Also in the letter:

■ Amazon to cross $8 billion in India exports

■ Q1 FY24 preview: IT may not be all that shiny

■ Apple ups retail focus in India

PharmEasy plans Rs 2,400 cr rights issue at 90% discount

PharmEasy’s cofounder and CEO Siddharth Shah

PharmEasy plans to raise around Rs 2,400 crore through a rights issue at a 90% discount to its peak stock price to repay its loan from Goldman Sachs, sources told ETtech. This comes after the firm breached a key loan term set by Goldman Sachs.

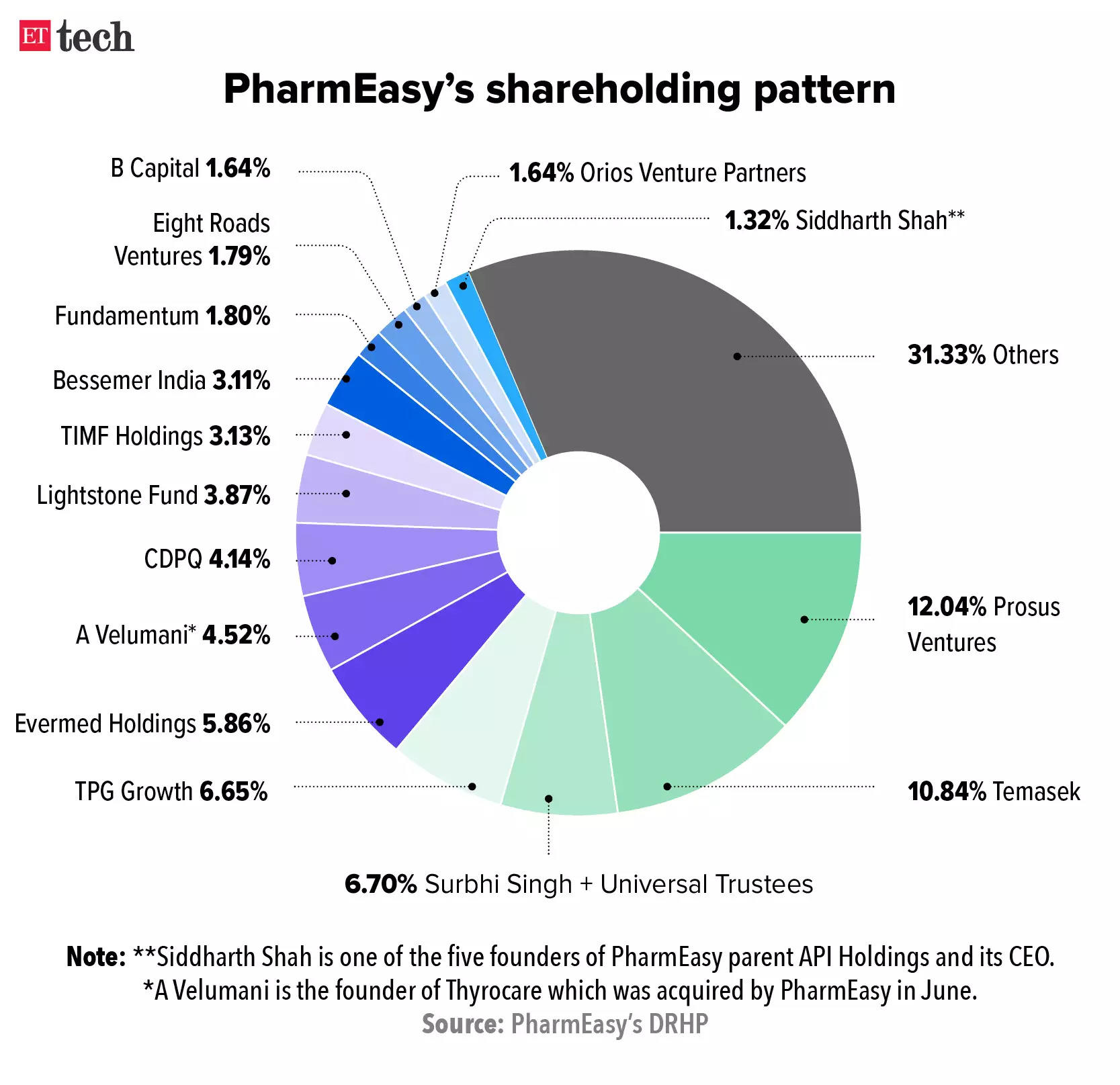

Driving the news: Existing shareholders TPG and Temasek are leading the rights issue, the sources said. Ranjan Pai, chairman of the Manipal group, where TPG and Temasek are investors, is expected to join the company’s board. Pai is likely to invest Rs 1,000 crore in the rights issue. “Whoever doesn’t participate in the rights issue will see their shareholding diluted by 40%’’, said a person in the know of the matter.

Deal deets: PharmEasy parent API Holdings — which also owns diagnostics firm Thyrocare — will issue new stock at Rs 5 per share, according to documents seen by ETtech. The rights issue will likely take place at a valuation of around $500-$600 million, according to ETtech’s calculations. Adjusted for the dollar-rupee rate, PharmEasy’s previous valuation would be around $5.6 billion.

Also read | PharmEasy delays IPO, targets Ebitda breakeven by next year

Tell me more: “After the covenant breach, the board and shareholders wanted the loan to be repaid to Goldman Sachs. Also, the price of the share had to be readjusted as it was freely available for Rs 20 in the grey market’’, said a person familiar with the developments, on condition of anonymity.

Down rounds: If the rights issue goes through, it would be one of the first major down rounds for a large internet firm. A down round is when a privately held firm picks up funds at a valuation lower than its previous round. So far, internet firms in India have mostly seen paper markdowns. Crossover and public market funds have pared the value of their holdings keeping in mind the wider correction in the technology industry globally.

Founders stay invested: According to sources, in order to address the value erosion, the investors and the board have in-principle agreed to grant new stock options to both the founders and the employees. The founders of PharmEasy own about 2% stake in the firm.

