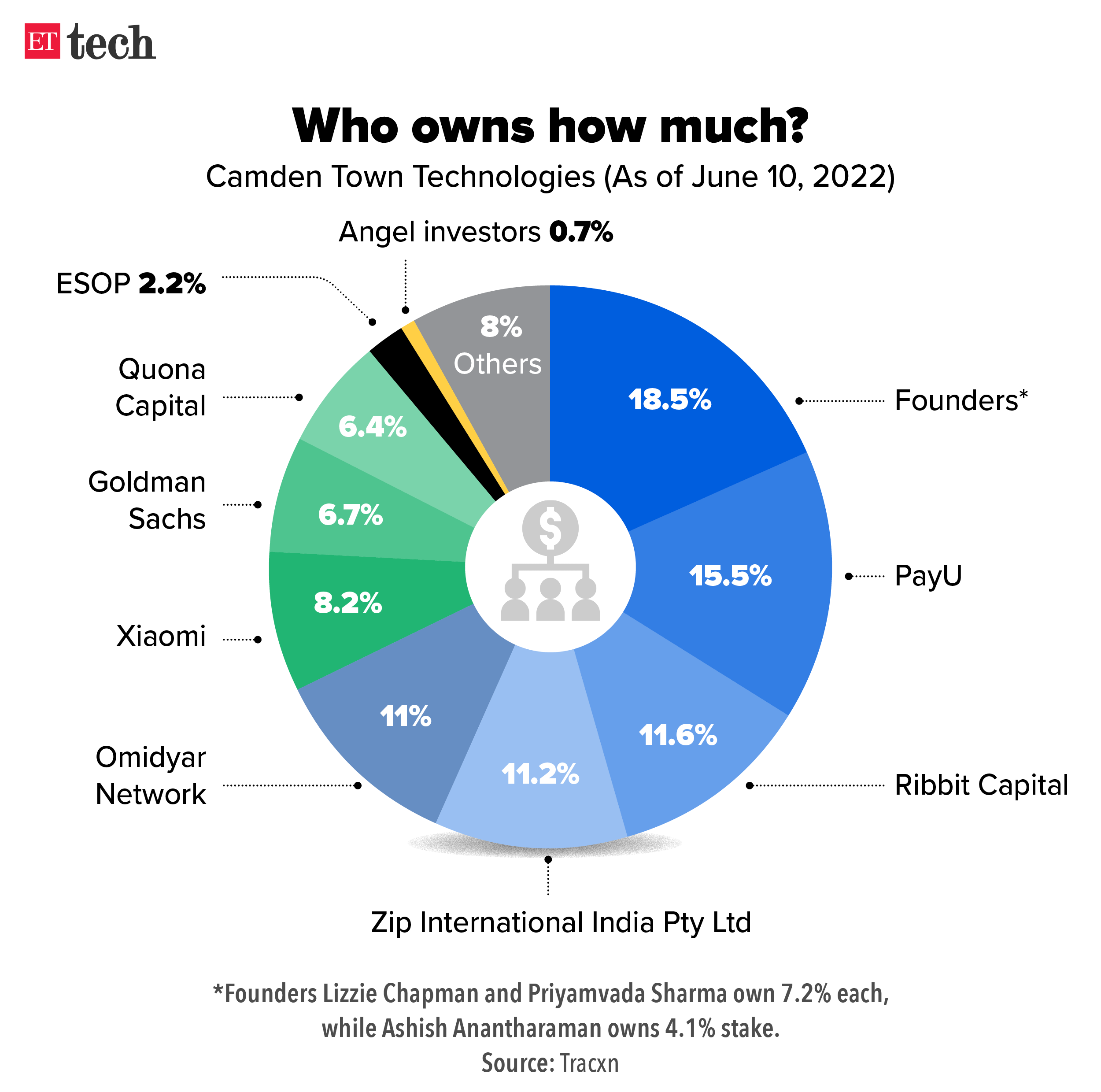

What led to the breakdown? Multiple sources told us that transaction fell through mainly because of due diligence concerns after more than five months of the term sheet being signed in November last year. ZestMoney’s shareholding structure was also a point of concern during the due diligence process.

What led to the breakup? ET had reported in November that the high delinquency rates of loans provided by ZestMoney had come under the scanner earlier as well which became a roadblock for the company’s attempts to raise capital. This issue is likely to have come up during the due diligence which took over five months.

During the negotiations, questions were raised around the complex structure of the company. Primrose Hill Ventures, the Singapore-based parent of India-registered Camden Town Technologies, is the entity which owns and operates the ZestMoney platform.

