Boston-based Advent is in talks to lead a $100-million (nearly 800 crore) round at KreditBee, which may value it around $600 million, these people said.

If the transaction goes through, Advent will join the likes of TPG — which last week announced it was backing instant loan disbursal startup, EarlySalary, through its Rise Fund — in ramping up their exposure in the Indian technology ecosystem. Advent, TPG and Singapore sovereign funds Temasek and

comprise a group of investors who have started to sign a number of larger cheques — typically $100 million and above — even as overall deal flow in late-stage funding has perceptibly slowed down.

Huge global losses

Others like Canadian pension funds CPPIB and CDPQ have also stayed on to make new investments here, amid a broader economic uncertainty and a global rout in tech stocks leading to massive losses clocked by funds which operate in the public markets.

Advent declined to comment. KreditBee did not respond to ET’s queries.

Discover the stories of your interest

Till last year, when the funding boom reached dizzying heights, these late-stage rounds were led by the likes of Tiger Global, SoftBank, Naspers and Alpha Wave (formerly Falcon Edge). But with all of these funds nursing the bruises of their public tech portfolio in the US, newer players are sensing an opportunity.

A venture investor said PEs typically look at businesses with a much finer lens on profitability and unit economics, which is why lending firms such as KreditBee and EarlySalary make sense for them.

“But the significant point here is that, for the past few months there has been no big rush to close rounds in a few weeks … PEs take much longer to execute transactions, unlike a Tiger … This is giving them a window to assess tech companies. Last year, the market was very different,” said the person who did not want to be named.