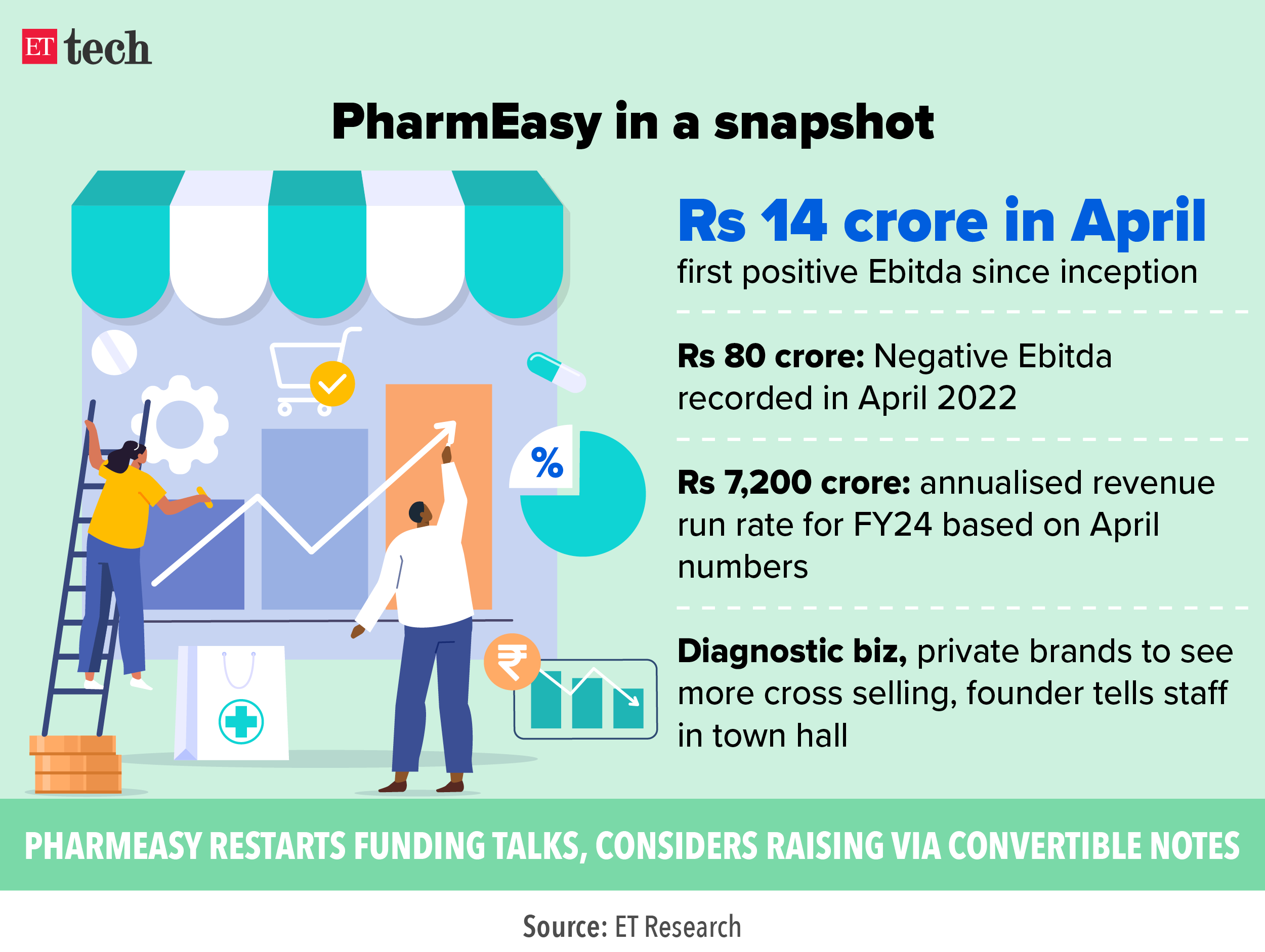

Turnaround: The epharmacy major clocked an operating profit of Rs 14 crore for the first time in April 2023, and is estimated to have closed FY2023 with a revenue of Rs 6,847.2 crore (up from Rs 6,466 crore in FY22). According to documents seen by ET, the company has projected revenues of around Rs 7,223.8 crore in FY24.

Also read | System of a down round: valuation markdowns hit Indian startups; to affect fundraising, IPO plans

Union Cabinet approves Digital Personal Data Protection bill

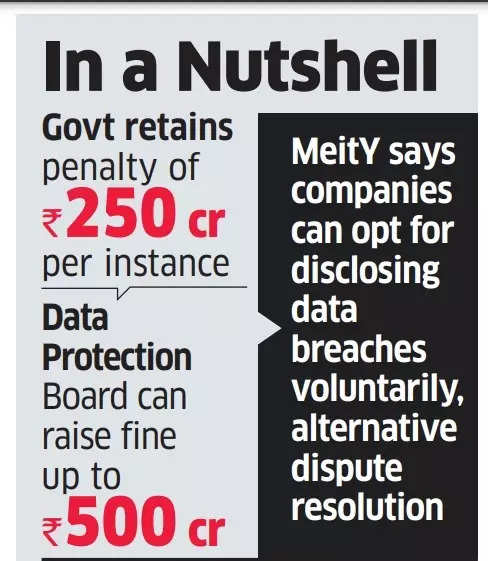

The Union Cabinet granted approval to the Digital Personal Data Protection bill (DPDP) on Wednesday, senior officials said. The bill enables companies to voluntarily disclose data breaches and also introduces an alternative dispute resolution (ADR) mechanism.