Primrose Hill Ventures owns Nahar Credits, which is the non-banking finance arm (NBFC) partner of ZestMoney, as well as Euston Insurance Advisors, the insurance broker arm of the group.

ZestMoney claims to have 17 million registered users and sports a network of 85,000 online and offline touchpoints. Unlike its counterparts, such as Simpl and PayU’s LazyPay, it focuses on big-ticket items and sits at the checkout counters of various ecommerce websites and points of sale of various offline retail partners. It competes with the likes of Axio (formerly CapitalFloat).

Unacademy to slash 12% of workforce in another round of layoffs

Unacademy CEO Gaurav Munjal

It just doesn’t end for Unacademy. Last April, the edtech startup laid off a thousand contractual and full-time employees. Three months later, founder Gaurav Munjal told staff that there would be no more layoffs and that the company would work to reduce other expenses.

Clearly, those efforts weren’t working, as it booted out more people within months. Now, Unacademy is at it again.

In an internal memo sent to Unacademy employees on Thursday, Munjal said the company is cutting another 12% of its workforce in a new round of layoffs. ET has seen a copy of the memo.

Broken compass? In the note, Munjal said that the Bengaluru-based edtech platform took “every step in the right direction” to make its core business profitable but the efforts have not been enough, and hence the decision was taken.

This comes a day after the company announced that it has hived off CodeChef, an acquisition made in 2020.

Past layoffs: In a bid to turn profitable, the edtech has slashed its workforce across multiple rounds over the last 12 months, including sacking 1,000 employees last April and then cutting 350 more jobs in November. Its subsidiary Relevel cut 40 jobs in January this year.

Quote unquote: “I have conducted detailed reviews with every leader in the organisation to determine the size of the team in line with a sustainable cost structure, the skills necessary for today’s business needs and the direction each team has to take to work towards our key business goals and achieve profitability,” Munjal wrote in the letter.

CCI gets powers to penalise tech firms based on global turnover

Global will soon become very local for Google, and not in a good way. The Lok Sabha, on Wednesday, passed changes to the Competition Act, aiming to include global deals made by tech companies within the confines of local laws. Additionally, the Competition Commission of India (CCI) will be authorised to levy fines on multinational corporations for breaches based on their global revenue.

The amendment: The Competition (Amendment) Bill, 2022 aims to capture big deals by tech companies that have a strong presence in India. Any deal larger than Rs 2,000 crore will need to be notified to the CCI.

Unlike the current practice of penalising companies 10% of the revenue generated in the market where the violation occurred (India), the amendment will let the competition watchdog now consider the global turnover of the company.

Settlement mechanism: The Bill proposes to introduce a settlement scheme for lighter violations and also provides more clarity on the definition of “control”. Under the settlement framework, an entity accused of an antitrust violation can settle the case with the CCI without admitting to or denying guilt.

Elon Musk, other tech leaders call for AI pause, citing ‘profound risks to society’

Who would’ve thunk it???? Elon Musk, of all people — yes, of the self-driving cars — has gone on record to state that certain technology is endangering humankind. More than 1,000 technology leaders and researchers, including Musk, have urged artificial intelligence labs to pause the development of the most advanced systems, warning in an open letter that AI tools present “profound risks to society and humanity”.

Why the alarm? AI developers are “locked in an out-of-control race to develop and deploy ever more powerful digital minds that no one — not even their creators — can understand, predict or reliably control,” according to the letter, which was released Wednesday by the nonprofit group Future of Life Institute.

Who are the signatories? Others who have signed the letter include Steve Wozniak, cofounder of Apple; Andrew Yang, an entrepreneur and candidate in the 2020 US presidential election; and Rachel Bronson, president of the Bulletin of the Atomic Scientists, which sets the Doomsday Clock, a symbol of the likelihood of a manmade global catastrophe.

Needless to say, Sam Altman, the CEO of OpenAI, did not sign the letter.

‘Governments should step in’: The open letter called for a pause in the development of AI systems more powerful than GPT-4, the chatbot introduced this month by the research lab OpenAI, which Musk co-founded. The pause would provide time to implement “shared safety protocols” for AI systems, the letter said.

“If such a pause cannot be enacted quickly, governments should step in and institute a moratorium,” it added.