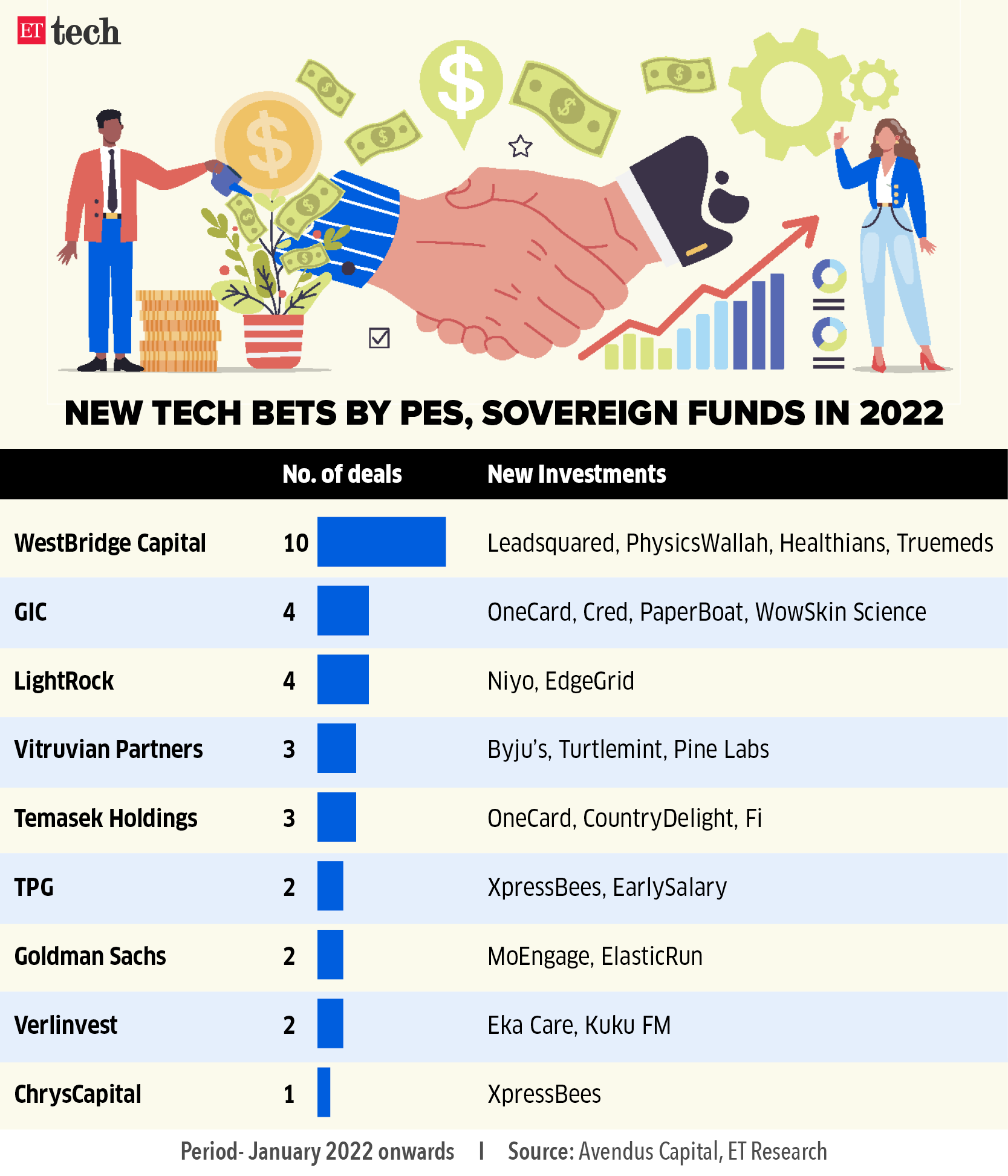

Among India-dedicated domestic PE funds, WestBridge Capital has been on a tear, with 10 deals under its belt since January. WestBridge racked up $1.5 billion separately for ploughing solely into technology startups.

Other India-focused firms chipping in for bigger funding rounds include IIFL, Kedaara Capital and ChrysCapital.

“While there has been a slowdown in investments from hedge funds, momentum investors and crossover funds, PE funds have continued to back companies this year as well…,” said Karan Sharma, executive director, co-head, digital & technology investment banking, Avendus. “One key factor has been the evolution of business fundamentals and positive unit economics, and some businesses achieving corporate profitability or core business profitability. This gives significant comfort to such investors who seek to protect the capital invested and expect a 3-5x return there on.”

Sharma said he expects to see increased activity from PE funds where the investment decision-making is more localised than others.

ETtech

ETtechWhat’s working for PEs?

“We felt PEs understand parameters such as return on assets and other efficiencies better (in financial services) and definitely have longer patient capital,” said Akshay Mehrotra, cofounder and chief executive of EarlySalary, in a recent chat with ET. “Further, with names such as TPG and Norwest, we know capital is available and we can bring the cost of borrowing further down with known marquee funds on our cap table.”

The digital lending fintech raised $110 million from investors co-led by TPG’s Rise Fund and Norwest Venture Partners, valuing it around $300 million.

Global macros continue to affect tech valuations, which have been falling from the highs of 2021, especially in the US. This is typically when traditional funds want to enter the market, not when it’s at its peak.

Fintech, especially, is an area that PEs understand well, having seen the financial services market closely in India and with numerous investments in the segment. Consumer and enterprise startups are also attractive to these funds.

What’s worked for some PEs is the early success in tech, such as TPG’s partial exits from omni-channel retailer Lenskart and

(TPG sold around 25% in the IPO), propelling the firm to double down locally. TPG has been a large tech investor in the US in companies like Uber and Airbnb.

“This year, PEs have stood out because they’ve continued their pace, unlike the tech-focused funds, which have slowed down immensely… These will become even more aggressive if valuations taper off in India like they have in US tech, or if the market turns and becomes more bullish and everyone has deployment pressure,” said an investor in one of the PE funds on the condition of anonymity.

Sovereigns get serious

The other cohort that continued to make fresh investments is sovereign funds, including CPPIB and CDPQ, along with Singapore’s GIC and Temasek. One of the largest fundraisings this year has been by VerSe Innovation, the parent firm of online news aggregator DailyHunt and short-video platform Josh, which mopped up $805 million in April in a round led by existing investor CPPIB.

Improved business economics helps such growth investors value the business beyond the usual revenue multiples, Sharma of Avendus said. “They are able to factor in a stable state profitability on the current scale as well as exit outcomes… Another variable in the current environment is deal timelines,” he said. “Reaction times last year were too low for the comfort of most such investors. The current environment suits their playbook of deliberate diligence and the rest of the processes.”