Cop a plea: One official, referring to the voluntary disclosure mechanism, likened it to plea bargains (whereby the defendant voluntarily admits something), a recognised legal procedure in many countries. They stated that companies have the opportunity to admit to any kind of breach and pay the required penalties.

Hefty penalties: The long-awaited draft of the Digital Personal Data Protection bill has eliminated the majority of the criminal provisions related to data breaches that existed in the previous versions. However, it grants the Data Protection Board (DPB), which will mostly consist of industry experts and not government officials, the authority to impose penalties of up to Rs 250 crore on organisations found to be in violation. Additionally, with the necessary cabinet approval, the DPB can escalate these fines to a maximum of Rs 500 crore.

The IT ministry has decided to retain the definition of children as anyone under the age of 18, in the face of sustained pushback from industry experts.

Unclogging the courts: Officials have described the proposed changes to the voluntary disclosure mechanism as an attempt to ease the burden on legal systems. They said that such disclosures and penalties will not exempt companies from any other legal action outlined in the DPDP bill.

Additionally, the government has introduced provisions in the alternative dispute resolution (ADR) mechanism, enabling two parties to resolve their complaints with the assistance of a mediator.

IT less shiny as weak macros signal dull quarter

India’s top four IT firms are looking at only a marginal increase in their revenues in the first quarter of FY23-24, given the weakness in the banking and financial services (BFS) sector, and rising interest rates in US and Europe.

Haircut: According to analysts, Infosys and HCLTech may trim the upper end of their revenue guidance range for the ongoing fiscal. An average of five analyst estimates collected by ET suggests that Tata Consultancy Services (TCS), Infosys, HCLTech, and Wipro may report 0.35% revenue growth, quarter-on-quarter for the three months ended June 30.

According to research house Motilal Oswal, weakness in demand for these IT companies would have continued into FY23-24, as clients focussed on cost and efficiency-driven projects while keeping the non-critical ones on hold.

Under pressure: Most companies will report flat or a slight decline in margins on a sequential basis due to the impact of annual wage hikes and overall growth slowdown. However, easing supply pressure, cooling attrition, and improvements in utilisation should help partially offset the impact.

The $245 billion industry was in for a reality check last quarter. Demand decelerated for the first time in two years, but the companies were hoping for cost-cutting projects to make up for deal ramp-downs and cut in discretionary spends.