Tweet of the day

Ransomware, malware attacks rose in 2022: report

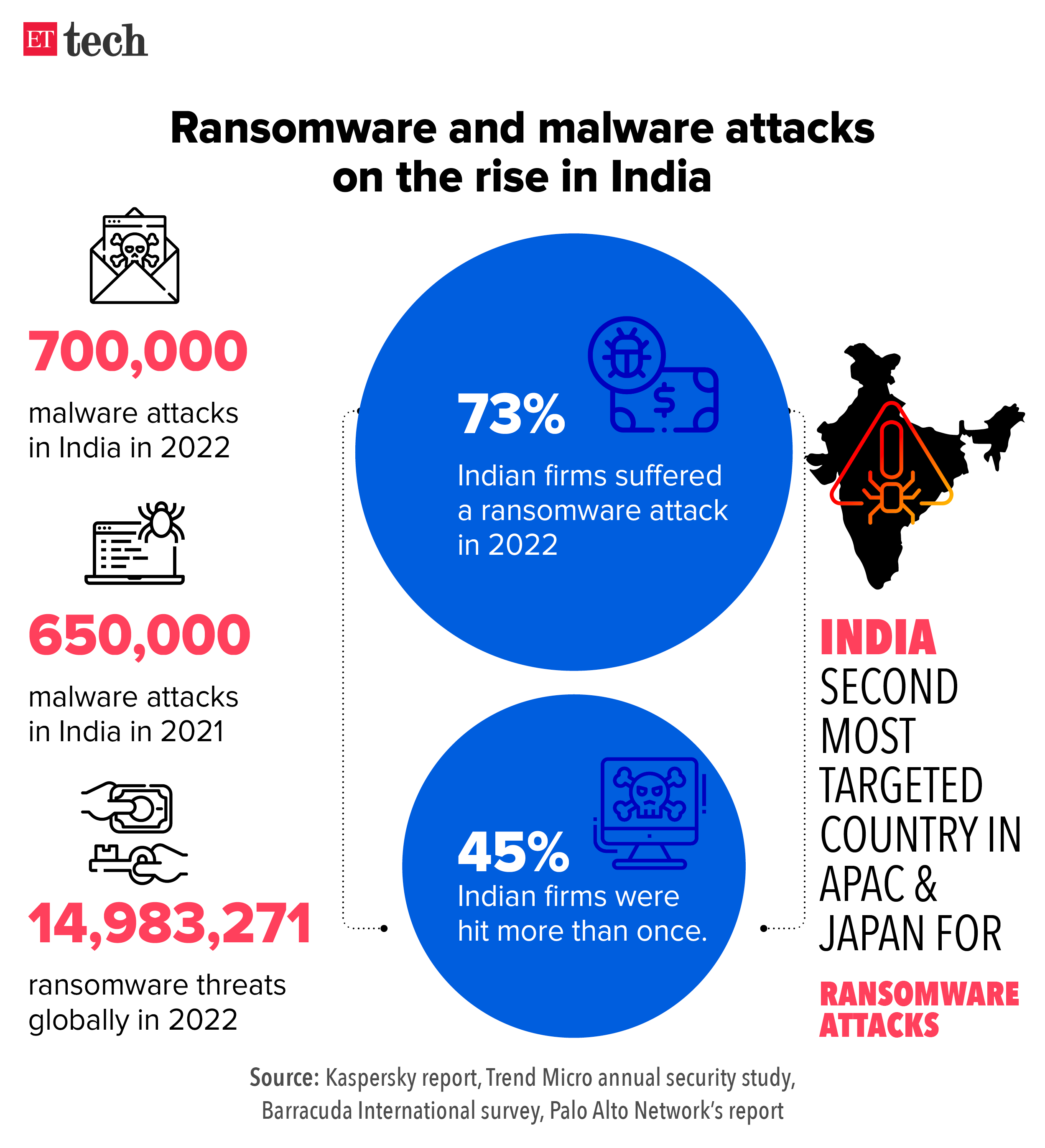

Ransomware and malware attacks are rising even as Indian enterprises continue to increase investments in cybersecurity. India experienced about 700,000 malware attacks in 2022, up from 650,000 in 2021, according to the Trend Micro annual security study.

India second most targeted Apac country: India was the second most targeted country in the Asia Pacific & Japan region for ransomware attacks, according to Palo Alto Network’s 2023 Unit 42 Ransomware and Extortion Report. It was the third most attacked country in 2021.

Attacks rising globally: Globally, too, the number of ransomware attacks has been increasing. According to Trend Micro, there were a total of 1,49,83,271 ransomware threats worldwide in 2022, with 38.06% of the attacks targeting Asia, and 10.51% of those attacks being detected in India.

Quote, unquote: “The data on ransomware and malware attacks in India highlights the ongoing threat to the country’s critical sectors, but there is some good news. Malware detections across key sectors have slightly declined, indicating that appropriate measures are being taken,” said Vijendra Katiyar, country manager for India & SAARC at Trend Micro.

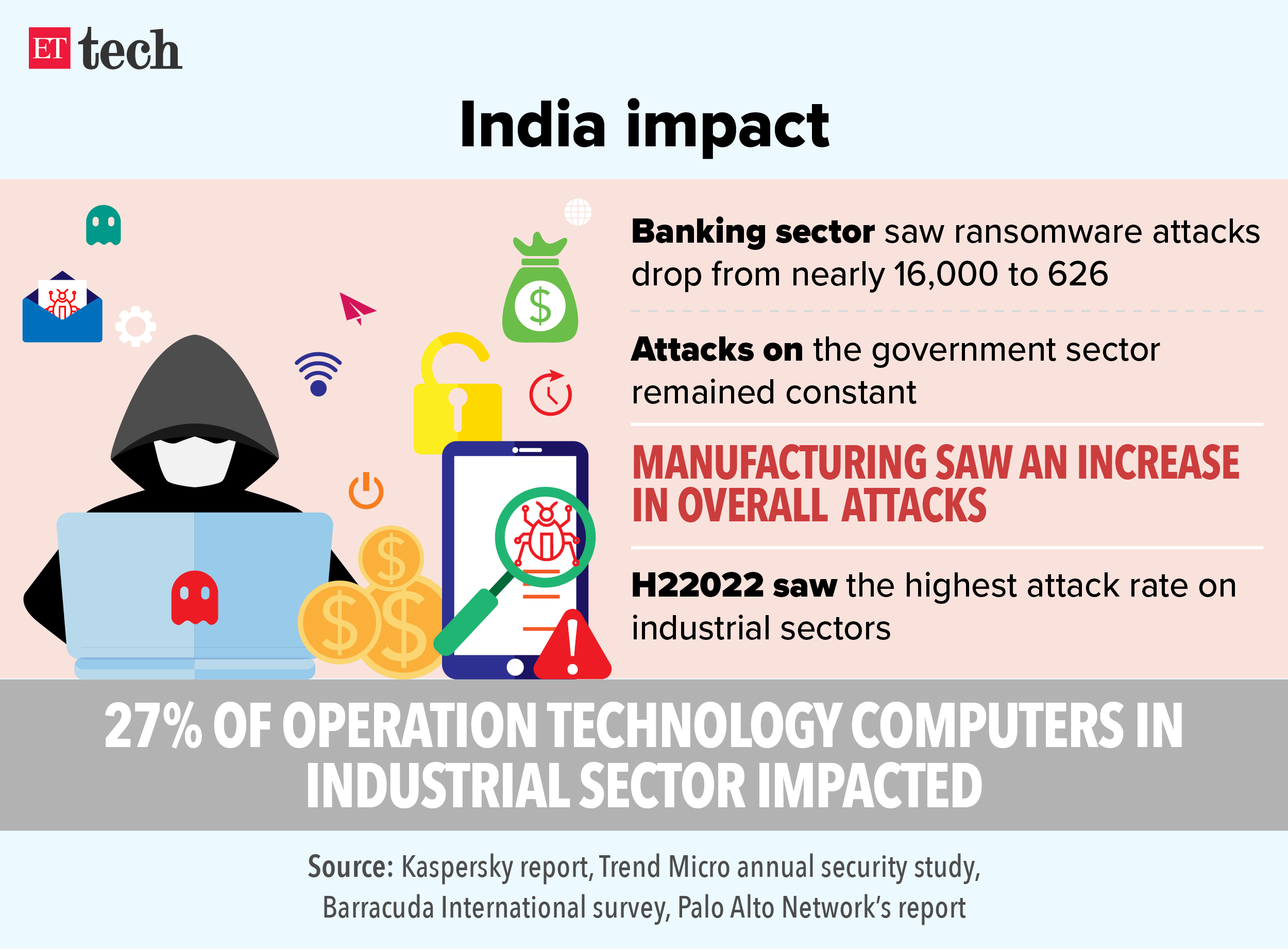

The usual targets: While India’s banking sector has been impacted the most by malware attacks, the good news is that there has been a sharp fall in ransomware attacks on lenders.

The number of such attacks plunged to just 626 over the past year, from 16,000. Attacks on the government sector remained constant, however, while manufacturing saw an increase in overall attacks over the same period.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.