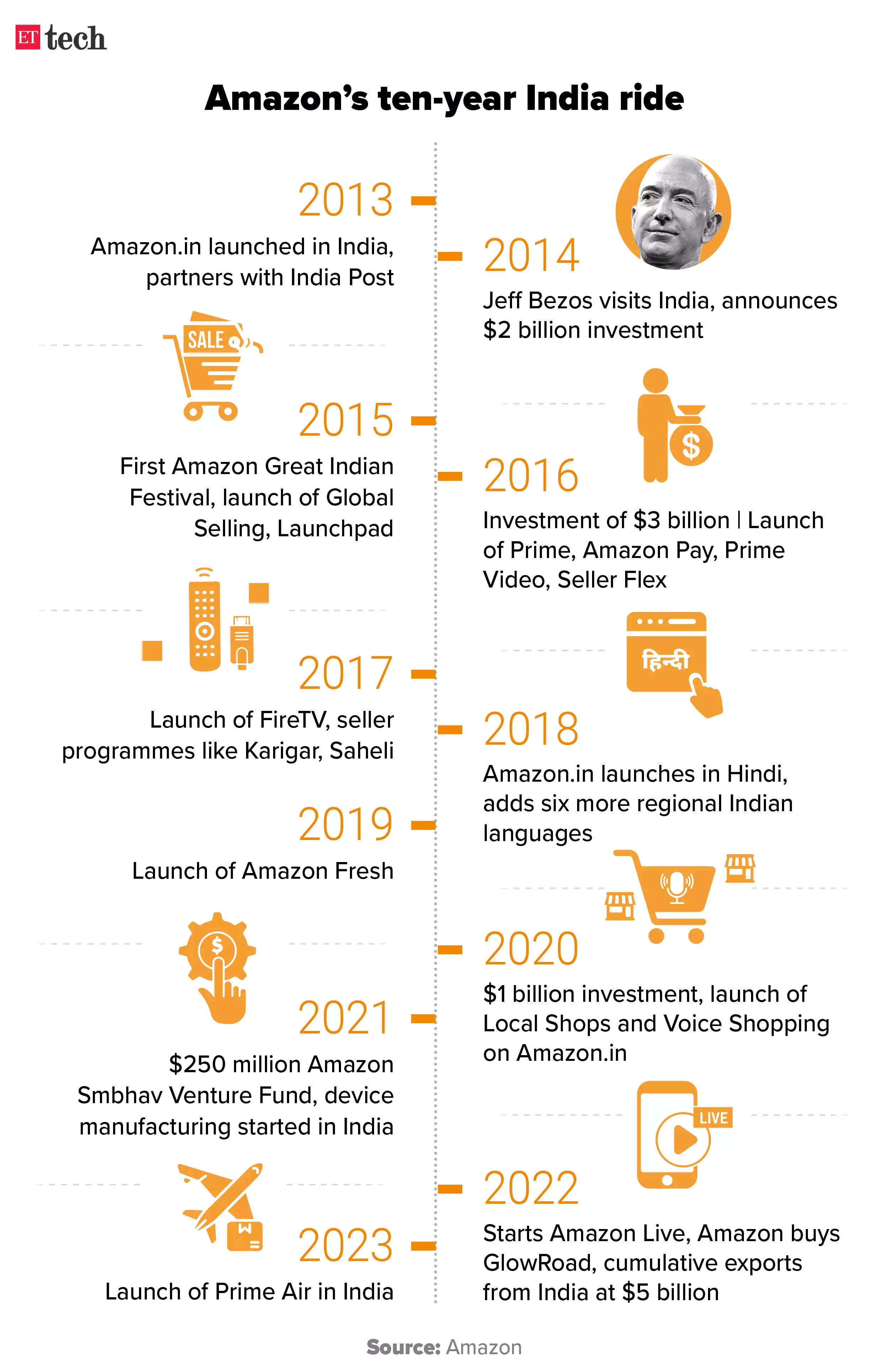

Amazon set to cross $8 billion in cumulative exports from India in 2023

.jpg)

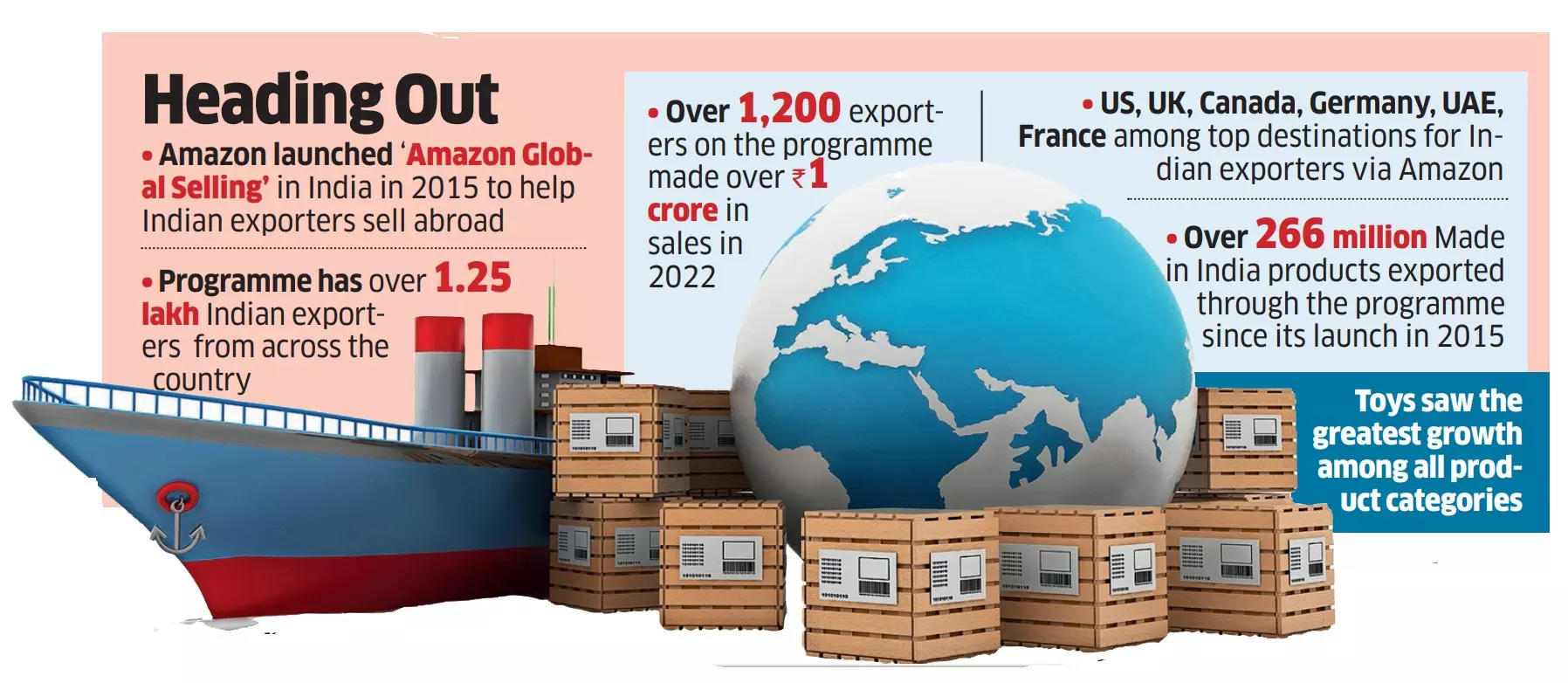

Seattle-based ecommerce major Amazon, which started its India operations in 2013, is set to surpass $8 billion in cumulative exports from the country by the end of 2023.

Shipping India: Amazon Global Selling, the export programme of Amazon, helped the company reach 1,25,000 exporters of which 1,200 (a little less than 1%), had crossed Rs 1 crore in sales in 2022. The firm reiterated the Indian export target of $20 billion by 2025 set a year ago — double the previous target.

Top towns: Maharashtra, Delhi, Gujarat, Rajasthan, and Uttar Pradesh were the states with the highest number of exporters in 2022, including many from tier 2 cities and beyond, places like Haridwar in Uttarakhand, Kolhapur in Maharashtra, and Tiruvallur in Tamil Nadu. Twenty-five cities saw their cumulative exports cross $10 million last year.

Toys R Us: Toys saw the greatest gain among all product categories, growing over 50% year-on-year, followed by kitchenware at over 35%, beauty at over 25%, and luggage at over 20%, the firm said in a statement.

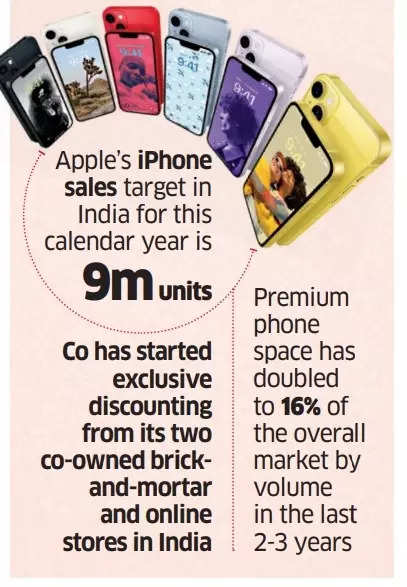

Apple ups retail focus in India amid slowdown

iPhone-maker Apple, in a bid to shore up revenues amid a slowing market, is increasing its focus on retail stores in India. The company has increased the sales targets of franchisee-owned outlets, and started offering exclusive discounts from its two company-owned brick-and-mortar stores, three industry executives said.

Double-digit push: According to industry insiders, the Cupertino-based company is pushing for double-digit revenue growth in India. The company has rolled out ‘student’ offers in its company-owned stores, which include discounts and freebies on Macs and iPads, making it cheaper for customers to buy from company stores compared to the franchise-owned Apple Premium Reseller stores.

The company has also increased the sales target for its 200-plus Premium Reseller stores by up to 100%.

Premium power: According to Counterpoint Research, Apple is expected to sell approximately nine million iPhones in India this year compared to six million in 2022, despite the overall smartphone market experiencing a significant decline. Apple achieved a 16% year-on-year growth in India in 2022.

Tarun Pathak, the director of research at Counterpoint, mentioned that the premium smartphone market (priced above Rs 30,000) that Apple operates in is witnessing growth, while the decline in sales is primarily in the sub-Rs 10,000 segment. He further stated that the volume of the premium segment has doubled to 16% of the overall market in the past 2-3 years, and in terms of value, it now constitutes about half the market.

Infy cybersecurity head Vishal Salvi joins Quick Heal as CEO

Vishal Salvi, the chief information and security officer (CISO) and cybersecurity head of Infosys, has taken on the role of chief executive officer (CEO) at Pune-based Quick Heal Technologies, with immediate effect.

An exodus? Salvi joins the ranks of former Infosys executives who have assumed CEO positions in other companies. Earlier this year, Ravi Kumar S, the company’s president, was appointed as the head of Cognizant, an IT firm listed on NASDAQ. Additionally, Mohit Joshi, another president at Infosys, was recruited by Tech Mahindra as their CEO.

Furthermore, Gopikrishanan Konnanath, who served as Infosys’ global engineering services and blockchain head, departed the company in March after 28 years to become the president of Cybage software.

Salvi’s CV: With a wealth of experience spanning 29 years in cybersecurity and information technology, Salvi has held numerous leadership positions at esteemed organisations including PwC, HDFC Bank, Standard Chartered Bank, and Crompton Greaves, before his tenure at Infosys.

Other Top Stories By Our Reporters

ITR, PF statement, rural job card on DigiLocker: Your income-tax returns may soon be available on e-document vault DigiLocker. Provident fund statements and NREGA (National Rural Employment Guarantee Act) job cards could also be available on DigiLocker, as the government’s online document repository is up for a major expansion.

Meta launches ‘Twitter Killer’ Threads app: Meta’s Mark Zuckerberg delivered a blow to Elon Musk on Wednesday night, as the tech billionaires’ rivalry went live with the launch of Instagram’s much-anticipated Threads platform, a clone of Twitter. While Threads launched as a standalone app, users could log in using their Instagram credentials and follow the same accounts, potentially making it an easy addition to existing habits for Instagram’s more than 2 billion monthly active users.

(L-R) Giva founders Ishendra Agarwal, Nikita Prasad and Sachin Shetty

Giva Jewellery raises Rs 200 crore from Premji Invest, others: The jewellery brand announced on Wednesday that it had raised Rs 200 crore in a series B funding round led by Premji Invest. The round also saw participation by existing investors Aditya Birla Ventures, Alteria Capital, and A91 Partners.

D2C denim-wear brand Freakins raises $4 million: Direct-to-consumer (D2C) denim-wear brand Freakins has raised $4 million in a funding round led by Matrix Partners India and Blume Ventures.

Global Picks We Are Reading

■ AI Could Change How Blind People See the World (Wired)

■ The ByteDance streaming app that’s quietly going global (Rest of world)

■ Instagram’s Twitter competitor, Threads, briefly went live on the web (The Verge)